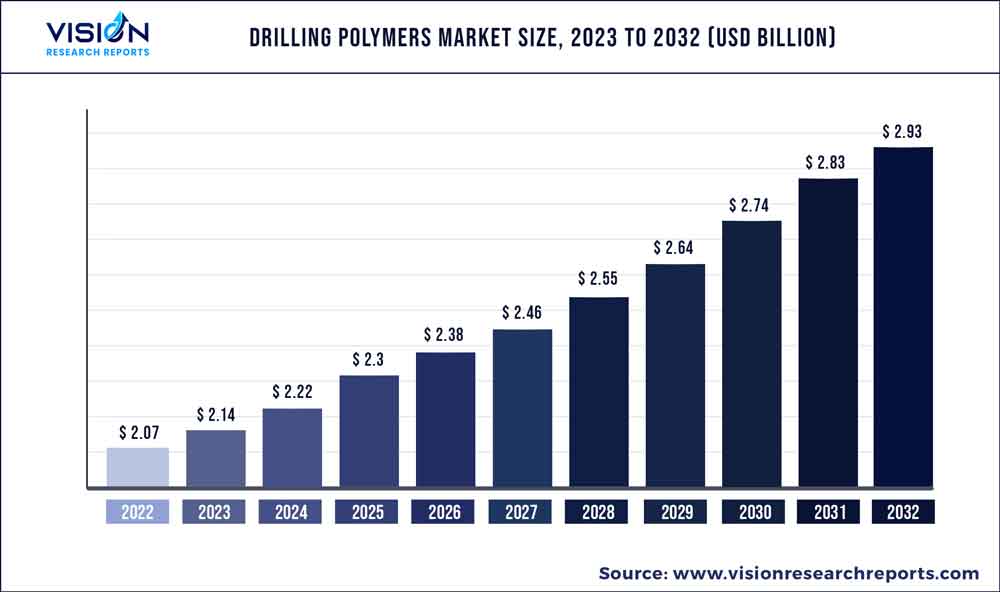

The global drilling polymers market was estimated at USD 2.07 billion in 2022 and it is expected to surpass around USD 2.93 billion by 2032, poised to grow at a CAGR of 3.55% from 2023 to 2032. The drilling polymers market in the United States was accounted for USD 214 million in 2022.

Key Pointers

Report Scope of the Drilling Polymers Market

| Report Coverage | Details |

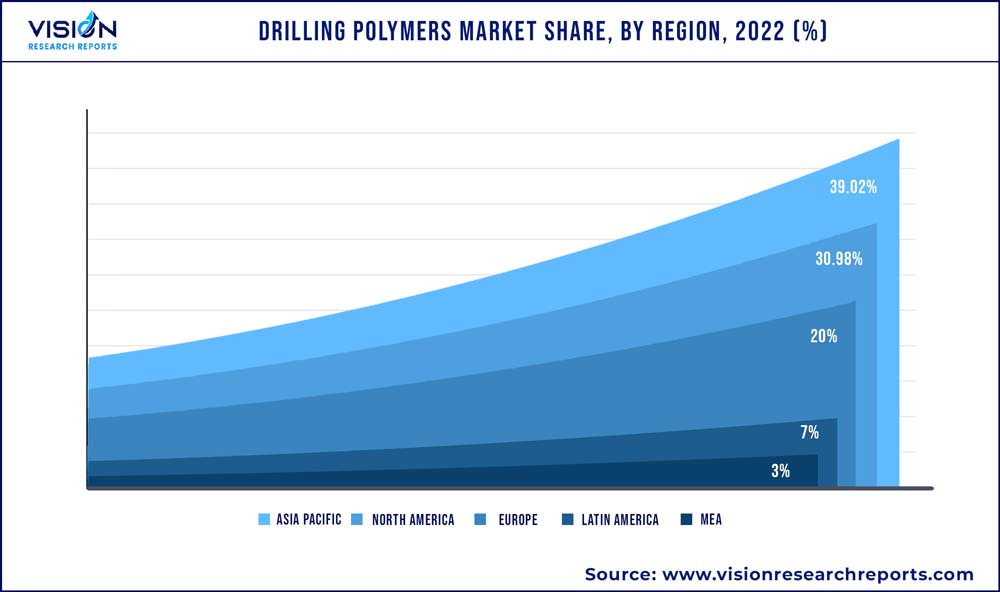

| Revenue Share of Asia Pacific in 2022 | 39.02% |

| Revenue Forecast by 2032 | USD 2.93 billion |

| Growth Rate from 2023 to 2032 | CAGR of 3.55% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | SINO MUD; Baroid Industrial Drilling Products; Baker Hughes, Inc.; Halliburton, Inc.; Chevron Corp.; Schlumberger Ltd.; Global Drilling Fluids; Chemicals Ltd.; Global Envirotech; Di-Corp. |

This growth is attributed to the ability of the product to enhance drilling operations in end-use industries, such as mining, construction, and oil & gas. These are added to water-based drilling mud to reduce viscosity, improve flow rate, and provide better lubrication to the drill bit. This results in a more efficient drilling process, which can reduce downtime and increase production rates. They are commonly used in the oil and gas industry to aid in the drilling of boreholes. These polymers are designed to improve the drilling process by reducing friction and providing better lubrication to the drill bit. Their use can significantly improve the efficiency of drilling operations, reducing downtime and increasing production rates. The U.S. is the largest consumer of the product in North America with a revenue share of 53.5% in 2022.

This is attributed to the growing oil & gas and mining industries in the country. According to the Council on Foreign Relations, the U.S. fulfills around 90% of its natural gas supply and 75% of its crude oil supply domestically, accounting for 11 million barrels of crude oil and 1 million cubic feet of natural gas per day in 2021. Thus, growing onshore oil & gas exploration activities in the U.S. is anticipated to drive product demand over the forecast period.

Type Insights

Polyacrylamide in the type segment dominated the global industry in 2022 and accounted for the maximum share of over 69.03% of the overall revenue. This growth is attributed to the fact that polyacrylamide is a water-soluble polymer, which is primarily used as a viscosifier, fluid loss reducer, and inhibitor by encapsulating or coating formations and cuttings. Polyacrylamide is often used in the oil and gas industry to optimize drilling efficiency and production rates.

As drilling demand increases globally, the use of polyacrylamide is expected to continue to grow. Others in the type segment include xanthan gum, guar gum, and starch. These are used as polymers due to their ability to improve the rheological properties of drilling fluids. Each of these products has different properties. Xanthan gum and guar gum, for example, are both natural and biodegradable, which makes them environmentally friendly, whereas starch is a renewable and low-cost source of polymer.

Technique Insights

Diamond drilling in the technique segment dominated the global industry in 2022 and accounted for the largest share of 22.64% of the overall revenue. This method uses diamond drill bits to cut and bore through hard rocks, concrete, and other materials. The drill bits have diamond-impregnated tips, which grind away the material as they rotate, allowing for fast and efficient drilling. Polymers are used in diamond drilling to improve the efficiency and effectiveness of the drilling operation. The polymers act as viscosifier and also help reduce the friction between the drill bit and the rock surface.

This increases penetration rates reducing wear & tear on the equipment. Reverse circulation drilling is another technique projected to witness significant growth over the forecast period. It is a specialized technique that is used for large-diameter wells on loose alluvial soils, where traditional rotary methods may not be as effective. The addition of polymers improves the ability of the drilling fluid to transport cuttings to the surface and reduces the likelihood of borehole collapse, which can be especially important in reverse circulation techniques where high volumes of cuttings are generated.

End-use Insights

The oil & gas end-use segment dominated the global industry in 2022 and accounted for the largest share of over 35.04% of the overall revenue. The growing demand for oil & gas worldwide has resulted in an increase in drilling activities for the exploration of oil & gas. This has resulted in driving the demand for drilling polymers. According to the Organization of the Petroleum Exporting Countries, the oil demand is expected to increase by 17.6 million barrels per day between 2020 and 2045 rising from 90.6 million barrels per day in 2020 to 108.2 million barrels per day in 2045.

Mining is another end-use industry that is expected to witness rapid growth over the forecast period. As populations grow and economies develop, the demand for metals and mineral resources rises, which drives growth in the mining sector. In addition, new technologies and processes have made it easier and more cost-effective to extract resources from the ground, which has boosted the productivity and profitability of mining operations.

Regional Insights

Asia Pacific emerged as the dominating region with a revenue share of around 39.02% in 2022. This growth is attributed to the increasing mining and drilling activities across geographies, such as China, India, Japan, and South Korea. According to Trade Commissioner Service, China has over 1,500 major mining operations and is the leading producer of cement, coal, gold, aluminum, graphite, iron, steel, zinc, magnesium, and rare earth elements (antimony, tellurium, and other minerals). The country spends around USD 200 billion per year on its mine supply and services and produces over USD 400 billion per year worth of minerals.

North America is another region witnessing growth over the forecasted period. The advancing oil & gas and mining activities in countries, such as Canada, Mexico, and the U.S. are anticipated to drive the demand for the product market over the forecast period. For instance, according to Canada’s Oil & Natural Gas Producers, the country is the 4th-largest producer of oil and 6th-largest producer of natural gas globally, with Alberta being the largest oil- and natural gas-producing province accounting for around 80% of the total oil production in Canada in 2021. Thus, all these factors are contributing to the growth of the product market in the region.

Drilling Polymers Market Segmentations:

By Type

By Technique

By End-Use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Drilling Polymers Market

5.1. COVID-19 Landscape: Drilling Polymers Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Drilling Polymers Market, By Type

8.1. Drilling Polymers Market, by Type, 2023-2032

8.1.1 Polyacrylamide

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Others

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Drilling Polymers Market, By Technique

9.1. Drilling Polymers Market, by Technique, 2023-2032

9.1.1. Down The Hole Drills (DTH)/Rotary Air Blast Drilling (RAB)

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Diamond Drilling

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Top Hammer Drilling

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Reverse Circulation Drilling

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Others (Auger Drill, Calyx Drill, Rotary Drill)

9.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Drilling Polymers Market, By End-Use

10.1. Drilling Polymers Market, by End-Use, 2023-2032

10.1.1. Mining

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Oil & Gas

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Construction

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Others (Geothermal, Water Wells, Military Operations, etc.)

10.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Drilling Polymers Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2020-2032)

11.1.2. Market Revenue and Forecast, by Technique (2020-2032)

11.1.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Technique (2020-2032)

11.1.4.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Technique (2020-2032)

11.1.5.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.2. Market Revenue and Forecast, by Technique (2020-2032)

11.2.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Technique (2020-2032)

11.2.4.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Technique (2020-2032)

11.2.5.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Technique (2020-2032)

11.2.6.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Technique (2020-2032)

11.2.7.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.2. Market Revenue and Forecast, by Technique (2020-2032)

11.3.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Technique (2020-2032)

11.3.4.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Technique (2020-2032)

11.3.5.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Technique (2020-2032)

11.3.6.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Technique (2020-2032)

11.3.7.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.2. Market Revenue and Forecast, by Technique (2020-2032)

11.4.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Technique (2020-2032)

11.4.4.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Technique (2020-2032)

11.4.5.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Technique (2020-2032)

11.4.6.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Technique (2020-2032)

11.4.7.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.5.2. Market Revenue and Forecast, by Technique (2020-2032)

11.5.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Technique (2020-2032)

11.5.4.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Technique (2020-2032)

11.5.5.3. Market Revenue and Forecast, by End-Use (2020-2032)

Chapter 12. Company Profiles

12.1. SINO MUD

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Baroid Industrial Drilling Products

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Baker Hughes, Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Halliburton, Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Chevron Corp.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Schlumberger Ltd.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Chemicals Ltd.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Global Envirotech

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Di-Corp.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others