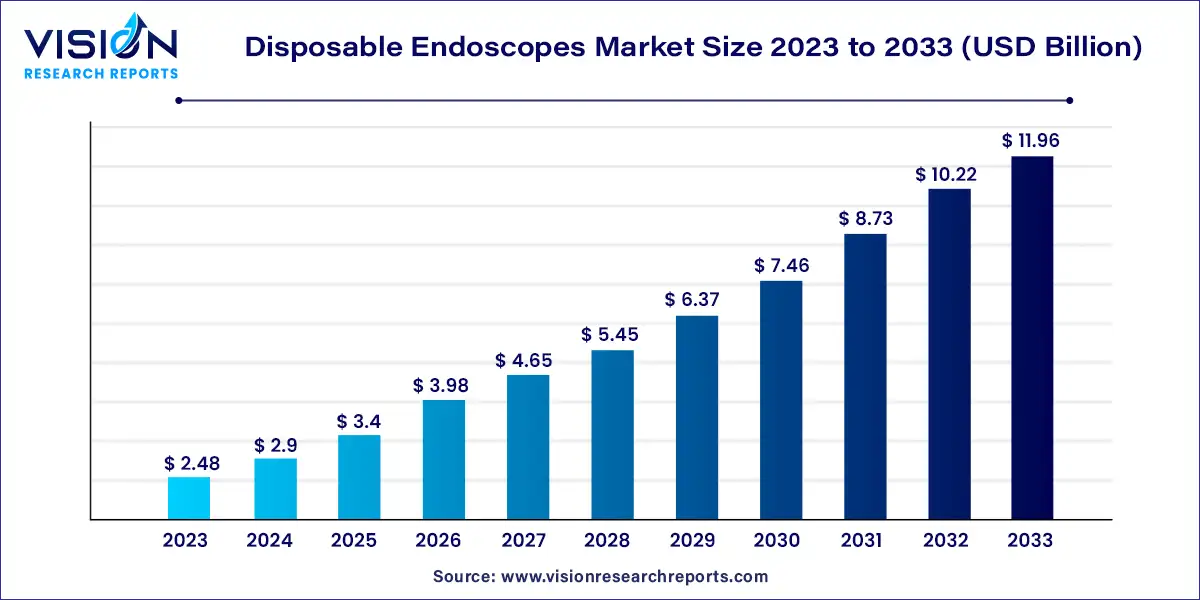

The global disposable endoscopes market size was estimated at around USD 2.48 billion in 2023 and it is projected to hit around USD 11.96 billion by 2033, growing at a CAGR of 17.04% from 2024 to 2033.

The growth of the disposable endoscopes market is driven by an advancement in medical technology have led to the development of disposable endoscopes with improved imaging capabilities and performance, enhancing their utility and acceptance among healthcare professionals. Secondly, the increasing prevalence of gastrointestinal diseases and disorders, coupled with the rising demand for minimally invasive procedures, has spurred the adoption of disposable endoscopes as an effective diagnostic and therapeutic tool. Additionally, the growing awareness about infection control measures and the need to mitigate the risk of cross-contamination in healthcare settings have fueled the transition from reusable to disposable endoscopes. Moreover, the expanding healthcare infrastructure in emerging markets and the rising healthcare expenditure globally are further contributing to market growth by increasing accessibility to disposable endoscopic procedures.

In 2023, the bronchoscopes segment dominated the market with a share of 28%, and it is expected to maintain a steady growth rate throughout the projected period. This significant share is primarily driven by the increasing prevalence of respiratory and lung disorders, alongside the widespread adoption of minimally invasive bronchoscopy procedures. According to the World Health Organization (WHO), chronic obstructive pulmonary disease (COPD) ranks as the third leading cause of death globally, with over 90% of COPD-related deaths occurring in low and middle-income countries. Additionally, the rising preference for single-use flexible bronchoscopes among healthcare professionals further contributes to the expansion of this segment. Moreover, the continuous influx of product approvals also supports market growth.

The ureteroscopes segment ranked second in terms of revenue among the type segments, with its substantial revenue attributed to the increasing number of ureteroscopy procedures performed due to the high disease burden. Furthermore, the lower costs associated with servicing and cleaning, coupled with reduced risks of cross-contamination, are driving the adoption of advanced ureteroscopes for kidney stone detection. Additionally, the availability of a robust product portfolio of technologically advanced ureteroscopes has created significant growth opportunities for the market. For example, Olympus Corporation offers a wide range of products aimed at improving stone management.

Outpatient facilities emerged as the dominant force in the global market in 2023, and this trend is expected to continue with a lucrative growth rate throughout the forecast period. The increasing number of outpatient facilities conducting endoscopic procedures is a key driver fueling demand within this segment. Additionally, the advantages of easy accessibility to outpatient facilities and cost-effective services further support the expansion of the market. Moreover, government initiatives aimed at fortifying healthcare infrastructure are anticipated to bolster the uptake of outpatient facilities in the years to come.

The hospital segment has experienced high revenue growth, owing to several factors including a favorable reimbursement scenario, a large number of hospitals offering endoscopic procedures, and hospitals' preference for minimally invasive techniques. Furthermore, the increased adoption of single-use endoscopes in hospitals to mitigate infection risks and leaks has contributed to the demand within this segment. Additionally, advancements in technology coupled with the high sensitivity of disposable endoscopes are driving the expansion of the hospital segment.

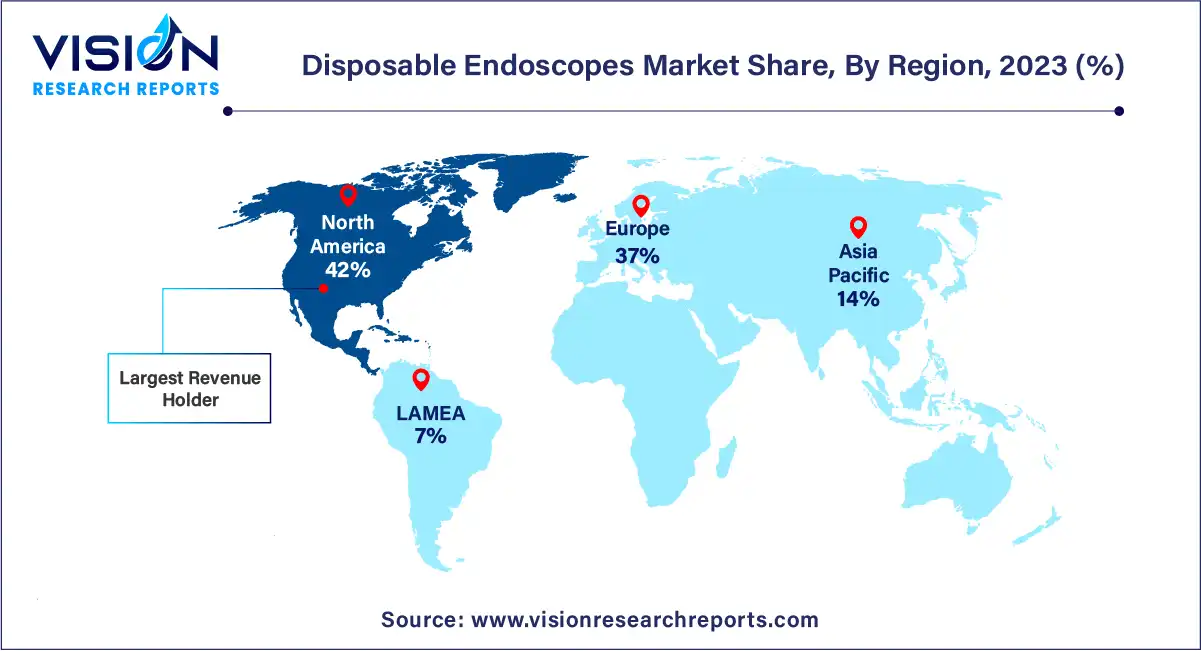

In 2023, North America emerged as the leader in the overall market, capturing the largest revenue share of 42%. This dominance can be attributed to the presence of a large number of market players and the strategic initiatives undertaken by them. Within North America, the United States stands out as the largest market, primarily because the majority of players initially sought approval from the U.S. Food and Drug Administration (FDA) to launch their products in the country. Moreover, the increasing awareness about cost-effective single-use endoscopes and high per capita health expenditure are additional factors driving the region's growth. Furthermore, advanced healthcare infrastructure, supportive government initiatives, and comprehensive treatment coverage also contribute to the robust growth of the North American region.

Asia Pacific is poised to witness a lucrative compound annual growth rate (CAGR) throughout the forecast period. This rapid growth is attributed to the high burden of target diseases and the larger population pool, which provide traction to the region's expansion. The improving healthcare infrastructure and rising investments from market players, owing to the flourishing demand for medical devices in the APAC region, have propelled the region's growth to a certain extent. Furthermore, the increasing transition from reusable to disposable endoscopes in the region, along with an increase in epidemiological factors, holds high promise for the region's growth.

By Type

By End-use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others