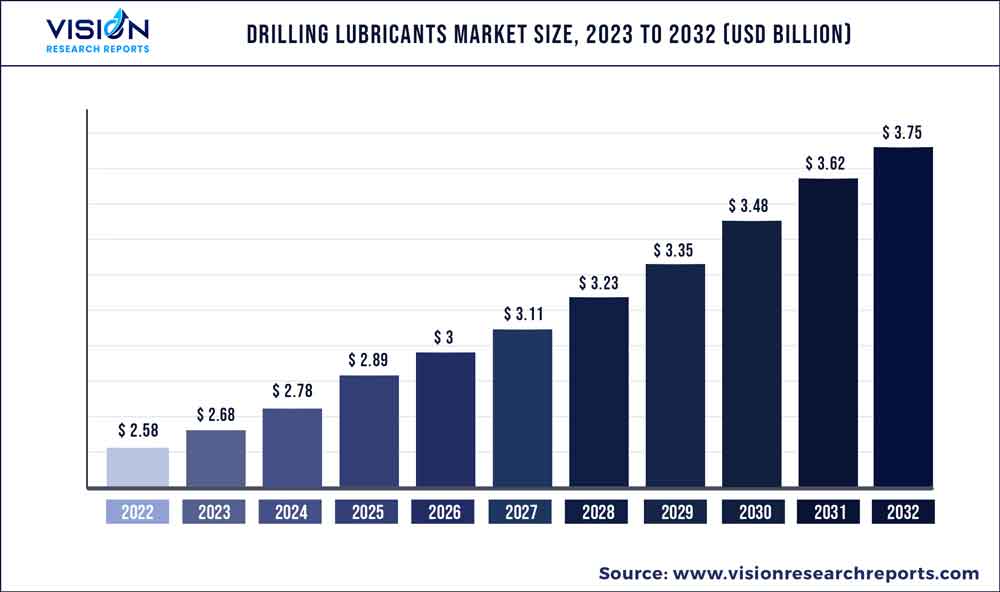

The global drilling lubricants market was valued at USD 2.58 billion in 2022 and it is predicted to surpass around USD 3.75 billion by 2032 with a CAGR of 3.82% from 2023 to 2032. The drilling lubricants market in the United States was accounted for USD 259.4 million in 2022.

Key Pointers

Report Scope of the Drilling Lubricants Market

| Report Coverage | Details |

| Revenue Share of Asia Pacific in 2022 | 40.03% |

| Revenue Forecast by 2032 | USD 3.75 billion |

| Growth Rate from 2023 to 2032 | CAGR of 3.82% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Imdex Limited; SINO MUD; Baroid Industrial Drilling Products; Baker Hughes, Inc; Halliburton, Inc; Chevron Corporation; Schlumberger Limited |

This is attributable to the growing utilization of drilling lubricants in the oil and gas sector due to increasing pace of the industry towards deeper reserves and unconventional resources. The drilling industry is highly competitive and constantly evolving due to technological advancements and changing market conditions. The industry can be divided into two main segments including onshore and offshore drilling. Onshore involves drilling wells on land, while offshore involves drilling wells in the sea or other bodies of water. Offshore drilling is generally more expensive and technically challenging due to the harsh marine environment.

The drilling industry has faced numerous challenges in recent years, including low oil prices, declining production levels, and increasing regulatory requirements. However, there are also opportunities for growth, such as increased demand for natural gas, the development of unconventional oil and gas resources, and the adoption of new technologies like automation and digitalization. This is anticipated to fuel the growth of drilling lubricants over the forecast period.

The raw materials used for manufacturing the product include crude oil, vegetable oil, and additives. Crude oil is further used for manufacturing synthetic oils and base oils, which is used for manufacturing the product. Vegetable oils such as rapeseed, castor oil, sunflower oil, and others are being used as raw materials in the manufacturing process.

Technique Insights

The diamond drilling segment dominated the market with a revenue share of over 30.03% in 2022. This is attributed to uncontaminated and high quality sampling obtained in the technique. This technique can drill hole in all directions and has ability to penetrate compact and hard rock formation. Drilling up to 1200 meter to 1800 meter is common in this technique which enables drilling at higher depths.

The down the hole drills/rotary air blast technique segment held the second-largest market share in 2022. The growth is attributed to its properties such as faster, cheaper, and large sample volumes. The technique uses a pneumatic reciprocating hammer which is piston-driven to drive a heavy drill bit in the rock. It can drill holes of diameter up to 20 cm and depth of 100 to 150 meters.

Other techniques include top hammer drilling, reverse circulation drilling, auger drill, calyx drill, and rotary drill. Reverse circulation technique is relatively cheap as compared to the diamond drilling and is able to drill holes up to depth of 350 meters.

End-use Insights

The oil and gas segment dominated the market with a revenue share of over 36.05% in 2022. This is attributed the growing importance of the industry as it is one of the crucial industries in the energy sector and is a primary fuel sources across the globe. According to the Organization of the Petroleum Exporting Countries, the global oil demand is projected to grow by 38 million barrels a day to 115 mb/d by 2025. This is expected to boost the product demand in the near future.

Mining was the second-largest segment and is anticipated to grow at a significant CAGR over the forecast period. The growth is attributed to the rising demand for minerals and metals, new technologies, and increasing investment in exploration and production. The mining industry is a major sector that is critical to the world's economy. It involves the extraction of minerals, metals, and other valuable resources from the earth's crust, which are used in a variety of applications, such as construction, manufacturing, and energy production.

Other applications include construction, geothermal, water wells, and military operations. Drilling is used in the construction industry to create foundations for buildings, bridges, and other structures. This includes creating holes for pilings, caissons, and piers.

Regional Insights

The Asia Pacific was the dominating region and accounted for a revenue share of over 40.03% in 2022. The growth is attributed to the rapid growth of several end-use industries including oil and gas and construction industry in the region. According to the International Energy Agency, the number of refineries in Asia is expected to increase by 60% by 2050. Additionally, the demand for oil in the region is predicted to rise by 9 million barrels per day by 2040.

According to the Government of Canada, China has around 1,500 major mining operations and produces over USD 400 million per year. The country has around 40,000 mines. 1,254 mining companies have been listed on the national green mine directory as of 2021. China has 163 proven reserves in minerals and has discovered around 173 minerals. The flourishing mining industry in the country is expected to drive the product demand in the country over the predicted years.

Europe accounted for a revenue share of over 18.04% in 2022. The construction industry in Europe is among the largest sectors in the region and accounts for around 9% of the total GDP. The construction industry in the region is also embracing digitalization and innovation to improve efficiency, reduce costs, and minimize environmental impact. This includes the use of Building Information Modelling (BIM), 3D printing, and other digital technologies. This is expected to boost the construction industry thereby having a positive impact on the market in the coming years.

Drilling Lubricants Market Segmentations:

By Technique

By End-use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Drilling Lubricants Market

5.1. COVID-19 Landscape: Drilling Lubricants Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Drilling Lubricants Market, By Technique

8.1. Drilling Lubricants Market, by Technique, 2023-2032

8.1.1. Down The Hole Drills (DTH)/ Rotary Air Blast Drilling (RAB)

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Diamond Drilling

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Top Hammer Drilling

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Reverse Circulation Drilling

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Other Techniques

8.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Drilling Lubricants Market, By End-use

9.1. Drilling Lubricants Market, by End-use, 2023-2032

9.1.1. Mining

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Oil & Gas

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Construction

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Drilling Lubricants Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Technique (2020-2032)

10.1.2. Market Revenue and Forecast, by End-use (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Technique (2020-2032)

10.1.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Technique (2020-2032)

10.1.4.2. Market Revenue and Forecast, by End-use (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Technique (2020-2032)

10.2.2. Market Revenue and Forecast, by End-use (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Technique (2020-2032)

10.2.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Technique (2020-2032)

10.2.4.2. Market Revenue and Forecast, by End-use (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Technique (2020-2032)

10.2.5.2. Market Revenue and Forecast, by End-use (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Technique (2020-2032)

10.2.6.2. Market Revenue and Forecast, by End-use (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Technique (2020-2032)

10.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Technique (2020-2032)

10.3.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Technique (2020-2032)

10.3.4.2. Market Revenue and Forecast, by End-use (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Technique (2020-2032)

10.3.5.2. Market Revenue and Forecast, by End-use (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Technique (2020-2032)

10.3.6.2. Market Revenue and Forecast, by End-use (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Technique (2020-2032)

10.4.2. Market Revenue and Forecast, by End-use (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Technique (2020-2032)

10.4.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Technique (2020-2032)

10.4.4.2. Market Revenue and Forecast, by End-use (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Technique (2020-2032)

10.4.5.2. Market Revenue and Forecast, by End-use (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Technique (2020-2032)

10.4.6.2. Market Revenue and Forecast, by End-use (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Technique (2020-2032)

10.5.2. Market Revenue and Forecast, by End-use (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Technique (2020-2032)

10.5.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Technique (2020-2032)

10.5.4.2. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 11. Company Profiles

11.1. Imdex Limited

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. SINO MUD

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Baroid Industrial Drilling Products

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Baker Hughes, Inc

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Halliburton, Inc

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Chevron Corporation

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Schlumberger Limited

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others