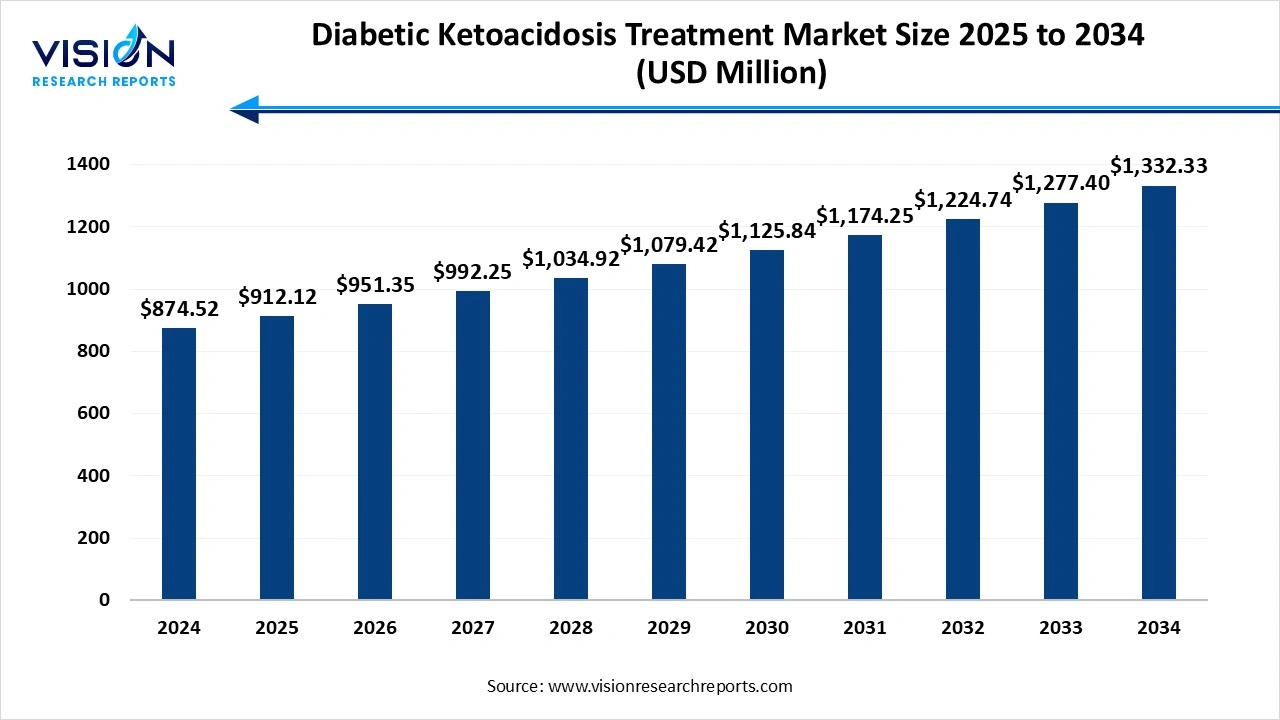

The global diabetic ketoacidosis treatment market size was evaluated at around USD 874.52 million in 2024 and it is projected to hit around USD 1,332.33 million by 2034, growing at a CAGR of 4.3% from 2025 to 2034. The market is driven by the rising global prevalence of diabetes and increasing awareness regarding diabetic complications, the Diabetic Ketoacidosis (DKA) Treatment Market is experiencing robust growth.

| Report Coverage | Details |

| Market Size in 2024 | USD 874.52 million |

| Revenue Forecast by 2034 | USD 1,332.33 million |

| Growth rate from 2025 to 2034 | CAGR of 4.3% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Novo Nordisk A/S. Sanofi S.A., Eli Lilly and Company, B. Braun, Melsungen AG, Pfizer Inc., Baxter International Inc., AstraZeneca plc, Fresenius Kabi AG, Johnson & Johnson Services, Inc. |

The Diabetic Ketoacidosis (DKA) treatment market is witnessing steady growth due to the increasing prevalence of diabetes worldwide and the rising number of hospital admissions related to diabetes complications. DKA is a serious and potentially life-threatening condition that typically affects individuals with type 1 diabetes and, less commonly, those with type 2 diabetes. The treatment market primarily involves insulin therapy, fluid replacement, and electrolyte management, which are essential for stabilizing patients and preventing organ failure. Technological advancements in point-of-care diagnostics and continuous glucose monitoring systems have further supported effective and timely DKA management. Moreover, growing awareness among patients and healthcare professionals, along with improved access to healthcare services in emerging regions, is expected to drive market expansion. However, high treatment costs and limited infrastructure in low-income countries may restrain market growth to some extent.

The growth of the Diabetic Ketoacidosis (DKA) treatment market is primarily driven by the rising global incidence of diabetes, especially type 1 diabetes, which significantly increases the risk of DKA. As diabetes continues to affect millions worldwide, particularly in developing economies where disease management remains inconsistent, the need for emergency interventions like DKA treatment is surging. Additionally, growing patient awareness about the complications of unmanaged diabetes, coupled with government and private initiatives aimed at improving early diagnosis and intervention, is contributing to market expansion.

Another key factor fueling market growth is the advancement in healthcare infrastructure and the development of more efficient and rapid diagnostic and treatment solutions. Hospitals and emergency care centers are increasingly adopting point-of-care testing and real-time monitoring technologies, which enhance patient outcomes and reduce treatment time.

One of the major challenges facing the Diabetic Ketoacidosis (DKA) treatment market is the high cost of care, particularly in emergency and intensive care settings. Managing DKA typically requires hospitalization, intravenous insulin administration, electrolyte replacement, and continuous monitoring, all of which can lead to substantial medical expenses. This poses a significant barrier,

especially in low- and middle-income countries where access to affordable healthcare is limited.

Another critical challenge is the shortage of skilled healthcare professionals trained to handle acute diabetic complications like DKA. In many rural and under-resourced areas, emergency departments may lack the capacity or expertise for rapid and effective DKA management. Furthermore, misdiagnosis or late-stage detection can complicate the treatment process and lead to extended hospital stays or long-term health consequences.

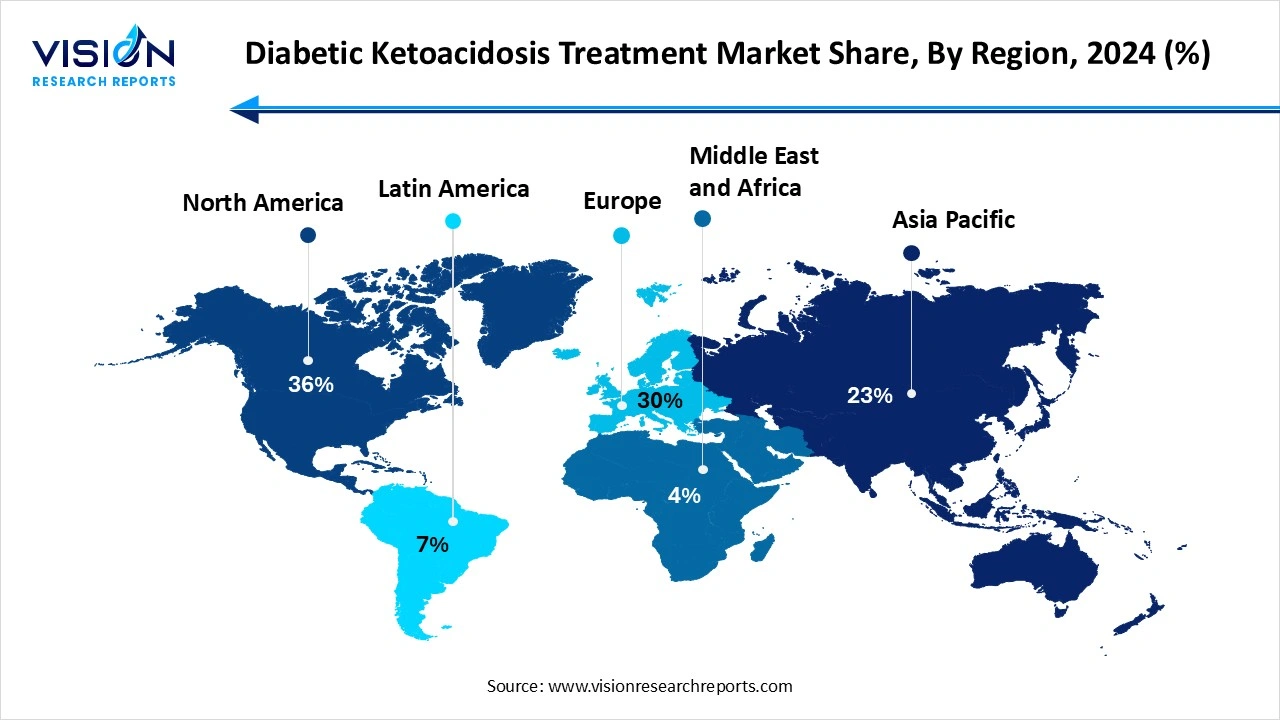

North America is projected to dominate the diabetic ketoacidosis (DKA) treatment market in 2024, holding the largest share of 36%. North America holds the largest market share, largely due to the high incidence of type 1 diabetes, well-established healthcare systems, and strong awareness regarding diabetes-related emergencies. The United States, in particular, benefits from advanced diagnostic and treatment facilities, widespread adoption of continuous glucose monitoring technologies, and supportive insurance coverage for acute care, all of which contribute to the dominance of the region in the global market.

The Asia-Pacific region is poised for the fastest growth during the forecast period, fueled by a rising diabetic population, improving healthcare access, and growing investments in medical infrastructure. Nations such as China, India, and Japan are experiencing a surge in DKA-related hospital admissions, and the increasing focus on early diagnosis and public health education is expected to support market growth.

The Asia-Pacific region is poised for the fastest growth during the forecast period, fueled by a rising diabetic population, improving healthcare access, and growing investments in medical infrastructure. Nations such as China, India, and Japan are experiencing a surge in DKA-related hospital admissions, and the increasing focus on early diagnosis and public health education is expected to support market growth.

The insulin therapy segment is expected to lead the diabetic ketoacidosis (DKA) treatment market, accounting for the highest revenue share of 29% in 2024. It plays a central role in correcting hyperglycemia and halting ketone production, which are critical in reversing the acute metabolic crisis seen in DKA. Rapid-acting intravenous insulin is the standard in hospital settings, ensuring precise and continuous glucose control during the critical phase of treatment. The effectiveness of insulin therapy in stabilizing patients quickly has made it the frontline solution in both developed and developing healthcare systems.

The apart from insulin therapy, other treatment types also contribute significantly to the comprehensive management of DKA. These include fluid replacement therapy to address dehydration, electrolyte replenishment especially for potassium, sodium, and chloride imbalances and supportive care such as bicarbonate therapy in severe cases. These supportive treatments are crucial for restoring the body’s metabolic balance and preventing complications like cardiac arrhythmias and cerebral edema. The demand for such complementary therapies continues to grow alongside insulin usage, particularly in regions with increasing DKA incidence.

The hospital segment is anticipated to hold the dominant share of 76% in the market for 2024. These include fluid replacement therapy to address dehydration, electrolyte replenishment especially for potassium, sodium, and chloride imbalances and supportive care such as bicarbonate therapy in severe cases. These supportive treatments are crucial for restoring the body’s metabolic balance and preventing complications like cardiac arrhythmias and cerebral edema. The demand for such complementary therapies continues to grow alongside insulin usage, particularly in regions with increasing DKA incidence.

The homecare settings segment is emerging as the fastest-growing end-user category, driven by the rising adoption of home-based diabetes management solutions. Most DKA cases require immediate medical attention, advanced diagnostic tools, and intensive monitoring, all of which are best delivered in a hospital setting. Hospitals are equipped with the necessary infrastructure, such as emergency departments, intensive care units (ICUs), and trained healthcare professionals capable of administering intravenous insulin, fluid resuscitation, and electrolyte management. smaller share compared to hospitals, its potential is expanding due to technological innovation and greater emphasis on self-management of diabetes.

By Treatment Type

By End-user

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Diabetic Ketoacidosis Treatment Market

5.1. COVID-19 Landscape: Diabetic Ketoacidosis Treatment r Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Diabetic Ketoacidosis Treatment Market, By Treatment Type

8.1. Diabetic Ketoacidosis Treatment Market, by Treatment Type, 2024-2033

8.1.1. Fluid Replacement Therapy

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Electrolyte Replacement Therapy

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Insulin Therapy

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Diabetic Ketoacidosis Treatment Market, By End-user

9.1. Diabetic Ketoacidosis Treatment Market, by End-user, 2024-2033

9.1.1. Hospitals

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Ambulatory Surgical Centers (ASCs)

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Homecare Settings

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Pharmaceutical Water Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Treatment Type (2021-2033)

10.1.2. Market Revenue and Forecast, by End-user (2021-2033)

Chapter 11. Company Profiles

11.1. Novo Nordisk A/S

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Sanofi S.A.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Eli Lilly and Company

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. B. Braun Melsungen AG

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Pfizer Inc.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Baxter International Inc.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. AstraZeneca plc

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. ab Fresenius Kabi AG

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Johnson & Johnson Services, Inc.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others