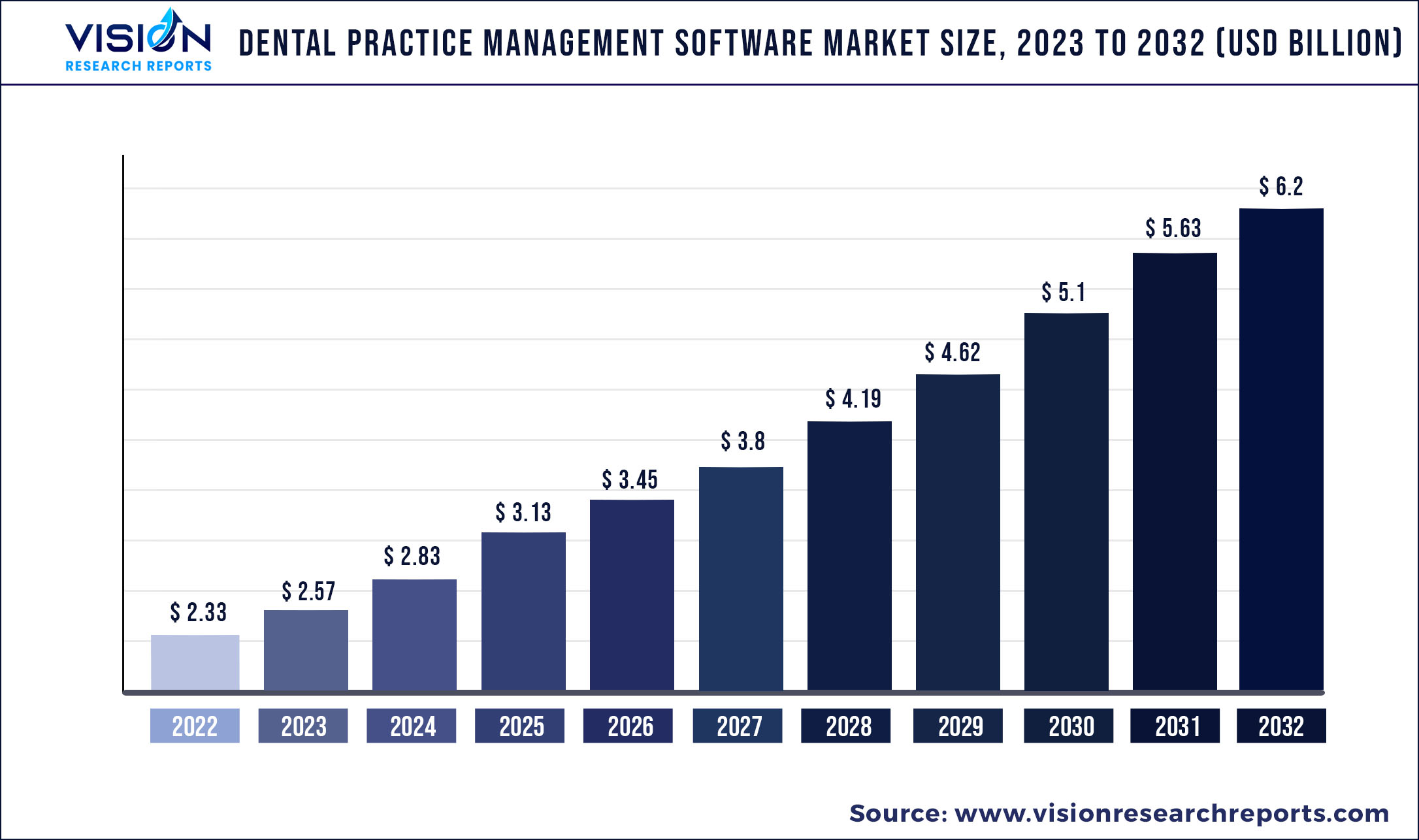

The global dental practice management software market size was estimated at around USD 2.33 billion in 2022 and it is projected to hit around USD 6.2 billion by 2032, growing at a CAGR of 10.29% from 2023 to 2032.

Key Pointers

Report Scope of the Dental Practice Management Software Market

| Report Coverage | Details |

| Market Size in 2022 | USD 2.33 billion |

| Revenue Forecast by 2032 | USD 6.2 billion |

| Growth rate from 2023 to 2032 | CAGR of 10.29% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Henry Schein, Inc.; Carestream Dental, LLC; DentiMax; Practice-Web, Inc.; Nextgen Healthcare, Inc.; ACE Dental Software; Datacon Dental Systems, Inc.; CareStack (Good Methods Global Inc.); CD Nevco LLC (Curve Dental); Dentiflow |

The market is driven by factors such as the rising geriatric population, increasing interest and awareness of oral health in Europe and the United States, and rapid technological advancements. The Health Information Technology for Economic and Clinical Health (HITEC) Act encourages and accelerates the use of health information technology in the United States. The Adoption of healthcare IT solutions, especially by specialty clinics such as oral practices, is anticipated to grow insurance coverage. These factors are expected to boost the demand for oral services, thereby driving the need for DPM software.

An increase in life expectancy has led to a rise in the geriatric population, which is likely to continue in the future. According to a report by the United Nations, in 2017, the global geriatric population was nearly 962 million and is projected to be 2.1 billion by 2050. According to the report by World Population Prospects 2019, by 2050, 16% of the world’s population would be over 65 years of age. This has resulted in a higher per capita demand for oral care services, creating a significant need for DPM solutions. According to the American Dental Association (ADA), older people enter the second round of cavity-prone years mainly due to dry mouth, which can be an adverse effect of drugs for asthma, high BP & cholesterol, pain, anxiety, Parkinson’s, and Alzheimer’s disease.

Since a major portion of the geriatric population uses these medicines, they are more prone to oral health problems. This is expected to drive the demand for DPM software. The number of independent practitioners has increased significantly in the U.S., Australia, and India owing to supportive government policies and increasing awareness about oral health. Patients visiting independent practitioners often pay out of pocket, as they are more affordable than large establishments, because a large number of patients seeking oral care are either uninsured or their insurance plans do not cover oral medical care.

During the early phases of the COVID-19 pandemic, most oral practices were completely stopped. In the United States, the ADA set limitations on oral procedures. Limitations on movement worldwide have been detrimental to the industry. According to the ADA, 76% of oral practice offices were closed due to the pandemic but continued to provide emergency care. In addition, 19% of practices were completely closed and did not provide any services, while only 5% of practices were fully operational but had a small patient base. Following the pandemic, software systems are projected to be widely used for managing business & patient data and health records. This is likely to encourage market expansion. The post-pandemic demand for DPM software increased as clinics, hospitals, and other facilities resumed non-emergency services. In the coming years, most oral care practices are predicted to invest in DPM solutions, resulting in significant growth in the market.

Dental Practice Management Software Market Segmentations:

| By Deployment Mode | By Application | By End-use |

|

On-premise Web-based Cloud-based |

Patient Communication Invoice/Billing Payment Processing Insurance Management Others |

Dental Clinics Hospitals Others |

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Dental Practice Management Software Market

5.1. COVID-19 Landscape: Dental Practice Management Software Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Dental Practice Management Software Market, By Deployment Mode

8.1. Dental Practice Management Software Market, by Deployment Mode, 2023-2032

8.1.1 On-premise

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Web-based

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Cloud-based

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Dental Practice Management Software Market, By Application

9.1. Dental Practice Management Software Market, by Application, 2023-2032

9.1.1. Patient Communication

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Invoice/Billing

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Payment Processing

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Insurance Management

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Dental Practice Management Software Market, By Dental Clinics

10.1. Dental Practice Management Software Market, by End-use, 2023-2032

10.1.1. Dental Clinics

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Hospitals

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Others

10.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Dental Practice Management Software Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Deployment Mode (2020-2032)

11.1.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.3. Market Revenue and Forecast, by End-use (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Deployment Mode (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Deployment Mode (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Deployment Mode (2020-2032)

11.2.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Deployment Mode (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Deployment Mode (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Deployment Mode (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.6.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Deployment Mode (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.7.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Deployment Mode (2020-2032)

11.3.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Deployment Mode (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Deployment Mode (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Deployment Mode (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.6.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Deployment Mode (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.7.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Deployment Mode (2020-2032)

11.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Deployment Mode (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Deployment Mode (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Deployment Mode (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.6.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Deployment Mode (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.7.3. Market Revenue and Forecast, by End-use (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Deployment Mode (2020-2032)

11.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Deployment Mode (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Deployment Mode (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.5.3. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 12. Company Profiles

12.1. Henry Schein, Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Carestream Dental, LLC

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. DentiMax

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Practice-Web, Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Nextgen Healthcare, Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. ACE Dental Software

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Datacon Dental Systems, Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. CareStack (Good Methods Global Inc.)

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. CD Nevco LLC (Curve Dental)

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Dentiflow

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others