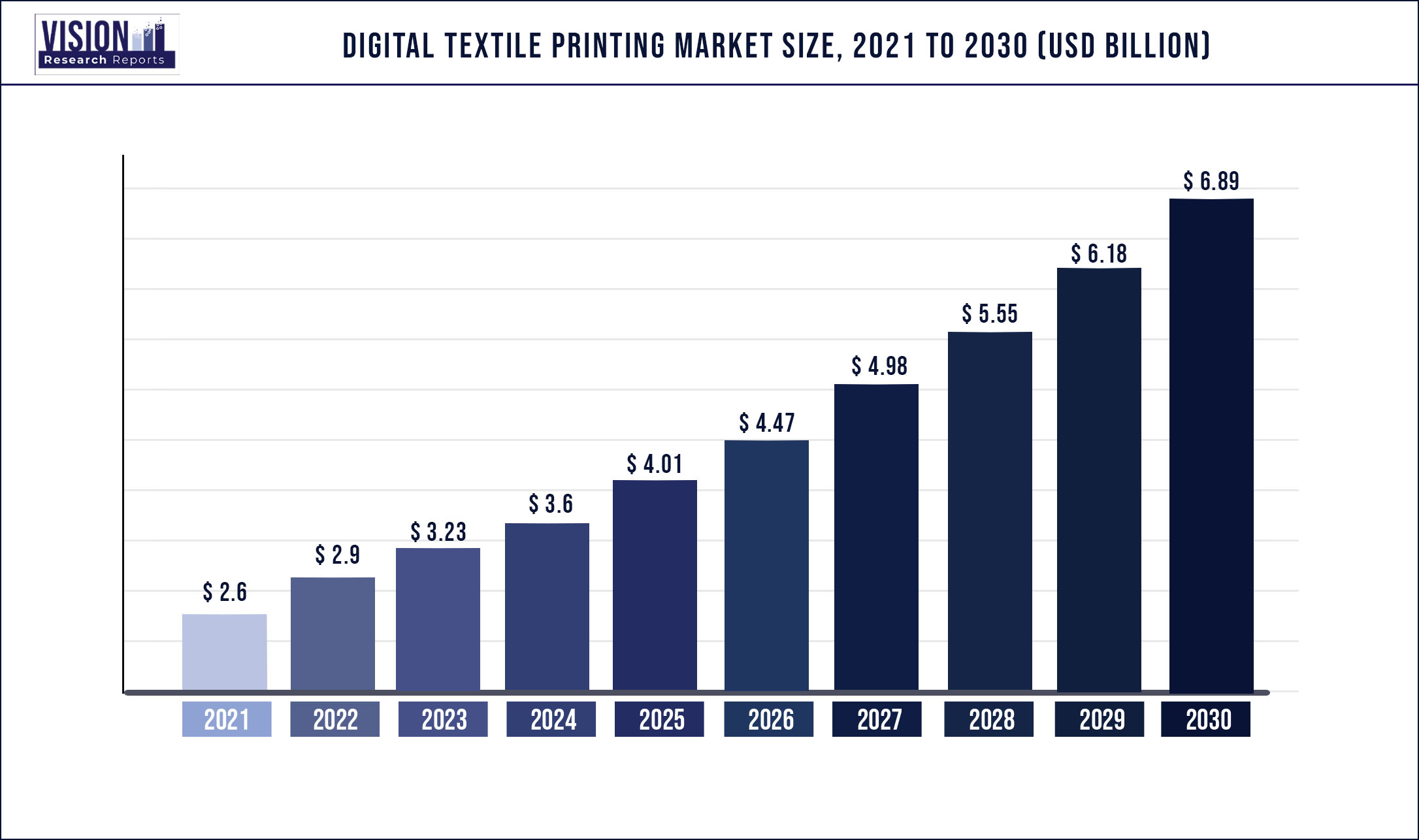

The global digital textile printing market size was estimated at around USD 2.6 billion in 2021 and it is projected to hit around USD 6.89 billion by 2030, growing at a CAGR of 11.44% from 2022 to 2030.

Report Highlights

Digital printing refers to the process of printing a digital image on a variety of substrates materials. Digital textile printing is used to print on a variety of textile materials such as cotton, polyester, silk, nylon, and other synthetic fabrics.

Any design or pattern designed digitally can be printed on clothes, fabric rolls, and other textile items such as accessories, bedsheets, curtains, carpets, etc. The designs are generated with the aid of software. Printing techniques in digital textile printing are direct-to-garment (DTG) printing and roll-to-roll/direct-to-fabric printing. Pre-treating the fabric is essential in digital printing as it ensures that the fabric retains the ink effectively and allows the use of a broad set of colors on the textile.

Digital textile printing is set out to be the "next generation" of printing. Many textile business owners are investing in digital printing technology as fabric printing transitions to the modern form of printing. To suit the demands of the new generation, the textile sector around the globe is embracing digital printing technology for printing novel designs on garments and fabrics. Different types of inks are utilized for digital textile printing. Acid, reactive, dispersion, pigment, sublimation, and reactive are the most commonly used dyes for digital printing. These inks are available in vivid colors and can be utilized for commercial printing purposes.

Choice of ink differs with each fabric; for example, reactive inks are mostly used on cotton, linen, and rayon, dispersion inks for polyester, and acid inks for silk and nylon. As compared to traditional printing, digital textile printing has several benefits. The advantages of digital printing include the ability to print multiple colors on a garment at once, the ability to print on multiple garments at once, ability to print a varied range of color shades, among others. It also enables accurate, faster, and small volume printing at an economical cost. Also, the digital printing process is more efficient and economical. Designers, and textile businesses, are therefore increasingly adopting digital textile printing technology.

The textile sector is one of the significant sources of pollution. Digital textile printing is a greener alternative to the other technologies, which are more polluting. Digital printing of textiles is a better alternative as it does not require fabric washing, and hence less water and power are utilized in the process of printing. The digital textile printing technology does have some limitations, such as metallic hues cannot be printed with digital technology. Europe held the largest market share of more than 37% in the global market, owing to the growing demand for digital textile printing in the fashion hubs of Europe, such as Italy, and France. Italy holds a significant share in the European market.

The presence of numerous fashion enterprises in Rome, Milan, Venice, and Palermo increases the demand for specialized digital textile printing. Asia-Pacific is expected to be the fastest-growing region with a CAGR of 15.1% during the forecast period. This is owing to the presence of a large number of textile hubs across the region. China and India are the two major contributors to the Asia Pacific market. Countries like Bangladesh, and Vietnam are also emerging as hubs of the textile market.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 2.6 billion |

| Revenue Forecast by 2030 | USD 6.89 billion |

| Growth rate from 2022 to 2030 | CAGR of 11.44% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Printing process, textile material, operation, ink type, application, region |

| Companies Covered |

Mimaki Engineering; Seiko Epson Corporation; Kornit Digital; Brother Industries; Konica Minolta |

Printing Process Insights

The Direct to Fabric (DTF) printing method held the largest market share of more than 67.7% in the year 2021. In this method, designs and patterns are printed directly on a big roll of fabric. Once the fabric roll is printed, the fabric is cut out and sewed into a wide range of apparel and home décor items such as curtains, wallpapers, etc. DTF printing can be carried out by using a wide range of inks such as pigment inks, reactive dyes, dye-sublimation inks, and acid dyes. Players are providing both types of printers as the demand for each type is growing significantly.

The global digital textile printing market is segmented into Direct to Fabric (Roll to roll) and Direct to Garment (DTG) based on the printing process. Direct to-garment technique prints the design directly onto the garment. The rise of on-demand printing on garments and the growing demand for custom printing on t-shirts, and shirts are propelling the demand for direct-to-garment printers. The demand for custom-made garments is mainly from sports clubs and schools for uniforms, and corporate gifting among others. Digital printing is increasingly being used in custom garments as it allows printing of any design on the substrate. Direct-to garment is the fastest growing category in the printing process segment.

Textile Material Insights

The global market is dominated by the cotton segment as it held more than 52.3% of the global market share. Due to its excellent moisture absorption and extended durability, cotton is the most widely used textile material in fashion and sportswear. Cotton is highly durable, and has excellent printability which makes it an ideal choice for garments especially fashion wears. Cotton is also the first choice for several home décor items such as bed sheets, curtains, cushion covers, and table covers owing to the softness, easy washability, and attractiveness of the cotton material. These factors are aiding the demand for printed cotton fabrics and garments.

The polyester material is expected to be the fastest growing textile material with a CAGR of 13.09% during the forecast period. Sublimation ink is primarily used on a polyester fabric substrate. Over the past few years, polyester has gained popularity as a fabric in the fashion sector owing to its properties such as resistance to wrinkles, abrasion, and low cost, among others. Silk is also in demand for clothing purposes, and home décor items. The demand for silk textiles is majorly in Gulf countries and Japan. However, the cost of silk is high which limits its usage and demand.

Operation Insights

The single pass operation segment is projected to be the fastest growing segment with a CAGR of 12.45% during the forecast period. The operation segment is divided into two categories single pass and multi-pass. Single-pass printers have multiple printer heads that are distributed evenly across the fabric's breadth. The fabric passes through the printer at a steady speed and the entire image is printed in one pass on the textile. Thus, the single-pass method is faster compared to the multi-pass operation. The high production speed and sharpness are two significant advantages of single-pass printers. A single-pass printer can print up to 40 linear meters per minute.

The multi-pass operation segment dominated the global market as it held over 62.3% of the global market share in 2021. In multi-pass, the printer heads move across the width of the fiber. The designs are printed by moving the printer heads across the fiber multiple times. The multi-pass is cost-effective as it uses a fewer number of print heads. The benefit of multi-pass digital textile printing is that any errors that may occur during the first runs of the print heads are covered up by the subsequent pass. Multi-pass printers are also known as scanning printers.

Application Insights

Based on application the global digital textile printing market is segmented into clothing/apparel, home décor, soft signage, and industrial. The clothing/apparel segment held the highest market share of more than 53.1% in 2021. The dynamic nature of the fashion industry is the key contributor to the growth of the segment. Clothing/ apparel is also projected to be the fastest growing segment with a CAGR of 12.7% during the forecast period. Digital printing is being adopted in the fashion industry as it presents a huge number of design possibilities sustainably. Digital technology enables faster printing on all kinds of fabrics.

The adoption of digital textile printing is also growing home décor and soft signage applications. Digital printing is used for various home décors products such as bedsheets, pillow covers, wallpapers, and wood. The home décor is the second fastest growing segment with an anticipated CAGR of 12.34% during the forecast period. Digital textile printing has a wide range of applications in the soft signage industry such as banners for indoor and outdoor advertising, event frames, exhibition stands, flags, fabric roll-ups, displays, sound-absorbing panels and backgrounds, and wall coverings among others.

Ink Type Insights

Due to the rising demand for dye-sublimation in customized printing services, the sublimation segment held more than 52% of the market share in the global market in 2021. Sublimation inks are more durable than other ink types as they are absorbed into the fabric rather than just adding a layer of colour to the fabric. The sublimation segment is also projected to be the fastest growing segment with a CAGR of 12.6%. The sublimation inks are primarily used on synthetic fibers such as polyester. The sublimation method is environmentally friendly as compared to other ink types as it does not require washing of the textile after printing.

The reactive ink type is expected to be the second fastest growing segment with a CAGR of 12.4% during the forecast period. Reactive inks are primarily used for cotton. In addition, reactive inks can be utilized for printing on silk and fleece as well. Acid inks are mostly used on textile materials that do not easily retain printed colors such as wool and silk. Pigments and disperse inks are used most commonly the conventional textile printing. However, in digital textile printing, these ink types have the least usage.

Regional Insights

Asia Pacific is expected to witness the fastest CAGR of 15.12% during the forecast period due to the presence of a large number of textile hubs in the region. China and India are the two major contributors to the growth of the regional market. China is one of the largest exporters of garments and textiles and hence the demand for textile printers is significantly expanding in the country. Countries like Bangladesh, Vietnam, and Japan have emerged as hubs for textile printing because of the growth of the textile industry in the region.

Europe held the largest share of more than 37.8% in the global market in 2021. Italy is the dominant market in the region owing to the growing need for printing from Italy's fashion industry. Additionally, the existence of numerous fashion enterprises and big brands in Milan, Rome, Venice, and Palermo is contributing to the increasing demand for specialized digital textile printing that offers a wide range of color schemes and fashion patterns. Germany and France are also among the key markets in the European region contributing significantly to the growth.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Digital Textile Printing Market

5.1. COVID-19 Landscape: Digital Textile Printing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Digital Textile Printing Market, By Printing Process

8.1. Digital Textile Printing Market, by Printing Process, 2022-2030

8.1.1. Direct to Fabric

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Direct to Garment

8.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Digital Textile Printing Market, By Operation

9.1. Digital Textile Printing Market, by Operation, 2022-2030

9.1.1. Single Pass

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Multi-Pass

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Digital Textile Printing Market, By Textile Material

10.1. Digital Textile Printing Market, by Textile Material, 2022-2030

10.1.1. Cotton

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Silk

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Polyester

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Digital Textile Printing Market, By Ink Type

11.1. Digital Textile Printing Market, by Ink Type, 2022-2030

11.1.1. Sublimation

11.1.1.1. Market Revenue and Forecast (2017-2030)

11.1.2. Pigment

11.1.2.1. Market Revenue and Forecast (2017-2030)

11.1.3. Reactive

11.1.3.1. Market Revenue and Forecast (2017-2030)

11.1.4. Acid

11.1.4.1. Market Revenue and Forecast (2017-2030)

11.1.5. Others

11.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 12. Global Digital Textile Printing Market, By Application

12.1. Digital Textile Printing Market, by Application, 2022-2030

12.1.1. Clothing/Apparel

12.1.1.1. Market Revenue and Forecast (2017-2030)

12.1.2. Home Décor

12.1.2.1. Market Revenue and Forecast (2017-2030)

12.1.3. Soft Signage

12.1.3.1. Market Revenue and Forecast (2017-2030)

12.1.4. Industrial

12.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 13. Global Digital Textile Printing Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Printing Process (2017-2030)

13.1.2. Market Revenue and Forecast, by Operation (2017-2030)

13.1.3. Market Revenue and Forecast, by Textile Material (2017-2030)

13.1.4. Market Revenue and Forecast, by Ink Type (2017-2030)

13.1.5. Market Revenue and Forecast, by Application (2017-2030)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Printing Process (2017-2030)

13.1.6.2. Market Revenue and Forecast, by Operation (2017-2030)

13.1.6.3. Market Revenue and Forecast, by Textile Material (2017-2030)

13.1.6.4. Market Revenue and Forecast, by Ink Type (2017-2030)

13.1.7. Market Revenue and Forecast, by Application (2017-2030)

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Printing Process (2017-2030)

13.1.8.2. Market Revenue and Forecast, by Operation (2017-2030)

13.1.8.3. Market Revenue and Forecast, by Textile Material (2017-2030)

13.1.8.4. Market Revenue and Forecast, by Ink Type (2017-2030)

13.1.8.5. Market Revenue and Forecast, by Application (2017-2030)

13.2. Europe

13.2.1. Market Revenue and Forecast, by Printing Process (2017-2030)

13.2.2. Market Revenue and Forecast, by Operation (2017-2030)

13.2.3. Market Revenue and Forecast, by Textile Material (2017-2030)

13.2.4. Market Revenue and Forecast, by Ink Type (2017-2030)

13.2.5. Market Revenue and Forecast, by Application (2017-2030)

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Printing Process (2017-2030)

13.2.6.2. Market Revenue and Forecast, by Operation (2017-2030)

13.2.6.3. Market Revenue and Forecast, by Textile Material (2017-2030)

13.2.7. Market Revenue and Forecast, by Ink Type (2017-2030)

13.2.8. Market Revenue and Forecast, by Application (2017-2030)

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Printing Process (2017-2030)

13.2.9.2. Market Revenue and Forecast, by Operation (2017-2030)

13.2.9.3. Market Revenue and Forecast, by Textile Material (2017-2030)

13.2.10. Market Revenue and Forecast, by Ink Type (2017-2030)

13.2.11. Market Revenue and Forecast, by Application (2017-2030)

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Printing Process (2017-2030)

13.2.12.2. Market Revenue and Forecast, by Operation (2017-2030)

13.2.12.3. Market Revenue and Forecast, by Textile Material (2017-2030)

13.2.12.4. Market Revenue and Forecast, by Ink Type (2017-2030)

13.2.13. Market Revenue and Forecast, by Application (2017-2030)

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Printing Process (2017-2030)

13.2.14.2. Market Revenue and Forecast, by Operation (2017-2030)

13.2.14.3. Market Revenue and Forecast, by Textile Material (2017-2030)

13.2.14.4. Market Revenue and Forecast, by Ink Type (2017-2030)

13.2.15. Market Revenue and Forecast, by Application (2017-2030)

13.3. APAC

13.3.1. Market Revenue and Forecast, by Printing Process (2017-2030)

13.3.2. Market Revenue and Forecast, by Operation (2017-2030)

13.3.3. Market Revenue and Forecast, by Textile Material (2017-2030)

13.3.4. Market Revenue and Forecast, by Ink Type (2017-2030)

13.3.5. Market Revenue and Forecast, by Application (2017-2030)

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Printing Process (2017-2030)

13.3.6.2. Market Revenue and Forecast, by Operation (2017-2030)

13.3.6.3. Market Revenue and Forecast, by Textile Material (2017-2030)

13.3.6.4. Market Revenue and Forecast, by Ink Type (2017-2030)

13.3.7. Market Revenue and Forecast, by Application (2017-2030)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Printing Process (2017-2030)

13.3.8.2. Market Revenue and Forecast, by Operation (2017-2030)

13.3.8.3. Market Revenue and Forecast, by Textile Material (2017-2030)

13.3.8.4. Market Revenue and Forecast, by Ink Type (2017-2030)

13.3.9. Market Revenue and Forecast, by Application (2017-2030)

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Printing Process (2017-2030)

13.3.10.2. Market Revenue and Forecast, by Operation (2017-2030)

13.3.10.3. Market Revenue and Forecast, by Textile Material (2017-2030)

13.3.10.4. Market Revenue and Forecast, by Ink Type (2017-2030)

13.3.10.5. Market Revenue and Forecast, by Application (2017-2030)

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Printing Process (2017-2030)

13.3.11.2. Market Revenue and Forecast, by Operation (2017-2030)

13.3.11.3. Market Revenue and Forecast, by Textile Material (2017-2030)

13.3.11.4. Market Revenue and Forecast, by Ink Type (2017-2030)

13.3.11.5. Market Revenue and Forecast, by Application (2017-2030)

13.4. MEA

13.4.1. Market Revenue and Forecast, by Printing Process (2017-2030)

13.4.2. Market Revenue and Forecast, by Operation (2017-2030)

13.4.3. Market Revenue and Forecast, by Textile Material (2017-2030)

13.4.4. Market Revenue and Forecast, by Ink Type (2017-2030)

13.4.5. Market Revenue and Forecast, by Application (2017-2030)

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Printing Process (2017-2030)

13.4.6.2. Market Revenue and Forecast, by Operation (2017-2030)

13.4.6.3. Market Revenue and Forecast, by Textile Material (2017-2030)

13.4.6.4. Market Revenue and Forecast, by Ink Type (2017-2030)

13.4.7. Market Revenue and Forecast, by Application (2017-2030)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Printing Process (2017-2030)

13.4.8.2. Market Revenue and Forecast, by Operation (2017-2030)

13.4.8.3. Market Revenue and Forecast, by Textile Material (2017-2030)

13.4.8.4. Market Revenue and Forecast, by Ink Type (2017-2030)

13.4.9. Market Revenue and Forecast, by Application (2017-2030)

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Printing Process (2017-2030)

13.4.10.2. Market Revenue and Forecast, by Operation (2017-2030)

13.4.10.3. Market Revenue and Forecast, by Textile Material (2017-2030)

13.4.10.4. Market Revenue and Forecast, by Ink Type (2017-2030)

13.4.10.5. Market Revenue and Forecast, by Application (2017-2030)

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Printing Process (2017-2030)

13.4.11.2. Market Revenue and Forecast, by Operation (2017-2030)

13.4.11.3. Market Revenue and Forecast, by Textile Material (2017-2030)

13.4.11.4. Market Revenue and Forecast, by Ink Type (2017-2030)

13.4.11.5. Market Revenue and Forecast, by Application (2017-2030)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Printing Process (2017-2030)

13.5.2. Market Revenue and Forecast, by Operation (2017-2030)

13.5.3. Market Revenue and Forecast, by Textile Material (2017-2030)

13.5.4. Market Revenue and Forecast, by Ink Type (2017-2030)

13.5.5. Market Revenue and Forecast, by Application (2017-2030)

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Printing Process (2017-2030)

13.5.6.2. Market Revenue and Forecast, by Operation (2017-2030)

13.5.6.3. Market Revenue and Forecast, by Textile Material (2017-2030)

13.5.6.4. Market Revenue and Forecast, by Ink Type (2017-2030)

13.5.7. Market Revenue and Forecast, by Application (2017-2030)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Printing Process (2017-2030)

13.5.8.2. Market Revenue and Forecast, by Operation (2017-2030)

13.5.8.3. Market Revenue and Forecast, by Textile Material (2017-2030)

13.5.8.4. Market Revenue and Forecast, by Ink Type (2017-2030)

13.5.8.5. Market Revenue and Forecast, by Application (2017-2030)

Chapter 14. Company Profiles

14.1. Seiko Epson

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. Mimaki Engineering

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Kornit Digital

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. D.Gen

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. RolandDG Corporation

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Dover Corporation

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Konica Minolta

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. Brother Industries

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Colorjet

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others