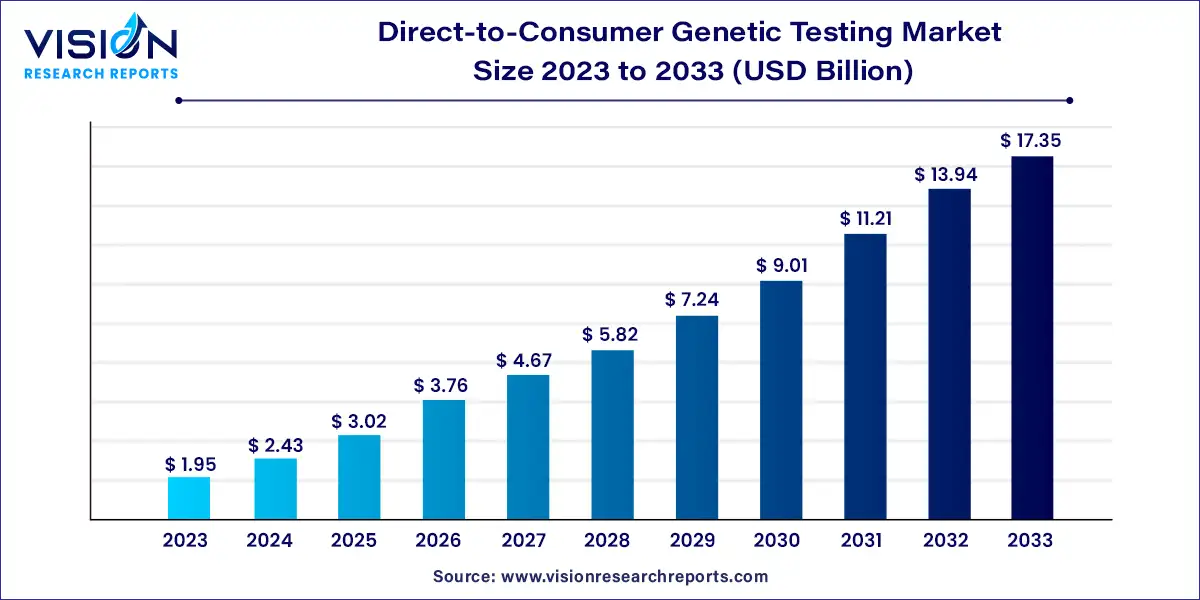

The direct-to-consumer genetic testing market was surpassed at USD 1.95 billion in 2023 and is expected to hit around USD 17.35 billion by 2033, growing at a CAGR of 24.43% from 2024 to 2033.

Direct-to-consumer (DTC) genetic testing has emerged as a prominent trend in the healthcare industry, offering individuals unprecedented access to their genetic information. This market overview aims to provide insights into the dynamics, trends, and factors shaping the landscape of DTC genetic testing.

The growth of the direct-to-consumer (DTC) genetic testing market is driven by an advancements in genetic technology have made testing more accessible and affordable, allowing consumers to gain insights into their genetic makeup with ease. Additionally, increasing awareness about personalized healthcare and the importance of genetic information in disease prevention and management has driven demand for DTC genetic testing services. Moreover, the rise of online platforms and direct-to-consumer marketing strategies has expanded the reach of genetic testing companies, reaching a broader demographic of consumers. Furthermore, the growing trend of self-care and proactive health management has led individuals to seek out DTC genetic testing as a means of taking control of their health. Lastly, partnerships between genetic testing companies and healthcare providers have facilitated the integration of genetic information into mainstream medical practices, further driving market growth. These factors collectively contribute to the expansion of the DTC genetic testing market, shaping it into a dynamic and rapidly evolving segment of the healthcare industry.

The predictive testing segment dominated the market with the largest revenue share of 39% in 2023 and is expected to grow at the fastest CAGR over the forecast period. Predictive genetic testing refers to the use of genomic information to predict an individual's risk of developing a particular disease or condition. Rising demand for personalized medicine and the increasing prevalence of genetic disorders contributing to the segment growth. In addition, an increasing number of product launches are also expected to offer a favorable environment for segment growth. For instance, in February 2022, Invitae Corporation announced the launch of its new genetic testing kits for cancer diagnosis, LiquidPlex Dx and FusionPlex Dx in Europe.

On the other hand, the nutrigenomics testing segment is anticipated to show lucrative growth over the forecast period owing to increasing awareness since nutrigenomics examination involves analyzing an individual's DNA to identify genetic variations that can influence their nutritional needs and their risk of developing certain health conditions.

The whole genome sequencing segment dominated the DTC genetic testing market and accounted for the maximum revenue share of 40% in 2023. It is expected to grow at the fastest CAGR. Whole genome sequencing provides a complete view of an individual's entire genome, including all genes and non-coding regions. For instance, in February 2023, the NIH researchers launched an innovative software Verkko, which is capable of assembling the complete genome sequence more easily and economically. Moreover, the increase in cancer-causing mutations further boosts the whole genome sequencing segment.

The targeted analysis segment is expected to show lucrative growth over the forecast period. In targeted analysis, specific genetic markers are analyzed using techniques such as polymerase chain reaction (PCR), sequencing, or genotyping. This allows for the identification of genomic variations that may increase an individual's risk of developing certain health conditions, such as cardiovascular disease, cancer, or inherited genomic disorders. Owing to this advantage the segment is expected to grow during the forecast period.

Based on the distribution channel, the online platform segment dominated the market and held the largest revenue share of 65% in 2023. This segment is also anticipated to witness the fastest CAGR over the forecast period. DTC genetic testing companies offering their services through online platforms provide convenience to consumers, who can easily order a test kit online and receive their results electronically. For instance, in May 2022, FDA granted the usage of LabCorp Seasonal Respiratory Virus RT-PCR DTC test to make the process accessible. Apart from this, online platforms are often promoting privacy as a key selling point, thus, allowing consumers to order and receive their results without having to go through a healthcare provider or disclose their inherited information to others.

Moreover, online platforms allow companies to innovate and offer new services and features, such as personalized recommendations based on heritable data, interactive tools for exploring genomic information, and social networking features that allow consumers to connect with others who share similar hereditary traits or interests.

OTC platform is anticipated to grow at a significant CAGR over the forecast period since many underdeveloped countries rely more on OTC over the online platform. OTC medicines are those that can be purchased without a prescription from a healthcare professional. Some medicines can interact with other medications or medical conditions, and some people may have allergies or sensitivities to certain ingredients. To avoid such conditions OTC platform plays a crucial role.

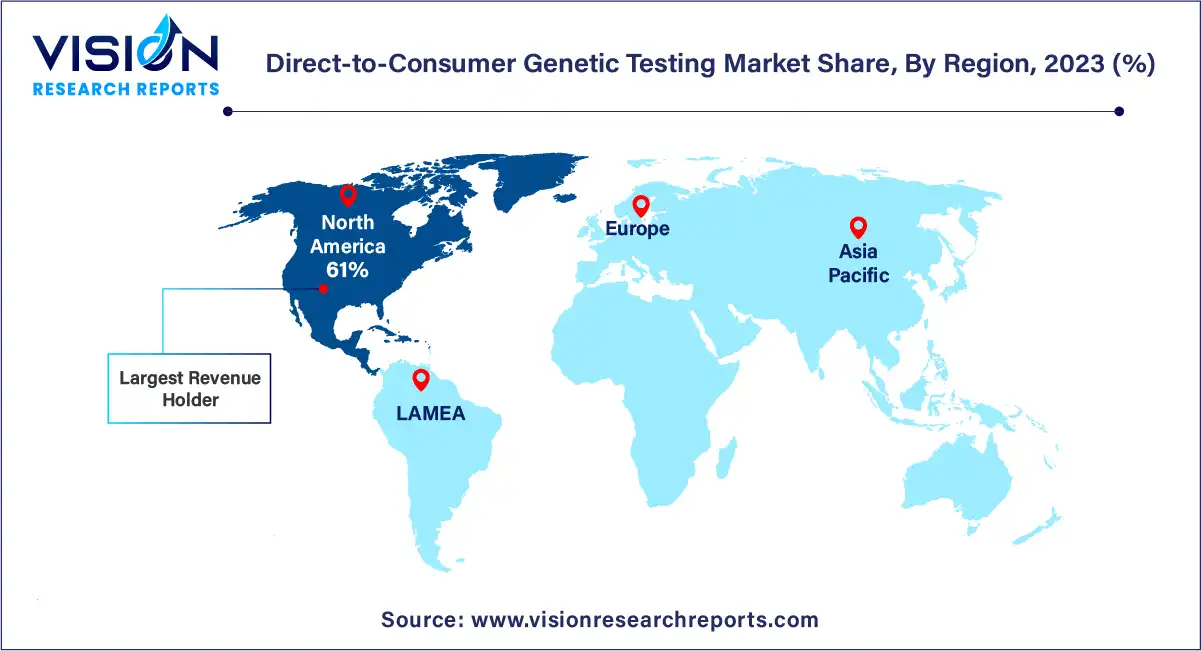

North America dominated the DTC genetic testing market and held the largest revenue share of 61% in 2023. The dominance is attributed to the significant shift in the outlook of consumers toward genomic examination. Also, the rise in expenditure will further boost the market growth in the region during the forecast period. The healthcare system in North America is relatively well-developed, which provides a strong foundation for the growth of genomic examination services, which further boosts the market growth in the region.

Europe is expected to show the fastest growth over the forecast period. The major factor that will drive the market growth in this region is the increased emphasis on early disease detection and prevention as well as the increased application of genomic examining among others. For instance, the European Commission announced four new European Union Cancer Plan initiatives in February 2022 to assist Member States in addressing disparities, enhancing HPV infection screening and vaccination, and supporting cancer survivors.

By Test Type

By Technology

By Distributional

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Test Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Direct-to-Consumer Genetic Testing Market

5.1. COVID-19 Landscape: Direct-to-Consumer Genetic Testing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Direct-to-Consumer Genetic Testing Market, By Test Type

8.1. Direct-to-Consumer Genetic Testing Market, by Test Type, 2024-2033

8.1.1 Nutrigenomics Testing

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Predictive Testing

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Carrier Testing

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Direct-to-Consumer Genetic Testing Market, By Technology

9.1. Direct-to-Consumer Genetic Testing Market, by Technology, 2024-2033

9.1.1. Whole Genome Sequencing

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Single Nucleotide Polymorphism Chips

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Targeted Analysis

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Direct-to-Consumer Genetic Testing Market, By Distributional Channel

10.1. Direct-to-Consumer Genetic Testing Market, by Distributional Channel, 2024-2033

10.1.1. Online Platform

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. OTC

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Direct-to-Consumer Genetic Testing Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Test Type (2021-2033)

11.1.2. Market Revenue and Forecast, by Technology (2021-2033)

11.1.3. Market Revenue and Forecast, by Distributional Channel (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Test Type (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Technology (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Distributional Channel (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Test Type (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Technology (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Distributional Channel (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Test Type (2021-2033)

11.2.2. Market Revenue and Forecast, by Technology (2021-2033)

11.2.3. Market Revenue and Forecast, by Distributional Channel (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Test Type (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Technology (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Distributional Channel (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Test Type (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Technology (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Distributional Channel (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Test Type (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Technology (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Distributional Channel (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Test Type (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Technology (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Distributional Channel (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Test Type (2021-2033)

11.3.2. Market Revenue and Forecast, by Technology (2021-2033)

11.3.3. Market Revenue and Forecast, by Distributional Channel (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Test Type (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Technology (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Distributional Channel (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Test Type (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Technology (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Distributional Channel (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Test Type (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Technology (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Distributional Channel (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Test Type (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Technology (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Distributional Channel (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Test Type (2021-2033)

11.4.2. Market Revenue and Forecast, by Technology (2021-2033)

11.4.3. Market Revenue and Forecast, by Distributional Channel (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Test Type (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Technology (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Distributional Channel (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Test Type (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Technology (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Distributional Channel (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Test Type (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Technology (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Distributional Channel (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Test Type (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Technology (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Distributional Channel (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Test Type (2021-2033)

11.5.2. Market Revenue and Forecast, by Technology (2021-2033)

11.5.3. Market Revenue and Forecast, by Distributional Channel (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Test Type (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Technology (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Distributional Channel (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Test Type (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Technology (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Distributional Channel (2021-2033)

Chapter 12. Company Profiles

12.1. 23andMe

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Family Tree DNA

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Ancestry

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Genesis HealthCare

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. EasyDNA

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Veritas

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Myriad Genetics Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Full Genomes Corporation, Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Living DNA Ltd.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Color Health, Inc.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others