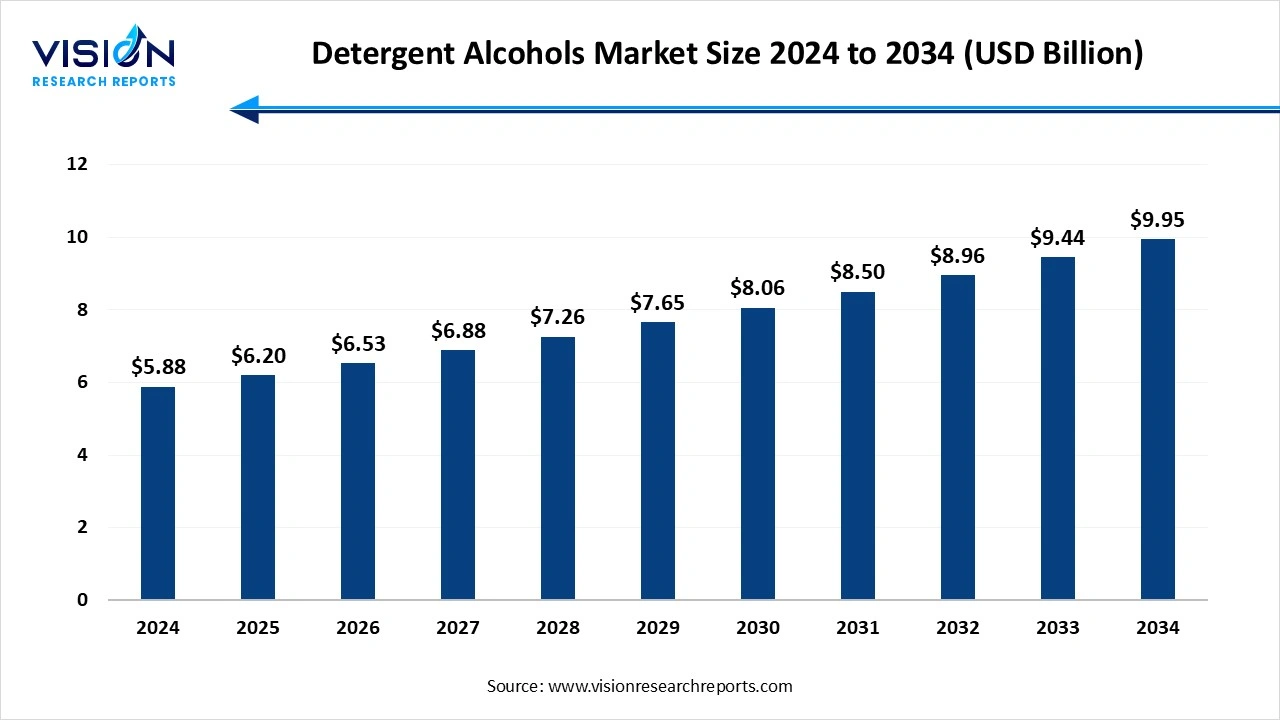

The global detergent alcohols market size was surpassed at USD 5.88 billion in 2024 and it is expected to surpass around USD 9.95 billion by 2034, poised to grow at a CAGR of 5.30% from 2025 to 2034.

The detergent alcohols market plays a vital role in the global surfactants and cleaning agents industry, driven by the growing demand for sustainable and biodegradable raw materials in home and personal care products. Detergent alcohols, primarily derived from natural or synthetic fatty alcohols, serve as key intermediates in the production of alcohol-based surfactants such as alcohol ethoxylates and sulfates. These compounds are extensively used in formulations of detergents, shampoos, soaps, and industrial cleaners due to their excellent emulsifying, wetting, and foaming properties.

The detergent alcohols market is primarily driven by the rising global demand for surfactants used in household and industrial cleaning products. As urbanization and disposable income levels increase, especially in emerging economies, there has been a noticeable rise in the consumption of laundry detergents, dishwashing liquids, and personal care items like shampoos and body washes. These products heavily rely on detergent alcohols as essential raw materials.

Another key growth factor is the shift toward sustainable and bio-based alternatives. With increasing environmental concerns and regulatory pressure to reduce carbon footprints and avoid petrochemical-based ingredients, manufacturers are investing in renewable feedstocks to produce detergent alcohols. This trend is further supported by consumer preference for green-label products, encouraging innovation in production technologies and raw material sourcing.

One of the most prominent trends in the detergent alcohols market is the accelerating shift toward bio-based and sustainable raw materials. As environmental regulations tighten and consumer awareness grows, companies are increasingly turning to natural feedstocks such as palm oil, coconut oil, and other plant-derived sources for detergent alcohol production. This transition is particularly evident in North America and Europe, where brands seek to align with eco-label certifications and sustainability goals.

Another major trend is the integration of advanced production technologies and process optimization. Manufacturers are adopting catalytic and enzymatic technologies to improve yield efficiency and lower the environmental footprint of production. Innovations in continuous processing and feedstock flexibility are helping to streamline operations and reduce costs. Additionally, digital monitoring systems and automation are increasingly being employed in manufacturing facilities to improve quality control and operational safety.

One of the primary challenges faced by the detergent alcohols market is the volatility in raw material prices, particularly those derived from natural oils such as palm and coconut oil. Fluctuations in crop yields, climate change impacts, and geopolitical factors affecting major producing countries can significantly influence the cost and availability of these feedstocks. This price instability not only affects production margins but also complicates long-term planning and pricing strategies for manufacturers, making supply chain management more complex and less predictable.

Another key challenge is the increasing regulatory scrutiny regarding environmental and ethical concerns, especially related to the sourcing of bio-based raw materials. For example, palm oil production has faced criticism for contributing to deforestation, loss of biodiversity, and labor rights issues. These concerns have prompted stricter sustainability standards and certifications, requiring companies to ensure traceability and responsible sourcing practices. Complying with these evolving regulatory frameworks can be resource-intensive and may limit market entry for smaller players who lack the capacity to meet rigorous compliance requirements.

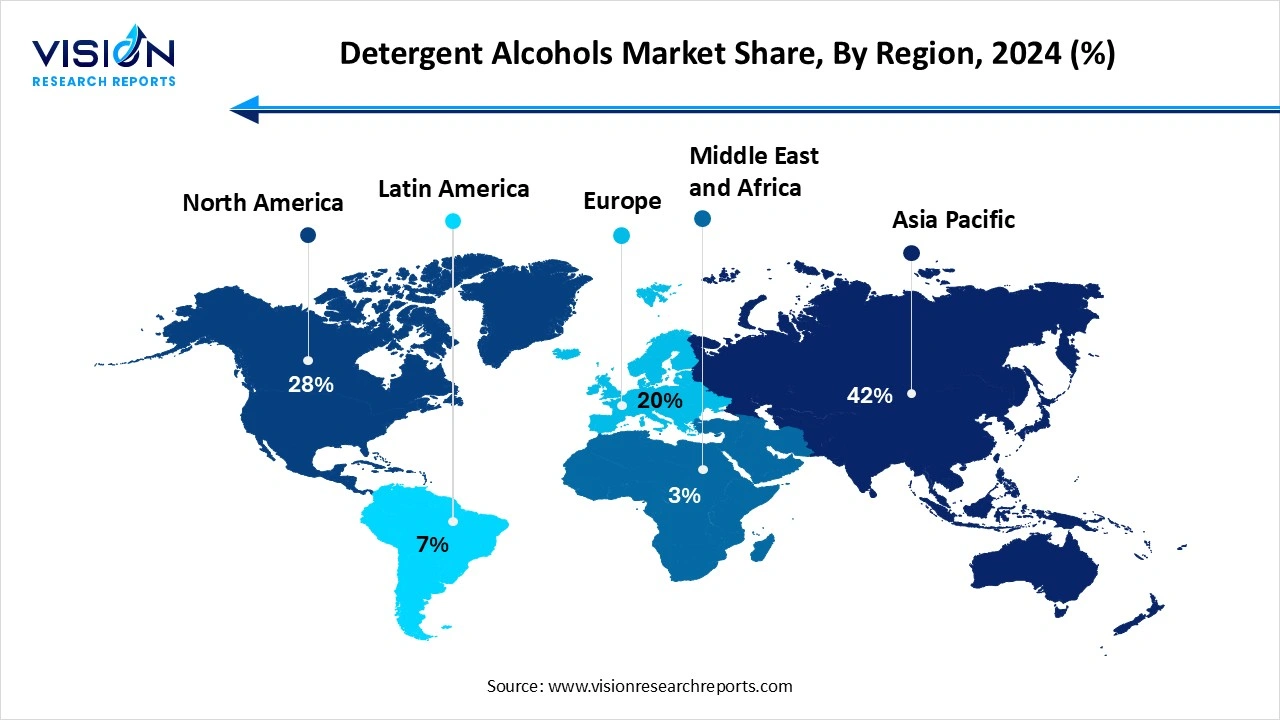

Asia Pacific accounted for the highest revenue share, capturing 42% of the market in 2024. The region also benefits from rapid industrialization, rising consumer demand for personal care and household cleaning products, and the presence of major manufacturing hubs. China and India, in particular, are experiencing robust growth due to their large population bases, increasing disposable income, and expanding detergent and cosmetics industries.

North America represents a mature but significant market for detergent alcohols, especially due to the widespread use of surfactants in household and industrial cleaning products. The region's emphasis on product innovation, sustainability, and regulatory compliance has led to increased adoption of bio-based and low-VOC detergent alcohols. The United States remains the key contributor to regional demand, supported by strong consumer awareness, well-established retail distribution networks, and technological advancements in formulation science.

North America represents a mature but significant market for detergent alcohols, especially due to the widespread use of surfactants in household and industrial cleaning products. The region's emphasis on product innovation, sustainability, and regulatory compliance has led to increased adoption of bio-based and low-VOC detergent alcohols. The United States remains the key contributor to regional demand, supported by strong consumer awareness, well-established retail distribution networks, and technological advancements in formulation science.

The synthetic segment dominated the market, capturing the largest revenue share of 68% in 2024. These alcohols are particularly favored in industrial applications where uniformity and high-volume production are critical. The synthetic segment has traditionally dominated the market in regions with a strong petrochemical base, including North America and parts of Europe. However, environmental concerns and rising fossil fuel prices have prompted a gradual shift away from synthetic sources in favor of more sustainable alternatives.

The natural detergent alcohols are obtained from renewable sources such as palm oil, coconut oil, and other vegetable oils. These bio-based alcohols are increasingly gaining traction as industries and consumers prioritize eco-friendly and biodegradable ingredients. The demand for natural sources is especially strong in the personal care and household cleaning segments, where brand image and consumer perception play a crucial role. While natural alcohols may face challenges related to price volatility and supply chain disruptions due to agricultural dependencies, their long-term growth is supported by global sustainability initiatives and regulatory support.

The laundry detergents segment accounted for the highest revenue share at 41%, underscoring its leading position in the market in 2024. Detergent alcohols are vital intermediates in the production of alcohol-based surfactants such as alcohol ethoxylates and alcohol sulfates, which are essential components in liquid and powder laundry detergents. These surfactants offer excellent cleansing, foaming, and emulsifying properties, enabling effective removal of dirt, oil, and stains from fabrics. The increasing demand for high-performance and low-residue detergents, especially in urban households and institutional settings, has fueled the growth of detergent alcohols in this segment.

The personal care and cosmetics industry also constitutes a major application area for detergent alcohols, driven by their versatile role in formulations for shampoos, body washes, facial cleansers, and creams. These alcohols serve as emulsifiers, viscosity enhancers, and foaming agents, contributing to the texture, performance, and stability of personal care products. With growing consumer awareness regarding product ingredients and increasing demand for natural and skin-friendly cosmetics, the market is experiencing a shift toward bio-based detergent alcohols in this segment.

By Source

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Detergent Alcohols Market

5.1. COVID-19 Landscape: Detergent Alcohols Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Detergent Alcohols Market, By Source

8.1. Detergent Alcohols Market, by Source

8.1.1. Natural

8.1.1.1. Market Revenue and Forecast

8.1.2. Synthetic

8.1.2.1. Market Revenue and Forecast

Chapter 9. Detergent Alcohols Market, By Application

9.1. Detergent Alcohols Market, by Application

9.1.1. Laundry Detergents

9.1.1.1. Market Revenue and Forecast

9.1.2. Dishwashing Detergents

9.1.2.1. Market Revenue and Forecast

9.1.3. Personal Care & Cosmetics

9.1.3.1. Market Revenue and Forecast

9.1.4. Industrial Cleaners

9.1.4.1. Market Revenue and Forecast

9.1.5. Other Applications

9.1.5.1. Market Revenue and Forecast

Chapter 10. Detergent Alcohols Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Source

10.1.2. Market Revenue and Forecast, by Application

Chapter 11. Company Profiles

11.1. Sasol Limited

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Shell Chemicals

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Kuala Lumpur Kepong Berhad (KLK OLEO)

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Godrej Industries Limited

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. BASF SE

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Emery Oleochemicals

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Croda International Plc

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Ecogreen Oleochemicals

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Procter & Gamble Chemicals

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Musim Mas Group

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others