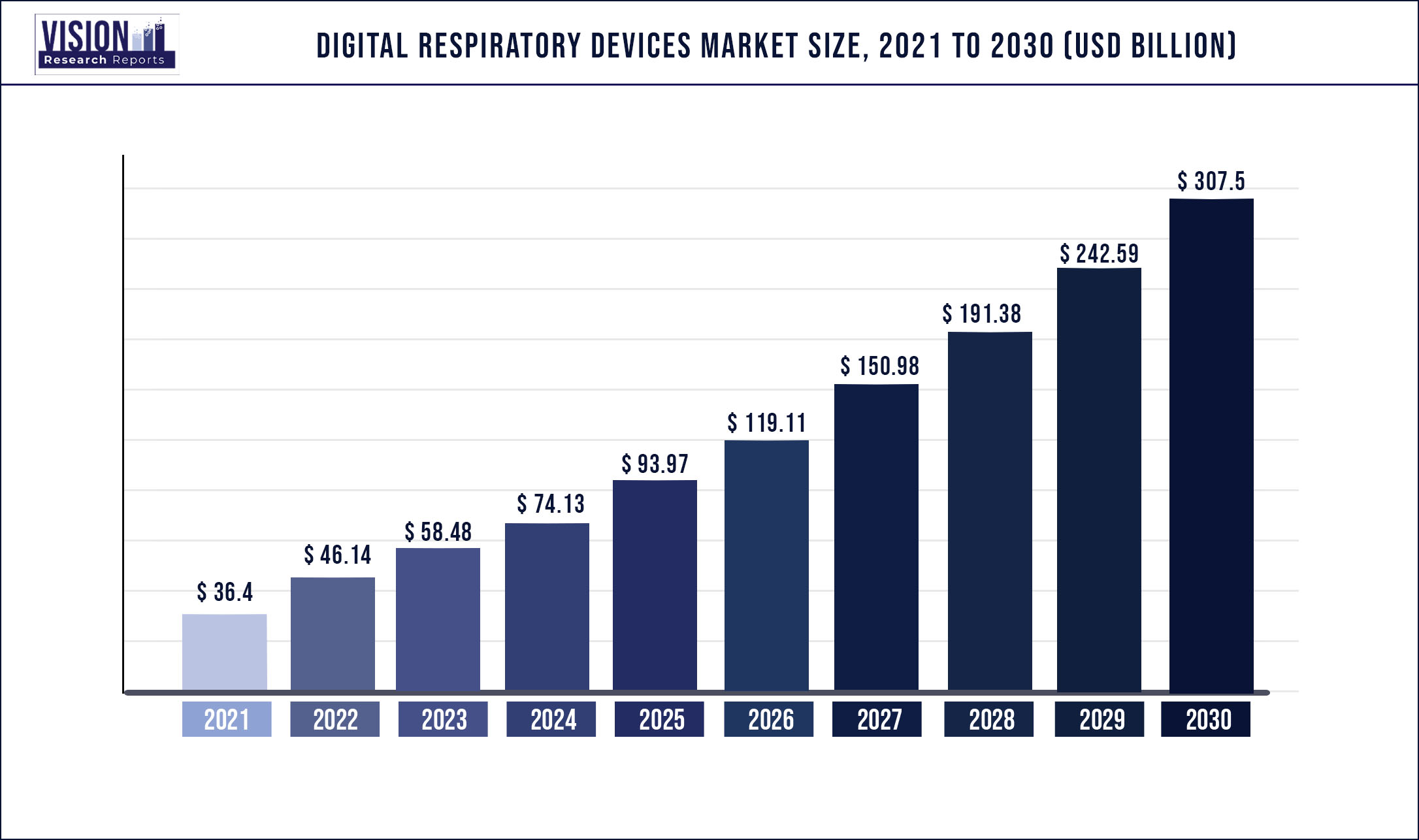

The global digital respiratory devices market was surpassed at USD 36.4 billion in 2021 and is expected to hit around USD 307.5 billion by 2030, growing at a CAGR of 26.76% from 2022 to 2030.

Report Highlights

The market growth can be attributed to an increase in the number of people with chronic respiratory diseases (CRDs) such as chronic obstructive pulmonary disease (COPD), asthma, cystic fibrosis, and lung disorders. Moreover, COVID-19 has prompted a rise in the number of innovative digital devices and systems for respiratory and pulmonary care, which is driving the demand for digital respiratory devices. For instance, in March 2022, Brisbane-based ResApp informed about the positive data that it received from the Covid-19 instant screening test. The coughing sound is used with the help of a smartphone to detect the presence of the COVID-19 virus in the new test.

Furthermore, during the COVID-19 outbreak, several patients were unable to receive consultations and treatments in person. The pandemic demonstrated how serious respiratory illnesses and infections may become if not treated quickly and carefully. As a result of this, in the post-pandemic era, smart inhaler adoption is anticipated to increase as healthcare professionals turn to connected medical devices to ensure that patients receive the best care and consultation possible, regardless of the circumstance.

Additionally, a growing number of technological advancements in the field of digital respiratory devices are scaling up the digital technologies into existing product portfolios to improve the efficiency of medication as well as the management of asthma and COPD. Moreover, recent studies conducted by research experts have shown that smart inhaler technology may be able to resolve this problem and offer patients a simple way to keep up treatment compliance and control symptoms. For example, a 2019 study from the Cleveland Clinic found that COPD patients utilizing Propeller smart inhalers had a significantly lower risk of being admitted to the hospital, with a nearly 35% drop in visits compared to the previous year (2020).

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 36.4 billion |

| Revenue Forecast by 2030 | USD 307.5 billion |

| Growth rate from 2022 to 2030 | CAGR of 26.76% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Product, indication, distribution channel, end-use, region |

| Companies Covered | COHERO Health Inc.; Cognita Labs; Adherium Limited; Amiko Digital Health Limited; Teva Pharmaceuticals Industries Ltd.; Propeller Health; Novartis AG; Pneuma Respiratory Inc.; 3M Health Care Limited; AireHealth, Inc.; FindAir Sp. z o.o |

Product Insights

In 2021, the smart inhalers and nebulizers segment held the largest revenue share of over 60.02% and is expected to register the fastest CAGR during the forecast period. The growing prevalence of asthma and other respiratory conditions and the rising air pollution levels are expected to contribute to the growing demand for digital respiratory devices. Moreover, patients with asthma and COPD have been shown to adhere more frequently while using smart inhalers. In addition, when compared to conventional inhalers, smart inhalers assist more effectively and monitor the technique used for inhaling the medication. In July 2020, Novartis International AG got EC clearance for Enerzair Breezhaler. This device is the first digital companion (sensor and app), which is prescribed with medication for uncontrolled asthma in the European Union. Based on product, the market is segmented into sensors and apps and smart inhalers and nebulizers.

The sensors and apps segment is anticipated to expand at a CAGR of 27.92% over the forecast period. The adoption of respiration sensors to enable continuous and non-invasive patient monitoring is one of the key factors driving the sensors and apps market. The market is also being driven by the aging population, respiratory problems, and an increase in life expectancy.

Indication Insights

The COPD segment dominated the market with a revenue share of over 50.2% in 2021. COPD affects 200 million people worldwide. In addition, slightly more than 8% of all chronic diseases in the world are respiratory diseases. According to the World Health Organization prediction (2020), COPD will surpass ischemic heart disease and HIV/AIDS to become the fourth-leading causes of death, respectively, by 2030. Furthermore, people continuing to smoke and longer life expectancies are all contributing to the considerable increase in COPD; these changes are particularly significant in emerging nations. Based on indication, the market is segmented into asthma, COPD, and other diseases.

The asthma segment is anticipated to expand at a CAGR of 27.56% during the forecast period. Approximately 300 million people globally are now suffering from asthma, and the prevalence of the condition is increasing by 50% every ten years. In addition, 10% of people in North America suffer from asthma and it affects over 25 million people in the U.S. Moreover, a surge in severe asthma, inadequate disease treatment, and poverty are all effects of the increasing frequency of asthma hospitalizations, especially among young children. As a result, the demand for digital respiratory devices is increasing.

Distribution Channel Insights

The hospital pharmacies segment accounted for the largest revenue share of over 35.03% in 2021. The older population is regularly hospitalized in hospitals for various chronic respiratory illnesses, and they obtain medicine from hospital pharmacies for such conditions. Additionally, hospital pharmacies give medicinal supplies to healthcare professionals so that patients may easily obtain medications. The market for hospital pharmacies is expanding as a result of the growing population and rising prevalence of chronic respiratory diseases. Based on the distribution channel, the market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies.

The online pharmacies segment is anticipated to expand at the fastest CAGR of 31.22% over the forecast period. The market growth is being favorably impacted by the quick expansion and modernization of existing e-pharmacies to boost market penetration. Moreover, the expansion of e-prescription uses in hospitals and other healthcare facilities, an increase in online consumers, better access to web-based and online services, and other factors all contribute to the expansion of the online pharmacy industry.

End-use Insights

In 2021, hospitals accounted for the largest revenue share of over 50.3%. The market for hospitals is anticipated to grow significantly over the next few years as a result of expanding public-private partnerships, rapid improvements in healthcare infrastructure, and improved access to healthcare services. The market is segmented into hospitals, homecare settings, and other settings.

The homecare settings segment is anticipated to expand at the fastest CAGR of 29.67% during the forecast period due to the financial benefits of home care equipment and services compared to hospital visits. In addition, many individuals with chronic respiratory disorders prefer to get care in homecare settings as a result of the growing expense of the healthcare industry. Moreover, the growing incidence of chronic illnesses such as COPD and asthma throughout the world is the main driver of the homecare market.

Regional Insights

In 2021, North America dominated the market with a revenue share of over 45.11% owing to the rising rates of asthma, COPD, and other chronic respiratory diseases. Asthma affects more than 25 million people in the U.S. Moreover, 14.8 million adults have COPD, and annually, more than 150,000 Americans die from COPD or one death every four minutes. Furthermore, significant improvements in digital respiratory products and their growing acceptability and accuracy are expected to fuel the market growth during the forecast period. The U. S. Centers for Medicare & Medicaid Services (CMS) recently released the 2022 reimbursement rates for Current Procedural Terminology (CPT) codes for Remote Physiologic Monitoring (RPM) as well as Remote Therapeutic Monitoring (RTM) services. This amendment will increase the use of and demand for digital respiratory devices during the forecast period in the U.S.

Asia Pacific is projected to expand at a lucrative CAGR of 30.84% during the forecast period. This growth can be attributed to growing COPD and asthma incidence rates in China and India. In China, COPD positions first among the leading cause of disability and is a growing public health concern. In May 2020, Bevespi Aerosphere from AstraZeneca received approval in China as maintenance therapy for treating symptoms of COPD, which includes chronic bronchitis and/or emphysema.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Digital Respiratory Devices Market

5.1. COVID-19 Landscape: Digital Respiratory Devices Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Digital Respiratory Devices Market, By Product

8.1. Digital Respiratory Devices Market, by Product, 2022-2030

8.1.1. Smart Inhalers & Nebulizers

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Sensors & Apps

8.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Digital Respiratory Devices Market, By Indication

9.1. Digital Respiratory Devices Market, by Indication, 2022-2030

9.1.1. Asthma

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. COPD

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Other Diseases

9.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Digital Respiratory Devices Market, By Distribution Channel

10.1. Digital Respiratory Devices Market, by Distribution Channel, 2022-2030

10.1.1. Distribution Channel

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Retail Pharmacies

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Online Pharmacies

10.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Digital Respiratory Devices Market, By End-use

11.1. Digital Respiratory Devices Market, by End-use, 2022-2030

11.1.1. Hospitals

11.1.1.1. Market Revenue and Forecast (2017-2030)

11.1.2. Homecare Settings

11.1.2.1. Market Revenue and Forecast (2017-2030)

11.1.3. Other Settings

11.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 12. Global Digital Respiratory Devices Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Product (2017-2030)

12.1.2. Market Revenue and Forecast, by Indication (2017-2030)

12.1.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

12.1.4. Market Revenue and Forecast, by End-use (2017-2030)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Product (2017-2030)

12.1.5.2. Market Revenue and Forecast, by Indication (2017-2030)

12.1.5.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

12.1.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Product (2017-2030)

12.1.6.2. Market Revenue and Forecast, by Indication (2017-2030)

12.1.6.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

12.1.6.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Product (2017-2030)

12.2.2. Market Revenue and Forecast, by Indication (2017-2030)

12.2.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

12.2.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Product (2017-2030)

12.2.5.2. Market Revenue and Forecast, by Indication (2017-2030)

12.2.5.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

12.2.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Product (2017-2030)

12.2.6.2. Market Revenue and Forecast, by Indication (2017-2030)

12.2.6.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

12.2.6.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Product (2017-2030)

12.2.7.2. Market Revenue and Forecast, by Indication (2017-2030)

12.2.7.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

12.2.7.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Product (2017-2030)

12.2.8.2. Market Revenue and Forecast, by Indication (2017-2030)

12.2.8.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

12.2.8.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Product (2017-2030)

12.3.2. Market Revenue and Forecast, by Indication (2017-2030)

12.3.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

12.3.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Product (2017-2030)

12.3.5.2. Market Revenue and Forecast, by Indication (2017-2030)

12.3.5.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

12.3.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Product (2017-2030)

12.3.6.2. Market Revenue and Forecast, by Indication (2017-2030)

12.3.6.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

12.3.6.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Product (2017-2030)

12.3.7.2. Market Revenue and Forecast, by Indication (2017-2030)

12.3.7.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

12.3.7.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Product (2017-2030)

12.3.8.2. Market Revenue and Forecast, by Indication (2017-2030)

12.3.8.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

12.3.8.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Product (2017-2030)

12.4.2. Market Revenue and Forecast, by Indication (2017-2030)

12.4.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

12.4.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Product (2017-2030)

12.4.5.2. Market Revenue and Forecast, by Indication (2017-2030)

12.4.5.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

12.4.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Product (2017-2030)

12.4.6.2. Market Revenue and Forecast, by Indication (2017-2030)

12.4.6.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

12.4.6.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Product (2017-2030)

12.4.7.2. Market Revenue and Forecast, by Indication (2017-2030)

12.4.7.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

12.4.7.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Product (2017-2030)

12.4.8.2. Market Revenue and Forecast, by Indication (2017-2030)

12.4.8.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

12.4.8.4. Market Revenue and Forecast, by End-use (2017-2030)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Product (2017-2030)

12.5.2. Market Revenue and Forecast, by Indication (2017-2030)

12.5.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

12.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Product (2017-2030)

12.5.5.2. Market Revenue and Forecast, by Indication (2017-2030)

12.5.5.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

12.5.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Product (2017-2030)

12.5.6.2. Market Revenue and Forecast, by Indication (2017-2030)

12.5.6.3. Market Revenue and Forecast, by Distribution Channel (2017-2030)

12.5.6.4. Market Revenue and Forecast, by End-use (2017-2030)

Chapter 13. Company Profiles

13.1. COHERO Health Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Cognita Labs

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Adherium Limited

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Amiko Digital Health Limited

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Teva Pharmaceuticals Industries Ltd.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Propeller Health

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Novartis AG

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Pneuma Respiratory Inc.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. 3M Health Care Limited

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. AireHealth, Inc.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others