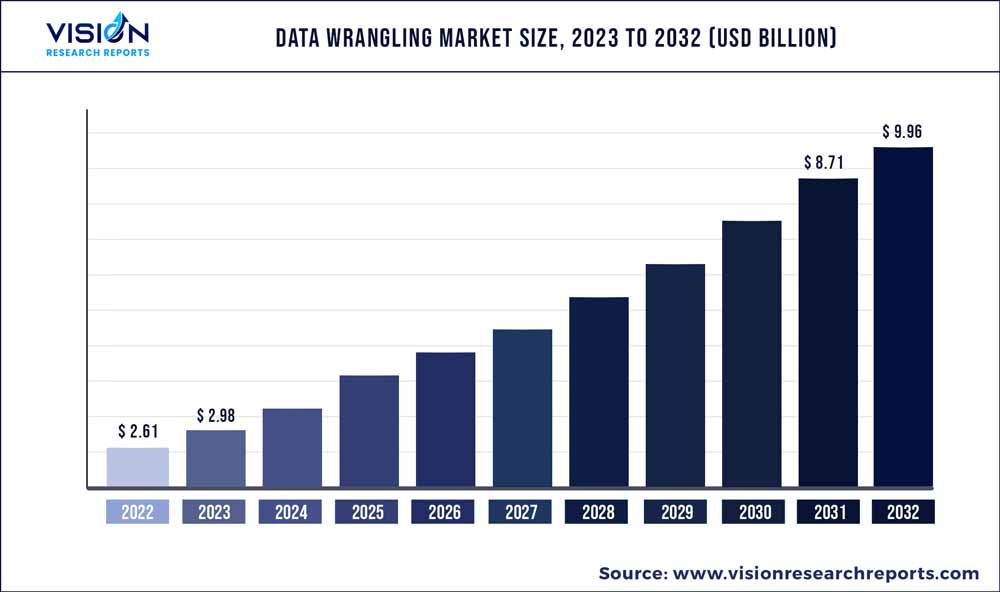

The global data wrangling market size was estimated at around USD 2.61 billion in 2022 and it is projected to hit around USD 9.96 billion by 2032, growing at a CAGR of 14.33% from 2023 to 2032. The data wrangling market in the United States was accounted for USD 426 million in 2022.

Key Pointers

Report Scope of the Data Wrangling Market

| Report Coverage | Details |

| Revenue Share of North America in 2022 | 48% |

| CAGR of Asia Pacific from 2023 to 2032 | 18.95% |

| Revenue Forecast by 2032 | USD 9.96 billion |

| Growth Rate from 2023 to 2032 | CAGR of 14.33% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Altair Engineering Inc.; Alteryx, Inc.; Datameer, Inc.; Hitachi Vantara Corporation; International Business Machines Corporation; Impetus Technologies, Inc.; Oracle Corporation; Paxata, Inc.; SAS Institute Inc.; TIBCO Software Inc.; Teradata Corporation |

Data wrangling market growth is anticipated to be significantly accelerated by increasing concerns about data loss and theft, rising to bring your device (BYOD) trends, and workplace mobility. Furthermore, the volume and velocity of data, along with technological developments in artificial intelligence and machine learning, may further hinder the expansion of the data wrangling market.

The amount of data being generated by businesses and individuals is growing exponentially. This data comes in many different formats and sources, making it challenging to manage and analyze. Data wrangling tools are designed to help organizations deal with this complexity, making it easier to clean, transform, and structure data for analysis. Moreover, Data analytics has become a critical tool for organizations looking to gain insights and make data-driven decisions. However, data must be properly managed and structured to use data analytics effectively. Data wrangling tools help businesses prepare their data for analysis, making it easier to gain insights and make decisions based on data.

Data wrangling tools can help businesses quickly prepare their data for real-time analysis, making it easier to monitor key metrics and detect trends as they happen. Using data wrangling tools, businesses can gain deeper insights into their operations and make faster, more informed decisions. In addition, data wrangling can help businesses identify anomalies and errors in real-time data, enabling them to quickly correct issues and avoid potential problems. This can be especially important for businesses operating in fast-moving industries, where real-time insights can be critical for success.

Component Insights

The solution segment dominates the market with a revenue share of 74% in 2022. The data wrangling market is experiencing strong growth and innovation in its solution segment, including end-to-end data wrangling solutions that incorporate various tools and technologies for data integration, preparation, and analysis. Moreover, many data wrangling solutions are now being integrated with cloud-based analytics platforms, such as Microsoft Azure, Amazon Web Services, and Google Cloud Platform. This enables organizations to leverage the power of cloud computing to scale their data processing capabilities and gain deeper insights from their data.

The services segment is expected to grow with the fastest CAGR of 15.32% from 2023 to 2032. The services segment of the data wrangling market is expected to continue to grow and evolve as organizations seek to optimize their data wrangling processes and gain a competitive advantage through improved data-driven decision-making. The services segment of the data wrangling market includes professional services, such as consulting, implementation, and training that help organizations optimize their data wrangling processes. With the increasing importance of data security and privacy, many data wrangling service providers are now focusing on ensuring the security and privacy of their client's data. This includes implementing best practices for data encryption, access controls, and compliance with data privacy regulations.

Deployment Insights

The on-premises segment dominates the market with a revenue share of 64% in 2022. The on-premises segment of the data wrangling market refers to the deployment of data wrangling tools and solutions on local infrastructure rather than in the cloud. As data privacy and security concerns continue to grow, on-premises solutions are likely to become more attractive to organizations that need to comply with strict regulations and data protection laws. Moreover, On-premises solutions allow organizations to customize and control their data wrangling processes and workflows to meet their specific needs, which is especially important for organizations that deal with sensitive or complex data.

The cloud segment is experiencing strong growth during the forecasted period, driven by the increasing demand for cloud-based solutions and their benefits, such as scalability, flexibility, and cost-effectiveness. Organizations are increasingly adopting multi-cloud and hybrid cloud strategies to take advantage of different cloud providers' benefits and avoid vendor lock-in. Data wrangling solutions supporting these strategies will likely become more popular. Moreover, Cloud-based data wrangling solutions that leverage automation and AI technologies to streamline data preparation and accelerate data analysis are likely to become more popular. These solutions can help organizations reduce costs, improve productivity, and gain insights quickly.

Enterprise Size Insights

The large enterprises segment leads the market with a revenue share of 77% in 2022. The large enterprises segment of the data wrangling market refers to the use of data wrangling tools and solutions by large organizations with significant data volumes and complex data infrastructure. Moreover, large enterprises typically have complex data infrastructures with multiple data sources and systems. Data wrangling solutions can easily integrate with these systems and provide a unified view of the data. Moreover, large enterprises are increasingly adopting AI and machine learning technologies to automate data wrangling tasks and gain insights from their data.

The SMEs segment is projected to grow with the fastest CAGR of 16.74% from 2023 to 2032. The SMEs (Small and Medium-sized Enterprises) segment of the data wrangling market refers to using data wrangling tools and solutions by small and medium-sized organizations. SMEs may have smaller data volumes than large enterprises, but their data needs can grow quickly. Data wrangling solutions can scale up or down based on demand and are affordable for SMEs with limited budgets are likely to become more popular. Moreover, SMEs may need more resources to process and analyze their data manually. Data wrangling solutions that leverage automation and AI technologies to streamline data preparation and accelerate data analysis.

End-User Insights

The BFSI segment dominates the market, with a revenue share of 25% in 2022. The BFSI industry handles sensitive data and is subject to strict regulations. Data wrangling solutions provide robust data security features and comply with data protection regulations. Moreover, BFSI companies require robust data governance and management frameworks to ensure data accuracy, reliability, and compliance. Data wrangling solutions provide data governance and management features, such as data lineage, metadata management, and data cataloging.

The IT and Telecom segment is expected to grow with a maximum CAGR of 14.82%. IT and Telecom companies often operate in complex environments with diverse data sources and systems. Data wrangling tools help integrate and consolidate data from different sources, such as CRM systems, billing systems, network logs, and customer support platforms. This integration gives organizations a holistic view of operations, improves data quality, and enhances decision-making processes. Moreover, Telecom companies face the challenge of optimizing network performance, ensuring high-quality service delivery, and reducing downtime. Data wrangling tools assist in processing network data to identify bottlenecks, analyse usage patterns, and predict network capacity requirements. By efficiently managing and analysing network data, IT and Telecom companies can improve their infrastructure, enhance customer experience, and optimize operations.

Regional Insights

North America dominated the market with a revenue share of 48% in 2022, owing to the presence of major technology hubs and a strong emphasis on data-driven decision-making. Many start-ups and established companies in the region have focused on developing data wrangling tools and solutions. The demand for data wrangling is driven by industries such as finance, healthcare, e-commerce, and technology. European countries, including the United Kingdom, Germany, and France, have also seen significant growth in the data wrangling market. The European Union's General Data Protection Regulation (GDPR) has increased the importance of data governance and compliance, leading to a greater need for data wrangling solutions. Industries such as banking, manufacturing, and retail have been adopting data wrangling practices to extract value from their data.

The Asia Pacific region is expected to grow with the fastest CAGR of 18.95% from 2023 to 2032. The increasing adoption of digital technologies, rising internet penetration, and the emergence of big data analytics have contributed to the demand for data wrangling tools and services. Industries such as telecommunications, e-commerce, healthcare, and finance are driving the market growth in this region. Moreover, The Asia-Pacific region has been at the forefront of digital transformation, with countries like China, Japan, India, and South Korea making significant advancements in technology adoption. This has led to a massive influx of data from various sources, creating a need for efficient data wrangling solutions to extract insights and drive business value.

Data Wrangling Market Segmentations:

By Component

By Deployment

By Enterprise Size

By End-User

By Market Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Data Wrangling Market

5.1. COVID-19 Landscape: Data Wrangling Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Data Wrangling Market, By Component

8.1. Data Wrangling Market, by Component, 2023-2032

8.1.1. Solution

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Services

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Data Wrangling Market, By Deployment

9.1. Data Wrangling Market, by Deployment, 2023-2032

9.1.1. Cloud

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. On-premises

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Data Wrangling Market, By Enterprise Size

10.1. Data Wrangling Market, by Enterprise Size, 2023-2032

10.1.1. SMEs

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Large Enterprises

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Data Wrangling Market, By End-User

11.1. Data Wrangling Market, by End-User, 2023-2032

11.1.1. BFSI

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Government

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. Retail

11.1.3.1. Market Revenue and Forecast (2020-2032)

11.1.4. Healthcare

11.1.4.1. Market Revenue and Forecast (2020-2032)

11.1.5. IT & Telecom

11.1.5.1. Market Revenue and Forecast (2020-2032)

11.1.6. Others (Media & Entertainment, Transportation)

11.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global Data Wrangling Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Component (2020-2032)

12.1.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.1.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.1.4. Market Revenue and Forecast, by End-User (2020-2032)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Component (2020-2032)

12.1.5.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.1.5.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.1.5.4. Market Revenue and Forecast, by End-User (2020-2032)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Component (2020-2032)

12.1.6.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.1.6.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.1.6.4. Market Revenue and Forecast, by End-User (2020-2032)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Component (2020-2032)

12.2.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.2.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.2.4. Market Revenue and Forecast, by End-User (2020-2032)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Component (2020-2032)

12.2.5.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.2.5.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.2.5.4. Market Revenue and Forecast, by End-User (2020-2032)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Component (2020-2032)

12.2.6.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.2.6.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.2.6.4. Market Revenue and Forecast, by End-User (2020-2032)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Component (2020-2032)

12.2.7.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.2.7.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.2.7.4. Market Revenue and Forecast, by End-User (2020-2032)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Component (2020-2032)

12.2.8.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.2.8.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.2.8.4. Market Revenue and Forecast, by End-User (2020-2032)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Component (2020-2032)

12.3.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.3.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.3.4. Market Revenue and Forecast, by End-User (2020-2032)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Component (2020-2032)

12.3.5.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.3.5.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.3.5.4. Market Revenue and Forecast, by End-User (2020-2032)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Component (2020-2032)

12.3.6.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.3.6.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.3.6.4. Market Revenue and Forecast, by End-User (2020-2032)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Component (2020-2032)

12.3.7.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.3.7.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.3.7.4. Market Revenue and Forecast, by End-User (2020-2032)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Component (2020-2032)

12.3.8.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.3.8.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.3.8.4. Market Revenue and Forecast, by End-User (2020-2032)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Component (2020-2032)

12.4.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.4.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.4.4. Market Revenue and Forecast, by End-User (2020-2032)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Component (2020-2032)

12.4.5.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.4.5.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.4.5.4. Market Revenue and Forecast, by End-User (2020-2032)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Component (2020-2032)

12.4.6.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.4.6.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.4.6.4. Market Revenue and Forecast, by End-User (2020-2032)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Component (2020-2032)

12.4.7.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.4.7.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.4.7.4. Market Revenue and Forecast, by End-User (2020-2032)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Component (2020-2032)

12.4.8.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.4.8.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.4.8.4. Market Revenue and Forecast, by End-User (2020-2032)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Component (2020-2032)

12.5.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.5.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.5.4. Market Revenue and Forecast, by End-User (2020-2032)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Component (2020-2032)

12.5.5.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.5.5.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.5.5.4. Market Revenue and Forecast, by End-User (2020-2032)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Component (2020-2032)

12.5.6.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.5.6.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.5.6.4. Market Revenue and Forecast, by End-User (2020-2032)

Chapter 13. Company Profiles

13.1. Altair Engineering Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Alteryx, Inc.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Datameer, Inc.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Hitachi Vantara Corporation

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. International Business Machines Corporation

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Impetus Technologies, Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Oracle Corporation

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Paxata, Inc.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. SAS Institute Inc.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. TIBCO Software Inc.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others