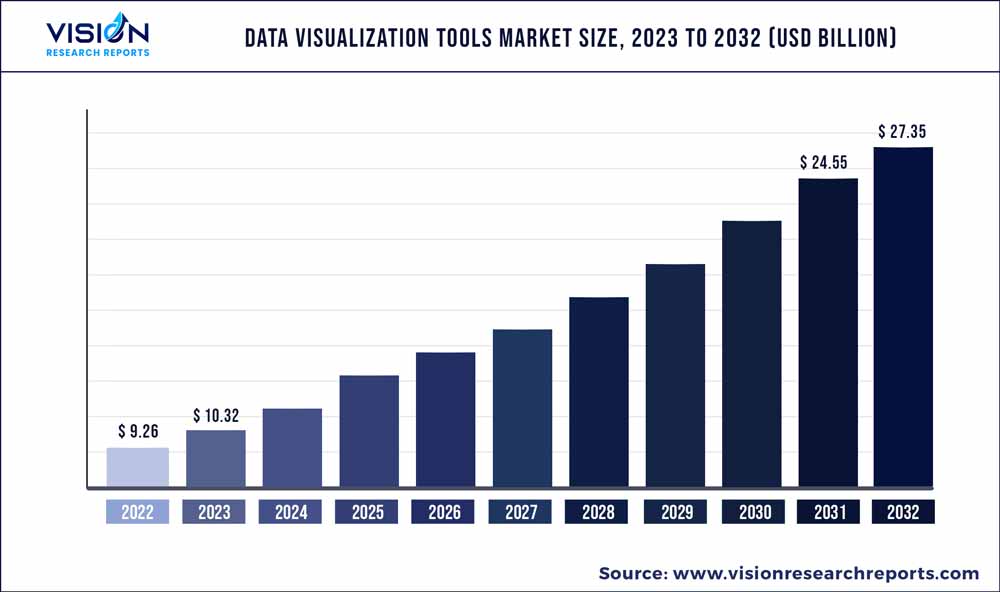

The global data visualization tools market was valued at USD 9.26 billion in 2022 and it is predicted to surpass around USD 27.35 billion by 2032 with a CAGR of 11.44% from 2023 to 2032. The data visualization tools market in the United States was accounted for USD 2.3 billion in 2022.

Key Pointers

Report Scope of the Data Visualization Tools Market

| Report Coverage | Details |

| Revenue Share of North America in 2022 | 42% |

| Revenue Forecast by 2032 | USD 27.35 billion |

| Growth Rate from 2023 to 2032 | CAGR of 11.44% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Salesforce, Inc.; Alibaba Cloud; Oracle; Amazon Web Services, Inc.; SAS Institute Inc.; Sisense Inc.; Microsoft Corporation; TIBCO software; International Business Machines Corp.; SAP |

Data visualization tools are essential for businesses and organizations to interpret, analyze, and communicate data insights, allowing users to create graphs, charts, and other visual representations of data, making it easier to identify trends, patterns, and relationships in data. Several key factors drive the data visualization tools market, such as the increasing volume and complexity of data being generated and collected by organizations. With vast data available, organizations can analyze and transcribe it with data visualization tools, enabling them to easily create charts, graphs, and other visual representations of their data, making it easier to identify patterns and insights.

Another factor driving the growth of the data visualization tools market is the need for real-time data analysis. Visualization tools enable users to quickly analyze and understand data, allowing them to make informed decisions in real time. Visual Analytics tools enable users to effectively analyze and understand complex data sets, allowing them to identify patterns, trends, relationships, and opportunities within their data and explore detailed data with simple drill-down and drill-through capabilities. With visual analytics tools, users can analyze structured and unstructured data. These tools often provide users with interactive dashboards and visualizations, such as charts, graphs, and maps that help to bring the data to life and make it easier to understand.

Cloud-based solutions have been a catalyst for the growth of the data visualization tools market due to their ability to offer flexibility and scalability to organizations. With cloud-based data visualization tools, users can access and analyze data from anywhere with an internet connection. It is essential for organizations with remote or distributed workforces, as it enables users to collaborate and work together on data analysis, regardless of their location. With cloud-based data visualization tools, organizations can pay for only the resources they need rather than invest in expensive hardware and software licenses, which makes cloud-based solutions more accessible to smaller organizations or those with limited budgets.

The COVID-19 pandemic has significantly impacted many industries, including the data visualization tools market. One of the most significant impacts has been the increased demand for data visualization tools, as organizations have had to adapt to remote work and quickly change business conditions. The pandemic has also highlighted the importance of real-time data analysis, particularly in industries such as healthcare and supply chain management. With many businesses facing disruptions to their supply chains, shifts in consumer behavior, and other challenges, data visualization tools have been essential in helping organizations understand and adapt to these changes.

Component Insights

The software segment contributed the highest revenue share of over 65% in 2022 and the segment is anticipated to hold the maximum share throughout the forecast period. Startup companies in the data visualization tools market are constantly introducing new products and innovative solutions to meet the evolving needs of organizations. These new products often leverage the latest technological advancements to give users more powerful and intuitive data analysis capabilities. For instance, Flourish is a data visualization tool that enables users to import and analyze data in various formats. While the tool is suitable for personal use cases, such as visualizing health data from any Android smartwatch, it also offers enterprise-level capabilities to handle larger datasets for organizations. With Flourish, users have the flexibility to manage and present complex data in a clear and understandable format, regardless of the size of the dataset or the intended audience.

The services segment is estimated to expand at the highest CAGR over the forecast period. Many data visualization tool providers offer integration services to help businesses merge data from different sources into a single platform. It allows a comprehensive data view and enables better analysis. Additionally, companies can build customized dashboards that cater to specific business requirements, allowing for better visualization and analysis of the data. Market players often provide training and support services to ensure that businesses can use their software effectively and get the most out of the platform.

Organization Size Insights

The large enterprises' segment led the market in 2022 and accounted for over 70% share of the global revenue. Data visualization tools allow large enterprises to manage and analyze vast amounts of data, to make better-informed decisions. In addition to helping enterprises identify insights, data visualization tools allow them to communicate findings and trends more effectively. Visual representations of data are easier to understand and interpret, making it easier for teams to collaborate, share information, and make informed decisions.

The SMEs segment is estimated to grow significantly over the forecast period. SMEs face unique challenges when managing and analyzing their business data. These tools can help SMEs analyze customer behavior across various touchpoints, such as social media, email campaigns, and website visits. By visualizing this data, SMEs can identify customer preferences and tailor their marketing messages, leading to more effective campaigns and increased sales. These tools can help SMEs optimize their operations and drive growth by providing a clear and intuitive way to analyze and understand data.

Deployment Insights

The on-premises segment witnessed the highest market share in 2022 and accounted for over 60% of global revenue. One of the primary needs for on-premises data visualization tools is data security and privacy. Some organizations, particularly those in heavily regulated industries like finance and healthcare, must keep their data on-premises due to compliance and security concerns. Preserving data on their infrastructure gives these organizations more control over their data and can better ensure its protection. Additionally, the need for mobile access drives the development of on-premises solutions that support remote and mobile access.

The cloud segment is estimated to grow steadily over the forecast period. One of the biggest trends in cloud-based data visualization tools is using artificial intelligence (AI) and machine learning (ML) algorithms. Another trend is integrating data visualization tools with other cloud-based services, such as data warehousing and business intelligence platforms. With AI-powered analytics, seamless integrations, scalability, and robust security features, cloud-based data visualization tools are becoming increasingly important for organizations looking to gain insights and make data-driven decisions.

End-users Insights

The IT and telecommunication segment alone held the largest revenue share of over 22% in 2022. Data visualization tools enable IT and telecom companies to analyze and decipher vast amounts of data, including network performance data, customer behavior data, and financial data. Predictive analytics is a trend in the IT and telecommunications industry. Predictive analytics can help companies forecast future trends and identify potential problems before they occur. Data visualization tools that support predictive analytics can provide companies with insights that can help them stay ahead of the competition.

The healthcare and life sciences segment is anticipated to witness the highest CAGR over the forecast period. There is a need for data visualization tools in the healthcare & life sciences industry to support decision-making. Healthcare companies need to make informed decisions based on their data, and data visualization tools can help by providing a clear and easy-to-understand view of the data. Solutions can help companies make better decisions and improve their performance and patient treatment. Further, the need for data security and privacy is becoming increasingly important in the healthcare industry. Healthcare companies handle sensitive customer data, and data visualization tools must support the highest levels of security and privacy, including billing information, patient details, and other security features that help protect customer data.

Application Insights

The marketing and sales segment led the market in 2022 and accounted for over 36% of global revenue. Marketing departments use data visualization tools to identify patterns and trends in consumer behavior, allowing marketers to make more informed decisions about their campaigns. Marketers can create targeted campaigns that resonate with their audience and drive higher engagement and conversions by analyzing customer demographics, behavior, and preferences. Similarly, data visualization tools in sales can be used to analyze customer data and identify critical trends and patterns. By visualizing sales data, teams can quickly identify areas of opportunity and focus their efforts on the most profitable segments of the market.

The Human Resources (HR) segment is estimated to grow significantly over the forecast period. Data visualization tools can help HR professionals to communicate complex data in a way that is easy to understand. It can be beneficial when presenting data to executives or other stakeholders who may need a background in HR or data analysis. Additionally, as companies become more data-driven, there is an increasing demand for HR professionals with strong analytical skills. Data visualization tools can bridge the gap between HR and data analytics, allowing HR professionals to analyze and interpret data without requiring specialized technical skills.

Regional Insights

North America dominated the market in 2022 and accounted for over 42% share of the global revenue. Businesses and organizations in North America rely heavily on data to make informed decisions, and data visualization tools play a critical role in this process. Some of North America's popular data visualization tools include Tableau, Power BI, D3.js, and Google Data Studio. As data security and privacy concerns continue to grow, there is also an increasing demand for data visualization tools to ensure secure data storage and transfer. Such tools are required to protect sensitive data from cyber threats and ensure compliance with data privacy regulations such as GDPR.

With the rise of big data, machine learning, and other advanced technologies, organizations in Asia Pacific need data visualization tools to help them identify patterns, trends, and anomalies in their data. This need is particularly acute in finance, healthcare, and logistics industries, where timely and accurate decision-making is critical to success. With the rise of online shopping and social media, businesses in the Asia Pacific are using data visualization to gain insights into consumer behavior and preferences and to develop targeted marketing campaigns that drive sales and engagement. This trend is particularly evident in countries like China and India, where e-commerce is a significant driver of economic growth.

Data Visualization Tools Market Segmentations:

By Component

By Application

By Organization Size

By Deployment

By End-users

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Data Visualization Tools Market

5.1. COVID-19 Landscape: Data Visualization Tools Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Data Visualization Tools Market, By Component

8.1. Data Visualization Tools Market, by Component, 2023-2032

8.1.1. Software

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Service

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Data Visualization Tools Market, By Application

9.1. Data Visualization Tools Market, by Application, 2023-2032

9.1.1. Human Resources

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Operations

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Finance

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Marketing & Sales

9.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Data Visualization Tools Market, By Organization Size

10.1. Data Visualization Tools Market, by Organization Size, 2023-2032

10.1.1. Large Enterprises

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. SMEs

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Data Visualization Tools Market, By Deployment

11.1. Data Visualization Tools Market, by Deployment, 2023-2032

11.1.1. Cloud

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. On-premises

11.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global Data Visualization Tools Market, By End-users

12.1. Data Visualization Tools Market, by End-users, 2023-2032

12.1.1. BFSI

12.1.1.1. Market Revenue and Forecast (2020-2032)

12.1.2. IT and Telecommunication

12.1.2.1. Market Revenue and Forecast (2020-2032)

12.1.3. Manufacturing

12.1.3.1. Market Revenue and Forecast (2020-2032)

12.1.4. Healthcare & Life Sciences

12.1.4.1. Market Revenue and Forecast (2020-2032)

12.1.5. Retail and E-commerce

12.1.5.1. Market Revenue and Forecast (2020-2032)

12.1.6. Government

12.1.6.1. Market Revenue and Forecast (2020-2032)

12.1.7. Transportation & logistics

12.1.7.1. Market Revenue and Forecast (2020-2032)

12.1.8. Others

12.1.8.1. Market Revenue and Forecast (2020-2032)

Chapter 13. Global Data Visualization Tools Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Component (2020-2032)

13.1.2. Market Revenue and Forecast, by Application (2020-2032)

13.1.3. Market Revenue and Forecast, by Organization Size (2020-2032)

13.1.4. Market Revenue and Forecast, by Deployment (2020-2032)

13.1.5. Market Revenue and Forecast, by End-users (2020-2032)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Component (2020-2032)

13.1.6.2. Market Revenue and Forecast, by Application (2020-2032)

13.1.6.3. Market Revenue and Forecast, by Organization Size (2020-2032)

13.1.6.4. Market Revenue and Forecast, by Deployment (2020-2032)

13.1.7. Market Revenue and Forecast, by End-users (2020-2032)

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Component (2020-2032)

13.1.8.2. Market Revenue and Forecast, by Application (2020-2032)

13.1.8.3. Market Revenue and Forecast, by Organization Size (2020-2032)

13.1.8.4. Market Revenue and Forecast, by Deployment (2020-2032)

13.1.8.5. Market Revenue and Forecast, by End-users (2020-2032)

13.2. Europe

13.2.1. Market Revenue and Forecast, by Component (2020-2032)

13.2.2. Market Revenue and Forecast, by Application (2020-2032)

13.2.3. Market Revenue and Forecast, by Organization Size (2020-2032)

13.2.4. Market Revenue and Forecast, by Deployment (2020-2032)

13.2.5. Market Revenue and Forecast, by End-users (2020-2032)

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Component (2020-2032)

13.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

13.2.6.3. Market Revenue and Forecast, by Organization Size (2020-2032)

13.2.7. Market Revenue and Forecast, by Deployment (2020-2032)

13.2.8. Market Revenue and Forecast, by End-users (2020-2032)

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Component (2020-2032)

13.2.9.2. Market Revenue and Forecast, by Application (2020-2032)

13.2.9.3. Market Revenue and Forecast, by Organization Size (2020-2032)

13.2.10. Market Revenue and Forecast, by Deployment (2020-2032)

13.2.11. Market Revenue and Forecast, by End-users (2020-2032)

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Component (2020-2032)

13.2.12.2. Market Revenue and Forecast, by Application (2020-2032)

13.2.12.3. Market Revenue and Forecast, by Organization Size (2020-2032)

13.2.12.4. Market Revenue and Forecast, by Deployment (2020-2032)

13.2.13. Market Revenue and Forecast, by End-users (2020-2032)

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Component (2020-2032)

13.2.14.2. Market Revenue and Forecast, by Application (2020-2032)

13.2.14.3. Market Revenue and Forecast, by Organization Size (2020-2032)

13.2.14.4. Market Revenue and Forecast, by Deployment (2020-2032)

13.2.15. Market Revenue and Forecast, by End-users (2020-2032)

13.3. APAC

13.3.1. Market Revenue and Forecast, by Component (2020-2032)

13.3.2. Market Revenue and Forecast, by Application (2020-2032)

13.3.3. Market Revenue and Forecast, by Organization Size (2020-2032)

13.3.4. Market Revenue and Forecast, by Deployment (2020-2032)

13.3.5. Market Revenue and Forecast, by End-users (2020-2032)

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Component (2020-2032)

13.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

13.3.6.3. Market Revenue and Forecast, by Organization Size (2020-2032)

13.3.6.4. Market Revenue and Forecast, by Deployment (2020-2032)

13.3.7. Market Revenue and Forecast, by End-users (2020-2032)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Component (2020-2032)

13.3.8.2. Market Revenue and Forecast, by Application (2020-2032)

13.3.8.3. Market Revenue and Forecast, by Organization Size (2020-2032)

13.3.8.4. Market Revenue and Forecast, by Deployment (2020-2032)

13.3.9. Market Revenue and Forecast, by End-users (2020-2032)

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Component (2020-2032)

13.3.10.2. Market Revenue and Forecast, by Application (2020-2032)

13.3.10.3. Market Revenue and Forecast, by Organization Size (2020-2032)

13.3.10.4. Market Revenue and Forecast, by Deployment (2020-2032)

13.3.10.5. Market Revenue and Forecast, by End-users (2020-2032)

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Component (2020-2032)

13.3.11.2. Market Revenue and Forecast, by Application (2020-2032)

13.3.11.3. Market Revenue and Forecast, by Organization Size (2020-2032)

13.3.11.4. Market Revenue and Forecast, by Deployment (2020-2032)

13.3.11.5. Market Revenue and Forecast, by End-users (2020-2032)

13.4. MEA

13.4.1. Market Revenue and Forecast, by Component (2020-2032)

13.4.2. Market Revenue and Forecast, by Application (2020-2032)

13.4.3. Market Revenue and Forecast, by Organization Size (2020-2032)

13.4.4. Market Revenue and Forecast, by Deployment (2020-2032)

13.4.5. Market Revenue and Forecast, by End-users (2020-2032)

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Component (2020-2032)

13.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

13.4.6.3. Market Revenue and Forecast, by Organization Size (2020-2032)

13.4.6.4. Market Revenue and Forecast, by Deployment (2020-2032)

13.4.7. Market Revenue and Forecast, by End-users (2020-2032)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Component (2020-2032)

13.4.8.2. Market Revenue and Forecast, by Application (2020-2032)

13.4.8.3. Market Revenue and Forecast, by Organization Size (2020-2032)

13.4.8.4. Market Revenue and Forecast, by Deployment (2020-2032)

13.4.9. Market Revenue and Forecast, by End-users (2020-2032)

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Component (2020-2032)

13.4.10.2. Market Revenue and Forecast, by Application (2020-2032)

13.4.10.3. Market Revenue and Forecast, by Organization Size (2020-2032)

13.4.10.4. Market Revenue and Forecast, by Deployment (2020-2032)

13.4.10.5. Market Revenue and Forecast, by End-users (2020-2032)

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Component (2020-2032)

13.4.11.2. Market Revenue and Forecast, by Application (2020-2032)

13.4.11.3. Market Revenue and Forecast, by Organization Size (2020-2032)

13.4.11.4. Market Revenue and Forecast, by Deployment (2020-2032)

13.4.11.5. Market Revenue and Forecast, by End-users (2020-2032)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Component (2020-2032)

13.5.2. Market Revenue and Forecast, by Application (2020-2032)

13.5.3. Market Revenue and Forecast, by Organization Size (2020-2032)

13.5.4. Market Revenue and Forecast, by Deployment (2020-2032)

13.5.5. Market Revenue and Forecast, by End-users (2020-2032)

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Component (2020-2032)

13.5.6.2. Market Revenue and Forecast, by Application (2020-2032)

13.5.6.3. Market Revenue and Forecast, by Organization Size (2020-2032)

13.5.6.4. Market Revenue and Forecast, by Deployment (2020-2032)

13.5.7. Market Revenue and Forecast, by End-users (2020-2032)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Component (2020-2032)

13.5.8.2. Market Revenue and Forecast, by Application (2020-2032)

13.5.8.3. Market Revenue and Forecast, by Organization Size (2020-2032)

13.5.8.4. Market Revenue and Forecast, by Deployment (2020-2032)

13.5.8.5. Market Revenue and Forecast, by End-users (2020-2032)

Chapter 14. Company Profiles

14.1. Salesforce, Inc.

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. Alibaba Cloud

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Oracle

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Amazon Web Services, Inc.

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. SAS Institute Inc.

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Sisense Inc.

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Microsoft Corporation

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. TIBCO software

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. International Business Machines Corp.

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. SAP

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others