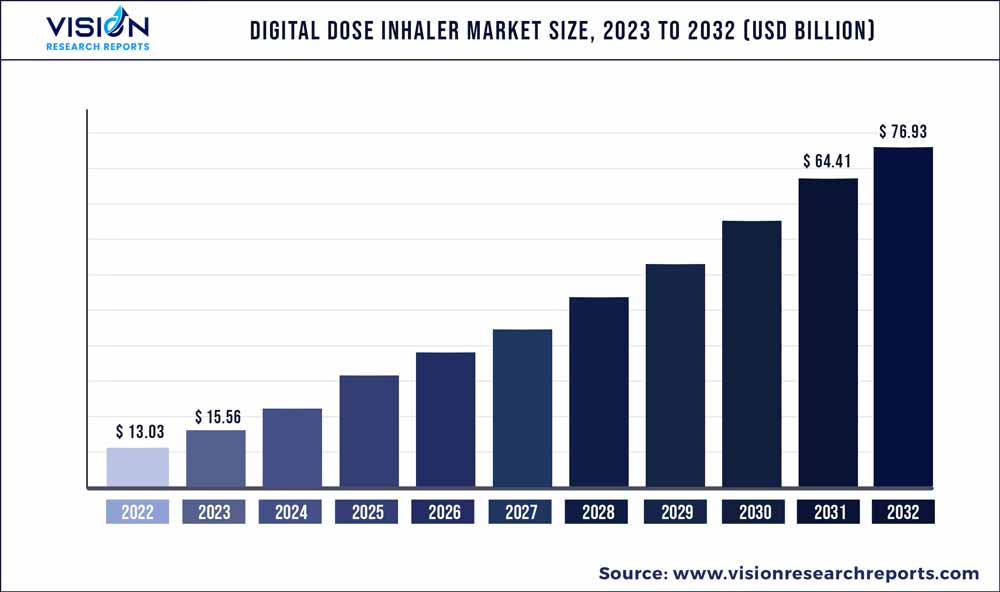

The global digital dose inhaler market size was estimated at around USD 13.03 billion in 2022 and it is projected to hit around USD 76.93 billion by 2032, growing at a CAGR of 19.43% from 2023 to 2032. The digital dose inhaler market in the United States was accounted for USD 4.9 million in 2022.

Key Pointers

Report Scope of the Digital Dose Inhaler Market

| Report Coverage | Details |

| Revenue Share of North America in 2022 | 46% |

| CAGR of Asia Pacific from 2023 to 2032 | 21.23% |

| Revenue Forecast by 2032 | USD 76.93 billion |

| Growth Rate from 2023 to 2032 | CAGR of 19.43% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | 3M Company; AstraZeneca Plc; Glenmark Pharmaceuticals Ltd.; Novartis AG; Propeller Health; Sensirion AG Switzerland; Opko Health, Inc.; Teva Pharmaceutical Industries Ltd., BEXIMCO Pharmaceuticals, GlaxoSmithKline Plc, Mundipharma Deutschland GmbH & Co. KG |

There is a growing demand for digital dose inhalers owing to the prevalence of chronic respiratory diseases, such as asthma, Chronic Obstructive Pulmonary Disease (COPD), and respiratory disorders. The increasing need to effectively monitor the date and time of dosing, which promotes collaborative care between clinics and patients, further contributes to the product demand. Moreover, the rising geriatric population suffering from both severe and mild respiratory disorders is another factor driving product demand. For instance, according to the United Nations Department of Economic and Social Affairs, the share of the population aged 65 years and above increased from 6% to 9% between 1990 to 2019.

The increasing per capita income as a result of the development in the fast-emerging economies, such as China, India, and Brazil, and the subsequent rise in disposable income are also expected to drive market growth in the coming years. The rise in cases of chronic respiratory diseases and the demand for technology-enabled respiratory devices will also support market growth. Inhalers are used to provide a reliable yet simple dose counter for asthma and COPD caused by smoking, poor quality of air, and exposure to occupational dust for people working in agriculture, forest, and mines. According to the Centers for Disease Control and Prevention (CDC), in 2021, nearly 11% of the adult population in the U.S. smoked cigarettes.

The efforts taken by various Non-Governmental Organizations (NGOs) and companies, in the form of programs, such as awareness camps about respiratory diseases, contribute to the adoption of inhalers. For instance, through various activities, Cipla runs a patient awareness campaign named Berok Zindagi through various activities in Kochi, India; Aster Medcity Pulmonology Department organized a free lung disease awareness camp on World COPD Day. Several technological advancements are revolutionizing inhalation therapy devices, including the Metered Dose Inhalers (MDIs) equipped with an e-dose counter and internet-connected and compact inhalers, among others that are spurring the growth of the digital dose inhaler.

Medical device manufacturers are focusing on connectivity technologies to improve patient medication adherence and ensure appropriate dosage administration. Furthermore, favorable reimbursement policies available to patients in the form of government-sponsored Medicare & Medicaid plans, individual insurance policies, group association policies, and employee policies are expected to boost the treatment rates for asthma, COPD, and other respiratory disorders; altogether, these developments will support the emergence of the market over the forecast period.

Medicare, a U.S. government insurance program, offers to cover medication and inhalers of beneficiaries affected by moderate to severe pulmonary disease. During the COVID-19 pandemic, patients suffering from asthma and COPD were at high risk of hospitalization due to infection. The increase in COVID-19 cases resulted in a rise in respiratory disorder cases boosting product demand. For instance, the U.S. CDC listed COPD and uncontrolled asthma as risk factors for severe COVID-19.

Type Insights

The branded medication segment accounted for the largest share in 2022 owing to a steep rise in the healthcare expenditure levels and a rise in demand for new respiratory medication development. The penetration of branded drugs is expected to increase due to the continuous investment by manufacturers in R&D activities. In 2020, GlaxoSmithKline plc of the UK and Innoviva, Inc. of the U.S. announced the U.S. Food and Drug Administration (FDA) approval for Trelegy Ellipta for treating asthma in patients aged 18 years and above.

The generic medication segment is expected to grow rapidly over the forecast period. The rising awareness regarding the same benefits of generic drugs as branded ones and the high demand for cost-effective medications are expected to significantly augment the segment's growth. In March 2022, the FDA approved the first generic drug for Symbicort: Breyna, used for treating asthma and COPD. The U.S. FDA approved Perrigo's abbreviated new drug application in February 2022 for generic albuterol sulfate inhalation aerosol, the first ProAir HFA replacement for receiving an AB rating.

Product Insights

The MDI product segment accounted for the largest revenue share of 64% in 2022 owing to increased healthcare expenditure and a rise in the cases of respiratory diseases.Moreover, consistent technological advances pertaining to the development of inhalation medication, such as mechanistic Pharmacokinetic/Pharmacodynamics (PK/PD) modeling, patient-feedback features in electronic monitoring systems, controlled-release formulations, and nanotechnology-based formulations with high drug loads enclosed in smaller dose sizes, are some of the pivotal factors involved in improving the therapeutic efficacy of the medication & impacting the overall patient compliance patterns that are expected to boost the product demand over the forecast period.

In 2020, Aptar Pharma, a drug delivery specialist company, collaborated with Lupin Ltd. to launch India’s first connection-enabled device for MDI. The Dry Powder Inhaler (DPI) segment is expected to register a significant CAGR of 18.73% from 2023 to 2032. DPI is better for users with low cognitive ability and needs no preparation. Concerns related to drug irritation caused by propellant components, such as Chlorofluorocarbons (CFCs) in MDI, have favored the adoption of DPIs, with fewer irritant effects, while delivering comparable therapeutic efficacy as MDIs. Moreover, increased R&D and the introduction of advanced & effective DPIs by industry players also drive the segment growth. For instance, in 2021, Glenmark Pharma introduced the Tiotropium Bromide DPI in the UK to treat COPD.

Indication Insights

The COPD segment dominated the global industry with a share of 51% of the overall revenue in 2022. The segment is expected to retain its dominance over the forecast period owing to the increasing incidence rate of COPD globally. Factors responsible for COPD include smoking, air pollution, dust, chemical fumes, and childhood infections. According to a report published by the World Health Organization (WHO) in March 2023, COPD was one of the leading causes of death worldwide in 2019.

Nearly 90% of deaths of those under 70 years of age occur in Low- and Middle-Income Countries (LMIC). The asthma segment is estimated to grow at a significant CAGR of 16.43% over the forecast period. According to the National Institute of Health, in 2019, around 300 million people were affected by asthma globally, and it is estimated to affect around 100 million people by 2050, making it a serious health problem. Therefore, an increase in the number of asthma patients is anticipated to be opportunistic for the market in the coming years.

Regional Insights

North America dominated the global industry in 2022 and accounted for the largest share of 46% of the overall revenue owing to rigorous research and development activities and increased awareness regarding the currently available hi-tech respiratory devices. In addition, an upsurge in the prevalence of respiratory conditions among both the pediatric and elderly populations will boost the market growth over the forecast years. According to stats published in 2020 by the American Lung Association, approximately 5.0% of adults, or 12.5 million people, reported a diagnosis of COPD in the region.

Asia Pacific is expected to grow at the fastest CAGR of 21.23% during the forecast period. Japan and China constitute the key identified hubs for respiratory devices due to an increase in the aging population, high expenditure on healthcare, and evolving healthcare industry. According to the National Institutes of Health, in China, 4.2% or 45.7 million adults are reported to have asthma, making it a significant public health issue, whereas, in Japan, between 6% and 10% of adults are reported to have the disease.

Digital Dose Inhaler Market Segmentations:

By Product

By Type

By Indication

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Digital Dose Inhaler Market

5.1. COVID-19 Landscape: Digital Dose Inhaler Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Digital Dose Inhaler Market, By Product

8.1. Digital Dose Inhaler Market, by Product, 2023-2032

8.1.1 Metered Dose Inhaler (MDI)

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Dry Powder Inhaler (DPI)

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Digital Dose Inhaler Market, By Type

9.1. Digital Dose Inhaler Market, by Type, 2023-2032

9.1.1. Branded Medication

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Generic Medication

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Digital Dose Inhaler Market, By Indication

10.1. Digital Dose Inhaler Market, by Indication, 2023-2032

10.1.1. Asthma

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Chronic Obstructive Pulmonary Disease (COPD)

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Others

10.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Digital Dose Inhaler Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2020-2032)

11.1.2. Market Revenue and Forecast, by Type (2020-2032)

11.1.3. Market Revenue and Forecast, by Indication (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Type (2020-2032)

11.1.4.3. Market Revenue and Forecast, by Indication (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Type (2020-2032)

11.1.5.3. Market Revenue and Forecast, by Indication (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.2. Market Revenue and Forecast, by Type (2020-2032)

11.2.3. Market Revenue and Forecast, by Indication (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Type (2020-2032)

11.2.4.3. Market Revenue and Forecast, by Indication (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Type (2020-2032)

11.2.5.3. Market Revenue and Forecast, by Indication (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Type (2020-2032)

11.2.6.3. Market Revenue and Forecast, by Indication (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Type (2020-2032)

11.2.7.3. Market Revenue and Forecast, by Indication (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.2. Market Revenue and Forecast, by Type (2020-2032)

11.3.3. Market Revenue and Forecast, by Indication (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Type (2020-2032)

11.3.4.3. Market Revenue and Forecast, by Indication (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Type (2020-2032)

11.3.5.3. Market Revenue and Forecast, by Indication (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Type (2020-2032)

11.3.6.3. Market Revenue and Forecast, by Indication (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Type (2020-2032)

11.3.7.3. Market Revenue and Forecast, by Indication (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.2. Market Revenue and Forecast, by Type (2020-2032)

11.4.3. Market Revenue and Forecast, by Indication (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Type (2020-2032)

11.4.4.3. Market Revenue and Forecast, by Indication (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Type (2020-2032)

11.4.5.3. Market Revenue and Forecast, by Indication (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Type (2020-2032)

11.4.6.3. Market Revenue and Forecast, by Indication (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Type (2020-2032)

11.4.7.3. Market Revenue and Forecast, by Indication (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.5.2. Market Revenue and Forecast, by Type (2020-2032)

11.5.3. Market Revenue and Forecast, by Indication (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Type (2020-2032)

11.5.4.3. Market Revenue and Forecast, by Indication (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Type (2020-2032)

11.5.5.3. Market Revenue and Forecast, by Indication (2020-2032)

Chapter 12. Company Profiles

12.1. 3M Company

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. AstraZeneca Plc

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Glenmark Pharmaceuticals Ltd.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Novartis AG

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Propeller Health

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Sensirion AG Switzerland

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Opko Health, Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Teva Pharmaceutical Industries Ltd.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. BEXIMCO Pharmaceuticals.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. GlaxoSmithKline Plc

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others