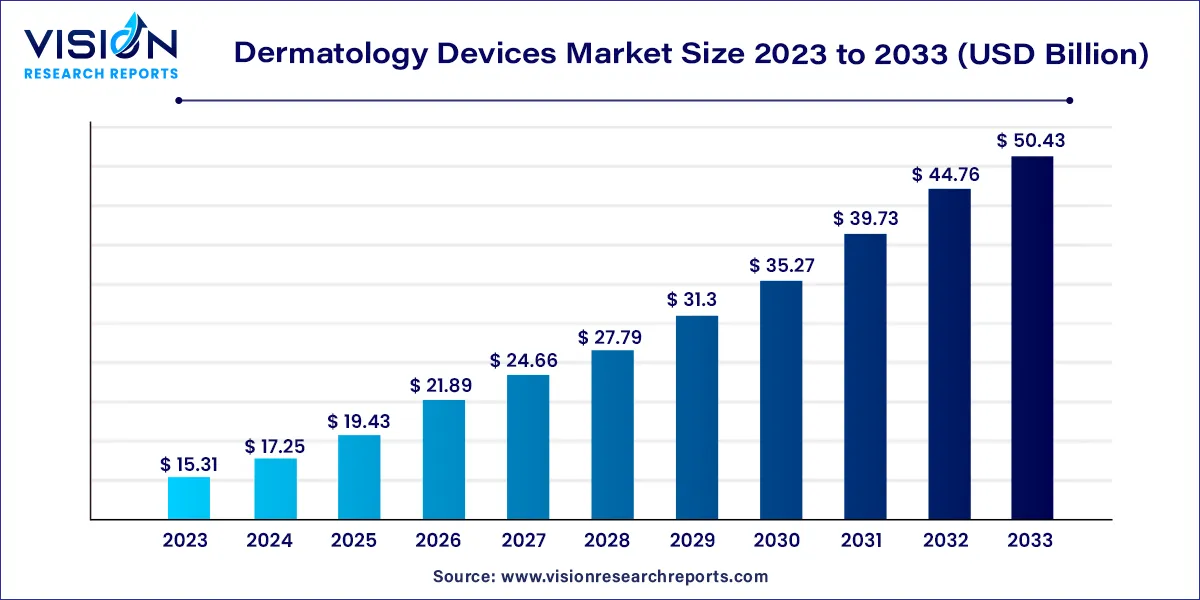

The global dermatology devices market size was estimated at around USD 15.31 billion in 2023 and it is projected to hit around USD 50.43 billion by 2033, growing at a CAGR of 12.66% from 2024 to 2033. The dermatology devices market is driven by a confluence of factors including technological advancements, rising prevalence of skin disorders, and increasing awareness regarding aesthetic procedures.

The growth of the dermatology devices market is fueled by several key factors. Firstly, technological advancements have revolutionized the field, introducing non-invasive and minimally invasive procedures that offer enhanced precision and efficacy. Additionally, the rising prevalence of skin disorders globally, attributed to factors like lifestyle changes and environmental pollution, has spurred the demand for advanced diagnostic and treatment solutions. Moreover, the increasing emphasis on aesthetic procedures, driven by growing consumer awareness and demand for cosmetic enhancements, has contributed significantly to market growth. These factors collectively underscore a promising trajectory for the dermatology devices market, presenting ample opportunities for innovation and expansion in the coming years.

The treatment devices segment dominated the market with a share of approximately 80% in 2023 and is projected to maintain the highest compound annual growth rate (CAGR) throughout the forecast period. This is primarily due to the broad spectrum of applications offered by dermatological treatment devices. Furthermore, the introduction of novel technologies within the laser device category has significantly contributed to the robust growth observed in this segment. Conversely, the relatively lower market share of diagnostic devices can be attributed to limited awareness regarding emerging diagnostic instruments. Nevertheless, the escalating prevalence of skin cancer is expected to bolster the growth trajectory of this segment in the forthcoming years.

Within the treatment devices category, laser products commanded the largest market share in 2023 and are poised to exhibit the most substantial growth over the forecast period, driven by their widespread adoption. Conversely, dermatoscopes emerged as the dominant segment within the diagnostic devices category in 2023, owing to the availability of advanced technological features.

The dermatology diagnostic devices market is forecasted to witness notable expansion over the forecast period, fueled by the escalating prevalence of dermatological conditions on a global scale. The surge in skin disorders, coupled with heightened awareness regarding early detection and treatment, has propelled the demand for advanced diagnostic devices within the dermatology devices market.

In 2023, the hair removal application segment emerged as the market leader, holding the largest share. Within the treatment application segment, hair removal is one of several categories, including skin rejuvenation, acne treatment, psoriasis management, tattoo removal, wrinkle reduction, skin resurfacing, body contouring, fat removal, cellulite reduction, vascular and pigmented lesion removal, and others.

According to data from the International Society of Aesthetic Plastic Surgery, plastic surgeons worldwide reported a substantial increase in procedures performed in 2022. The statistics revealed an 11.2% rise in overall procedures, with over 14.9 million surgical and 18.8 million non-surgical procedures conducted globally. This trend underscores the increasing demand for aesthetic treatments, which will directly influence the adoption of advanced and efficient dermatology devices.

In 2023, the hospital segment dominated the market, holding the largest share, primarily due to the presence of advanced dermatology equipment within hospital settings. Additionally, the wide array of treatment options available in these facilities has contributed to an increased number of visits for skin disease diagnosis and treatment.

The demand for specialized skin care treatments has prompted patients to seek services from specialty dermatology clinics, resulting in significant growth in this segment. Moreover, the global rise in the prevalence of skin cancer and melanoma, coupled with the growing number of clinics offering skin care services, has further bolstered patient visits to dermatology clinics for treatment and care.

Clinics serve as both cosmetic and medical facilities specializing in the diagnosis and treatment of various skin conditions. They provide a range of services, including both surgical and nonsurgical procedures, administered by certified plastic surgeons. According to TripleTree, as of 2020, there were 9,000 dermatology practices and 14,000 dermatologists in the United States. Among these practices, 34% operated as solo practices, while 48% included three or more physicians.

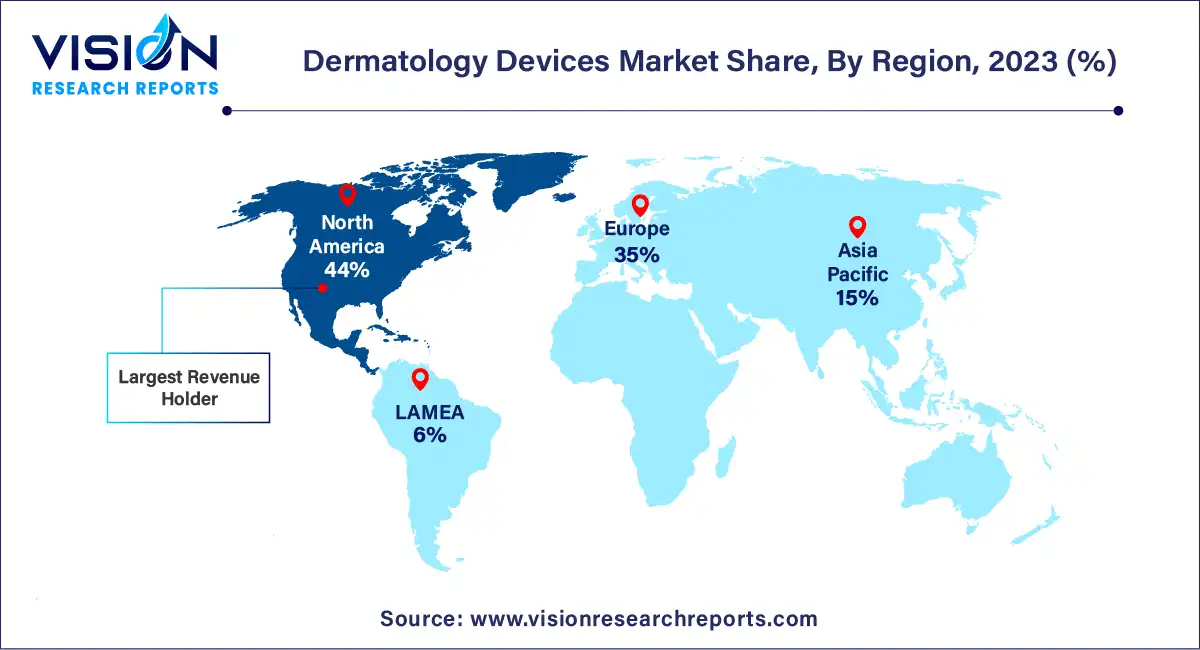

In 2023, North America held the largest revenue share in the market, accounting for 44%. This dominance is attributed to several factors, including the rising prevalence of skin cancer and other skin conditions such as acne, eczema, and rosacea. Additionally, the increasing adoption of cosmetic procedures has contributed to market growth in this region.

The U.S. dermatology device market is projected to sustain its growth momentum in the upcoming years. This growth will be driven by factors such as the growing demand for non-invasive and minimally invasive treatments, continuous advancements in technology, the introduction of new devices, and the escalating prevalence of skin care diseases. According to the Centers for Disease Control and Prevention (CDC), Acne vulgaris affects 80% of the U.S. population at some point in their lives, with 20% experiencing severe acne, which can lead to permanent physical and mental scarring.

By Production

By Application

By End-Use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Production Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Dermatology Devices Market

5.1. COVID-19 Landscape: Dermatology Devices Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Dermatology Devices Market, By Production

8.1. Dermatology Devices Market, by Production, 2024-2033

8.1.1 Diagnostic Devices

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Treatment Devices

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Dermatology Devices Market, By Application

9.1. Dermatology Devices Market, by Application, 2024-2033

9.1.1. Diagnostic Devices

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Treatment Devices

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Dermatology Devices Market, By End-Use

10.1. Dermatology Devices Market, by End-Use, 2024-2033

10.1.1. Hospitals

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Clinics

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Others

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Dermatology Devices Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Production (2021-2033)

11.1.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.3. Market Revenue and Forecast, by End-Use (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Production (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.4.3. Market Revenue and Forecast, by End-Use (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Production (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.5.3. Market Revenue and Forecast, by End-Use (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Production (2021-2033)

11.2.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.3. Market Revenue and Forecast, by End-Use (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Production (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.4.3. Market Revenue and Forecast, by End-Use (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Production (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.5.3. Market Revenue and Forecast, by End-Use (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Production (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.6.3. Market Revenue and Forecast, by End-Use (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Production (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.7.3. Market Revenue and Forecast, by End-Use (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Production (2021-2033)

11.3.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.3. Market Revenue and Forecast, by End-Use (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Production (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.4.3. Market Revenue and Forecast, by End-Use (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Production (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.5.3. Market Revenue and Forecast, by End-Use (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Production (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.6.3. Market Revenue and Forecast, by End-Use (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Production (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.7.3. Market Revenue and Forecast, by End-Use (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Production (2021-2033)

11.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.3. Market Revenue and Forecast, by End-Use (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Production (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.4.3. Market Revenue and Forecast, by End-Use (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Production (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.5.3. Market Revenue and Forecast, by End-Use (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Production (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.6.3. Market Revenue and Forecast, by End-Use (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Production (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.7.3. Market Revenue and Forecast, by End-Use (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Production (2021-2033)

11.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.3. Market Revenue and Forecast, by End-Use (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Production (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.4.3. Market Revenue and Forecast, by End-Use (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Production (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.5.3. Market Revenue and Forecast, by End-Use (2021-2033)

Chapter 12. Company Profiles

12.1. Alma Lasers GmbH.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Cynosure, Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Solta Medical, Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Cutera, Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Syneron Medical Ltd.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Canfield Scientific, Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. 3Gen.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Aesthetic Group

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Ambicare Health.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Image Derm, Inc

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others