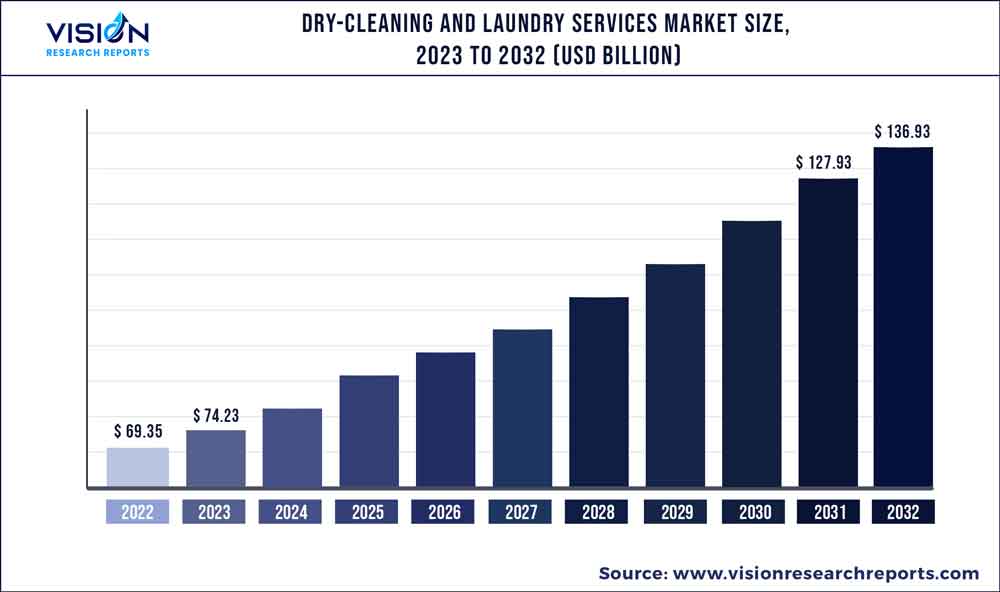

The global dry-cleaning and laundry services market was valued at USD 69.35 billion in 2022 and it is predicted to surpass around USD 136.93 billion by 2032 with a CAGR of 7.04%from 2023 to 2032. The dry-cleaning and laundry services market in the United States was accounted for USD 10.2 billion in 2022.

Key Pointers

Report Scope of the Dry-cleaning And Laundry Services Market

| Report Coverage | Details |

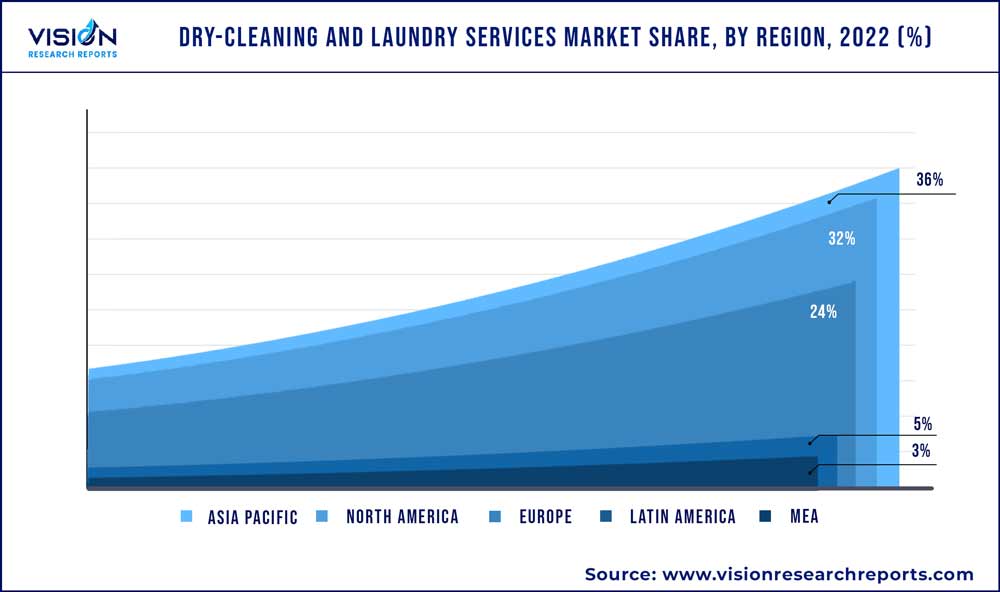

| Revenue Share of Asia Pacific in 2022 | 36% |

| CAGR of Asia Pacific from 2023 to 2032 | 8.44% |

| Revenue Forecast by 2032 | USD 136.93 billion |

| Growth Rate from 2023 to 2032 | CAGR of 7.04% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Alliance Laundry Systems LLC; The Huntington Company; ZIPS Dry Cleaners; Alsco Pty Limited; Rinse, Inc.; Marberry Cleaners & Launderers, Inc.; Tide Dry Cleaners (Procter & Gamble); City Dry Cleaning Company; East Rand Cleaners; Cleanly |

The dry-cleaning and laundry industry is experiencing growth due to rising demand from customers seeking convenient and cost-effective solutions for garment care. Consumer spending on these services is expected to further drive market expansion. As individuals lead increasingly busy lifestyles, they prioritize clean and well-maintained garments, leading to a greater need for professional laundry services. As per statistics published by Harvard Business Review in 2022, 86.5 million U.S. citizens have utilized an on-demand laundry and dry-cleaning service at least once in their lives.

In addition, 40% of these service users are between the ages of 18 and 34 years, indicating that the younger generation is driving the growth of the global industry.Since busy consumers are now prepared to pay for their laundry, dry cleaning, and laundry services are growing in popularity as dependable, practical, and reasonably priced services. The market is also being propelled by the increasing employment and spending expenditure of people in economically developing regions, as well as the growth in the hospitality sector and rising franchising opportunities. Technologically advanced Internet of Things (IoT)-enabled cleaning appliances and smart washing machines are also contributing to the market's growth by providing more efficient services.

There has been a notable shift in laundry practices among consumers, with a move away from home-based washing to coin-operated and on-demand services. This change is driven by a preference for convenience and time-saving measures, as individuals seek to juggle increasingly busy schedules. As a result, dry cleaning and laundry businesses are experiencing heightened demand for their services.The rising consumer awareness about environmental impact has created a demand for energy-efficient laundry services that utilize environmentally-friendly products and equipment. Companies, such as The Laundry Room, have seized this opportunity by incorporating eco-friendly practices into their business strategy, including the use of energy-efficient drying and washing machines as well as solar power.

In addition, the commercial services sector makes one of the largest customer segments for laundry facilities and dry-cleaning services. This involves hospitality, industry workers, factory or warehouse workers, healthcare sectors, beauty salons, and spas. In a majority of these sectors, tablecloths, upholstery, uniforms, sheets, and towels are soiled in large numbers at the end of every week. To cater to the rising demand from the commercial sector, many service providers have started upgrading their commercial laundry equipment to improve energy efficiency and attract more environment-conscious customers.

In addition, the convenience and accessibility of on-demand laundry services, with features, such as app-based booking, digital payment options, real-time tracking, and delivery at a specified time, have made them increasingly popular among customers. Consequently, full-cycle on-demand laundry services present an attractive business opportunity in the current market.Due to their exceptional services, attractive deals, such as coupons and discounts, and on-demand washing services have revolutionized the sector and have been on top of the most chosen services among consumers.

Numerous businesses, including Cleanly and Rinse, have already realized the enormous potential of these services and are investing heavily to improve their market share.Online laundry services are experiencing more demand as there are more hotels, hospitals, restaurants, and other business establishments. In addition, businesses strive to use cutting-edge technologies to provide fresh goods on the market. For instance, Girbau, S.A. introduced an 85kg capacity washing machine in April 2019. The product can remove moisture and cut drying time in half by reaching high extract speeds of up to 405 G-force. Such initiatives are expected to boost market growth in the coming years.

Services Insights

The laundry services segment dominated the market in 2022 with a share of more than 58%. These services are becoming more and more popular as a result of their dependability, technical developments in the laundry sector, and an increase in urbanization, all of which are expected to drive the market forward throughout the projection period. In addition, the market is anticipated to rise due to the growing popularity of cashless transactions and the emergence of digital payments. Moreover, the combination of smart meters and rising consumer use of efficient & affordable dry-cleaning & laundry services is anticipated to promote market expansion.

However, it is projected that the rise in at-home washing would restrain the industry's growth during the forecast period. The duvet-cleaning services segmentis expected to grow at a CAGR of 7.04% over the forecast period. In today's fast-paced world, individuals with packed schedules may lack the time or resources to personally clean their duvets. Engaging in a professional duvet-cleaning service not only saves time and effort but also offers a convenient solution for those who require bedding maintenance. With specific equipment and know-how, professional duvet-cleaning services possess the ability to efficiently sanitize and clean duvets to a higher standard than an individual could achieve independently.

Application Insights

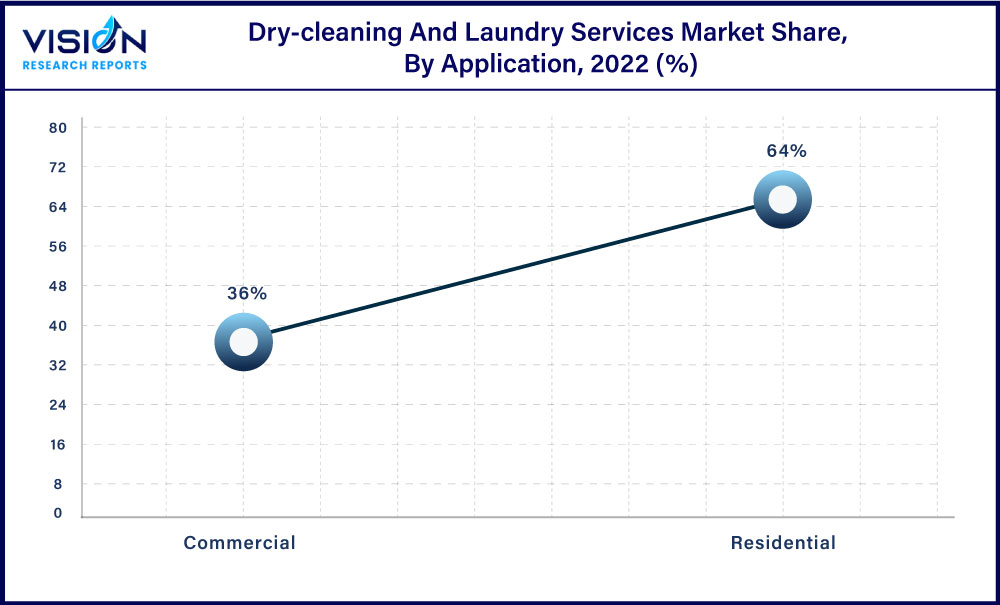

The residential application segment dominated the market in 2022 with a share of 64%. The expansion of the residential segment is anticipated to be fueled by an increase in the number of residential units and rising number of working professionals around the world, as well as increased spending on clothing and dry cleaning. In addition, rising consumer preference for professional cleaning services due to concerns over personal hygiene and cleanliness is predicted to fuel the expansion of the residential segment over the forecast period. The commercial application segment is anticipated to grow at a CAGR of 7.63% over the forecast period.

The commercial sector is expected to experience substantial demand for dry-cleaning and laundry services in the near future due to the rapid expansion of the hospitality industry. This industry is continuously seeking professional services to clean bedding and other items, which is likely to drive demand for the commercial segment during the forecast period. Consumers are increasingly opting for professional duvet-cleaning services due to their highly efficient machines, which allow for regular cleaning of bedding, resulting in flexibility and convenience in their busy lifestyles. These factors are expected to propel the demand for dry-cleaning and laundry services in the commercial sector.

Regional Insights

Asia Pacific emerged as the largest shareholder in 2022 with a share of around 36% and is projected to maintain its lead with a CAGR of 8.44% over the forecast period. The presence of emerging economies, such as India and China, growing working population, and rising spending on dry-cleaning and laundry services are expected to drive the market during the forecast period. In Asia Pacific, China is expected to remain a prominent shareholder owing to the presence of a large population pool looking for convenient and energy-efficient dry-cleaning and laundry services.

The Central and South America region is anticipated to have potential growth with a CAGR of 6.73% over the forecast period. Brazil is the largest market for dry-cleaning and laundry services in the region, accounting for a significant share of the overall market. The country has a large population with growing middle-class population, which has increased the demand for professional cleaning services. Other countries, such as Argentina, Colombia, and Mexico, are also seeing growth in the industry, driven by similar factors.

Dry-cleaning And Laundry Services Market Segmentations:

By Services

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Dry-cleaning And Laundry Services Market

5.1. COVID-19 Landscape: Dry-cleaning And Laundry Services Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Dry-cleaning And Laundry Services Market, By Services

8.1. Dry-cleaning And Laundry Services Market, by Services, 2023-2032

8.1.1. Laundry

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Dry Cleaning

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Duvet Cleaning

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Dry-cleaning And Laundry Services Market, By Application

9.1. Dry-cleaning And Laundry Services Market, by Application, 2023-2032

9.1.1. Residential

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Commercial

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Dry-cleaning And Laundry Services Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Services (2020-2032)

10.1.2. Market Revenue and Forecast, by Application (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Services (2020-2032)

10.1.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Services (2020-2032)

10.1.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Services (2020-2032)

10.2.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Services (2020-2032)

10.2.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Services (2020-2032)

10.2.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Services (2020-2032)

10.2.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Services (2020-2032)

10.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Services (2020-2032)

10.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Services (2020-2032)

10.3.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Services (2020-2032)

10.3.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Services (2020-2032)

10.3.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Services (2020-2032)

10.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Services (2020-2032)

10.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Services (2020-2032)

10.4.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Services (2020-2032)

10.4.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Services (2020-2032)

10.4.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Services (2020-2032)

10.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Services (2020-2032)

10.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Services (2020-2032)

10.5.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Services (2020-2032)

10.5.4.2. Market Revenue and Forecast, by Application (2020-2032)

Chapter 11. Company Profiles

11.1. Alliance Laundry Systems LLC

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. The Huntington Company

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. ZIPS Dry Cleaners

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Alsco Pty Limited

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Rinse, Inc.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Marberry Cleaners & Launderers, Inc

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Tide Dry Cleaners (Procter & Gamble)

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. City Dry Cleaning Company

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. East Rand Cleaners

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Cleanly

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others