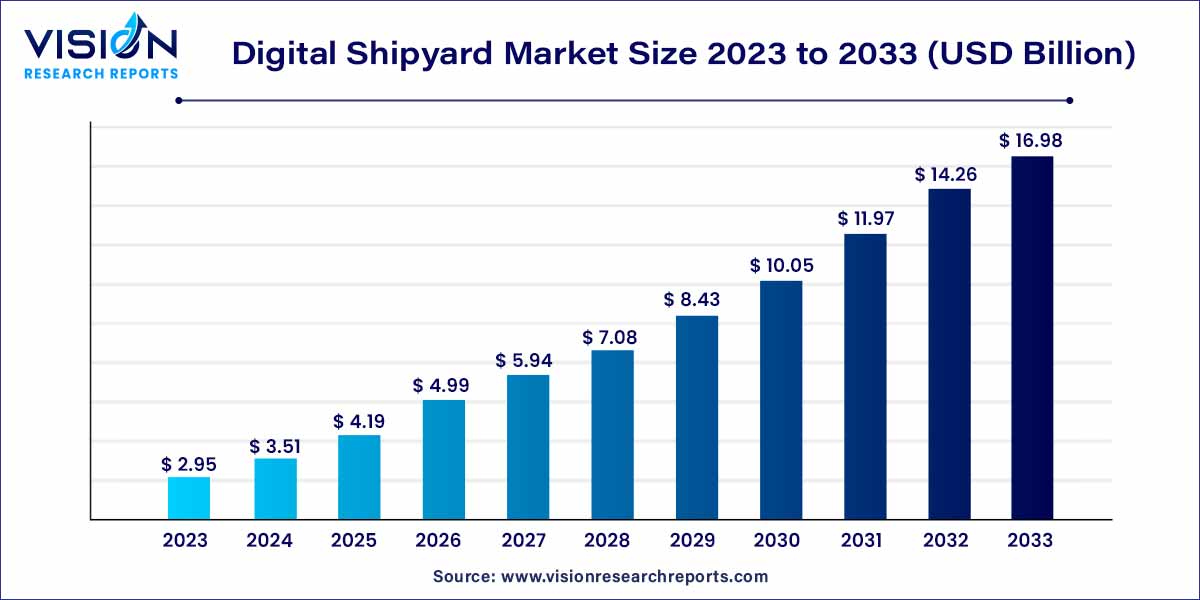

The global digital shipyard market size was estimated at around USD 2.95 billion in 2023 and it is projected to hit around USD 16.98 billion by 2033, growing at a CAGR of 19.13% from 2024 to 2033. The Industrial Internet of Things (IIoT) is expected to proliferate in the shipbuilding sector, propelling market growth. Shipyards can gather and evaluate real-time data by integrating digital systems with physical assets and machinery thanks to the IIoT.

In the dynamic landscape of maritime technology, the Digital Shipyard market has emerged as a pioneering force, reshaping traditional shipbuilding and maintenance paradigms. This overview provides a comprehensive insight into the key aspects defining the Digital Shipyard market and its transformative impact on the maritime industry.

The robust growth of the digital shipyard market is propelled by a confluence of key factors driving its expansion. Firstly, the integration of cutting-edge technologies such as IoT, AI, and virtualization has revolutionized traditional shipbuilding and maintenance practices. Real-time monitoring facilitated by IoT sensors enhances predictive maintenance capabilities, leading to reduced downtime and operational costs. Additionally, AI applications contribute to informed decision-making and workflow optimization, ensuring precision throughout the shipbuilding process. The immersive experiences offered by virtual and augmented reality technologies streamline design reviews, training programs, and maintenance procedures. Cloud computing further reinforces this growth by fostering secure collaboration, data accessibility, and the creation of agile working environments. As the industry embraces Industry 4.0 principles, the digital shipyard market is poised for continued expansion, with a focus on cybersecurity measures and a commitment to sustainability, aligning with broader industry goals. This amalgamation of advanced technologies and strategic industry trends positions the digital shipyard market as a transformative force shaping the future of maritime operations.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 16.98 billion |

| Growth Rate from 2024 to 2033 | CAGR of 19.13% |

| Revenue Share of Europe in 2023 | 28% |

| CAGR of Asia Pacific from 2024 to 2033 | 20.76% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Based on solution, the market is classified into hardware, software, and services. The hardware segment held a dominant revenue share of 47% in 2023. The ongoing advancements in hardware technologies, such as encompassing sensors, the Industrial Internet of Things (IIoT), and edge computing devices, propel the integration of hardware components in the digital shipyard sector. These progressions empower real-time data collection and enable seamless network connectivity and integration with digital twin systems. Notably, these hardware components are pivotal in establishing connections between digital twin models and the tangible assets present within the digital shipyard industry.

The services segment is expected to emerge with a significant CAGR of 20.25% over the forecast period. As the global fleet of ships continues to grow, there is a constant need for ship maintenance and repair services. The services segment within the market caters to this demand by providing specialized services such as ship repair, retrofitting, and maintenance. The need to keep ships in optimal condition and comply with regulations drives the demand for these services.

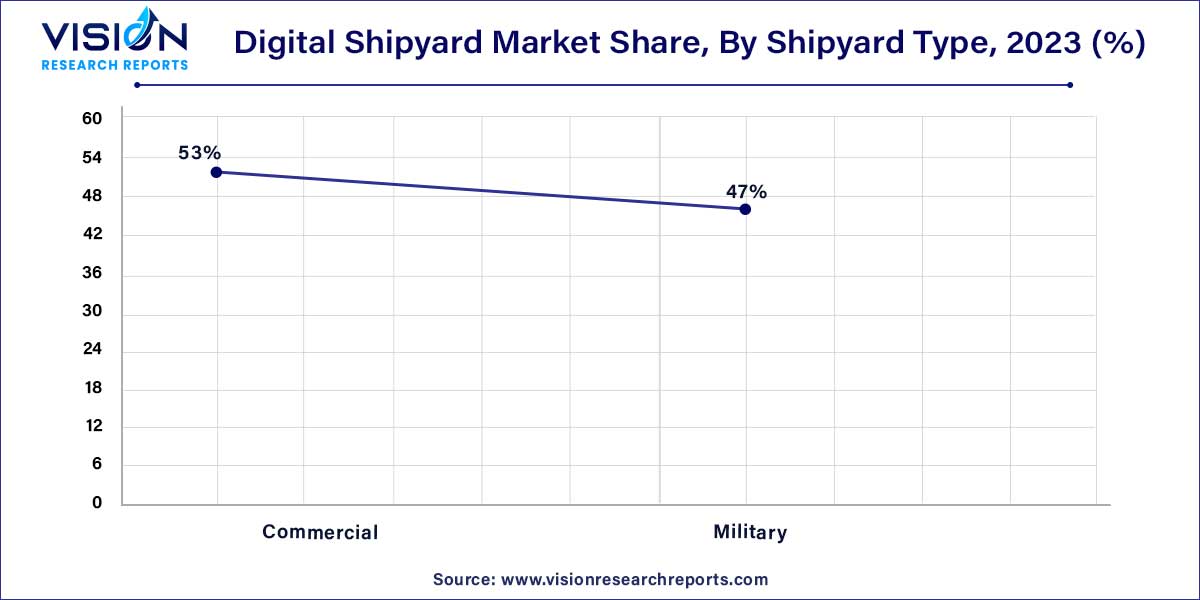

Based on shipyard type, the market is classified into commercial and military. The commercial segment led with a revenue share of 53% in 2023. The growth influences the commercial shipyard segment in maritime trade. As global trade continues to expand, there is a higher demand for new commercial ships and the maintenance and repair of existing ones. For instance, in April 2022, Wartsila introduced virtual and augmented simulation solutions that leverage the latest AR and VR technology. These solutions create immersive environments that simulate real-life shipboard operations, improving learning retention, job performance, and team collaboration. Such innovation drives the need for such services that can optimize shipbuilding and maintenance processes.

The military segment is expected to grow at a faster CAGR of 20.04% over the forecast period. The allocation of defense budgets plays a crucial role in driving the military shipyard segment. Governments invest in digital shipyard services to optimize defense spending, improve shipbuilding capabilities, and extend the lifespan of existing naval assets. The demand for digital shipyard services within the military segment is influenced by the availability of defense funding and the strategic priorities of nations.

For instance, in December 2022, the government of India intends to provide cash subsidies, tax reductions, and other incentives to support its shipbuilding sector. This move aims to alleviate the impact of elevated freight rates on the country's manufacturers. The proposed measures involve offering subsidies to facilitate the construction of a minimum of 50 new vessels and granting the shipbuilding industry "infrastructure status," which would assist in securing financing from banks.

Based on capacity, the market is classified into small, medium, and small and large. Among these, the large capacity segment dominated with a revenue share of 45% in 2023 and is anticipated to retain its dominance over the projected period. The need for larger vessels in various industries, such as shipping, oil and gas, and offshore exploration, drives the demand for digital shipyard services in the large-capacity segment. These services enable shipyards to efficiently design, construct, and maintain large-scale vessels, meeting the increasing demand for transportation and other maritime activities.

The medium capacity segment held a considerable revenue share in 2023. The medium capacity segment caters to the demand for customized vessels in industries such as offshore support, fishing, and coastal transportation. Digital shipyard solutions enable shipyards to efficiently design and construct vessels that meet the specific requirements of their clients. The ability to offer customized solutions drives the growth of the medium capacity segment within the digital shipyard industry.

Based on technology, the market is classified into AR/VR, digital twin, additive manufacturing, AI and big data analytics, High-Performance Computing (HPC), blockchain, and others. Among these, the AI/big data segment had the largest market share of 25% in 2023. Adopting AI and big data analytics in the digital shipyard market allows shipyards to collect, analyze, and interpret vast amounts of data generated throughout the shipbuilding process. AI and big data technologies enable shipyards to implement predictive maintenance and condition monitoring systems. By analyzing data from various sensors and equipment onboard vessels, shipyards can detect potential issues in real time, predict maintenance needs, and proactively address them. This helps reduce downtime, increase vessel availability, and optimize maintenance schedules, leading to cost savings and improved operational performance.

The digital twin segment is expected to emerge as the fastest-growing segment with a CAGR of 20.45% over the forecast period. Digital twins enable shipyards to create virtual replicas of vessels, allowing for enhanced ship design and planning. Shipyards can optimize vessel performance, identify potential issues, and make informed decisions before physical construction begins by simulating and analyzing different design scenarios. This leads to improved efficiency, reduced costs, and faster time-to-market. Key players such as Dassault Systèmes are undergoing partnerships to enhance the creation of digital shipyards. For instance, in November 2022, Dassault Systèmes and Samsung Heavy Industries (SHI) signed a memorandum of understanding (MoU) to collaborate on the development of a smart shipyard. This partnership aims to utilize digital twin technologies to facilitate the transformation of SHI's shipyard operations and support its business initiatives.

Europe region dominated the market with the largest market share of 28% in 2023. The Europe region has stringent environmental regulations and strongly focuses on sustainable shipping practices. This drives the demand for digital solutions in shipbuilding that can help optimize vessel design, reduce emissions, and improve fuel efficiency. For instance, the International Maritime Organization (IMO) is leading a collective industry endeavor to expedite a significant shift in fuel and technology in response to the climate crisis. The objective is to achieve a minimum 50% reduction in annual CO2 emissions by the year 2050. Digital Shipyard technologies enable shipyards to implement eco-friendly practices and comply with these regulations, leading to increased adoption in the European market.

Asia Pacific is anticipated to grow at the fastest CAGR of 20.76% throughout the forecast period. The demand for shipbuilding automation has surged in response to the labor shortage that arose during the pandemic. Digital shipyard solutions offer automation capabilities that help address this labor shortage and improve overall productivity in the Asia Pacific shipbuilding industry. The Asia Pacific region is a major hub for shipbuilding, with countries like China, South Korea, and Japan leading the market. The growth of the shipbuilding industry in the region drives the demand for digital shipyard solutions to streamline operations, optimize resources, and meet the increasing demand for ships.

By Solution

By Shipyard Type

By Capacity

By Technology

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Digital Shipyard Market

5.1. COVID-19 Landscape: Digital Shipyard Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Digital Shipyard Market, By Solution

8.1. Digital Shipyard Market, by Solution, 2024-2033

8.1.1. Hardware

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Software

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Services

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Digital Shipyard Market, By Shipyard Type

9.1. Digital Shipyard Market, by Shipyard Type, 2024-2033

9.1.1. Commercial

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Military

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Digital Shipyard Market, By Capacity

10.1. Digital Shipyard Market, by Capacity, 2024-2033

10.1.1. Small

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Medium

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Large

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Digital Shipyard Market, By Technology

11.1. Digital Shipyard Market, by Technology, 2024-2033

11.1.1. AR/VR

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Digital Twin

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Additive Manufacturing

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. AI & Big Data Analytics

11.1.4.1. Market Revenue and Forecast (2021-2033)

11.1.5. High performance Computing (HPC)

11.1.5.1. Market Revenue and Forecast (2021-2033)

11.1.6. Blockchain

11.1.6.1. Market Revenue and Forecast (2021-2033)

11.1.7. Others

11.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Digital Shipyard Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Solution (2021-2033)

12.1.2. Market Revenue and Forecast, by Shipyard Type (2021-2033)

12.1.3. Market Revenue and Forecast, by Capacity (2021-2033)

12.1.4. Market Revenue and Forecast, by Technology (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Solution (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Shipyard Type (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Capacity (2021-2033)

12.1.5.4. Market Revenue and Forecast, by Technology (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Solution (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Shipyard Type (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Capacity (2021-2033)

12.1.6.4. Market Revenue and Forecast, by Technology (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Solution (2021-2033)

12.2.2. Market Revenue and Forecast, by Shipyard Type (2021-2033)

12.2.3. Market Revenue and Forecast, by Capacity (2021-2033)

12.2.4. Market Revenue and Forecast, by Technology (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Solution (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Shipyard Type (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Capacity (2021-2033)

12.2.5.4. Market Revenue and Forecast, by Technology (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Solution (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Shipyard Type (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Capacity (2021-2033)

12.2.6.4. Market Revenue and Forecast, by Technology (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Solution (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Shipyard Type (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Capacity (2021-2033)

12.2.7.4. Market Revenue and Forecast, by Technology (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Solution (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Shipyard Type (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Capacity (2021-2033)

12.2.8.4. Market Revenue and Forecast, by Technology (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Solution (2021-2033)

12.3.2. Market Revenue and Forecast, by Shipyard Type (2021-2033)

12.3.3. Market Revenue and Forecast, by Capacity (2021-2033)

12.3.4. Market Revenue and Forecast, by Technology (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Solution (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Shipyard Type (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Capacity (2021-2033)

12.3.5.4. Market Revenue and Forecast, by Technology (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Solution (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Shipyard Type (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Capacity (2021-2033)

12.3.6.4. Market Revenue and Forecast, by Technology (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Solution (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Shipyard Type (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Capacity (2021-2033)

12.3.7.4. Market Revenue and Forecast, by Technology (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Solution (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Shipyard Type (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Capacity (2021-2033)

12.3.8.4. Market Revenue and Forecast, by Technology (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Solution (2021-2033)

12.4.2. Market Revenue and Forecast, by Shipyard Type (2021-2033)

12.4.3. Market Revenue and Forecast, by Capacity (2021-2033)

12.4.4. Market Revenue and Forecast, by Technology (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Solution (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Shipyard Type (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Capacity (2021-2033)

12.4.5.4. Market Revenue and Forecast, by Technology (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Solution (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Shipyard Type (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Capacity (2021-2033)

12.4.6.4. Market Revenue and Forecast, by Technology (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Solution (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Shipyard Type (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Capacity (2021-2033)

12.4.7.4. Market Revenue and Forecast, by Technology (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Solution (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Shipyard Type (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Capacity (2021-2033)

12.4.8.4. Market Revenue and Forecast, by Technology (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Solution (2021-2033)

12.5.2. Market Revenue and Forecast, by Shipyard Type (2021-2033)

12.5.3. Market Revenue and Forecast, by Capacity (2021-2033)

12.5.4. Market Revenue and Forecast, by Technology (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Solution (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Shipyard Type (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Capacity (2021-2033)

12.5.5.4. Market Revenue and Forecast, by Technology (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Solution (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Shipyard Type (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Capacity (2021-2033)

12.5.6.4. Market Revenue and Forecast, by Technology (2021-2033)

Chapter 13. Company Profiles

13.1. SAP

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Wartsila, BAE Systems

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Dassault Systemes

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. AVEVA

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Siemens Digital Industries Software

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Accenture

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Hexagon

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Inmarsat Plc.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Damen Shipyards Group

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others