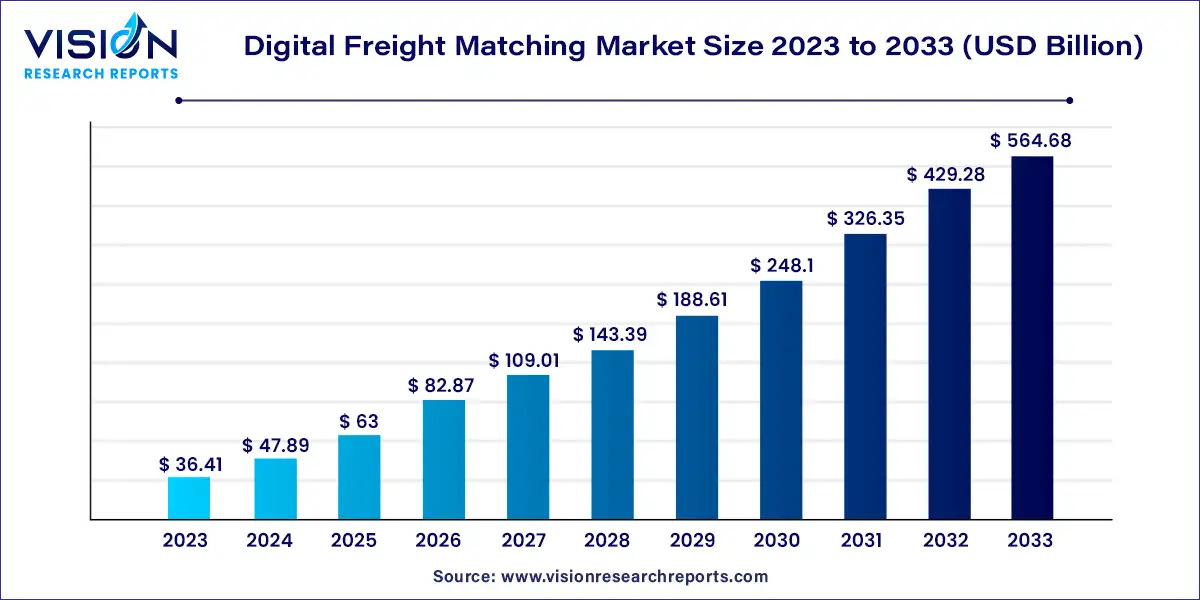

The global digital freight matching market size was estimated at around USD 36.41 billion in 2023 and it is projected to hit around USD 564.68 billion by 2033, growing at a CAGR of 31.54% from 2024 to 2033.

Digital Freight Matching refers to the process of using online platforms, mobile applications, and software solutions to connect shippers with carriers in real-time. By utilizing algorithms and machine learning capabilities, DFM platforms analyze various factors such as shipment requirements, carrier capacity, geographic location, and pricing preferences to identify the most suitable matches quickly and efficiently.

The growth of the digital freight matching (DFM) market is driven by an advancement in technology, including artificial intelligence and machine learning algorithms, have significantly enhanced the efficiency and accuracy of freight matching processes. Secondly, the increasing demand for real-time visibility and transparency in logistics operations has driven the adoption of DFM solutions, enabling stakeholders to track shipments and optimize routes more effectively. Additionally, the growing emphasis on cost savings and operational efficiency has led businesses to seek out DFM platforms to streamline their supply chain processes and reduce transportation costs. Moreover, the scalability and flexibility offered by DFM solutions, along with the ability to access a broader network of carriers, have further fueled market growth.

| Report Coverage | Details |

| Revenue Share of North America in 2023 | 33% |

| CAGR of Asia Pacific from 2024 to 2033 | 35.37% |

| Revenue Forecast by 2033 | USD 564.68 billion |

| Growth Rate from 2024 to 2033 | CAGR of 31.54% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

In terms of service, the market is classified into freight-matching services and value-added services. The freight matching services segment dominated the overall market, gaining a market share of 83% in 2023. Market players provide freight matching services like freight listing and brokerage, and online transaction services. These services are the platform's core services, and the market players have contracts with shippers and carriers for using brokerage services. The growing innovation in technologies such as AI and ML and their adoption in digital freight matching platforms is driving the growth of this segment. Algorithms powered by these technologies can help in various freight brokerage applications such as capacity management and dynamic pricing.

The value-added services segment is anticipated to grow at the fastest CAGR of 32.74% throughout the forecast period. Value-added services include services such as support and insurance services. Moreover, these services can offer shippers access to TMS and carriers access to software for managing traffic ticket records. These services address the needs of carriers and shippers, improving their engagement on the platform. The need for essential services on a single platform is driving the growth of this segment.

In terms of platform, the market is classified into web-based and mobile-based. The mobile-based segment dominated the overall market, gaining a market share of more than 63% in 2023. It is expected to grow at the fastest CAGR of 32.5% throughout the forecast period. Most market players provide mobile applications on Google Play and Apple Inc.'s App Store. China-based Full Truck Alliance (JiangSu ManYun Software Technology Co., Ltd.) provides freight matching and value-added services through mobile apps such as Yunmanman and Huochebang. Mobile-based platforms are faster than web-based apps and can work offline. Moreover, they are safer as they must be approved on the app store. The growing penetration of smartphones and ease of use drive the segment's growth.

The web-based segment is expected to grow at a considerable CAGR of 29.97% during the forecast period. Web-based digital freight matching platforms are platforms accessed through web browsers. Web-based applications are easier to build compared to mobile apps. Moreover, they can be launched quickly, as they do not require app store approval. The ease of maintenance of web-based platforms is driving the segment’s growth.

In terms of transportation mode, the market is classified into Full truckload (FTL), Less-than-truckload (LTL), intermodal, and others. The Full truckload (FTL) segment has dominated the market, gaining a market share of more than 44% in 2023 and witnessing the fastest CAGR of 32.66% during the forecast period. Full truckload (FTL) involves booking the entire truck, and the goods are delivered from the starting to the end point without intermediate loading. It is a good option for shipping temperature-sensitive goods not meant to be transported with other goods. Moreover, it is a good option for transporting goods quickly without stopovers. The flexibility and quickness of Full truckload (FTL) transportation is driving the segment’s growth.

The intermodal segment is anticipated to witness a CAGR of 31.38% throughout the forecast period. Intermodal shipping includes goods shipment through a combination of truckload and rail. Intermodal transportation is a good option when shipping needs to be done over longer distances. It is a lower-cost alternative to truckload and a more environmentally sustainable option. Asia Pacific countries are taking initiatives to make intermodal transportation more effective by expanding their rail network. Intermodal transportation's cost-effectiveness and environmental sustainability drive the segment's growth.

In terms of industry, the market is classified into food & beverages, retail & e-commerce, manufacturing, oil & gas, automotive, healthcare, and others. The food & beverages segment has dominated the overall market, gaining a market share of more than 23% in 2023 and witnessing a CAGR of 32.25% during the forecast period. The food & beverage industry consists of time-sensitive goods. The quality of the products can deteriorate over time and require specific conditions across the supply chain. Hence, they require quick and efficient transportation solutions to maintain their quality. A digital freight matching platform can improve the overall speed of freight brokerage operations as the platform connects the shippers with carriers as per load requirements. The need to maintain food quality and ensure regulatory compliance is driving the segment’s growth.

The retail & e-commerce segment is anticipated to witness the fastest CAGR of 34.84% throughout the forecast period. Growing access to internet and smartphones is driving the growth of the e-commerce sector. Moreover, e-commerce provides customers convenience as they can shop for goods from their homes. The COVID-19 pandemic accelerated e-commerce sales as people stayed at home.

North America dominated the overall market in 2023, with a market share of 33%. It is expected to grow at a CAGR of 28.85% throughout the forecast period. North America has a developed technological infrastructure with high internet and smartphone penetration. Hence, the shippers and carriers in the region can access digital freight matching platforms. The presence of prominent market players such as U.S.-based Uber Freight (Uber Technologies, Inc.) and Convoy, Inc, and high Research and Development (R&D) activity of technologies such as AI and ML in the region is a favorable environment for the growth of the market in the region.

Asia Pacific is expected to grow at the fastest CAGR of 35.37%. Asia Pacific makes up a significant share of the global population, and the e-commerce industry is growing rapidly. Hence, digital freight matching platforms are likely to be adopted at a significant rate to meet consumer demand in the region. According to the GSM Association’s 2023 report, about 47% of Asia Pacific’s population doesn’t have mobile internet access. However, smartphone adoption and 5G connections are expected to grow significantly by 2032. Improving technological infrastructure and growing e-commerce sales are driving the market’s growth in the region.

By Service

By Platform

By Transportation Mode

By Industry

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Digital Freight Matching Market

5.1. COVID-19 Landscape: Digital Freight Matching Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Digital Freight Matching Market, By Service

8.1. Digital Freight Matching Market, by Service, 2024-2033

8.1.1. Freight Matching Services

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Value Added Services

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Digital Freight Matching Market, By Platform

9.1. Digital Freight Matching Market, by Platform, 2024-2033

9.1.1. Web-based

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Mobile-based

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Digital Freight Matching Market, By Transportation Mode

10.1. Digital Freight Matching Market, by Transportation Mode, 2024-2033

10.1.1. Full Truckload (FTL)

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Less-than-truckload (LTL)

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Intermodal

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Digital Freight Matching Market, By Industry

11.1. Digital Freight Matching Market, by Industry, 2024-2033

11.1.1. Food & Beverages

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Retail & E-Commerce

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Manufacturing

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Oil & Gas

11.1.4.1. Market Revenue and Forecast (2021-2033)

11.1.5. Automotive

11.1.5.1. Market Revenue and Forecast (2021-2033)

11.1.6. Healthcare

11.1.6.1. Market Revenue and Forecast (2021-2033)

11.1.7. Others

11.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Digital Freight Matching Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Service (2021-2033)

12.1.2. Market Revenue and Forecast, by Platform (2021-2033)

12.1.3. Market Revenue and Forecast, by Transportation Mode (2021-2033)

12.1.4. Market Revenue and Forecast, by Industry (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Service (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Platform (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Transportation Mode (2021-2033)

12.1.5.4. Market Revenue and Forecast, by Industry (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Service (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Platform (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Transportation Mode (2021-2033)

12.1.6.4. Market Revenue and Forecast, by Industry (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Service (2021-2033)

12.2.2. Market Revenue and Forecast, by Platform (2021-2033)

12.2.3. Market Revenue and Forecast, by Transportation Mode (2021-2033)

12.2.4. Market Revenue and Forecast, by Industry (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Service (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Platform (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Transportation Mode (2021-2033)

12.2.5.4. Market Revenue and Forecast, by Industry (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Service (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Platform (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Transportation Mode (2021-2033)

12.2.6.4. Market Revenue and Forecast, by Industry (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Service (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Platform (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Transportation Mode (2021-2033)

12.2.7.4. Market Revenue and Forecast, by Industry (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Service (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Platform (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Transportation Mode (2021-2033)

12.2.8.4. Market Revenue and Forecast, by Industry (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Service (2021-2033)

12.3.2. Market Revenue and Forecast, by Platform (2021-2033)

12.3.3. Market Revenue and Forecast, by Transportation Mode (2021-2033)

12.3.4. Market Revenue and Forecast, by Industry (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Service (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Platform (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Transportation Mode (2021-2033)

12.3.5.4. Market Revenue and Forecast, by Industry (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Service (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Platform (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Transportation Mode (2021-2033)

12.3.6.4. Market Revenue and Forecast, by Industry (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Service (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Platform (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Transportation Mode (2021-2033)

12.3.7.4. Market Revenue and Forecast, by Industry (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Service (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Platform (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Transportation Mode (2021-2033)

12.3.8.4. Market Revenue and Forecast, by Industry (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Service (2021-2033)

12.4.2. Market Revenue and Forecast, by Platform (2021-2033)

12.4.3. Market Revenue and Forecast, by Transportation Mode (2021-2033)

12.4.4. Market Revenue and Forecast, by Industry (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Service (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Platform (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Transportation Mode (2021-2033)

12.4.5.4. Market Revenue and Forecast, by Industry (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Service (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Platform (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Transportation Mode (2021-2033)

12.4.6.4. Market Revenue and Forecast, by Industry (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Service (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Platform (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Transportation Mode (2021-2033)

12.4.7.4. Market Revenue and Forecast, by Industry (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Service (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Platform (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Transportation Mode (2021-2033)

12.4.8.4. Market Revenue and Forecast, by Industry (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Service (2021-2033)

12.5.2. Market Revenue and Forecast, by Platform (2021-2033)

12.5.3. Market Revenue and Forecast, by Transportation Mode (2021-2033)

12.5.4. Market Revenue and Forecast, by Industry (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Service (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Platform (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Transportation Mode (2021-2033)

12.5.5.4. Market Revenue and Forecast, by Industry (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Service (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Platform (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Transportation Mode (2021-2033)

12.5.6.4. Market Revenue and Forecast, by Industry (2021-2033)

Chapter 13. Company Profiles

13.1. Uber Freight (Uber Technologies, Inc.)

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Redwood

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. C.H. Robinson Worldwide, Inc.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. XPO, Inc.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Convoy, Inc

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Full Truck Alliance (JiangSu ManYun Software Technology Co., Ltd.)

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Freight Technologies, Inc.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Freight Tiger

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Cargomatic Inc.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Roper Technologies, Inc

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others