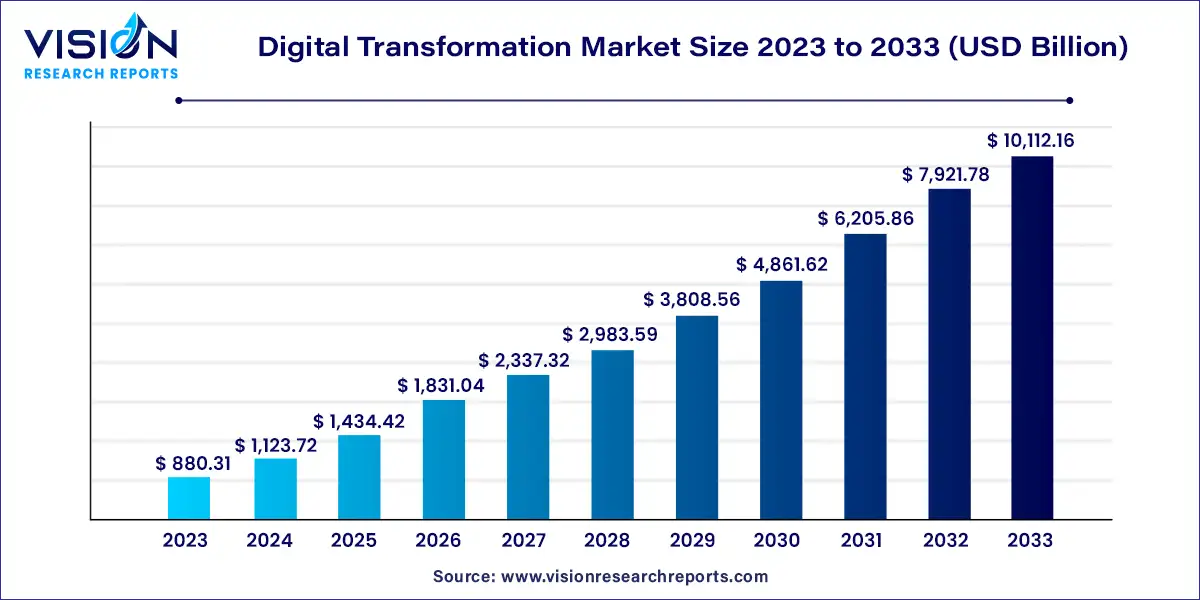

The global digital transformation market size was estimated at around USD 880.31 billion in 2023 and it is projected to hit around USD 10,112.16 billion by 2033, growing at a CAGR of 27.65% from 2024 to 2033.

Digital transformation is more than just a buzzword; it represents a fundamental shift in how businesses operate, leveraging digital technologies to revamp processes, enhance customer experiences, and drive growth. From cloud computing and big data analytics to artificial intelligence and IoT, a myriad of technologies fuels this revolution, empowering organizations to adapt, innovate, and thrive in an increasingly digital world.

The growth trajectory of the digital transformation market is propelled by an escalating demand for enhanced operational efficiency, agility, and scalability fosters a compelling case for digital transformation initiatives. Organizations recognize the imperative of harnessing digital technologies to streamline processes, optimize resource utilization, and drive productivity gains. Secondly, evolving consumer expectations and behaviors necessitate a shift towards digital-first strategies, as customers increasingly prefer seamless, personalized experiences across channels. This customer-centric approach drives investments in technologies such as AI, data analytics, and cloud computing to deliver tailored solutions and services. Moreover, the competitive landscape underscores the urgency for organizations to innovate and differentiate to maintain relevance and capture market share.

The big data and analytics segment emerged as the market leader in 2023, capturing the largest revenue share of 35%. This achievement can be attributed to the versatility of analytical solutions, which cater to diverse applications across various industries. End-user firms are increasingly recognizing the value of gaining profound insights from vast volumes of data, thus driving the demand for analytical solutions. These solutions play a pivotal role in enhancing operational efficiency, optimizing yield, and minimizing equipment downtime across industries. By leveraging analytical solutions effectively, companies can delve into consumer purchasing behaviors, leading to more accurate sales forecasts.

On the other hand, the social media segment is poised for substantial growth, projected to achieve a remarkable CAGR of 29.53% during the forecast period. This growth is fueled by the shifting focus of enterprises towards harnessing social media platforms to expand their reach and enhance brand visibility. Social media channels are utilized for various purposes including sales promotion, marketing initiatives, public relations, and product launches. Moreover, businesses increasingly rely on social media platforms to glean valuable market insights.

In 2023, the professional service segment emerged as the dominant force in the market, capturing a commanding revenue share of 76%. This substantial market share is driven by the escalating demand for professional services, including managed and consulting services, across diverse industries. As organizations increasingly prioritize the digitalization of their business processes, the need for professional services becomes paramount. These services play a vital role in addressing various challenges, such as vendor selection and cultural transformation, encountered during the digital transformation journey.

Meanwhile, the implementation and integration service segment are poised for rapid growth, projected to achieve the highest CAGR of 27.44% during the forecast period. This growth trajectory is fueled by the inclination of end-user organizations towards implementation service providers for the seamless deployment of digital solutions. The implementation and integration of digital transformation solutions entail complex tasks, necessitating proper assistance to ensure their seamless integration into the existing framework. As a result, the demand for implementation service providers is on the rise, driving the growth of this segment.

In 2023, the on-premises segment emerged as the market leader, commanding the largest revenue share of 50%. On-premises solutions are favored by end-user companies due to their robust data security features, facilitating compliance with various government regulations. Additionally, these solutions provide businesses with greater control over their sensitive data. However, there is a noticeable shift towards cloud-based digital transformation solutions among end-user companies. Cloud solutions offer diverse subscription plans and lower operating costs, driving their adoption despite the strong appeal of on-premises solutions. This trend is expected to somewhat restrain the market growth in the forecast period.

Conversely, the hosted segment is anticipated to experience the fastest growth rate, with a projected CAGR of 30.83% during the forecast period. This growth is fueled by the widespread use of mobile devices and advancements in information-sharing technologies. Cloud-based digital transformation solutions enable end-use industries to adapt swiftly to evolving markets, offering effective and efficient ways to manage business operations. Furthermore, increasing investments in cloud-based technology, both from private and public sectors, are poised to create a highly lucrative environment for segment growth in the forecast period.

In 2023, the large organization segment emerged as the market leader, commanding the largest revenue share of 58%. Large enterprises prioritize digital transformation initiatives due to their inherent benefits, including cost-effectiveness and streamlined business processes. These organizations place a premium on data security, enhanced flexibility, and seamless integration within their frameworks. With ample financial resources at their disposal, large businesses can effectively implement new strategies across the entire organization, leading to increased profitability.

Conversely, the Small & Medium Enterprise (SME) segment is poised for significant growth, projected to achieve a notable CAGR of 29.23% over the forecast period. Factors such as rapid digitization, improved scalability, and enhanced customer experience drive the adoption of digital transformation solutions among SMEs. Additionally, the growing demand for cloud-based solutions, characterized by their accessibility and affordability, further propels market growth in the SME segment in the years to come.

In 2023, the BFSI (Banking, Financial Services, and Insurance) segment emerged as the market leader, capturing the largest revenue share of 29%. Banks and financial institutions are increasingly prioritizing the enhancement of consumer experiences to bolster their brand identity and expand their customer base. This heightened focus on customer satisfaction, coupled with efforts to improve overall retention rates and provide seamless technical support, is driving significant growth in the BFSI segment. Moreover, the growing prevalence of remote working practices has further fueled market growth within the BFSI industry.

Concurrently, the healthcare segment is poised for substantial growth, with a projected CAGR of 29.44% over the forecast period. Digital transformation initiatives in healthcare hold the potential to yield significant benefits in marketing, sales, and patient care, providing a comprehensive view of each patient's health journey. Key market players are actively modernizing their solutions by integrating advanced technologies such as machine learning, artificial intelligence, and big data analytics across their business portfolios. Furthermore, digitalization in healthcare enables organizations to deliver contextual and predictive offerings to their customers, driving further growth and innovation in the sector.

In 2023, North America asserted its dominance in the market, commanding a substantial revenue share of 43%. This leadership position is primarily driven by the widespread adoption of various online payment modes and the rapid uptake of cloud computing technologies across the region. Additionally, the growing inclination of consumers towards digital media for sharing reviews and experiences is compelling brands and enterprises to embrace digital transformation solutions and pivot towards a customer-centric business model. Notably, enterprises in the U.S. and Canada are displaying aggressive spending behaviors, allocating dedicated budgets for marketing and digital channels, thereby reinforcing this industry trend.

Conversely, the Asia Pacific digital transformation market is poised to emerge as the fastest-growing regional market, with a projected CAGR of 30.34%. This growth trajectory is fueled by the increasing adoption of digital transformation solutions among Small and Medium Enterprises (SMEs). Moreover, the widespread uptake of AI-driven advanced analytics tools to deliver personalized services for both B2B and B2C consumers is a significant factor driving growth in the regional market. With a large proportion of smartphone users accessing social media through their mobile devices, the Asia Pacific region presents vast opportunities for the deployment of digital transformation solutions.

By Solution

By Service

By Deployment

By Enterprise Size

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Digital Transformation Market

5.1. COVID-19 Landscape: Digital Transformation Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Digital Transformation Market, By Solution

8.1. Digital Transformation Market, by Solution, 2024-2033

8.1.1. Analytics

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Cloud Computing

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Mobility

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Social Media

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Digital Transformation Market, By Service

9.1. Digital Transformation Market, by Service, 2024-2033

9.1.1. Professional Services

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Implementation & Integration

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Digital Transformation Market, By Deployment

10.1. Digital Transformation Market, by Deployment, 2024-2033

10.1.1. Hosted

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. On-premise

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Digital Transformation Market, By Enterprise Size

11.1. Digital Transformation Market, by Enterprise Size, 2024-2033

11.1.1. Large Enterprise

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Small & Medium Enterprise

11.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Digital Transformation Market, By End-use

12.1. Digital Transformation Market, by End-use, 2024-2033

12.1.1. BFSI

12.1.1.1. Market Revenue and Forecast (2021-2033)

12.1.2. Government

12.1.2.1. Market Revenue and Forecast (2021-2033)

12.1.3. Healthcare

12.1.3.1. Market Revenue and Forecast (2021-2033)

12.1.4. IT & Telecom

12.1.4.1. Market Revenue and Forecast (2021-2033)

12.1.5. Manufacturing

12.1.5.1. Market Revenue and Forecast (2021-2033)

12.1.6. Retail

12.1.6.1. Market Revenue and Forecast (2021-2033)

12.1.7. Others

12.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 13. Global Digital Transformation Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Solution (2021-2033)

13.1.2. Market Revenue and Forecast, by Service (2021-2033)

13.1.3. Market Revenue and Forecast, by Deployment (2021-2033)

13.1.4. Market Revenue and Forecast, by Enterprise Size (2021-2033)

13.1.5. Market Revenue and Forecast, by End-use (2021-2033)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Solution (2021-2033)

13.1.6.2. Market Revenue and Forecast, by Service (2021-2033)

13.1.6.3. Market Revenue and Forecast, by Deployment (2021-2033)

13.1.6.4. Market Revenue and Forecast, by Enterprise Size (2021-2033)

13.1.7. Market Revenue and Forecast, by End-use (2021-2033)

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Solution (2021-2033)

13.1.8.2. Market Revenue and Forecast, by Service (2021-2033)

13.1.8.3. Market Revenue and Forecast, by Deployment (2021-2033)

13.1.8.4. Market Revenue and Forecast, by Enterprise Size (2021-2033)

13.1.8.5. Market Revenue and Forecast, by End-use (2021-2033)

13.2. Europe

13.2.1. Market Revenue and Forecast, by Solution (2021-2033)

13.2.2. Market Revenue and Forecast, by Service (2021-2033)

13.2.3. Market Revenue and Forecast, by Deployment (2021-2033)

13.2.4. Market Revenue and Forecast, by Enterprise Size (2021-2033)

13.2.5. Market Revenue and Forecast, by End-use (2021-2033)

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Solution (2021-2033)

13.2.6.2. Market Revenue and Forecast, by Service (2021-2033)

13.2.6.3. Market Revenue and Forecast, by Deployment (2021-2033)

13.2.7. Market Revenue and Forecast, by Enterprise Size (2021-2033)

13.2.8. Market Revenue and Forecast, by End-use (2021-2033)

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Solution (2021-2033)

13.2.9.2. Market Revenue and Forecast, by Service (2021-2033)

13.2.9.3. Market Revenue and Forecast, by Deployment (2021-2033)

13.2.10. Market Revenue and Forecast, by Enterprise Size (2021-2033)

13.2.11. Market Revenue and Forecast, by End-use (2021-2033)

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Solution (2021-2033)

13.2.12.2. Market Revenue and Forecast, by Service (2021-2033)

13.2.12.3. Market Revenue and Forecast, by Deployment (2021-2033)

13.2.12.4. Market Revenue and Forecast, by Enterprise Size (2021-2033)

13.2.13. Market Revenue and Forecast, by End-use (2021-2033)

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Solution (2021-2033)

13.2.14.2. Market Revenue and Forecast, by Service (2021-2033)

13.2.14.3. Market Revenue and Forecast, by Deployment (2021-2033)

13.2.14.4. Market Revenue and Forecast, by Enterprise Size (2021-2033)

13.2.15. Market Revenue and Forecast, by End-use (2021-2033)

13.3. APAC

13.3.1. Market Revenue and Forecast, by Solution (2021-2033)

13.3.2. Market Revenue and Forecast, by Service (2021-2033)

13.3.3. Market Revenue and Forecast, by Deployment (2021-2033)

13.3.4. Market Revenue and Forecast, by Enterprise Size (2021-2033)

13.3.5. Market Revenue and Forecast, by End-use (2021-2033)

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Solution (2021-2033)

13.3.6.2. Market Revenue and Forecast, by Service (2021-2033)

13.3.6.3. Market Revenue and Forecast, by Deployment (2021-2033)

13.3.6.4. Market Revenue and Forecast, by Enterprise Size (2021-2033)

13.3.7. Market Revenue and Forecast, by End-use (2021-2033)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Solution (2021-2033)

13.3.8.2. Market Revenue and Forecast, by Service (2021-2033)

13.3.8.3. Market Revenue and Forecast, by Deployment (2021-2033)

13.3.8.4. Market Revenue and Forecast, by Enterprise Size (2021-2033)

13.3.9. Market Revenue and Forecast, by End-use (2021-2033)

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Solution (2021-2033)

13.3.10.2. Market Revenue and Forecast, by Service (2021-2033)

13.3.10.3. Market Revenue and Forecast, by Deployment (2021-2033)

13.3.10.4. Market Revenue and Forecast, by Enterprise Size (2021-2033)

13.3.10.5. Market Revenue and Forecast, by End-use (2021-2033)

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Solution (2021-2033)

13.3.11.2. Market Revenue and Forecast, by Service (2021-2033)

13.3.11.3. Market Revenue and Forecast, by Deployment (2021-2033)

13.3.11.4. Market Revenue and Forecast, by Enterprise Size (2021-2033)

13.3.11.5. Market Revenue and Forecast, by End-use (2021-2033)

13.4. MEA

13.4.1. Market Revenue and Forecast, by Solution (2021-2033)

13.4.2. Market Revenue and Forecast, by Service (2021-2033)

13.4.3. Market Revenue and Forecast, by Deployment (2021-2033)

13.4.4. Market Revenue and Forecast, by Enterprise Size (2021-2033)

13.4.5. Market Revenue and Forecast, by End-use (2021-2033)

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Solution (2021-2033)

13.4.6.2. Market Revenue and Forecast, by Service (2021-2033)

13.4.6.3. Market Revenue and Forecast, by Deployment (2021-2033)

13.4.6.4. Market Revenue and Forecast, by Enterprise Size (2021-2033)

13.4.7. Market Revenue and Forecast, by End-use (2021-2033)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Solution (2021-2033)

13.4.8.2. Market Revenue and Forecast, by Service (2021-2033)

13.4.8.3. Market Revenue and Forecast, by Deployment (2021-2033)

13.4.8.4. Market Revenue and Forecast, by Enterprise Size (2021-2033)

13.4.9. Market Revenue and Forecast, by End-use (2021-2033)

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Solution (2021-2033)

13.4.10.2. Market Revenue and Forecast, by Service (2021-2033)

13.4.10.3. Market Revenue and Forecast, by Deployment (2021-2033)

13.4.10.4. Market Revenue and Forecast, by Enterprise Size (2021-2033)

13.4.10.5. Market Revenue and Forecast, by End-use (2021-2033)

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Solution (2021-2033)

13.4.11.2. Market Revenue and Forecast, by Service (2021-2033)

13.4.11.3. Market Revenue and Forecast, by Deployment (2021-2033)

13.4.11.4. Market Revenue and Forecast, by Enterprise Size (2021-2033)

13.4.11.5. Market Revenue and Forecast, by End-use (2021-2033)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Solution (2021-2033)

13.5.2. Market Revenue and Forecast, by Service (2021-2033)

13.5.3. Market Revenue and Forecast, by Deployment (2021-2033)

13.5.4. Market Revenue and Forecast, by Enterprise Size (2021-2033)

13.5.5. Market Revenue and Forecast, by End-use (2021-2033)

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Solution (2021-2033)

13.5.6.2. Market Revenue and Forecast, by Service (2021-2033)

13.5.6.3. Market Revenue and Forecast, by Deployment (2021-2033)

13.5.6.4. Market Revenue and Forecast, by Enterprise Size (2021-2033)

13.5.7. Market Revenue and Forecast, by End-use (2021-2033)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Solution (2021-2033)

13.5.8.2. Market Revenue and Forecast, by Service (2021-2033)

13.5.8.3. Market Revenue and Forecast, by Deployment (2021-2033)

13.5.8.4. Market Revenue and Forecast, by Enterprise Size (2021-2033)

13.5.8.5. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 14. Company Profiles

14.1. Accenture plc

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. Apple Inc.

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Adobe Systems Incorporated

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. CA Technologies

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Dell EMC

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Hewlett Packard Enterprise Co.

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. International Business Machines Corporation

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. Microsoft Corporation

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Kellton Tech Solutions Ltd.

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Google Inc.

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others