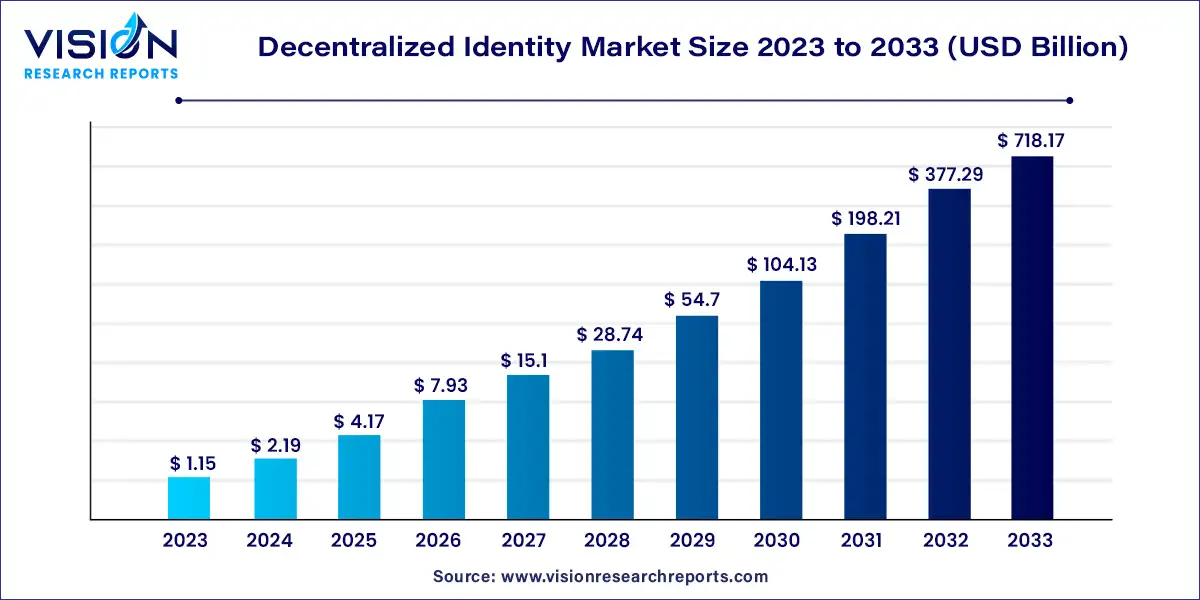

The global decentralized identity market size was estimated at around USD 1.15 billion in 2023 and it is projected to hit around USD 718.17 billion by 2033, growing at a CAGR of 90.35% from 2024 to 2033.

The growth of the decentralized identity market is propelled by the increasing concern regarding data privacy and security breaches in centralized identity systems are driving demand for alternative solutions that offer greater control and ownership over personal data. Secondly, the widespread adoption of blockchain technology, with its inherent characteristics of immutability and transparency, has positioned decentralized identity as a viable solution for secure and tamper-resistant identity management. Additionally, the growing digitization of services across various industries is fueling the need for efficient and trustworthy identity verification mechanisms. Moreover, regulatory initiatives and standards development efforts aimed at fostering interoperability and compliance are contributing to the market's growth by instilling confidence and trust among stakeholders. Lastly, the rising awareness and acceptance of self-sovereign identity principles among individuals and organizations are further accelerating the adoption of decentralized identity solutions, driving market expansion and innovation.

| Report Coverage | Details |

| Revenue Share of North America in 2023 | 33% |

| CAGR of Asia Pacific from 2024 to 2033 | 91.97% |

| Revenue Forecast by 2033 | USD 718.17 billion |

| Growth Rate from 2024 to 2033 | CAGR of 90.35% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

In terms of identity type, the biometric segment dominated the market in 2023 with a revenue share of more than 66%. Biometric identifiers, such as fingerprints, facial recognition, iris scans, and voice recognition, provide a high level of precision and security in authenticating an individual's identity. This type of identity verification offers a strong level of verification and is difficult to forge or replicate, making it highly reliable for forming trust in digital interactions. Biometric identity also offers convenience and ease of use for users. With biometric authentication, individuals can confirm their identity quickly and seamlessly by solely using their distinctive biological traits. This excludes the necessity for passwords or other traditional forms of authentication, which can be easily forgotten, stolen, or compromised.

The non-biometrics segment is anticipated to grow substantially over the forecast period. The growing demand for non-biometric identity among consumers owing to easy portability and convenience is expected to drive the segment's growth. Moreover, non-biometric authentication is typically used as a backup for biometric password-less security. Such factors are anticipated to contribute to the segment growth over the forecast period.

In terms of end-user, the enterprises segment dominated the market in 2023 with a revenue share of more than 67%. The growing concern for reducing business risk is a significant factor driving the segment growth. Moreover, a decentralized identity framework enables enterprises to control users’ identities independently of the identity issuer. Furthermore, a decentralized identity eliminates the initial need for organizations to gather and store personal data.

The individual segment is expected to register the fastest CAGR of 91.64% over the forecast period. The growth of the individual segment can be attributed to the increasing adoption of decentralized identity solutions by individuals for creating and maintaining their identities. Furthermore, the decentralized identity solutions help individuals verify and authenticate themselves in various identification processes for different use cases such as loan sanctioning, bank account opening, and other KYC processes, among others. Thus, such wide use cases of the decentralized identity to the individual users are further expected to drive the growth of the segment over the forecast period.

In terms of enterprise size, the large enterprises segment dominated the market in 2023 with a revenue share of over 69%. The demand for decentralized identity is rising among large enterprises as these enterprises are trying aggressively to avoid identity risk. For instance, in August 2023, Litentry, a multi-chain identity protocol, announced a partnership with Node Real, a blockchain infrastructure solution provider. Through the partnership, Litentry can incorporate NodeReal's MegaNode, which offers powerful real-time and historical data indexing on the Ethereum and Binance Chain networks.

The small & medium enterprises (SMEs) segment is anticipated to register the fastest CAGR of 90.85% over the forecast period. Small enterprises typically try to digitalize their services and enhance the customer experience. Furthermore, the application of blockchain technology-based identity management can be widely adopted as a means of guaranteeing the protection of private information and improving accountability and trust between parties. In addition, SMEs also benefit from increased product and service efficiency and quality, improved supply chain management, and blockchain-driven business model innovation.

In terms of vertical, the BFSI segment dominated the market in 2023 with a revenue share of over 21%. Banks are required to conduct KYC checks to confirm customers' identity and ensure they are not involved in any illegal activity, such as bribery or money laundering. In addition, the U.S. spends USD 25 billion on Anti Money Laundering (AML) compliances. Moreover, according to Forbes, in April 2019, major banks spent up to USD 500 million annually on cybersecurity.

The telecom & IT segment is anticipated to grow at the fastest CAGR of 92.17% over the forecast period. With the increasing digitization of communication and the growing demand for secure and seamless identity verification, the telecom & IT segment is actively exploring decentralized identity solutions to enhance user experiences and ensure robust security. Telecom and IT companies often handle a vast amount of sensitive customer data, including personal information and authentication credentials. By adopting decentralized identity solutions, they can provide their customers with greater control and ownership over their identity information while also enhancing data privacy and protection.

In terms of region, North America dominated the market in 2023 with a revenue share of more than 33%. The North America region has a varied range of industries and sectors that can benefit from decentralized identity solutions. These comprise financial services, healthcare, government, and e-commerce, among others. The need for secure and effectual identity authentication, data sharing, and user verification in these sectors has driven the adoption of decentralized identity technologies. In addition, it has a huge and tech-savvy population that is progressively more aware of the significance of data privacy and digital security, which is also accentuating the market growth in the region

Asia Pacific is anticipated to grow at the fastest CAGR of 91.97% over the forecast period. The regional market's growth can be attributed to the growing awareness of cybersecurity in nations such as India, China, and Japan. Aggressive efforts are being pursued by various organizations across the Asia Pacific to safeguard consumer identity, which is also expected to contribute to the regional market’s growth. For instance, in April 2021, Affinidi, a Tamsek identity startup, and The Commons Project Foundation, a global nonprofit tech firm, formed a collaboration. The main aim of this collaboration was to integrate digital credentials for secure international travel.

By Identity Type

By End-user

By Enterprise Size

By Vertical

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Decentralized Identity Market

5.1. COVID-19 Landscape: Decentralized Identity Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Decentralized Identity Market, By Identity Type

8.1. Decentralized Identity Market, by Identity Type, 2024-2033

8.1.1. Biometrics

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Non-biometrics

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Decentralized Identity Market, By End-user

9.1. Decentralized Identity Market, by End-user, 2024-2033

9.1.1. Individual

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Enterprises

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Decentralized Identity Market, By Enterprise Size

10.1. Decentralized Identity Market, by Enterprise Size, 2024-2033

10.1.1. Large Enterprises

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Small & Medium Enterprises

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Decentralized Identity Market, By Vertical

11.1. Decentralized Identity Market, by Vertical, 2024-2033

11.1.1. BFSI

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Government

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Healthcare & Life Sciences

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Telecom & IT

11.1.4.1. Market Revenue and Forecast (2021-2033)

11.1.5. Retail & E-commerce

11.1.5.1. Market Revenue and Forecast (2021-2033)

11.1.6. Transport & Logistics

11.1.6.1. Market Revenue and Forecast (2021-2033)

11.1.7. Real Estate

11.1.7.1. Market Revenue and Forecast (2021-2033)

11.1.8. Media & Entertainment

11.1.8.1. Market Revenue and Forecast (2021-2033)

11.1.9. Travel & Hospitality

11.1.9.1. Market Revenue and Forecast (2021-2033)

11.1.10. Others

11.1.10.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Decentralized Identity Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Identity Type (2021-2033)

12.1.2. Market Revenue and Forecast, by End-user (2021-2033)

12.1.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.1.4. Market Revenue and Forecast, by Vertical (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Identity Type (2021-2033)

12.1.5.2. Market Revenue and Forecast, by End-user (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.1.5.4. Market Revenue and Forecast, by Vertical (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Identity Type (2021-2033)

12.1.6.2. Market Revenue and Forecast, by End-user (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.1.6.4. Market Revenue and Forecast, by Vertical (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Identity Type (2021-2033)

12.2.2. Market Revenue and Forecast, by End-user (2021-2033)

12.2.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.2.4. Market Revenue and Forecast, by Vertical (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Identity Type (2021-2033)

12.2.5.2. Market Revenue and Forecast, by End-user (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.2.5.4. Market Revenue and Forecast, by Vertical (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Identity Type (2021-2033)

12.2.6.2. Market Revenue and Forecast, by End-user (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.2.6.4. Market Revenue and Forecast, by Vertical (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Identity Type (2021-2033)

12.2.7.2. Market Revenue and Forecast, by End-user (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.2.7.4. Market Revenue and Forecast, by Vertical (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Identity Type (2021-2033)

12.2.8.2. Market Revenue and Forecast, by End-user (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.2.8.4. Market Revenue and Forecast, by Vertical (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Identity Type (2021-2033)

12.3.2. Market Revenue and Forecast, by End-user (2021-2033)

12.3.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.3.4. Market Revenue and Forecast, by Vertical (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Identity Type (2021-2033)

12.3.5.2. Market Revenue and Forecast, by End-user (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.3.5.4. Market Revenue and Forecast, by Vertical (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Identity Type (2021-2033)

12.3.6.2. Market Revenue and Forecast, by End-user (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.3.6.4. Market Revenue and Forecast, by Vertical (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Identity Type (2021-2033)

12.3.7.2. Market Revenue and Forecast, by End-user (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.3.7.4. Market Revenue and Forecast, by Vertical (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Identity Type (2021-2033)

12.3.8.2. Market Revenue and Forecast, by End-user (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.3.8.4. Market Revenue and Forecast, by Vertical (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Identity Type (2021-2033)

12.4.2. Market Revenue and Forecast, by End-user (2021-2033)

12.4.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.4.4. Market Revenue and Forecast, by Vertical (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Identity Type (2021-2033)

12.4.5.2. Market Revenue and Forecast, by End-user (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.4.5.4. Market Revenue and Forecast, by Vertical (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Identity Type (2021-2033)

12.4.6.2. Market Revenue and Forecast, by End-user (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.4.6.4. Market Revenue and Forecast, by Vertical (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Identity Type (2021-2033)

12.4.7.2. Market Revenue and Forecast, by End-user (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.4.7.4. Market Revenue and Forecast, by Vertical (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Identity Type (2021-2033)

12.4.8.2. Market Revenue and Forecast, by End-user (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.4.8.4. Market Revenue and Forecast, by Vertical (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Identity Type (2021-2033)

12.5.2. Market Revenue and Forecast, by End-user (2021-2033)

12.5.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.5.4. Market Revenue and Forecast, by Vertical (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Identity Type (2021-2033)

12.5.5.2. Market Revenue and Forecast, by End-user (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.5.5.4. Market Revenue and Forecast, by Vertical (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Identity Type (2021-2033)

12.5.6.2. Market Revenue and Forecast, by End-user (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.5.6.4. Market Revenue and Forecast, by Vertical (2021-2033)

Chapter 13. Company Profiles

13.1. Microsoft Corporation

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Accenture plc

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Wipro Limited and Subsidiaries

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Secure Technologies Inc.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Persistent Systems Limited

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Avast Software s.r.o.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Civic Technologies, Inc.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. R3

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Validated ID, SL

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Dragonchain

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others