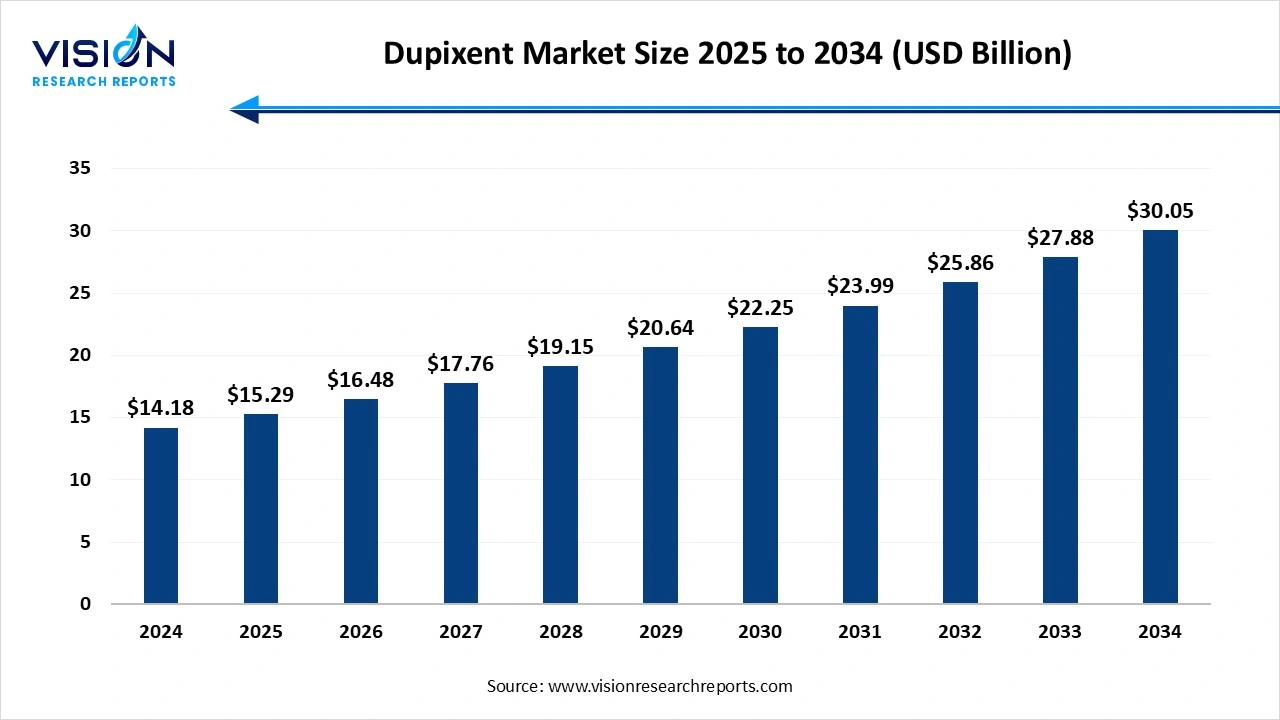

The dupixent market size was worth USD 14.18 billion in 2024 and is estimated to reach USD 15.29 billion in 2025 to approximately USD 30.05 billion by 2034, growing at a CAGR of 7.8% over the forecast period. The increasing inflammatory diseases, strong market position and efficacy, and continuous rollout in new markets, particularly in rapidly growing regions with improving healthcare infrastructure. The increased physician and patient awareness, rising prevalence of Type 2 inflammatory disease, drive the market growth.

| Report Coverage | Details |

| Market Size in 2024 | USD 14.18 billion |

| Revenue Forecast by 2034 | USD 30.05 billion |

| Growth rate from 2025 to 2034 | CAGR of 7.80% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Sanofi S.A., Regeneron Pharmaceuticals, Inc., GlaxoSmithKline plc (GSK), Novartis AG, AstraZeneca plc, Eli Lilly and Company, AbbVie Inc., Amgen Inc., F. Hoffmann-La Roche Ltd. |

The Dupixent market is a biologic prescription medicine that works as a monoclonal antibody targeted interleukin-4 and interleukin-13 pathways, which are key drivers of type-2 inflammation. The market growth is driven by the rising disease prevalence higher rate of chronic conditions creates greater demand for treatments. The increasing aging population, elderly populations need more medications, boosting pharmaceutical consumption. The increasing disposable income and healthcare access in the Asia Pacific, Latin America create new demand. The innovations in biologics, gene therapy, and AI-driven drug discovery expand treatment possibilities and drive market growth.

The growth of the Dupixent market is primarily driven by the increasing prevalence of chronic inflammatory diseases such as atopic dermatitis, asthma, and chronic rhinosinusitis with nasal polyps. As these conditions continue to affect millions worldwide, there is a growing demand for effective, long-term treatment solutions. Dupixent’s targeted mechanism of action and proven efficacy in reducing symptoms and improving patients’ quality of life have made it a preferred choice among healthcare providers.

The diseases, such as atopic dermatitis, asthma, eosinophilic esophagitis, and chronic rhinosinusitis with nasal polyps, are rising globally, driving the need for effective long-term therapies. The traditional treatment option often provides limited efficacy, positioning Duplixent as a preferred choice. The FDA approved Duplixent for eosinophilic esophagitis, making it the first treatment for this condition and expanding its market potential.

Growth in the COPD for the Dupixent Market

The treatment options for COPD have been limited to inhaled medicines. Many patients with severe disease, particularly those with a type 2 inflammatory phenotype, continue to experience frequent exacerbations despite being on maximal standard-of-care inhaled therapy. Dupixent directly addresses this gap.

In June 2025, the FDA approval of GSK's Nucala (mepolizumab) for eosinophilic chronic obstructive pulmonary disease (COPD) introduces a new, targeted competitor for Dupixent in the lucrative Type 2 inflammatory respiratory market. (Source: Pulmonology ADVISOR)

High Cost of Treatment of the Dupixent Market

The premium biologic drug, Dupixent, carries a high price point. This can make it unaffordable for patients, particularly in regions with limited health insurance coverage. Payer organizations, both public and private, exert pricing pressures and require robust cost-effectiveness data before approving coverage. Even with coverage, high co-payments can pose a financial burden for patients.

North America dominated the Dupixent market in 2024, accounting for the largest share of 77% in 2024. The high incidence of dermatitis, asthma, and other related conditions in the region is, major key player in the region. There is a growing trend among U.S. physicians to prescribe targeted biologic therapies like Dupixent instead of traditional, less effective options with more side effects, such as long-term systemic corticosteroids, which can significantly contribute to market share.

United States Dupixent Market Trends

The rising acceptance of biological treatments and growing patient population with chronic inflammatory conditions contribute to market growth. The FDA continues to approve Dupixent for additional conditions, broadening its patient base. Recent approvals. The growing prevalence of type-2 inflammatory diseases and high customer and physician satisfaction.

Why is Asia Pacific Significantly Growing in the Dupixent Market?

Asia Pacific expects significant growth in the Dupixent market during the forecast period. There is a high and growing prevalence of chronic diseases, creating a large patient base for Dupixent. The region has a large patient population suffering from conditions treated by Dupixent, expansion of therapeutic indications, and patient groups. The increasing healthcare expenditure and development of advanced healthcare infrastructure delivery of specific drugs.

Why did the Atopic Dermatitis (AD) Segment Dominate the Dupixent Market?

The atopic dermatitis (AD) segment held the leading position in the market in 2024, capturing the highest revenue share of 74% in 2024. The long-term observation study shows that Dupixent benefits are sustained over a year of treatment. The dermatologist and dermatologists playing a central role in managing moderate-to-severe AD, high awareness of Dupixent's effectiveness drives a strong participation rate. Global market reports note that dermatologists prefer Duplixent for its strong clinical profile.

The chronic obstructive pulmonary disease (COPD) segment is the fastest-growing in the Dupixent market during the forecast period. The growing number of diagnosed cases, due to an aging population and environmental risk factors, such as air pollution and smoking, creates a larger patient pool for treatment like Dupixent. The increasing awareness among pulmonologists about Dupixent's benefits and real-world success stories is driving demand for this targeted therapy. It offers a novel mechanism of action, a high unmet need, and boosts market growth.

In July 2024, the European Medicines Agency approved Dupixent as an add-on maintenance treatment for adults with uncontrolled COPD and a history of raised blood eosinophils. This first-in-the-world approval was a major catalyst for the COPD market. (Source: Sanofi)

How the Hospital Pharmacies Segment hold the Largest Share in the Dupixent Market?

The hospital pharmacies led the Dupixent market, accounting for the highest revenue share of 54% in 2024. Dupixent is a high-cost biological medication that often requires specialized handling, storage, and precise dosing. Many patients start Dupixent therapy under the close supervision of specialists in a hospital setting. This ensures proper evaluation, administration techniques (such as subcutaneous injection training), and initial monitoring for potential side effects. It is multidisciplinary care an established reimbursement pathway and stock management, and focuses on acute care and exacerbations.

The other segment is experiencing the fastest growth in the market during the forecast period. The more patients seek treatment in outpatient and home care settings, the demand for flexible and suitable access to biologics is growing. Specialty and mail-order pharmacies, in particular, offer services such as insurance coordination, home delivery, and patient support programs, making Dupixent more accessible for long-term use.

By Indication

By Distribution Channel

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Dupixent Market

5.1. COVID-19 Landscape: Dupixent r Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Dupixent Market, By Indication

8.1. Dupixent Market, by Indication, 2024-2033

8.1.1. Atopic Dermatitis (AD)

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Asthma

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Chronic Rhinosinusitis with Nasal Polyps (CRSwNP)

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Chronic Obstructive Pulmonary Disease (COPD)

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Dupixent Market, By Distribution Channel

9.1. Dupixent Market, by Distribution Channel, 2024-2033

9.1.1. Hospital Pharmacies

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Retail Pharmacies

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Others

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Pharmaceutical Water Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Indication (2021-2033)

10.1.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

Chapter 11. Company Profiles

11.1. Sanofi S.A.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Regeneron Pharmaceuticals, Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. GlaxoSmithKline plc (GSK)

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Novartis AG

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. AstraZeneca plc

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Eli Lilly and Company

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. AbbVie Inc.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Amgen Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. F. Hoffmann-La Roche Ltd.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others