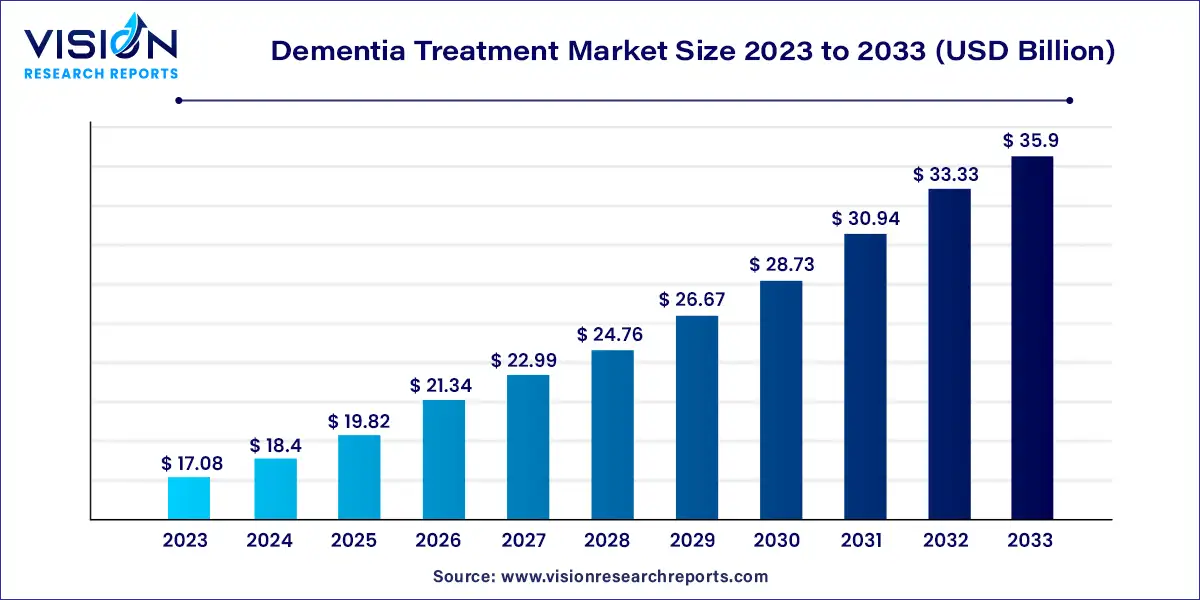

The global dementia treatment market size was estimated at around USD 17.08 billion in 2023 and it is projected to hit around USD 35.9 billion by 2033, growing at a CAGR of 7.71% from 2024 to 2033.

Dementia, a syndrome characterized by a decline in memory, cognitive function, and the ability to perform everyday activities, poses significant challenges to individuals, families, and healthcare systems worldwide. As the global population ages, the prevalence of dementia is expected to rise, driving the demand for effective treatment options and shaping the dynamics of the dementia treatment market.

The dementia treatment market encompasses a wide range of pharmaceutical and non-pharmaceutical interventions aimed at managing symptoms, slowing disease progression, and improving the quality of life for patients. Key treatment modalities include pharmacological agents, cognitive stimulation therapies, psychosocial interventions, and supportive care services.

The growth of the dementia treatment market is driven by an aging population worldwide is contributing to an increase in the prevalence of dementia, leading to greater demand for effective treatment options. Additionally, advancements in medical research and technology are facilitating the discovery of new therapeutic targets and innovative treatment approaches, thereby expanding the scope of available treatment options. Furthermore, rising awareness about the importance of early diagnosis and intervention is driving greater emphasis on dementia care and management. Moreover, collaborations between pharmaceutical companies, academic institutions, and government agencies are fostering research and development initiatives aimed at addressing the unmet needs in dementia treatment. Lastly, the evolving regulatory landscape and healthcare policies are creating opportunities for market growth by incentivizing investment in dementia research and drug development.

The Alzheimer’s disease (AD) dementia segment dominated the global market in 2023, holding a commanding share of 61%, and is poised to maintain its lead throughout the forecast period. This segment's significant share is primarily attributed to the prevalence of AD cases, high treatment rates, and growing public awareness. According to the World Health Organization (WHO), Alzheimer’s disease accounts for 60-70% of all dementia cases, making it the most prevalent form of the disease. Furthermore, the increasing approval of novel therapeutic drugs for AD treatment is expected to fuel the growth of this segment.

For instance, in September 2023, Eisai Co., Ltd. obtained market approval from the Ministry of Health, Labour and Welfare for lecanemab, a drug intended for the treatment of dementia due to AD in Japan. On the other hand, the Lewy body dementia (LBD) segment is forecasted to exhibit the highest compound annual growth rate (CAGR) from 2024 to 2030, driven by rising incidences and severity of this condition.

In 2023, the hospital pharmacy segment took the lead in the market, commanding a share of 65%. This dominance is driven by the rising rate of hospitalizations among the elderly population due to dementia. According to the Alzheimer’s Association Report of 2023, there were 518 hospitalizations per 1,000 Medicare beneficiaries aged 65 and older diagnosed with Alzheimer’s or other forms of dementia, compared to only 234 hospitalizations per 1,000 beneficiaries without these conditions.

On the other hand, the online segment is projected to experience the highest compound annual growth rate (CAGR) from 2024 to 2033. This growth is fueled by factors such as the expanding user base of the internet and smartphones, the convenience of ordering medications via e-commerce platforms, and the increasing availability of online pharmacies globally. Additionally, the growing adoption of telemedicine for managing mental health is expected to further drive growth in this segment in the years ahead.

In 2023, the cholinesterase inhibitors segment emerged as the market leader, capturing a share of 45%. This dominance is driven by the high prescription rates of medications such as donepezil, rivastigmine, and galantamine, which have shown promising efficacy in treating dementia. Additionally, the increasing adoption of transdermal cholinesterase inhibitors, known for their safety and effectiveness, further contributes to market growth. For instance, in September 2023, Corium, LLC reported positive results for Adlarity (a donepezil transdermal system) in terms of skin tolerability and adhesion, as demonstrated in a placebo-controlled trial.

However, the combination drugs segment is projected to witness the fastest compound annual growth rate (CAGR) from 2024 to 2033. This growth is fueled by the growing adoption of combination therapy, which has demonstrated superior efficacy compared to monotherapy. Furthermore, key players are introducing novel combination drugs into the market. For example, in April 2022, NovaMedica developed and registered a combination of donepezil and memantine molecules under the brand name Mioreol in the Russian and European markets. The increasing global approval of combination therapies comprising cholinesterase inhibitors and NMDA receptor antagonists is driving growth in this segment.

In 2023, the oral route of administration emerged as the market leader, capturing a share of 55%, and is anticipated to maintain its dominance in the years to come. The widespread use of oral medications, including memantine, donepezil, rivastigmine, galantamine, and others, along with the extensive offerings from numerous pharmaceutical companies, are key drivers behind the segment's growth. Additionally, the increasing approval of oral drugs contributes to the expansion of this segment. For example, in May 2023, the U.S. FDA granted supplemental approval for Rexulti (brexpiprazole) oral tablets to manage agitation associated with dementia.

On the other hand, the injectable drugs segment is projected to witness the fastest compound annual growth rate (CAGR) from 2024 to 2033. This growth is fueled by increasing research and development activities aimed at developing novel biological therapeutics, as well as the approval of injectable drugs that have shown improved efficacy in treating dementia. For instance, in July 2021, Biogen and Eisai Co., Ltd. received U.S. FDA approval for Aduhelm injection for the treatment of dementia related to Alzheimer’s disease.

In 2023, the North America dementia treatment market held the largest share, accounting for 38%, and is projected to maintain its dominance throughout the forecast period. This region's market growth is supported by factors such as high disease prevalence, the presence of key pharmaceutical companies engaged in marketing and developing novel dementia drugs, and favorable government initiatives. For example, in June 2023, Health Canada initiated the approval process for lecanemab in the country. Additionally, according to the Alzheimer's Association of Canada, approximately 747,000 individuals suffer from the disease in the country.

On the other hand, the Asia Pacific dementia treatment market is expected to witness the fastest compound annual growth rate (CAGR) from 2024 to 2033. This growth is driven by the region's large target population, high unmet clinical needs, and developing healthcare infrastructure, which present significant growth opportunities. Countries like China and India, with their sizable patient bases and high unmet medical needs, offer attractive market prospects for key players in the region.

Dementia Treatment Market Segmentations:

By Indication

By Drug Class

By Route of Administration

By Distribution Channel

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others