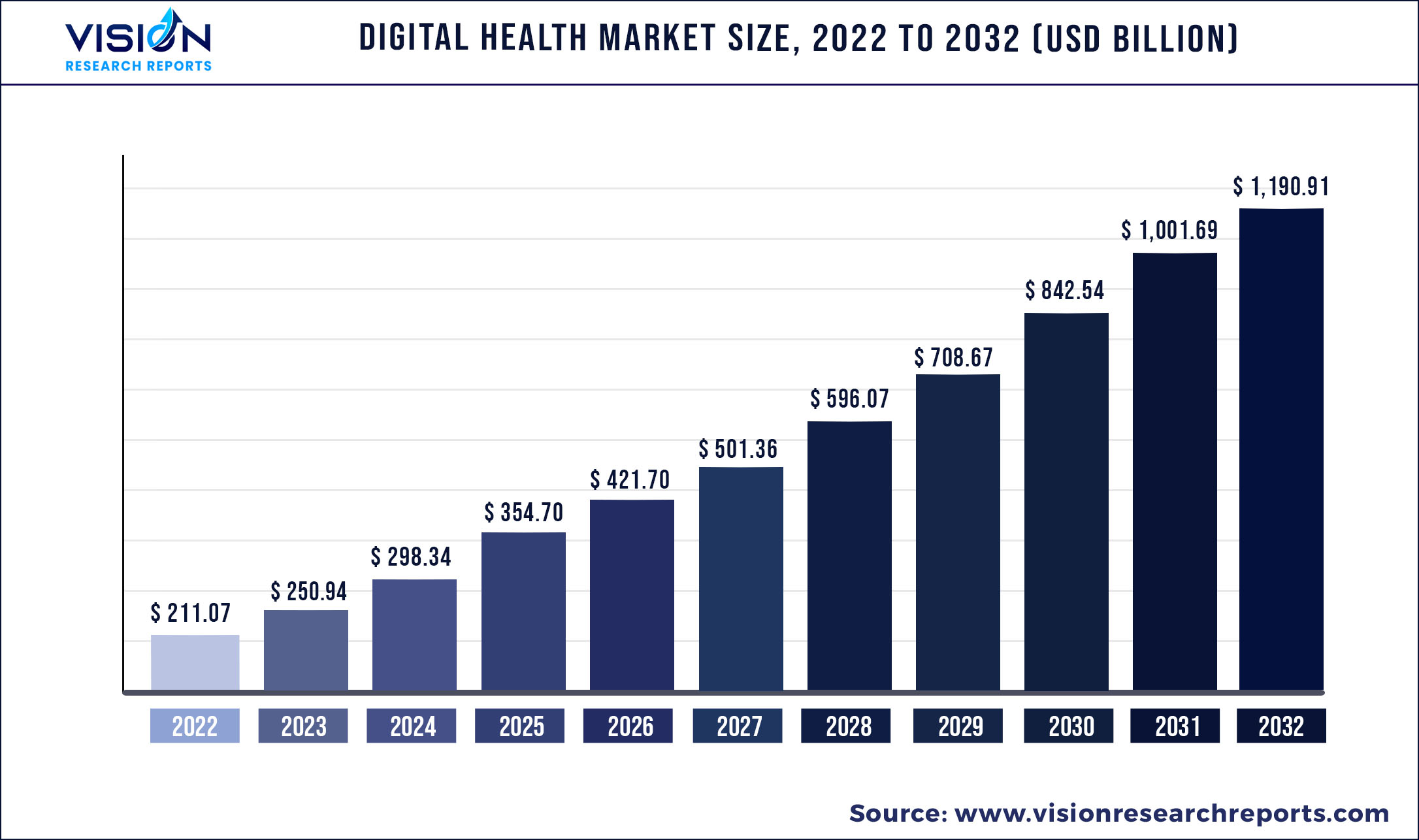

The global digital health market size was estimated at around USD 211.07 billion in 2022 and it is projected to hit around USD 1,190.91 billion by 2032, growing at a CAGR of 18.89% from 2023 to 2032.

Key Pointers

| Report Coverage | Details |

| Market Size in 2022 | USD 211.07 billion |

| Revenue Forecast by 2032 | USD 1,190.91 billion |

| Growth rate from 2023 to 2032 | CAGR of 18.89% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Cerner Corporation; Allscripts; Apple Inc; Telefonica S.A.; McKesson Corporation; Epic Systems Corporation; QSI Management, LLC; AT&T; Vodafone Group; Airstrip Technologies; Google, Inc; Samsung Electronics Co. Ltd; HiMS; Orange; Qualcomm Technologies, Inc; Softserve; MQure; Computer Programs and Systems, Inc; Vocera Communications; IBM Corporation; CISCO Systems, Inc. |

Increasing penetration of smartphones, improved internet connectivity with the introduction of 4G/5G, advancement in healthcare IT infrastructure, rising need to curb healthcare costs, rising prevalence of chronic diseases, and the increase in accessibility of virtual care are some of the major factors to fuel the market growth. Furthermore, key players focus on introducing advanced applications to improve user experience. For instance, in July 2021, Teladoc Health collaborated with Microsoft to integrate its Solo platform with the Microsoft Teams environment to improve clinician and patient access across the virtual healthcare space.

Government initiatives to spread digitalization across the healthcare sector throughout the globe are further driving the market. For instance, during the 2022 budget session, the Government of India introduced a digital health ecosystem under Ayushman Bharat Digital Health Mission (ABDM). Similarly, in October 2021, France government announced that they will invest over USD 650 million to expand their digital health infrastructure on a national level.

Several developed countries and emerging economies have a shortage of trained medical professionals. As per the projection of WHO, there will be a shortage of about 15 million healthcare workers by 2030. There is an increasing demand for healthcare professionals in various regions due to the rise in the aging population and the prevalence of chronic diseases. According to United Nation estimates, there were over 703 million individuals aged 65 and above in 2019, and this number is estimated to reach 1.5 billion by 2050 globally. Telehealth/telemedicine services help doctors to reach more patients. It enhances access to healthcare, improves the use of the time of patients & doctors, and helps reduce healthcare costs. People living in remote areas have to travel for hours to gain access to treatment, but now the population can fulfill their healthcare needs through telehealth, thereby aiding the market growth.

The rapid adoption rate of the internet and smart devices in the healthcare sector is increasing issues related to cybersecurity. There has been a significant rise in the incidents of hacking and tapping of confidential information through connected & smart devices. Owing to data security concerns related to healthcare information, governments of various countries, healthcare organizations, and experts are hesitating to adopt digital health solutions on a larger and national scale. For instance, as per the statistics of the Data Protection Report, 2021, there was a rise of about 73% in healthcare cybercrimes & data breaches in 2020 leading to exposing 12 billion units of healthcare information Moreover, digital health regulations are unclear and vary across countries & regions. These reasons are hindering market growth.

Digital Health Market Segmentations:

By Technology

By Component

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Digital Health Market

5.1. COVID-19 Landscape: Digital Health Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Digital Health Market, By Technology

8.1. Digital Health Market, by Technology, 2023-2032

8.1.1. Tele-healthcare

8.1.1.1. Market Revenue and Forecast (2019-2032)

8.1.2. mHealth

8.1.2.1. Market Revenue and Forecast (2019-2032)

8.1.3. Healthcare Analytics

8.1.3.1. Market Revenue and Forecast (2019-2032)

8.1.4. Digital Health Systems

8.1.4.1. Market Revenue and Forecast (2019-2032)

Chapter 9. Global Digital Health Market, By Component

9.1. Digital Health Market, by Component, 2023-2032

9.1.1. Software

9.1.1.1. Market Revenue and Forecast (2019-2032)

9.1.2. Hardware

9.1.2.1. Market Revenue and Forecast (2019-2032)

9.1.3. Services

9.1.3.1. Market Revenue and Forecast (2019-2032)

Chapter 10. Global Digital Health Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Technology (2019-2032)

10.1.2. Market Revenue and Forecast, by Component (2019-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Technology (2019-2032)

10.1.3.2. Market Revenue and Forecast, by Component (2019-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Technology (2019-2032)

10.1.4.2. Market Revenue and Forecast, by Component (2019-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Technology (2019-2032)

10.2.2. Market Revenue and Forecast, by Component (2019-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Technology (2019-2032)

10.2.3.2. Market Revenue and Forecast, by Component (2019-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Technology (2019-2032)

10.2.4.2. Market Revenue and Forecast, by Component (2019-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Technology (2019-2032)

10.2.5.2. Market Revenue and Forecast, by Component (2019-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Technology (2019-2032)

10.2.6.2. Market Revenue and Forecast, by Component (2019-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Technology (2019-2032)

10.3.2. Market Revenue and Forecast, by Component (2019-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Technology (2019-2032)

10.3.3.2. Market Revenue and Forecast, by Component (2019-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Technology (2019-2032)

10.3.4.2. Market Revenue and Forecast, by Component (2019-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Technology (2019-2032)

10.3.5.2. Market Revenue and Forecast, by Component (2019-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Technology (2019-2032)

10.3.6.2. Market Revenue and Forecast, by Component (2019-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Technology (2019-2032)

10.4.2. Market Revenue and Forecast, by Component (2019-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Technology (2019-2032)

10.4.3.2. Market Revenue and Forecast, by Component (2019-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Technology (2019-2032)

10.4.4.2. Market Revenue and Forecast, by Component (2019-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Technology (2019-2032)

10.4.5.2. Market Revenue and Forecast, by Component (2019-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Technology (2019-2032)

10.4.6.2. Market Revenue and Forecast, by Component (2019-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Technology (2019-2032)

10.5.2. Market Revenue and Forecast, by Component (2019-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Technology (2019-2032)

10.5.3.2. Market Revenue and Forecast, by Component (2019-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Technology (2019-2032)

10.5.4.2. Market Revenue and Forecast, by Component (2019-2032)

Chapter 11. Company Profiles

11.1. Cerner Corporation

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Allscripts

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Apple Inc

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Telefonica S.A.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. McKesson Corporation

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Epic Systems Corporation

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. QSI Management, LLC

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. AT&T

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Vodafone Group

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Airstrip Technologies

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others