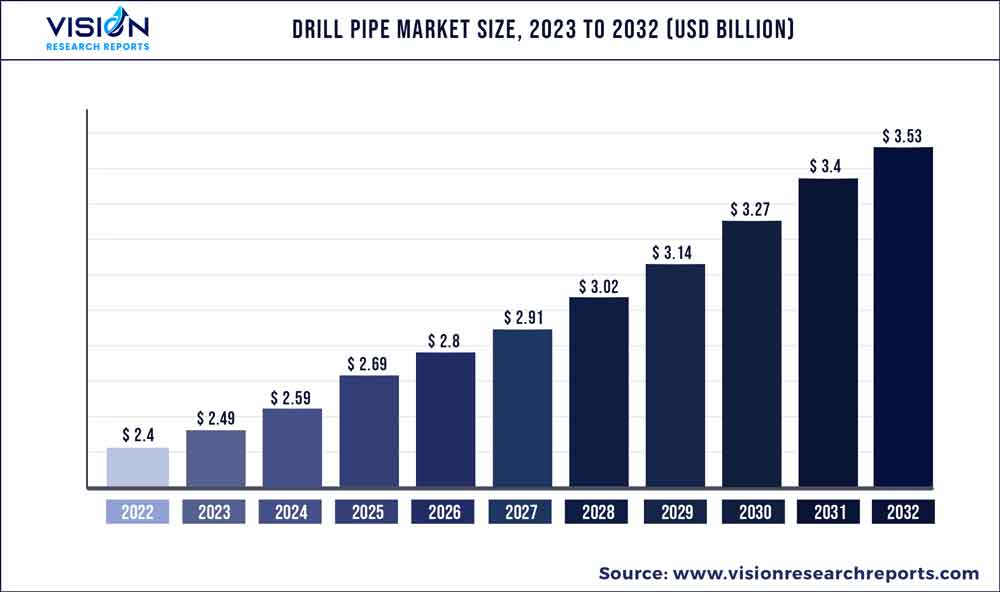

The global drill pipe market size was estimated at around USD 2.4 billion in 2022 and it is projected to hit around USD 3.53 billion by 2032, growing at a CAGR of 3.93% from 2023 to 2032.

Key Pointers

Report Scope of the Drill Pipe Market

| Report Coverage | Details |

| Revenue Share of North America in 2022 | 26.07% |

| Revenue Forecast by 2032 | USD 3.53 billion |

| Growth Rate from 2023 to 2032 | CAGR of 3.93% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | NOV Inc.; Inter Drill Asia Ltd.; Superior Drill Pipe Manufacturing Inc.; DP Master Manufacturing Pte Ltd.; Shanghai Hilong Drill Pipe Co. Ltd.; TPS TECHNITUBE RÖHRENWERKE GmbH; Tenaris Company; Drill Pipe International LLC; Vallourec; RK Pipe LLC |

Significant oilfield expansions particularly in North America and the Middle East along with improving drilling techniques with enhanced productivity have been the key factors steering industry growth over the past few years.

The global drilling activity has been steadily increasing in recent years, particularly in emerging markets. This increased drilling activity has led to higher demand for drill pipes. Moreover, Technological advancements in drilling equipment have led to the development of more efficient and effective drilling processes, which in turn has increased the demand for higher quality and more durable drill pipes.

API grade drill pipes dominated the global drill pipes market in the grade segment and accounted for more than 63.0% overall revenue share in 2022. API (American Petroleum Institute) grade drill pipes have dominated the global drill pipe market due to several factors, including their standardized design, high quality, and reliability. The API has established a set of standards for drill pipes that ensures that they meet certain specifications for size, weight, strength, and other factors. This standardization has made it easier for manufacturers to produce drill pipes that meet the needs of drilling contractors and oil and gas companies around the world.

Onshore segment dominated the application segment for the global drill pipes market and accounted for the largest revenue share of more than 60.0% in 2022. Onshore drilling is generally less expensive and easier to access than offshore drilling, which requires specialized equipment and transportation. As a result, onshore drilling is more common and widespread than offshore drilling, and thus the onshore segment has dominated the application segment for the global drill pipes market.

Drill pipes are an essential component in onshore drilling operations, and are used to transmit drilling fluid, torque, and weight to the drill bit during the drilling process. They are designed to withstand high stress and pressure, and are subject to wear and tear over time. As onshore drilling activity has increased over the years, the demand for drill pipes has grown, driving the growth of the market.

North America dominated the regional segment and accounted for the overall revenue share of more than 26.0% in 2022. North America has dominated the regional segment of the drill pipes market due to several factors, including the presence of a large number of oil and gas reserves, a well-developed oil and gas industry, and advanced drilling technologies. The United States and Canada are major players in the global oil and gas industry, with significant reserves of both conventional and unconventional oil and gas. The development of unconventional resources, such as shale gas and tight oil, has been a major driver of drilling activity in North America, leading to a surge in demand for drill pipes.

In addition, North America has a well-established infrastructure to support drilling operations, including a vast network of pipelines, storage facilities, and refineries. This infrastructure enables the efficient transportation and processing of oil and gas, further driving the demand for drill pipes. Furthermore, North America is home to some of the world's leading drilling technology companies, which have developed advanced drilling technologies and equipment, including high-quality drill pipes. This has enabled drilling companies in the region to adopt innovative drilling techniques and improve drilling efficiency, further boosting the demand for drill pipes.

Grade Insights

On the basis of grades, the global industry has been further bifurcated into API-grade and premium-grade drill pipes. The API-grade drill pipes segment dominated the global industry in 2022 and accounted for the maximum share of more than 63.04% of the overall revenue. The standardization of the finished products along with the relatively low prices of API-grade drill pipes is anticipated to promote the segment’s market penetration.

Utilizing these products also ensures reduced operational costs to the E&P and operator companies. API-grade products are mostly preferred in a normal environment, and conventional basins owing to the easy availability and reduced OpEx to both E&P and contractor companies. Exploration in unconventional and harsh environmental conditions, particularly in shale, CBM, and tight reserves, is expected to steer premium-grade drill pipes’ demand over the forecast period.

Application Insights

The onshore application segment dominated the industry in 2022 and accounted for the largest share of more than 60.05% of the overall revenue. Significant developments in onshore basins, particularly in the Middle East, Venezuela, Nigeria, and the U.S., over the last decade have led to the domination of the segment in the global petroleum industry. High IRR, high rate of rig activities, low risk as compared to offshore drilling, and significant familiarity with the key operators in the sector has been the key factor responsible for the market penetration in the segment.

The petroleum industry witnessed an estimated decline of around 35% to 40% in the overall rig count across all the regional markets. Momentous development in several offshore locations, such as the Golden Triangle, which includes the Gulf of Mexico, Brazil, and West Africa, the South China Sea, and the Persian Gulf, is expected to drive demand in the segment over the forecast period. The segment is estimated to witness the fastest growth rate over the forecast period.

Regional Insights

On the basis of geographies, the industry has been further categorized into North America, Asia Pacific, Central & South America, Middle East, Europe, and Africa. The North America region dominated the global industry in 2022 and accounted for the largest share of more than 26.07% of the overall revenue. The region is estimated to expand further at a steady growth rate maintaining its position throughout the forecast period. Heavy investments by major E&P companies in both conventional and unconventional fields have been the major factors responsible for initial market penetration in the region.

The other regions, such as Asia Pacific and Central & South America, are also anticipated to witness above-average expansion rates over the next few years. The expected increase in rig activities along with several new field developments including the offshore basins, especially in economies, such as China, Indonesia, Australia, and India, is expected to drive the market growth in the Asia Pacific region.

Drill Pipe Market Segmentations:

By Grade

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Drill Pipe Market

5.1. COVID-19 Landscape: Drill Pipe Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Drill Pipe Market, By Grade

8.1. Drill Pipe Market, by Grade, 2023-2032

8.1.1. API Grade

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Premium Grade

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Drill Pipe Market, By Application

9.1. Drill Pipe Market, by Application, 2023-2032

9.1.1. Onshore

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Offshore

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Drill Pipe Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Grade (2020-2032)

10.1.2. Market Revenue and Forecast, by Application (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Grade (2020-2032)

10.1.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Grade (2020-2032)

10.1.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Grade (2020-2032)

10.2.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Grade (2020-2032)

10.2.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Grade (2020-2032)

10.2.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Grade (2020-2032)

10.2.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Grade (2020-2032)

10.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Grade (2020-2032)

10.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Grade (2020-2032)

10.3.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Grade (2020-2032)

10.3.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Grade (2020-2032)

10.3.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Grade (2020-2032)

10.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Grade (2020-2032)

10.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Grade (2020-2032)

10.4.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Grade (2020-2032)

10.4.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Grade (2020-2032)

10.4.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Grade (2020-2032)

10.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Grade (2020-2032)

10.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Grade (2020-2032)

10.5.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Grade (2020-2032)

10.5.4.2. Market Revenue and Forecast, by Application (2020-2032)

Chapter 11. Company Profiles

11.1. Hilong Group

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. NOV Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Tenaris S.A.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Vallourec S.A.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. TMK Group

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Oil Country Tubular Ltd.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Tejas Tubular Grades Inc.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Texas Steel Conversion Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. DP Master

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Jiangyin Long Bright Drill Pipe Manufacture Co. Ltd.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others