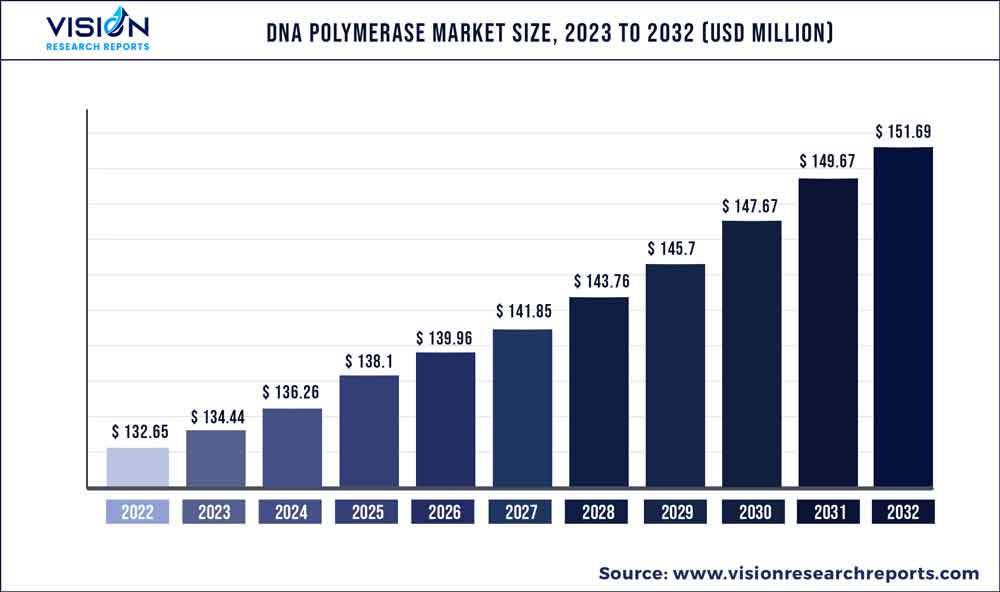

The global DNA polymerase market was estimated at USD 132.65 million in 2022 and it is expected to surpass around USD 151.69 million by 2032, poised to grow at a CAGR of 1.35% from 2023 to 2032. By type segment, the DNA polymerase market in the United States was accounted for USD 9.1 million in 2022.

Key Pointers

Report Scope of the DNA Polymerase Market

| Report Coverage | Details |

| Revenue Share of North America in 2022 | 47.27% |

| CAGR of Asia Pacific | 1.76% |

| Revenue Forecast by 2032 | USD 151.69 million |

| Growth rate from 2023 to 2032 | CAGR of 1.35% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Thermo Fisher Scientific, Inc.; Agilent Technologies; Merck KGaA; Danaher; QIAGEN; Hoffmann-La Roche Ltd; Bio-Rad Laboratories, Inc.; Takara Bio, Inc.; Promega Corporation; New England Biolabs |

DNA polymerase are essential enzymes involved in the replication and repair of DNA in living organisms. These polymerases market has experienced significant growth in recent years due to the increasing demand for DNA polymerases in various applications, such as molecular diagnostics, genetic engineering, and drug development. Moreover, the increasing use of such polymerases in various industries, such as pharmaceuticals, agriculture, and forensics, has further fueled the expansion of this market.

In addition, rising prevalence of genetic disorders and cancers is another factor is driving the growth of the market. According to the Genetic and Rare Disease (GARD) Information Centre reports there are more than 7,000 rare diseases. In the U.S. alone, it is estimated that between 25 million and 30 million people are living with a rare disease, and this number continues to rise. Additionally, at least 200,000 people are known survivors of genetic disorders, while over 30,000 babies and children are diagnosed annually with genetic disorders in the UK, resulting in more than 2.4 million survivors of various genetic conditions. This trend is expected to continue over the forecast period, leading to a growing demand for DNA polymerase and related products.

The COVID-19 pandemic has led to an increased demand for diagnostics and therapeutic development, resulting in a surge in the market. To better understand the virus and develop effective testing strategies, researchers and healthcare professionals have relied on DNA polymerases for various molecular diagnostic techniques, such as PCR and RT-PCR. This increased demand has resulted in a significant expansion of the market. The urgency to combat COVID-19 has propelled scientific innovation and collaboration efforts to develop new diagnostic tools and therapies. For instance, Ginkgo Bioworks, a biotechnology company, has launched Concentric by Ginkgo, a large-scale COVID-19 testing service that depends on DNA polymerase-based techniques like PCR. This initiative showcases the role of DNA polymerases in innovative diagnostic solutions.

The development of novel DNA polymerase with enhanced properties, such as high fidelity, processivity, and resistance to inhibitors, has expanded their range of applications. These advancements have allowed researchers to conduct more complex experiments and explore previously inaccessible areas of the genome. As the demand for efficient and accurate DNA polymerases increases, innovations in this area are expected to boost the market further.

Furthermore, the growing investment in personalized medicine research and the rising awareness of its benefits are expected to drive the market in the coming years. For instance, in December 2020, Tempus, a precision medicine technology company, secured USD 200 million in Series G-2 funding, leading to a substantial valuation of USD 8.1 billion. The company plans to use the additional funding to expand its operations and focus on a range of diseases, including infectious diseases, depression, and cardiology. Personalized medicine is an emerging field that aims to provide tailored treatment options based on an individual's genetic makeup. DNA polymerase play a crucial role in sequencing, which is an essential component of personalized medicine.

Type Insights

The Taq polymerase segment accounted for the largest revenue share of 53.99% in 2022. Taq polymerases are a type of DNA polymerases that is commonly used in the PCR techniques. The technique amplifies a specific DNA sequence, making it easier to study and analyze. Taq polymerases have several advantages that make them particularly useful for PCR, including their ability to withstand high temperatures and their high processivity, due to which, such DNA polymerases can extend DNA strands rapidly and efficiently. As the COVID-19 pandemic fueled several research prospects in genetics and molecular biology, demand for these DNA polymerases witnessed a rapid growth during the pandemic.

The proprietary enzyme blends segment is expected to exhibit the fastest CAGR of 3.05% during the forecast period. The use of proprietary enzymes, such as Q5 high-fidelity polymerases and Phusion DNA polymerases, which incorporate high-performance polymerases is expected to grow as the demand for accurate, reliable, and cost-effective amplification solutions increases across various fields. Furthermore, with the increasing availability of specialized polymerases and enzyme blends and the rising demand for specific applications in emerging domains, such as DNA sequencing, the segment is expected to grow in the coming years.

Application Insights

The polymerase chain reaction segment dominated the market with a share of 74.87% in 2022, due to the widespread use of this amplification technology in several molecular biology techniques. The PCR technology has now become indispensable in various fields, including biotechnology, medical diagnostics, and forensic sciences, where it can be used for DNA-based research and new product development. Similarly, the technique also played an important role in the COVID-19 testing and surveillance programs across the globe. As DNA polymerases form a crucial aspect of the reagents involved in PCR techniques, the segment held a majority share in 2022.

The DNA sequencing segment is anticipated to witness the fastest CAGR of 12.48% during the forecast period. Rapid advancements in sequencing technology have enabled the identification of DNA variations associated with an increased risk of disease. Next-generation Sequencing (NGS) is widely used due to its ability to test multiple genes in a single diagnostic platform, expanding the utility of the technique in clinical diagnosis applications. These methods have now reached a point where they can provide high-quality results in research labs and clinical diagnostic laboratories with the help of DNA polymerases. As a result, increasing applications of sequencing in drug discovery and rising involvement of DNA polymerases in this domain are expected to drive segment growth.

End-use Insights

The hospitals and diagnostic centers segment accounted for the largest market share of 41.67% in 2022, due to the increasing prevalence of genetic disorders and infectious diseases like COVID-19 that led to a surge in the adoption of PCR testing by these facilities for diagnosis. For instance, in 2020, more than 1,000 laboratories in the U.S., including hospitals and diagnostic centers, conducted COVID-19 PCR tests. Hence, the high demand for PCR testing and use of polymerases for various diagnostic applications contributed to the majority share of the segment in 2022.

Academic and research institutes segment is expected to witness the fastest CAGR of 5.46% during the forecast period in the market, due to an increase in funding and investment programs from government agencies and private organizations. These programs aim to support research in this field. For instance, in May 2020, the University of California, Irvine received a USD 2.5 million grant from the John and Mary Tu Foundation to conduct research, testing, and discoveries to aid COVID-19 patient care. Such funding provides support for the development of new technologies and is expected to fuel the segment growth.

Regional Insights

North America held a dominant market share of 47.27% in 2022, which can be attributed to the high demand for biotechnology techniques. The region is home to numerous prominent biotech and pharmaceutical companies that invest heavily in research and development of new drugs and therapies. These companies rely on DNA polymerases for various applications such as PCR, sequencing, and genetic engineering, which drive the demand for DNA polymerases. For instance, in November 2022, Cepheid launched its Xpert Xpress MVP. This multiplexed PCR test can identify DNA from organisms associated with bacterial trichomoniasis, vaginosis, and vulvovaginal candidiasis from a single sample.

The Asia Pacific market is expected to expand at the fastest CAGR of 1.76% during the forecast period. This growth can be attributed to the high incidence of target diseases, increasing funding for genomic research, and rising awareness about genetic testing in the region. Additionally, local and international market players are investing heavily in the development of novel DNA polymerases, which is expected to further propel the region’s growth in the coming years.

DNA Polymerase Market Segmentations:

By Type

By Application

By End-use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on DNA Polymerase Market

5.1. COVID-19 Landscape: DNA Polymerase Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global DNA Polymerase Market, By Type

8.1. DNA Polymerase Market, by Type, 2023-2032

8.1.1 Taq Polymerase

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Pfu Polymerase

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Proprietary Enzyme Blends

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global DNA Polymerase Market, By Application

9.1. DNA Polymerase Market, by Application, 2023-2032

9.1.1. Polymerase Chain Reaction

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. DNA Sequencing

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. DNA Cloning

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global DNA Polymerase Market, By End-use

10.1. DNA Polymerase Market, by End-use, 2023-2032

10.1.1. Pharmaceutical and Biotechnology Companies

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Academic and Research Institutes

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Hospitals & Diagnostic Centers

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global DNA Polymerase Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2020-2032)

11.1.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.3. Market Revenue and Forecast, by End-use (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.6.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.7.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.6.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.7.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.6.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.7.3. Market Revenue and Forecast, by End-use (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.5.3. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 12. Company Profiles

12.1. Thermo Fisher Scientific, Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Agilent Technologies

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Merck KGaA

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Danaher

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. QIAGEN

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Hoffmann-La Roche Ltd

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Bio-Rad Laboratories, Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Takara Bio, Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Promega Corporation

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. New England Biolabs

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others