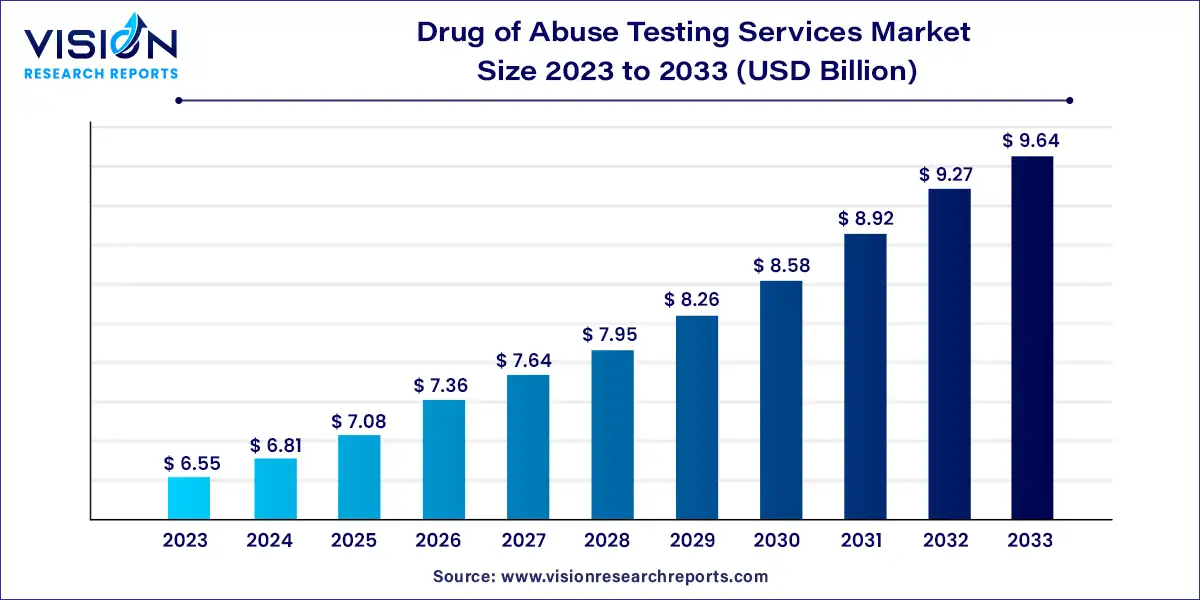

The global drug of abuse testing services market size was estimated at around USD 6.55 billion in 2023 and it is projected to hit around USD 9.64 billion by 2033, growing at a CAGR of 3.94% from 2024 to 2033.

The drug of abuse testing services market continues to witness significant growth driven by various factors such as the rising prevalence of substance abuse, stringent regulations mandating drug screening in workplaces, and advancements in testing technologies.

The growth of the drug of abuse testing services market is propelled by an escalating prevalence of substance abuse worldwide has significantly increased the demand for drug screening services across various sectors. Additionally, stringent regulations mandating drug testing in workplaces, sports organizations, and transportation sectors further drive market growth. Moreover, continuous advancements in testing technologies, such as the development of rapid testing kits and laboratory automation, play a crucial role in expanding the market. These factors collectively contribute to the sustained growth and evolution of the drug of abuse testing services market, highlighting its importance in addressing public health concerns related to substance abuse.

The Cannabis/Marijuana segment held the largest revenue share of 24% in 2023, dominating the market. This dominance is attributed to the increased demand for marijuana testing, including both medical screening and employment testing. Additionally, the growing prevalence of cannabis/marijuana addiction has fueled the demand for these services. According to the World Health Organization (WHO), approximately 147 million people, which accounts for around 2.5% of the global population, consume cannabis annually, surpassing the consumption of opioids and cocaine. Consequently, the Cannabis/Marijuana segment is expected to experience a surge in demand, particularly for screening programs in criminal justice, treatment centers, workplaces, and clinical settings.

The opioids segment is forecasted to witness a significant compound annual growth rate (CAGR) from 2024 to 2033. The robust growth of this segment is primarily driven by the need for employment screening and monitoring prescription misuse. Opioid testing is predominantly conducted using a patient’s blood, hair, saliva, sweat, or urine samples. As opioid abuse continues to be a pressing concern, the demand for opioid testing services is expected to remain high, further contributing to market growth.

North America emerged as the dominant market for drug of abuse testing services, capturing the largest revenue share of 53% in 2023. The region's supremacy is driven by various factors, including the expanding population vulnerable to addiction, escalating drug use in workplaces, a surge in accidents, and the presence of well-established healthcare facilities. Statistics from the National Council on Alcoholism & Drug Dependence (NCADD) reveal that 70% of the 14.8 million employed individuals in the United States are involved in drug abuse. Similarly, data from the National Drug-Free Workplace Alliance indicates that over 74% of current illegal drug users in the U.S. are employed, contributing to as much as 40% of industrial fatalities. Moreover, findings from the Ministry of Foreign Affairs, People's Republic of China, suggest that a significant percentage of U.S. drug users have experience with various substances, highlighting the pressing need for effective drug testing measures to ensure employee safety and well-being.

Asia Pacific is poised to exhibit the fastest growth in the drug of abuse testing services market during the forecast period. This rapid growth can be attributed to the persistent high levels of drug-related activities in Asian nations, coupled with stringent drug control policies. Additionally, the region benefits from developing healthcare infrastructure, enhanced drug intelligence exchange, strengthened law enforcement cooperation, anti-drug campaigns aimed at reducing trafficking, and increasing government initiatives. Furthermore, the rising incidence rates of alcohol, cannabis/marijuana, and opioid addiction in Asian countries are expected to further drive market growth in the region.

By Drug Type

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Drug of Abuse Testing Services Market

5.1. COVID-19 Landscape: Drug of Abuse Testing Services Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Drug of Abuse Testing Services Market, By Drug Type

8.1. Drug of Abuse Testing Services Market, by Drug Type Type, 2024-2033

8.1.1. Alcohol

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Cannabis/Marijuana

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Cocaine

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Opioids

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Amphetamine & Methamphetamine

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. LSD

8.1.6.1. Market Revenue and Forecast (2021-2033)

8.1.7. Others

8.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Drug of Abuse Testing Services Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by Drug Type (2021-2033)

9.1.2. U.S.

9.1.2.1. Market Revenue and Forecast, by Drug Type (2021-2033)

9.1.3. Rest of North America

9.1.3.1. Market Revenue and Forecast, by Drug Type (2021-2033)

9.2. Europe

9.2.1. Market Revenue and Forecast, by Drug Type (2021-2033)

9.2.2. UK

9.2.2.1. Market Revenue and Forecast, by Drug Type (2021-2033)

9.2.3. Germany

9.2.3.1. Market Revenue and Forecast, by Drug Type (2021-2033)

9.2.4. France

9.2.4.1. Market Revenue and Forecast, by Drug Type (2021-2033)

9.2.5. Rest of Europe

9.2.5.1. Market Revenue and Forecast, by Drug Type (2021-2033)

9.3. APAC

9.3.1. Market Revenue and Forecast, by Drug Type (2021-2033)

9.3.2. India

9.3.2.1. Market Revenue and Forecast, by Drug Type (2021-2033)

9.3.3. China

9.3.3.1. Market Revenue and Forecast, by Drug Type (2021-2033)

9.3.4. Japan

9.3.4.1. Market Revenue and Forecast, by Drug Type (2021-2033)

9.3.5. Rest of APAC

9.3.5.1. Market Revenue and Forecast, by Drug Type (2021-2033)

9.4. MEA

9.4.1. Market Revenue and Forecast, by Drug Type (2021-2033)

9.4.2. GCC

9.4.2.1. Market Revenue and Forecast, by Drug Type (2021-2033)

9.4.3. North Africa

9.4.3.1. Market Revenue and Forecast, by Drug Type (2021-2033)

9.4.4. South Africa

9.4.4.1. Market Revenue and Forecast, by Drug Type (2021-2033)

9.4.5. Rest of MEA

9.4.5.1. Market Revenue and Forecast, by Drug Type (2021-2033)

9.5. Latin America

9.5.1. Market Revenue and Forecast, by Drug Type (2021-2033)

9.5.2. Brazil

9.5.2.1. Market Revenue and Forecast, by Drug Type (2021-2033)

9.5.3. Rest of LATAM

9.5.3.1. Market Revenue and Forecast, by Drug Type (2021-2033)

Chapter 10. Company Profiles

10.1. Quest Diagnostics

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2. Abbott

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3. Clinical Reference Laboratory (CRL), Inc.

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4. Laboratory Corporation of America Holdings

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5. Cordant Health Solutions

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

10.6. Legacy Medical Services

10.6.1. Company Overview

10.6.2. Product Offerings

10.6.3. Financial Performance

10.6.4. Recent Initiatives

10.7. Abbot

10.7.1. Company Overview

10.7.2. Product Offerings

10.7.3. Financial Performance

10.7.4. Recent Initiatives

10.8. Omega Laboratories, Inc.

10.8.1. Company Overview

10.8.2. Product Offerings

10.8.3. Financial Performance

10.8.4. Recent Initiatives

10.9. Psychemedics Corporation

10.9.1. Company Overview

10.9.2. Product Offerings

10.9.3. Financial Performance

10.9.4. Recent Initiatives

10.10. Millennium Health, LLC

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11. Research Methodology

11.1. Primary Research

11.2. Secondary Research

11.3. Assumptions

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others