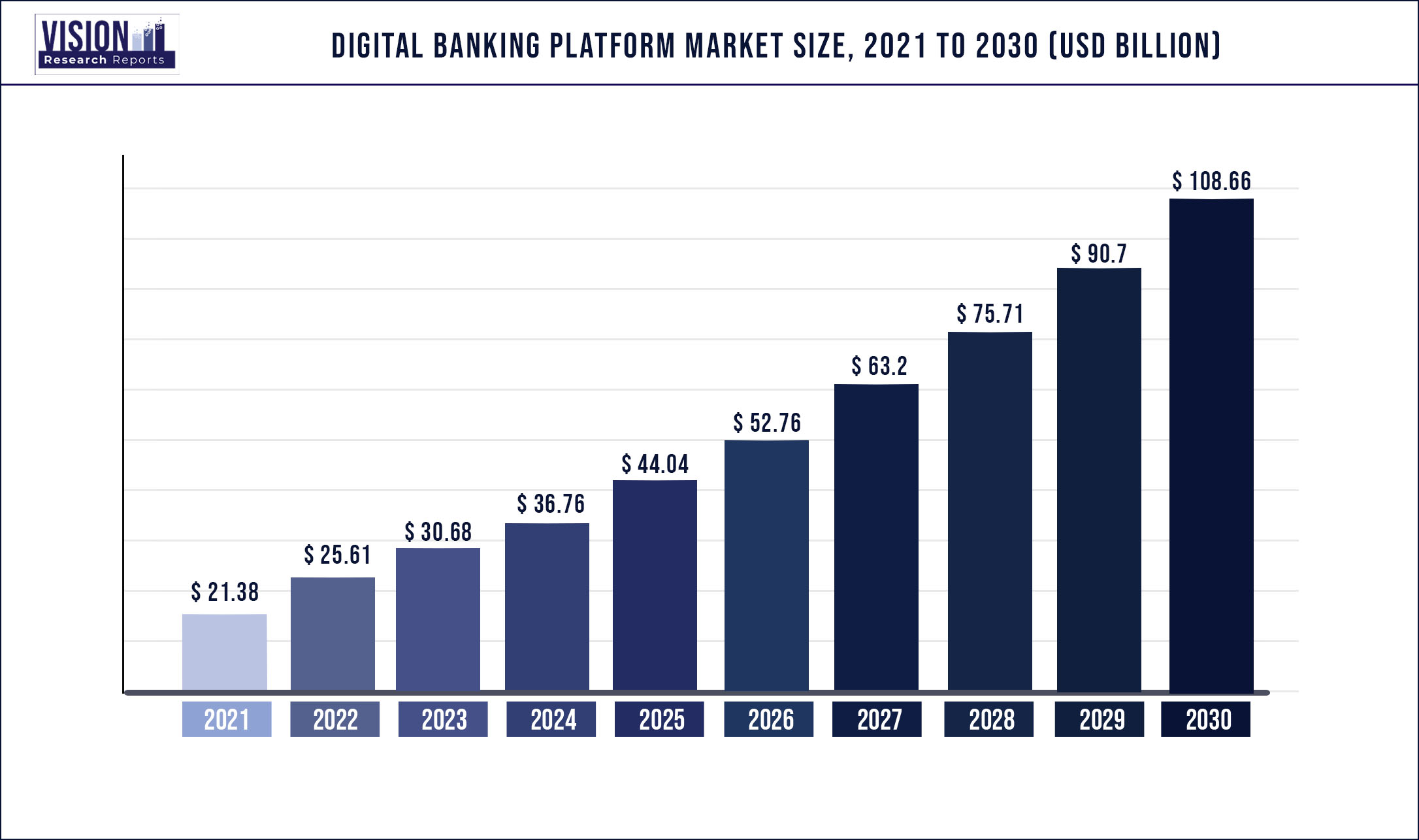

The global digital banking platform market was surpassed at USD 21.38 billion in 2021 and is expected to hit around USD 108.66 billion by 2030, growing at a CAGR of 19.75% from 2022 to 2030.

Report Highlights

The rise in internet users and the customers’ shift from traditional to online banking are key drivers for market growth. Furthermore, an expansion in the use of cloud-based platforms is expected to boost the digital banking platform market by providing greater scalability. Additionally, the banking industry is anticipated to benefit from increased use of artificial intelligence and machine learning in digital banking platforms, as well as from an increase in creative banking services and corporate investors.

However, problems with security and compliance in digital lending platforms are partially impeding the full-scale growth of the global market. On the other hand, the COVID-19 pandemic accelerated the growth of e-commerce, in turn increasing the scope of digital banking. For instance, as per Ecommerce Europe, the percentage of e-shoppers in Europe increased from 60% in 2017 to 71% in 2020. Whereas, the share of e-commerce GDP in the total European GDP increased from 3.11% in 2017 to 4.29% in 2020. Hence, the demand for digital banking platforms is likely to expand owing to the growth of online shopping and digital transaction volumes.

Asia Pacific held the largest market share in 2021 and is anticipated to witness the fastest growth of CAGR of 21.1% during the forecast period. This is attributed to the larger population and increased digitalization in the region. New firms such as Tonik Digital Bank, Inc., Anywhere 2 go Co., Ltd., and Cashfree Payments India Private Limited are fundamentally altering the banking industry by redefining the sector for both individuals and businesses. For instance, in June 2022, Cashfree Payments India Private Limited introduced its tokenization solution ‘Token Vault’ which is capable of exchanging and making use of information in card tokenization.

Globally, North America is the second largest market by revenue and is expected to expand at a compound annual growth rate (CAGR) of 19.9% from 2022 to 2030. The adoption of cloud-based solutions is enhancing in the North American region especially, in the business verticals that are pertaining to the finance and banking sectors. Banks are currently adopting cloud-based digital banking platform solutions due to their inexpensive start-up costs and quick updates, and this trend is anticipated to continue throughout the forecast period.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 21.38 billion |

| Revenue Forecast by 2030 | USD 108.66 billion |

| Growth rate from 2022 to 2030 | CAGR of 19.75% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Deployment, mode, component, service, type, region |

| Companies Covered |

Appway AG, Alkami Technology Inc., Finastra, Fiserv, Inc., Crealogix AG, Temenos, Urban FT Group, Inc., Q2 Software, Inc., Sopra Banking Software, Tata Consultancy Service |

Deployment Insights

In terms of deployment, the digital platform banking market has been segregated into on-premise, and cloud. The on-premise segment held the largest revenue share of 71.5% in 2021 and is anticipated to exhibit a CAGR of 21.34% in the forecast period. The on-premise model is favored by many users and it is safer than using cloud software. Additionally, security and IT staff have direct access to the software as it is installed and used exclusively within the user's network. There is complete control by the staff over its configuration, management, and security.

The cloud segment held the second-largest revenue share in 2021 and is expected to reveal the highest CAGR of 22.47% in the forecast period. Cloud and SaaS adoption will be critical to inclusive banking's future success. The inclusive banking environment is challenging, but much of that is offset by the benefits of Cloud and SaaS catering to communities with limited financial services. Financial insecurity caused by the COVID-19 crisis resulted in making Cloud and SaaS technology appealing to the developed world as well.

Mode Insights

The online banking segment dominated the digital banking platform market with a revenue share of 80.87% in 2021 and is anticipated to continue its dominance with a CAGR of 21.13% in the forecast period. The newest method of delivering retail banking services is online banking. Online banking refers to a variety of services, such as inter-account transfers, balanced reporting, and other common retail banking tasks.

These services are used by customers with which they can request information and perform using a telecommunication network to pay bills, etc., without leaving their homes or places of business. The mobile banking segment is expected to exhibit a CAGR of 22.55% in the forecast period. Key factors advancing the success of mobile banking include lower service fees and increasing smartphone penetration.

Component Insights

The platform segment dominated the digital banking platform market and held a revenue share of 59.8% in 2021. The services segment is expected to register the highest CAGR of 23.11% in the forecast period. Since the introduction of fintech, when tech corporate giants began enforcing reforms and developing new platforms for conducting business, banks have been pursuing digital transformation. To meet client needs and proactively launch new products, banks are now embracing digital technology and fully capitalize on these advances.

The advancement of financial services to the cloud is providing the opportunity to develop and reinforce a customer-centric strategy lowering obstacles to entry into the sector and expanding access to banking solutions. Additionally, it's opening possibilities for brand-new service packages that may take advantage of scale, data, and technology. Hence, there can be faster and easier access to data for ensuring regulatory reports, mitigation of risks, and identifying abnormalities in risk management.

Service Insights

The professional service segment dominated the market and held a revenue share of 63.04% in 2021. On the other hand, the managed service segment is expected to register the highest CAGR of 21.88% in the forecast period. Managed data center services may help optimize corporate operations in a hybrid IT architecture by increasing business automation and strengthening business management. As the frequency of cyberattacks increases, managed security services utilization in end-use industries is predicted to increase.

Managed security services are frequently utilized in business operations to protect sensitive data. The necessity for and adoption of managed security services is driven by the tremendous challenges that growing network complexity is creating to efficient data security management. The demand for managed security services has increased since it aids businesses in automating compliance monitoring in addition to helping them identify and reduce risks through security audits.

While client demands and competitive pressures lead banks to fully embrace digitization, performance demands force lenders to cut costs and maintain operating margins. Emerging technologies like AI and robotics are assisting banks in effectively addressing these limits as new regulatory requirements and data protection legislation add extra stress to already limited resources.

Type Insights

The retail banking segment held a revenue share of over 29.62% in 2021 and is anticipated to exhibit a CAGR of 20.91% in the forecast period. Banking is facing problems and opportunities because of the rise of digital banking, the development of new technologies, the blending of industrial ecosystems, and the increased emphasis on innovation. Customers are increasingly using digital platforms and fintech solutions, fragmenting the ties that were previously in place for basic financial services like deposits, loans, payments, and investments. For instance, according to Invest India, the Unified Payments Interface (UPI) in India has 323 banks participating as of May 2022 and has logged 5.9 billion monthly transactions totaling more than USD130 billion.

The investment banking segment dominated the market and held a revenue share of 35.95% in 2021 and is expected to reveal a CAGR of 20.7%. Following the reopening of international markets and the injection of economic stimulus by governments to minimize the negative impacts of COVID-19, the investment banking sector experienced a considerable increase in activity. Many investment banks have resumed operating from office locations and scheduling limited in-person client meetings. To restructure and remodel deal origination techniques, investment banks have started using hybrid conference strategies and the most recent technology.

Regional Insights

Asia Pacific dominated the regional market with a share of 30.67% in 2021 and is expected to register the highest CAGR of 21.22% in the forecast period. Asia's digital banking market is set for unprecedented expansion. New digital firms are radically changing the sector and revolutionizing banking for both individuals and businesses as demand for mobile and online alternatives increases. There is an exceptional potential for both existing players and new entrants to participate as regulators raise license allocations and define standards for a new age of banking.

For instance, India-based Wortgage Technologies Private Limited (WeRize), a digital banking platform startup launched in 2019, offers financial products to over 1,000 small cities and raised USD 8 million in a series known as “A funding round”. Besides this, North America was the second largest regional market with a revenue share of 28.12% in 2021 and is expected to reveal a CAGR of 20.3% during the forecast period. The adoption of cloud-based solutions is increasing across all business verticals, including the banking and finance sector. Banks are currently adopting cloud-based digital banking platform solutions, and this trend is expected to continue due to their low start-up costs and quick updates.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Digital Banking Platform Market

5.1. COVID-19 Landscape: Digital Banking Platform Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Digital Banking Platform Market, By Deployment

8.1. Digital Banking Platform Market, by Deployment, 2022-2030

8.1.1. On-Premise

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Cloud

8.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Digital Banking Platform Market, By Mode

9.1. Digital Banking Platform Market, by Mode, 2022-2030

9.1.1. Online Banking

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Mobile Banking

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Digital Banking Platform Market, By Component

10.1. Digital Banking Platform Market, by Component, 2022-2030

10.1.1. Platforms

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Services

10.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Digital Banking Platform Market, By Service

11.1. Digital Banking Platform Market, by Service, 2022-2030

11.1.1. Professional Service

11.1.1.1. Market Revenue and Forecast (2017-2030)

11.1.2. Managed Service

11.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 12. Global Digital Banking Platform Market, By Type

12.1. Digital Banking Platform Market, by Type, 2022-2030

12.1.1. Retail Banking

12.1.1.1. Market Revenue and Forecast (2017-2030)

12.1.2. Corporate Banking

12.1.2.1. Market Revenue and Forecast (2017-2030)

12.1.3. Investment Banking

12.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 13. Global Digital Banking Platform Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Deployment (2017-2030)

13.1.2. Market Revenue and Forecast, by Mode (2017-2030)

13.1.3. Market Revenue and Forecast, by Component (2017-2030)

13.1.4. Market Revenue and Forecast, by Service (2017-2030)

13.1.5. Market Revenue and Forecast, by Type (2017-2030)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Deployment (2017-2030)

13.1.6.2. Market Revenue and Forecast, by Mode (2017-2030)

13.1.6.3. Market Revenue and Forecast, by Component (2017-2030)

13.1.6.4. Market Revenue and Forecast, by Service (2017-2030)

13.1.7. Market Revenue and Forecast, by Type (2017-2030)

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Deployment (2017-2030)

13.1.8.2. Market Revenue and Forecast, by Mode (2017-2030)

13.1.8.3. Market Revenue and Forecast, by Component (2017-2030)

13.1.8.4. Market Revenue and Forecast, by Service (2017-2030)

13.1.8.5. Market Revenue and Forecast, by Type (2017-2030)

13.2. Europe

13.2.1. Market Revenue and Forecast, by Deployment (2017-2030)

13.2.2. Market Revenue and Forecast, by Mode (2017-2030)

13.2.3. Market Revenue and Forecast, by Component (2017-2030)

13.2.4. Market Revenue and Forecast, by Service (2017-2030)

13.2.5. Market Revenue and Forecast, by Type (2017-2030)

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Deployment (2017-2030)

13.2.6.2. Market Revenue and Forecast, by Mode (2017-2030)

13.2.6.3. Market Revenue and Forecast, by Component (2017-2030)

13.2.7. Market Revenue and Forecast, by Service (2017-2030)

13.2.8. Market Revenue and Forecast, by Type (2017-2030)

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Deployment (2017-2030)

13.2.9.2. Market Revenue and Forecast, by Mode (2017-2030)

13.2.9.3. Market Revenue and Forecast, by Component (2017-2030)

13.2.10. Market Revenue and Forecast, by Service (2017-2030)

13.2.11. Market Revenue and Forecast, by Type (2017-2030)

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Deployment (2017-2030)

13.2.12.2. Market Revenue and Forecast, by Mode (2017-2030)

13.2.12.3. Market Revenue and Forecast, by Component (2017-2030)

13.2.12.4. Market Revenue and Forecast, by Service (2017-2030)

13.2.13. Market Revenue and Forecast, by Type (2017-2030)

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Deployment (2017-2030)

13.2.14.2. Market Revenue and Forecast, by Mode (2017-2030)

13.2.14.3. Market Revenue and Forecast, by Component (2017-2030)

13.2.14.4. Market Revenue and Forecast, by Service (2017-2030)

13.2.15. Market Revenue and Forecast, by Type (2017-2030)

13.3. APAC

13.3.1. Market Revenue and Forecast, by Deployment (2017-2030)

13.3.2. Market Revenue and Forecast, by Mode (2017-2030)

13.3.3. Market Revenue and Forecast, by Component (2017-2030)

13.3.4. Market Revenue and Forecast, by Service (2017-2030)

13.3.5. Market Revenue and Forecast, by Type (2017-2030)

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Deployment (2017-2030)

13.3.6.2. Market Revenue and Forecast, by Mode (2017-2030)

13.3.6.3. Market Revenue and Forecast, by Component (2017-2030)

13.3.6.4. Market Revenue and Forecast, by Service (2017-2030)

13.3.7. Market Revenue and Forecast, by Type (2017-2030)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Deployment (2017-2030)

13.3.8.2. Market Revenue and Forecast, by Mode (2017-2030)

13.3.8.3. Market Revenue and Forecast, by Component (2017-2030)

13.3.8.4. Market Revenue and Forecast, by Service (2017-2030)

13.3.9. Market Revenue and Forecast, by Type (2017-2030)

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Deployment (2017-2030)

13.3.10.2. Market Revenue and Forecast, by Mode (2017-2030)

13.3.10.3. Market Revenue and Forecast, by Component (2017-2030)

13.3.10.4. Market Revenue and Forecast, by Service (2017-2030)

13.3.10.5. Market Revenue and Forecast, by Type (2017-2030)

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Deployment (2017-2030)

13.3.11.2. Market Revenue and Forecast, by Mode (2017-2030)

13.3.11.3. Market Revenue and Forecast, by Component (2017-2030)

13.3.11.4. Market Revenue and Forecast, by Service (2017-2030)

13.3.11.5. Market Revenue and Forecast, by Type (2017-2030)

13.4. MEA

13.4.1. Market Revenue and Forecast, by Deployment (2017-2030)

13.4.2. Market Revenue and Forecast, by Mode (2017-2030)

13.4.3. Market Revenue and Forecast, by Component (2017-2030)

13.4.4. Market Revenue and Forecast, by Service (2017-2030)

13.4.5. Market Revenue and Forecast, by Type (2017-2030)

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Deployment (2017-2030)

13.4.6.2. Market Revenue and Forecast, by Mode (2017-2030)

13.4.6.3. Market Revenue and Forecast, by Component (2017-2030)

13.4.6.4. Market Revenue and Forecast, by Service (2017-2030)

13.4.7. Market Revenue and Forecast, by Type (2017-2030)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Deployment (2017-2030)

13.4.8.2. Market Revenue and Forecast, by Mode (2017-2030)

13.4.8.3. Market Revenue and Forecast, by Component (2017-2030)

13.4.8.4. Market Revenue and Forecast, by Service (2017-2030)

13.4.9. Market Revenue and Forecast, by Type (2017-2030)

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Deployment (2017-2030)

13.4.10.2. Market Revenue and Forecast, by Mode (2017-2030)

13.4.10.3. Market Revenue and Forecast, by Component (2017-2030)

13.4.10.4. Market Revenue and Forecast, by Service (2017-2030)

13.4.10.5. Market Revenue and Forecast, by Type (2017-2030)

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Deployment (2017-2030)

13.4.11.2. Market Revenue and Forecast, by Mode (2017-2030)

13.4.11.3. Market Revenue and Forecast, by Component (2017-2030)

13.4.11.4. Market Revenue and Forecast, by Service (2017-2030)

13.4.11.5. Market Revenue and Forecast, by Type (2017-2030)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Deployment (2017-2030)

13.5.2. Market Revenue and Forecast, by Mode (2017-2030)

13.5.3. Market Revenue and Forecast, by Component (2017-2030)

13.5.4. Market Revenue and Forecast, by Service (2017-2030)

13.5.5. Market Revenue and Forecast, by Type (2017-2030)

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Deployment (2017-2030)

13.5.6.2. Market Revenue and Forecast, by Mode (2017-2030)

13.5.6.3. Market Revenue and Forecast, by Component (2017-2030)

13.5.6.4. Market Revenue and Forecast, by Service (2017-2030)

13.5.7. Market Revenue and Forecast, by Type (2017-2030)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Deployment (2017-2030)

13.5.8.2. Market Revenue and Forecast, by Mode (2017-2030)

13.5.8.3. Market Revenue and Forecast, by Component (2017-2030)

13.5.8.4. Market Revenue and Forecast, by Service (2017-2030)

13.5.8.5. Market Revenue and Forecast, by Type (2017-2030)

Chapter 14. Company Profiles

14.1. Appway AG

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. Alkami Technology Inc.

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Finastra

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Fiserv, Inc.

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Crealogix AG

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Temenos

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Urban FT Group, Inc.

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. Q2 Software, Inc.

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Sopra Banking Software

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Tata Consultancy Service

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others