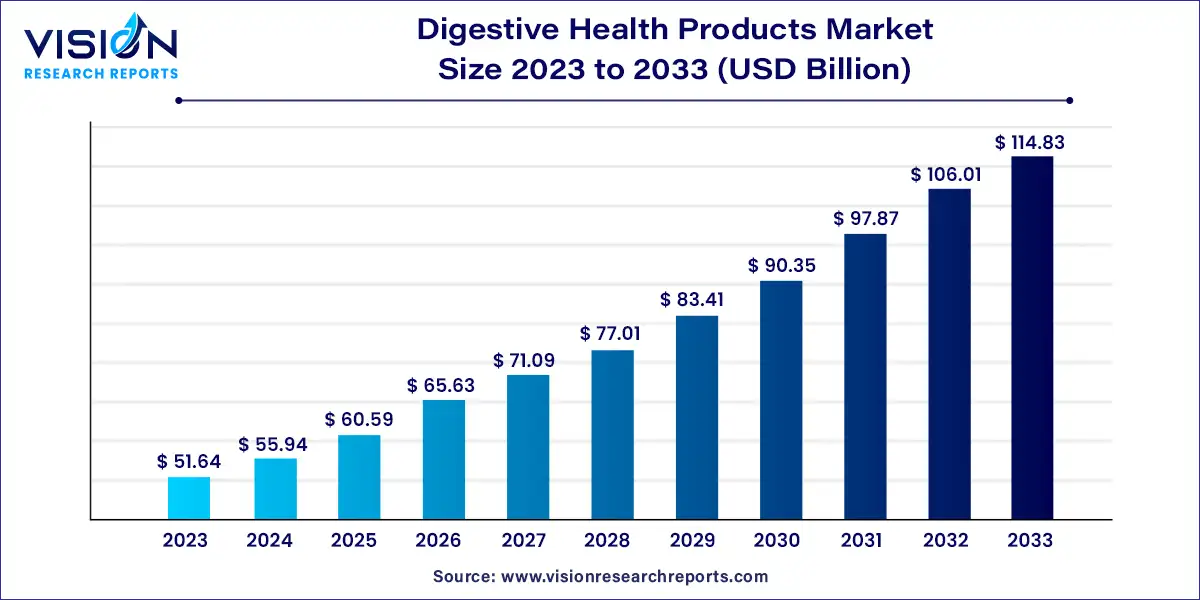

The global digestive health products market size was estimated at around USD 51.64 billion in 2023 and it is projected to hit around USD 114.83 billion by 2033, growing at a CAGR of 8.32% from 2024 to 2033. The digestive health products market encompasses a broad range of goods designed to support and improve digestive function. These products include dietary supplements, probiotics, prebiotics, functional foods, and over-the-counter medications aimed at addressing various digestive issues such as bloating, constipation, irritable bowel syndrome (IBS), and general gut health.

The digestive health products market is experiencing robust growth driven by an increasing consumer awareness about the vital role of gut health in overall well-being has significantly boosted demand. As people become more informed about the connection between digestive health and conditions like obesity, diabetes, and mental health issues, they are actively seeking products that support a healthy digestive system. Additionally, the rise in chronic digestive disorders, such as irritable bowel syndrome (IBS) and inflammatory bowel disease (IBD), is fueling the need for effective and specialized solutions. The aging population also contributes to market expansion, as older adults often face digestive challenges and seek products tailored to their needs. Furthermore, innovation in product development, including the creation of personalized probiotics and advanced prebiotics, is capturing consumer interest and expanding market opportunities. Enhanced availability through online platforms and retail channels further supports market growth by making these products more accessible to a wider audience.

In 2023, North America accounted for 34% of global revenue in the digestive health products market. Key factors contributing to this high market share include the presence of major players, government support for product development, and advancements in probiotic and prebiotic technologies. Additional drivers include rising healthcare costs, evolving food laws affecting product labeling, rapid scientific and processing technology advancements, an aging population, and growing interest in diet-related wellness.

In the U.S., the digestive health products market is projected to grow at a CAGR of 8.23% from 2024 to 2033. This growth is driven by increasing consumer emphasis on gut health and wellness. Factors such as heightened awareness of the link between digestive health and overall well-being, growing interest in functional foods, and a rise in digestive issues are contributing to the increased demand for digestive health products. Market players are employing strategies like collaborations and portfolio expansions to gain a competitive edge. For example, Kerry acquired Bio-K Plus in November 2020 to enhance its capabilities in the growing probiotics market.

The Asia Pacific region is expected to experience the fastest CAGR of 9.63% during the forecast period. This growth is fueled by major players launching their brands in untapped Southeast Asian markets. Rapid urbanization and rising disposable incomes have led to increased consumption of processed and fast foods, resulting in digestive issues such as acid reflux and Irritable Bowel Syndrome (IBS). This has created a demand for products that address these concerns. The expansion of e-commerce platforms in countries like India has also facilitated greater access to digestive health products. The Indian market is projected to grow at a CAGR of over 11% from 2024 to 2033, driven by a heightened focus on overall wellness and increasing awareness of the importance of digestive health.

In 2023, the dairy products segment led the market, capturing approximately 75% of the revenue share. This dominance is attributed to the rising consumer preference for preventive healthcare and the advancement of effective probiotic strains in dairy products, which help manage intestinal inflammation, enhance gut health, and boost immunity. Additionally, the popularity of functional beverages such as relaxation drinks, sports drinks, and kombucha has surged due to their distinctive flavors and health benefits. This trend is expected to drive an increase in the use of functional ingredients like prebiotics and probiotics in non-alcoholic beverages, thereby contributing to market growth.

Moreover, the demand for digestive dairy products is rising as consumers seek solutions to counteract the effects of unhealthy eating habits and sedentary lifestyles. Manufacturers are responding with innovative products that offer various digestive health benefits. For instance, Biocatalysts Ltd. introduced an enzyme, Lipomod 4MDP (L004MDP), in July 2021, specifically designed for the dairy flavor market. This enzyme produces significant quantities of short-chain fatty acids while minimizing medium- to long-chain fatty acids, resulting in a distinctive sharp, cheesy, and salty flavor profile.

The supplement segment is forecasted to grow at a CAGR of 9.03% from 2024 to 2033. This growth is driven by increasing awareness of nutrition and health, the benefits of an active lifestyle, and the role of nutritional supplements. The aging population and heightened concerns about gut health are also key factors fueling demand. As digestive efficiency declines with age, digestive health products are seen as a means to support gut health and overall well-being. Rising consumer spending on products that enhance intestinal health is expected to further stimulate market growth during the forecast period.

In 2023, probiotics held the largest market share, accounting for 88% of the industry. The widespread use of probiotic ingredients in healthy foods and supplements is due to growing consumer awareness of their benefits, which include supporting immune function, improving digestive health, reducing inflammation, and enhancing mental health. This trend reflects an increasing consumer interest in natural and healthy dietary options. Probiotics are increasingly incorporated into a variety of products, such as yogurts, kefir, and other fermented foods, as well as dietary supplements. The popularity of these ingredients is driving market expansion, with several companies launching new probiotic-based products. For example, Good Culture introduced Good Culture Probiotic Milk in March 2023, a lactose-free, long-life milk containing the BC30 probiotic (Bacillus coagulants GBI-30, 6086), which supports gut health and digestion.

The food enzymes segment is projected to grow at a CAGR of 9.3% from 2024 to 2033. The multifunctionality of food enzymes and the increasing demand from the food and beverage industry are expected to drive this growth. Food enzymes are used primarily in dairy product manufacturing and processing, enhancing the quality, texture, and flavor of various products. Their applications extend to traditional areas such as baking, brewing, and cheese-making, as well as newer areas like fat modification and the development of new sweeteners.

By Product

By Ingredient

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Digestive Health Products Market

5.1. COVID-19 Landscape: Digestive Health Products Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Digestive Health Products Market, By Product

8.1. Digestive Health Products Market, by Product, 2024-2033

8.1.1. Dairy Products

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Bakery & Cereals

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Non-Alcoholic Beverages

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Supplements

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Digestive Health Products Market, By Ingredient

9.1. Digestive Health Products Market, by Ingredient, 2024-2033

9.1.1. Prebiotics

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Probiotics

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Food Enzymes

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Digestive Health Products Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by Ingredient (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Ingredient (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Ingredient (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.2. Market Revenue and Forecast, by Ingredient (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Ingredient (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Ingredient (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Ingredient (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Ingredient (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.2. Market Revenue and Forecast, by Ingredient (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Ingredient (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Ingredient (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Ingredient (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Ingredient (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.2. Market Revenue and Forecast, by Ingredient (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Ingredient (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Ingredient (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Ingredient (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Ingredient (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.2. Market Revenue and Forecast, by Ingredient (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Ingredient (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Ingredient (2021-2033)

Chapter 11. Company Profiles

11.1. BASF SE

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Chr. Hansen Holding A/S

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Nestle SA

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. International Flavors & Fragrances Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. DuPont de Nemours, Inc.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Bayer AG

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Danone

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Arla Foods Amba

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Sanofi

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Cargill, Inc.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others