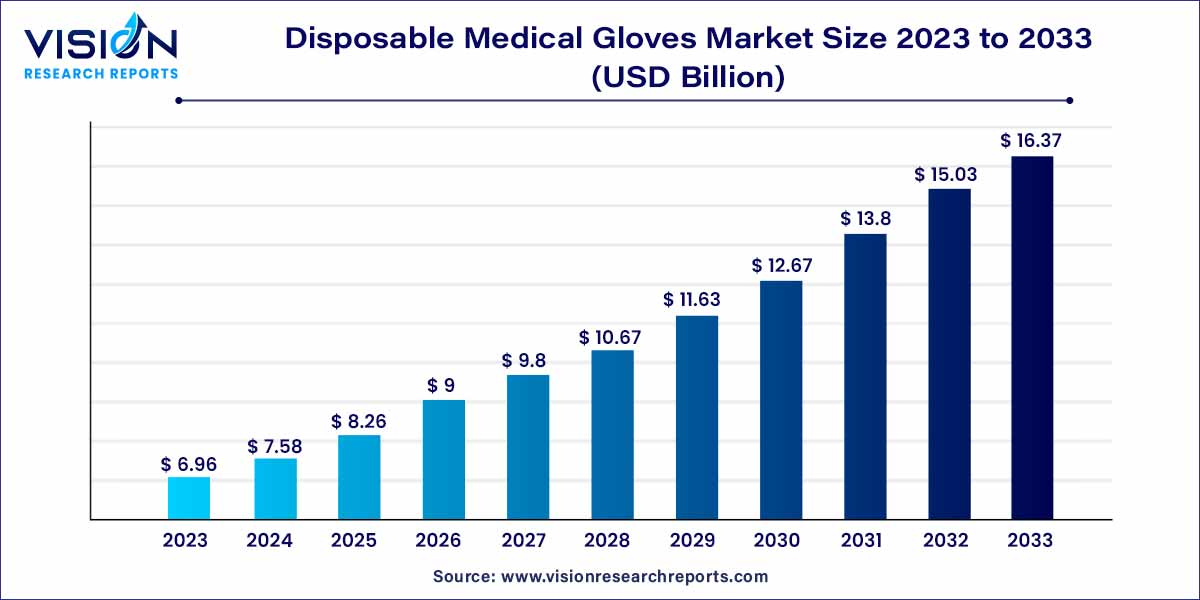

The global disposable medical gloves market size was estimated at around USD 6.96 billion in 2023 and it is projected to hit around USD 16.37 billion by 2033, growing at a CAGR of 8.93% from 2024 to 2033. The disposable medical gloves market is driven by an increasing need for safety and security in healthcare environments, coupled with the rise in healthcare spending, is anticipated to positively influence industry growth.

The disposable medical gloves market has witnessed significant growth in recent years, driven by various factors such as the increasing prevalence of infectious diseases, rising awareness about hygiene and safety measures, and the growing emphasis on infection control in healthcare settings. Disposable medical gloves play a crucial role in preventing the transmission of pathogens between healthcare workers and patients, thereby safeguarding public health and reducing the risk of cross-contamination.

The growth of the disposable medical gloves market is driven by several key factors. Firstly, the increasing prevalence of infectious diseases worldwide has heightened the demand for disposable gloves in healthcare settings to prevent the transmission of pathogens. Additionally, rising awareness about the importance of hygiene and safety measures, particularly in light of the COVID-19 pandemic, has led to greater adoption of disposable medical gloves among healthcare professionals and patients alike. Furthermore, technological advancements in glove manufacturing have resulted in products with improved barrier properties, durability, and comfort, further fueling market growth. Stringent regulatory standards governing the use of personal protective equipment (PPE) in healthcare facilities also contribute to market expansion, as compliance with these regulations is essential for ensuring product safety and efficacy. Overall, these factors collectively drive the growth of the disposable medical gloves market, with sustained demand expected in the foreseeable future.

In 2023, the natural rubber material segment held the largest share of the market, accounting for 38% of the total revenue. Disposable medical gloves crafted from natural rubber or latex offer tactile sensitivity and find widespread use in medical procedures and surgeries. Their flexibility and ease of use make them particularly well-suited for handling water-based or biological substances, driving demand within the industry.

The demand for nitrile disposable gloves is expected to witness significant growth from 2024 to 2033. Nitrile gloves are preferred in applications where protection against blood-borne diseases and other contaminants is paramount due to their exceptional puncture resistance, superior barrier properties, and durability. Additionally, their high elasticity and memory contribute to excellent comfort and fit, further enhancing their appeal.

In 2023, the examination disposable medical gloves application segment emerged as the market leader. The surge in demand for these products within the medical sector, driven by increased usage in hospitals, dental practices for routine check-ups, and patient consultations, is poised to fuel industry expansion. Moreover, significant growth is anticipated in the surgical segment throughout the forecast period. The escalating incidence of chronic diseases like heart disease and cancer, often requiring medical procedures and surgeries for treatment, is projected to propel the demand for disposable gloves in surgical settings.

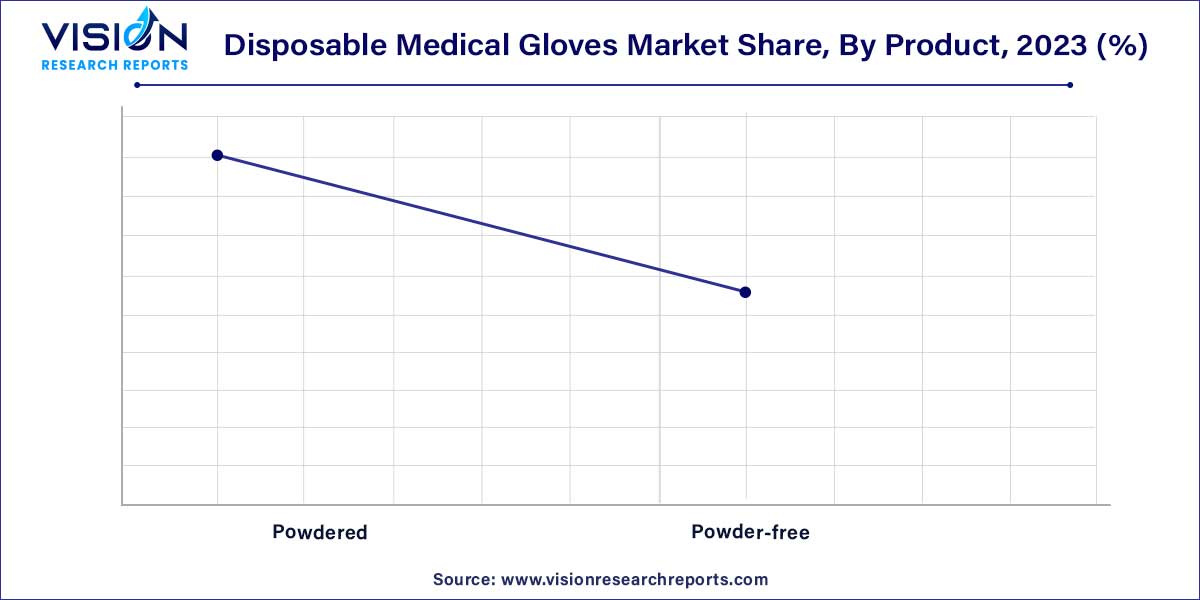

In 2023, the powdered disposable medical gloves product segment dominated the market. This segment utilizes powder, typically cornstarch or calcium carbonate, which acts as a lubricant, facilitating the easy donning of gloves by users. Such convenience is especially advantageous in high-paced environments like healthcare settings, where quick glove application is crucial for efficient patient care tasks.

However, the powder-free product segment is poised for significant growth from 2024 to 2033. Powder-free gloves eliminate the risk of adverse reactions associated with powder, such as allergies or respiratory issues, making them the preferred choice for individuals with sensitivities or allergies. Moreover, powder-free gloves minimize the potential for contamination in sensitive environments such as surgical procedures or laboratory work, where even minute traces of powder could compromise test results or patient outcomes.

In 2023, the hospital end-use segment emerged as the market leader. This was driven by the rapid growth of the geriatric population, particularly in developed countries, alongside the increasing prevalence of hospital-acquired infections and other diseases like hepatitis and AIDS. Primary care physicians play a crucial role in offering primary care services to specific patient populations.

These physicians serve as the initial point of contact (PoC) for patients experiencing unidentified symptoms, signs, or health concerns. Therefore, medical gloves are indispensable when working with individuals with undiagnosed conditions to prevent cross-transmission and contamination. The rising number of patients seeking consultation at primary care facilities is expected to bolster industry demand further.

In 2023, North America emerged as the market leader, capturing the largest share at 37%. The region's healthcare landscape is witnessing a surge in chronic illnesses, such as obesity, which is projected to drive up healthcare spending, thus fostering market growth. North America boasts the presence of numerous prominent manufacturers of disposable gloves, including 3M, Kimberly-Clark Corporation, Cardinal Health, and Medicom, among others. This strong presence is expected to further propel market growth throughout the forecast period.

By Material

By Product

By Application

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Disposable Medical Gloves Market

5.1. COVID-19 Landscape: Disposable Medical Gloves Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Disposable Medical Gloves Market, By Material

8.1. Disposable Medical Gloves Market, by Material, 2024-2033

8.1.1. Natural Rubber

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Nitrile

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Vinyl

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Neoprene

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Polyethylene

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Disposable Medical Gloves Market, By Product

9.1. Disposable Medical Gloves Market, by Product, 2024-2033

9.1.1. Powdered

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Powder-free

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Disposable Medical Gloves Market, By Application

10.1. Disposable Medical Gloves Market, by Application, 2024-2033

10.1.1. Examination

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Surgical

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Disposable Medical Gloves Market, By End-use

11.1. Disposable Medical Gloves Market, by End-use, 2024-2033

11.1.1. Hospitals

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Home Healthcare

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Outpatient/Primary Care Facilities

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Others

11.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Disposable Medical Gloves Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Material (2021-2033)

12.1.2. Market Revenue and Forecast, by Product (2021-2033)

12.1.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.4. Market Revenue and Forecast, by End-use (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Material (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Product (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Material (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Product (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Material (2021-2033)

12.2.2. Market Revenue and Forecast, by Product (2021-2033)

12.2.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Material (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Product (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Material (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Product (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Material (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Product (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.7.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Material (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Product (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.8.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Material (2021-2033)

12.3.2. Market Revenue and Forecast, by Product (2021-2033)

12.3.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Material (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Product (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Material (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Product (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Material (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Product (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.7.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Material (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Product (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.8.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Material (2021-2033)

12.4.2. Market Revenue and Forecast, by Product (2021-2033)

12.4.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Material (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Product (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Material (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Product (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Material (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Product (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.7.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Material (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Product (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.8.4. Market Revenue and Forecast, by End-use (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Material (2021-2033)

12.5.2. Market Revenue and Forecast, by Product (2021-2033)

12.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Material (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Product (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Material (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Product (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.6.4. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 13. Company Profiles

13.1. Ansell Ltd.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Top Glove Corporation Bhd

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Hartalega Holdings Berhad

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Supermax Corporation Berhad

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Kossan Rubber Industries Bhd.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Cardinal Health

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Semperit AG Holding

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Rubberex

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Dynarex Corporation

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. B. Braun Melsungen AG

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others