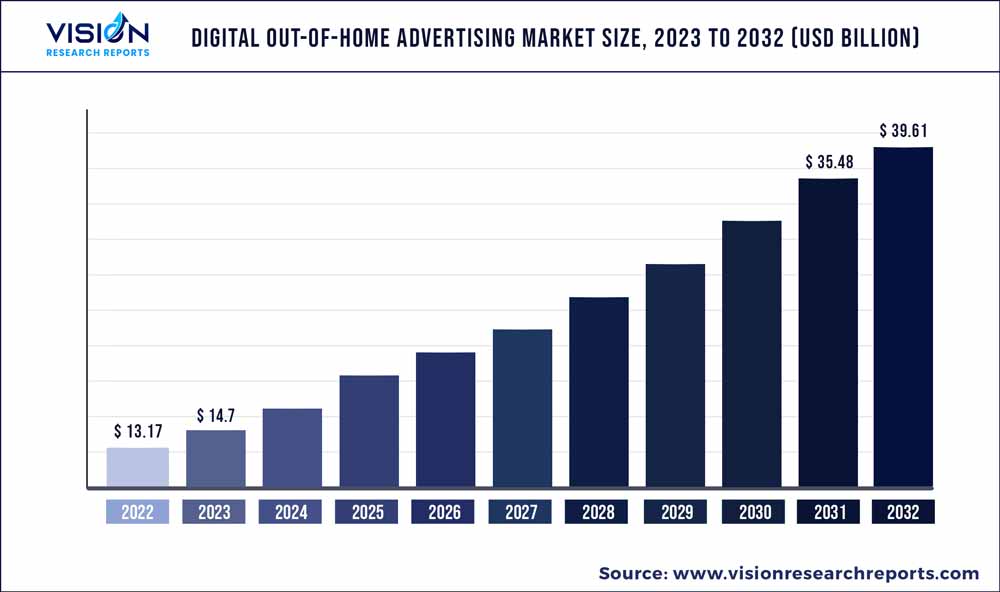

The global digital out-of-home advertising market size was estimated at around USD 13.17 billion in 2022 and it is projected to hit around USD 39.61 billion by 2032, growing at a CAGR of 11.64% from 2023 to 2032. The digital out-of-home advertising market in the United States was accounted for USD 4.5 billion in 2022.

Key Pointers

Report Scope of the Digital Out-of-home Advertising Market

| Report Coverage | Details |

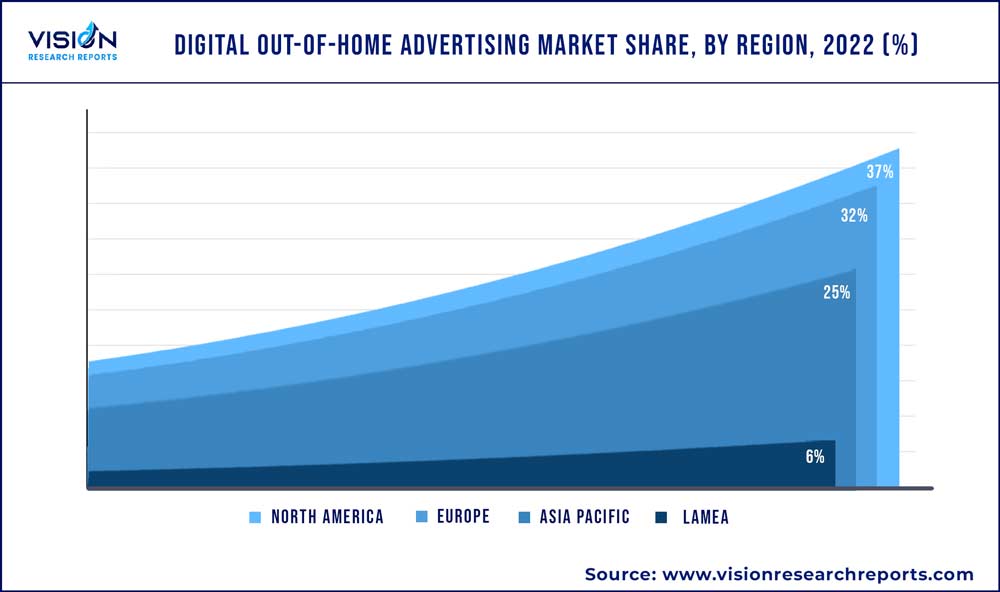

| Revenue Share of North America in 2022 | 37% |

| Revenue Forecast by 2032 | USD 39.61 billion |

| Growth Rate from 2023 to 2032 | CAGR of 11.64% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | JCDecaux; Stroer SE & Co. KGaA; Clear Channel Outdoor Holdings, Inc.; Outfront Media Inc.; oOh!media Limited; Lamar Advertising Company; Broadsign International LLC.; Focus Media; Global Outdoor Media Limited; Daktronics Dr. |

Digital out-of-home advertising is one of the fastest-growing advertising types due to expansion into new venues & markets, innovation, and enhanced features in outdoor advertising that are accelerating the market growth. Moreover, the increasing demand for creative and interactive displays of full-motion video and the inclusion of animation is expected to drive market growth over the forecast period. Digital out-of-home advertisements provide innovative and creative content, and it becomes more interactive and creative due to the display of data on digital screens in real-time. This feature results in better visibility for digital screens. The growing trend for interactive advertisements for consumers results in increased adoption of digital out-of-home advertisements hence driving the market growth.

Digital out-of-home advertisements are cost-effective using which commercials can reach a wide range of populations thus their usage is high and increasing thus fueling the market growth over the forecast period. Additionally, the growing urbanization and rising infrastructure development across the globe are anticipated to propel market growth over the forecast period. Furthermore, the increasing spending on outdoor advertising by various industries owing to its ability to run multiple advertisements on a single screen is accelerating market growth. For instance, in June 2022, JCDecaux, a provider of outdoor advertising services, in partnership with VIOOH Limited, announced the release of their programmatic digital out-of-home (DOOH) offering in Brazil. The new platform allows advertisers to create efficient, flexible, measurable digital out-of-home campaigns.

Digital outdoor advertising is gaining popularity in the advertising world as it creates brand awareness among people and also compliments the brand’s advertising campaigns on other channels, which are projected to accelerate the market growth. Moreover, as individuals spend much more time outside their offices and home, that allows brands to reach a mass audience consistently and rapidly through out-of-home advertising which is accelerating the market growth over the forecast period. However, intense competition among the vendors of the out-of-home advertising business is restraining the market growth.

Furthermore, the COVID-19 pandemic has accelerated the shift toward digital advertising as brands seek more cost-effective and measurable advertising solutions. Digital out-of-home advertising offers several advantages over traditional advertising, such as real-time tracking and targeting, which make it a more attractive option for brands. The growing popularity of smart cities and the increasing number of public-private partnerships are also expected to drive market growth. For instance, in October 2022, StackAdapt Inc., a company specializing in online advertising services in partnership with Vistar Media, Inc., a location-based ad technology company, announced the launch of a new digital out-of-home (DOOH) channel globally. StackAdapt intends to enhance its ability to deliver scalability and a future-proof differentiated solution through this offering.

Format Insights

The billboards segment contributed to the largest market share of over 68% in 2022. The growing smart advertisement has enabled digital outdoor billboards to interact with the target audience, which is expected to accelerate market growth. Moreover, technological advancements like augmented and virtual reality make outdoor advertising campaigns more engaging and visceral, driving the market growth. For instance, in February 2023, Maxam Ventures Private Limited, a gaming platform that provides various gamified solutions, announced its collaboration with Lemma Technologies to launch its metaverse billboards for real-world digital out-of-home clients. The collaboration intends to assist international brands in making a memorable brand impression on untapped audiences through virtual billboards in the metaverse.

The place-based media segment is anticipated to witness the highest CAGR over the forecast period. Furthermore, the transit & transportation segment held a significant share of the global revenue in 2022. The rising adoption of LCD screens in taxis, buses, or trains for displaying multiple advertisements on a single display accelerates the market growth. Moreover, the consumer's increasing preferences for public transport like buses and trains for daily traveling are the major driving factor for the market growth. Furthermore, the rising adoption of digital transit & transportation advertising for branding and spreading awareness regarding products is expected to accelerate market growth.

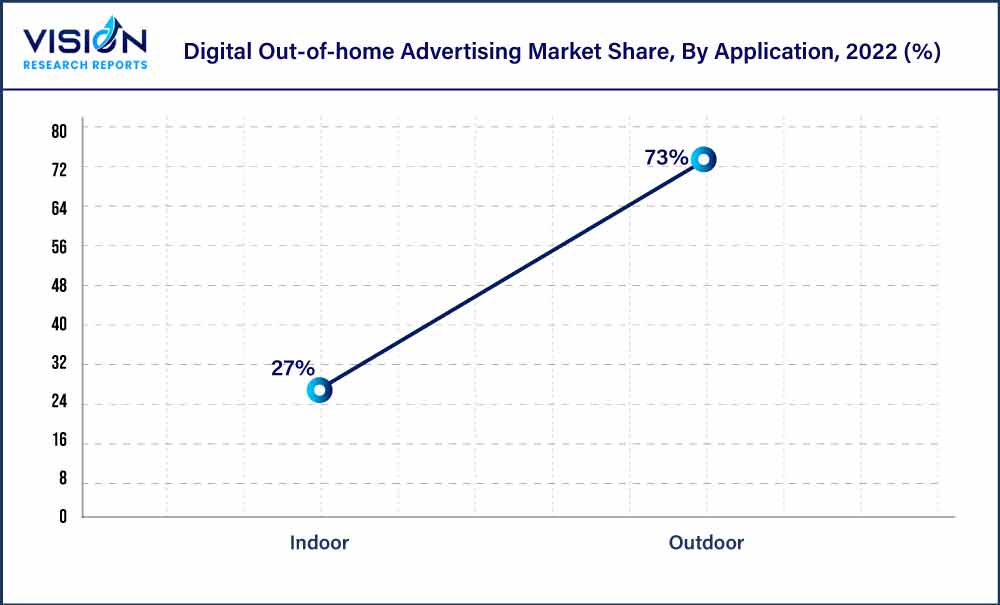

Application Insights

The outdoor segment contributed to the largest market share of over 73% in 2022. Outdoor digital out-of-home kits are more expensive than indoor alternatives. One of the key drivers of the segment's growth is the increasing use of digital technologies such as LED displays, projection mapping, and interactive displays. These technologies allow advertisers to create more engaging and dynamic advertising experiences that can capture consumers' attention in outdoor locations. Additionally, the rise of data-driven advertising solutions contributes to the growth of the outdoor segment. By leveraging data on consumer behavior, demographics, and preferences, advertisers can deliver more relevant and targeted advertising messages to consumers in outdoor locations, increasing their campaigns' effectiveness. For instance, in August 2022, Google, an American multinational technology company, launched digital out-of-home advertising in its display & video 360 ad planning tool. Users can now purchase screens in public sites such as airports, stadiums, shopping centers, bus stops, elevators, and taxis.

The indoor segment is estimated to grow significantly over the forecast period. The indoor segment is a significant part of the industry, encompassing advertising displays and other media in indoor locations such as shopping centers, airports, cinemas, and other public venues. As more business complexes and shopping centers are being built, the indoor segment is projected to grow. Data analytics is increasingly being used to measure the effectiveness of indoor DOOH advertising campaigns. By tracking metrics such as engagement rates, click-through rates, and conversion rates, advertisers can gain insights into which types of ads are most effective and adjust their campaigns accordingly.

Industry Vertical Insights

The real estate segment represented a significant share of above 16% in 2022. Construction industries' rising spending on outdoor advertising to promote their properties and build brand awareness is accelerating market growth. Moreover, the increasing popularity of digital out-of-home advertising for real estate marketing due to the high conversion rate of the ads is accelerating market growth. Furthermore, digital outdoor advertising provides real estate brands an opportunity for creative flexibility to contextually relevant and timely messaging accelerating the market growth over the forecast period.

The government segment is predicted to foresee significant growth in the forecast period. Various governments' rising adoption of digital out-of-home advertising to bring awareness about schemes and newly introduced policies is accelerating market growth. Moreover, increasing political spending on out-of-home advertising during the election campaign and various protests is expected to drive market growth. Furthermore, the automotive segment is also expected to grow at a significant CAGR from 2023 to 2032. The segment's growth is attributed to the elevated use of digital out-of-home advertising in the industry. With the use of digital out-of-home advertising, automotive businesses can launch campaigns in a faster, more flexible, and more accessible manner to raise the level of awareness among consumers regarding dealerships and vehicles. This helps in driving automotive sales, due to which its adoption is increasing hence boosting the market growth.

Regional Insights

North America dominated the market in 2022, accounting for over 37% share of the global revenue. The growth of the regional market is attributed to the growing adoption of digital out-of-home advertising in commercial verticals, and rapid urbanization in the region's emerging countries, such as the U.S. and Canada. The market's further growth in the region contributes to increasing technological advancements along with the growing proliferation of smart cities. For instance, in February 2022, VIOOH Limited, in partnership with JCDecaux, a provider of outdoor advertising services, launched programmatic digital out-of-home advertising at major U.S. airports. The offering will be available at airports across Texas, California, Pennsylvania, and Massachusetts.

Asia Pacific is anticipated to register the fastest CAGR over the forecast period. This can be credited to the increased spending on digital out-of-home advertising in emerging countries like China, India, and Japan owing to the vast consumer base. Moreover, the increasing popularity and acceptance of out-of-home advertising among the various industry verticals have been projected to boost the digital out-of-home advertising market over the forecast period. Furthermore, the rising infrastructural development in emerging economies like India and China are driving market growth over the last few years. For instance, in February 2023, Closeup, an American brand of toothpaste launched by Unilever, partnered with Times Innovative Media Limited, a provider of customized and comprehensive out-of-home (OOH) solutions, to launch a new digital billboard campaign in Ahmedabad. The campaign targeted the youth audience.

Digital Out-of-home Advertising Market Segmentations:

By Industry Vertical

By Application

By Format

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Industry Vertical Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Digital Out-of-home Advertising Market

5.1. COVID-19 Landscape: Digital Out-of-home Advertising Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Digital Out-of-home Advertising Market, By Industry Vertical

8.1. Digital Out-of-home Advertising Market, by Industry Vertical, 2023-2032

8.1.1 Automotive

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Financial Services

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Government

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Media & Entertainment

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Retail

8.1.5.1. Market Revenue and Forecast (2020-2032)

8.1.6. Real Estate

8.1.6.1. Market Revenue and Forecast (2020-2032)

8.1.7. Restaurants

8.1.7.1. Market Revenue and Forecast (2020-2032)

8.1.8. Others

8.1.8.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Digital Out-of-home Advertising Market, By Application

9.1. Digital Out-of-home Advertising Market, by Application, 2023-2032

9.1.1. Indoor

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Outdoor

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Digital Out-of-home Advertising Market, By Format

10.1. Digital Out-of-home Advertising Market, by Format, 2023-2032

10.1.1. Billboards

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Street Furniture

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Transit & Transportation

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Roadways

10.1.4.1. Market Revenue and Forecast (2020-2032)

10.1.5. Airways

10.1.5.1. Market Revenue and Forecast (2020-2032)

10.1.6. Railways

10.1.6.1. Market Revenue and Forecast (2020-2032)

10.1.7. Marine

10.1.7.1. Market Revenue and Forecast (2020-2032)

10.1.8. Place-Based Media

10.1.8.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Digital Out-of-home Advertising Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Industry Vertical (2020-2032)

11.1.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.3. Market Revenue and Forecast, by Format (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Industry Vertical (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.4.3. Market Revenue and Forecast, by Format (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Industry Vertical (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.5.3. Market Revenue and Forecast, by Format (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Industry Vertical (2020-2032)

11.2.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.3. Market Revenue and Forecast, by Format (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Industry Vertical (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.4.3. Market Revenue and Forecast, by Format (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Industry Vertical (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.5.3. Market Revenue and Forecast, by Format (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Industry Vertical (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.6.3. Market Revenue and Forecast, by Format (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Industry Vertical (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.7.3. Market Revenue and Forecast, by Format (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Industry Vertical (2020-2032)

11.3.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.3. Market Revenue and Forecast, by Format (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Industry Vertical (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.4.3. Market Revenue and Forecast, by Format (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Industry Vertical (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.5.3. Market Revenue and Forecast, by Format (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Industry Vertical (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.6.3. Market Revenue and Forecast, by Format (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Industry Vertical (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.7.3. Market Revenue and Forecast, by Format (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Industry Vertical (2020-2032)

11.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.3. Market Revenue and Forecast, by Format (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Industry Vertical (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.4.3. Market Revenue and Forecast, by Format (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Industry Vertical (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.5.3. Market Revenue and Forecast, by Format (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Industry Vertical (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.6.3. Market Revenue and Forecast, by Format (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Industry Vertical (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.7.3. Market Revenue and Forecast, by Format (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Industry Vertical (2020-2032)

11.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.3. Market Revenue and Forecast, by Format (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Industry Vertical (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.4.3. Market Revenue and Forecast, by Format (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Industry Vertical (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.5.3. Market Revenue and Forecast, by Format (2020-2032)

Chapter 12. Company Profiles

12.1. JCDecaux

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Stroer SE & Co. KGaA

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Clear Channel Outdoor Holdings, Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Outfront Media Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. oOh!media Limited

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Lamar Advertising Company

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Broadsign International LLC.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Focus Media

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Global Outdoor Media Limited

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Daktronics Dr.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others