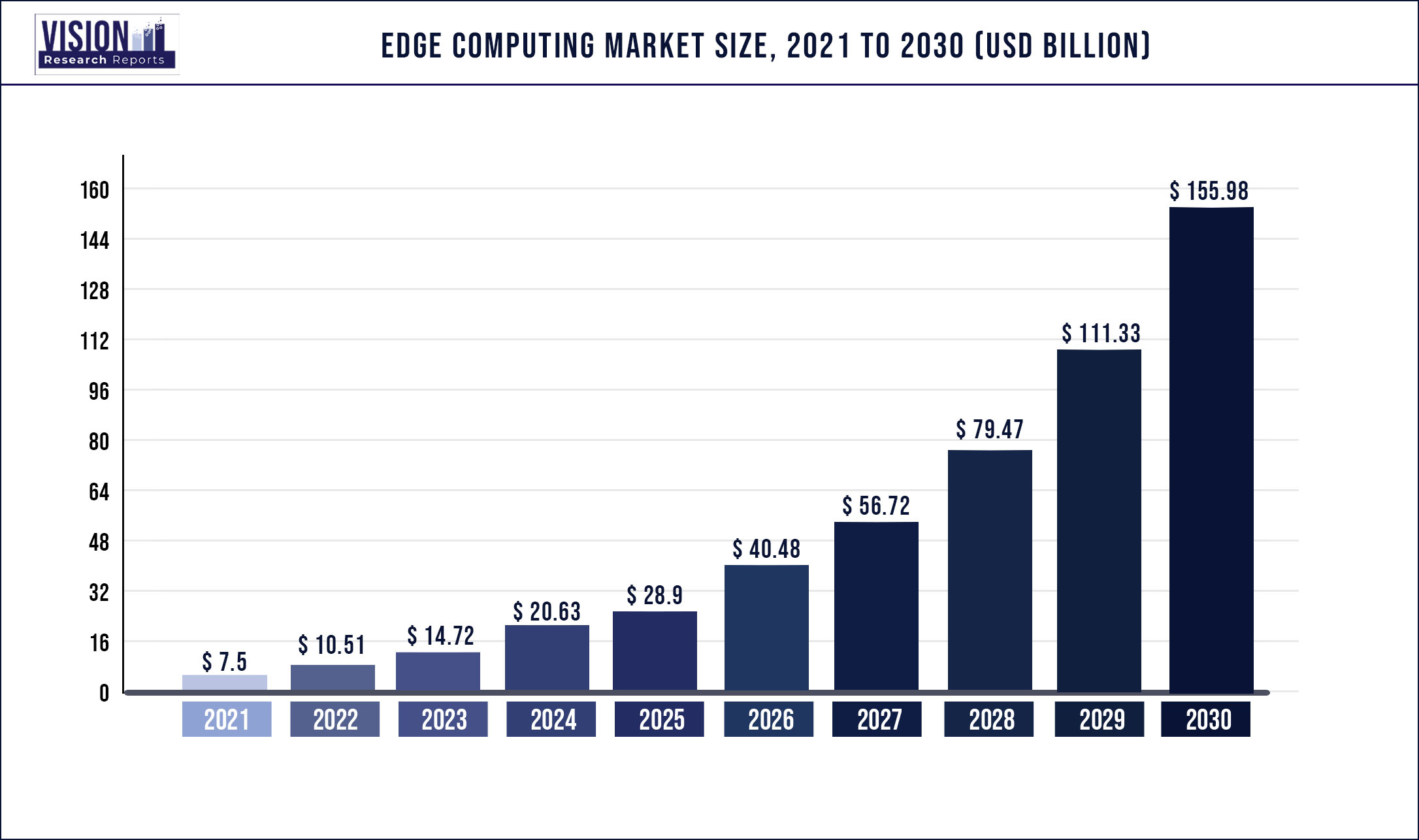

The global edge computing market was valued at USD 7.5 billion in 2021 and it is predicted to surpass around USD 155.98 billion by 2030 with a CAGR of 40.1% from 2022 to 2030.

An edge AI system is estimated to help businesses in making real-time decisions in milliseconds. The need to minimize privacy concerns associated with transmitting huge amounts of data, as well as latency and bandwidth issues that limit an organization's data transmission capabilities, is projected to fuel market growth in coming years.

Machinery control and precision monitoring are a few use cases that are well suited to using AI on the edge. The latency requirement for a fast-running production line must be maintained to a bare minimum, which can be accomplished by using the edge. Bringing data processing closer to the manufacturing facility can prove to be extremely important, which can be accomplished using AI. Artificial intelligence-based edge devices can be utilized in a wide range of endpoint devices, including sensors, cameras, smartphones, and other IoT devices.

Moreover, the telecom edge is estimated to grow exponentially during the projected period. The telecom edge shall execute computing adjacent to the telco's mini-data centers, which are operated on the telco-owned property. Several telecom operators, including Telstra and Telefonica, are developing prototypes and pilot projects of open-access networks integrated with edge computing. Edge will be at the forefront of the telecom industry once 5G is fully deployed. The telecom industry is in a great position to enhance edge computing, but telecom businesses risk being abridged by irrelevant edge suppliers if they do not move up the value chain.

Presently, Edge computing use cases have outpaced initial infrastructure deployments, and are projected to provide momentum to edge computing infrastructure and use cases investments. Edge computing is predicted to become more ubiquitous and evolve toward platform-centric solutions during the projection period. With this development, edge platforms can reduce the infrastructure intricacy using orchestration software and sophisticated management and provide user-friendly environments for programmers to implement innovative edge services and applications.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 7.5 billion |

| Revenue Forecast by 2030 | USD 155.98 billion |

| Growth rate from 2022 to 2030 | CAGR of 40.1% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Component, application, industry vertical, region |

| Companies Covered |

ABB; Amazon; Web Services (AWS), Inc.; Aricent, Inc.; Atos; Cisco Systems, Inc.; General Electric Company; Hewlett Packard Enterprise Development; Honeywell International Inc.; Huawei Technologies Co., Ltd.; IBM Corporation; Intel Corporation; Microsoft Corporation; Rockwell Automation, Inc; SAP SE; Siemens AG |

Component Insights

In terms of components, the hardware segment seized a revenue share of more than 40% in 2021. The hardware is increasing in popularity in the managed services industry and is predicted to account for the most significant market share during the forecast timeline. As the number of IoT and IIoT devices is growing fast, the volume of data created by these devices is also increasing. Therefore, to deal with the volume of data created, enterprises are adopting edge computing gear to lessen the load on the cloud and data centers.

The hardware segment is further bifurcated into Edge Nodes/Gateways (Servers), Sensors/Routers, and Others, wherein the Edge Nodes/Gateways (Servers) segment accounted for significant market share. Moreover, the increasing number of data centers across various industries boosts the demand for edge routers, linking local and wide-area networks (WAN). Edge data centers must be well-equipped with flexible and powerful edge routers capable of handling a large volume of incoming traffic while maintaining low latency. The demand for secure and efficient data processing at the edge of the network is likely to boost the growth of the hardware segment during the forecast period.

Application Insights

The Industrial Internet of Things (IIoT) segment dominated the edge computing market in terms of application. The segment captured a revenue share of over 28% in 2021. Edge computing has played an important role in allowing manufacturers to reach the goal of digitization of their facilities. A significant stake of edge computing is installed in the form of device edge in the manufacturing segment. The demand for edge infrastructure is projected to increase as service intricacy rises and the infrastructure edge becomes more accessible.

Moreover, the Industry 4.0 initiative creates a framework for modernizing manufacturing concerning industry disruptions, preparing the path for edge deployment. Industry 4.0 encourages operational agility by using technologies that bring uniformity to the cyber and physical systems. Smart factories can use an edge platform to transmit only processed data to their cloud solutions. The edge works as a path by analyzing data locally and sending summarized data to the cloud.

Industry Vertical Insights

The energy and utility segment seized a revenue share of more than 15 % in 2021. Smart grids, which depend on device edge infrastructure, are likely to contribute to revenue growth in the energy and utility segment. Environmental sustainability initiatives are fueling efforts to improve electrical utility service efficiencies worldwide, including the development of alternative renewable power sources like solar and wind. Smart grids are being installed worldwide to enable capabilities and enhance operational efficiencies, including real-time consumption control, incorporation with smart appliances, and microgrids to support generation from dispersed renewable sources.

Following the energy & utility segment, the healthcare segment seized a significant revenue share in 2021 and is likely to grow at a CAGR of 39% during the forecast period. The healthcare industry has typically been conservative concerning the implementation of digital technologies, and the industry is closely regulated, where the innovation is driven by consent instead of outright disruption.

However, as the healthcare industry becomes modern and digital, clinics and hospitals are increasingly implementing digital health strategies with varying degrees of success and maturity. Hospitals and clinics are adopting edge computing solutions across main use cases, including patient record management, continuous patient monitoring, remote patient care, and intervention to assist these strategies.

IoT in healthcare and life sciences and applications of the edge is estimated to experience robust growth in the coming future. The Internet of Things (IoT) and edge computing have enabled disruptive technology improvements to transform the healthcare industry. Medical professionals can treat their patients faster and more efficiently by using patient data, software applications, diagnostic devices, and telemedicine programs.

Regional Insights

North America captured the largest revenue share of more than 40 % in 2021. The convergence of IIoT with edge computing is forming favorable conditions for manufacturers in the U.S. to move toward connected factories. Several startups have also evolved to deliver platforms for developing edge-enabled solutions that are anticipated to boost the regional market's growth. For instance, Telus Communications and MobiledgeX, Inc. collaborate to build the MobiledgeX Early Access Programme. The program has allowed developers to build, test, and analyze the efficacy of edge-enabled applications in a low-latency environment.

In 2021, Asia Pacific accounted for a considerable revenue share due to an increasing focus on strengthening networking technology in the region due to the COVID-19 pandemic. The region's significant development of the connected device ecosystem results in a large amount of data being generated, demanding the need for a robust computational infrastructure. Google Inc. announced its Global Mobile Edge Cloud (GMEC) strategy, mainly aimed at the U.S. market. The announcement of Azure Edge Zones by Microsoft Corporation is projected to boost regional growth in the coming years.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Edge Computing Market

5.1. COVID-19 Landscape: Edge Computing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Edge Computing Market, By Component

8.1. Edge Computing Market, by Component, 2022-2030

8.1.1 Hardware

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Software

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Services

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Edge-managed Platform

8.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Edge Computing Market, By Application

9.1. Edge Computing Market, by Application, 2022-2030

9.1.1. IIoT

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Remote Monitoring

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Content Delivery

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Video Analytics

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. AR/VR

9.1.5.1. Market Revenue and Forecast (2017-2030)

9.1.6. Others

9.1.6.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Edge Computing Market, By Industry Vertical

10.1. Edge Computing Market, by Industry Vertical, 2022-2030

10.1.1. Industrial

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Energy & Utility

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Healthcare

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. Agriculture

10.1.4.1. Market Revenue and Forecast (2017-2030)

10.1.5. Transportation & Logistics

10.1.5.1. Market Revenue and Forecast (2017-2030)

10.1.6. Retail

10.1.6.1. Market Revenue and Forecast (2017-2030)

10.1.7. Datacenters

10.1.7.1. Market Revenue and Forecast (2017-2030)

10.1.8. Wearables

10.1.8.1. Market Revenue and Forecast (2017-2030)

10.1.9. Smart Cities, Smart Homes, Smart Buildings

10.1.9.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Edge Computing Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Component (2017-2030)

11.1.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.3. Market Revenue and Forecast, by Industry Vertical (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Component (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.4.3. Market Revenue and Forecast, by Industry Vertical (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Component (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.5.3. Market Revenue and Forecast, by Industry Vertical (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Component (2017-2030)

11.2.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.3. Market Revenue and Forecast, by Industry Vertical (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Component (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.4.3. Market Revenue and Forecast, by Industry Vertical (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Component (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.5.3. Market Revenue and Forecast, by Industry Vertical (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Component (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.6.3. Market Revenue and Forecast, by Industry Vertical (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Component (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.7.3. Market Revenue and Forecast, by Industry Vertical (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Component (2017-2030)

11.3.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.3. Market Revenue and Forecast, by Industry Vertical (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Component (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.4.3. Market Revenue and Forecast, by Industry Vertical (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Component (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.5.3. Market Revenue and Forecast, by Industry Vertical (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Component (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.6.3. Market Revenue and Forecast, by Industry Vertical (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Component (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.7.3. Market Revenue and Forecast, by Industry Vertical (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Component (2017-2030)

11.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.3. Market Revenue and Forecast, by Industry Vertical (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Component (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.4.3. Market Revenue and Forecast, by Industry Vertical (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Component (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.5.3. Market Revenue and Forecast, by Industry Vertical (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Component (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.6.3. Market Revenue and Forecast, by Industry Vertical (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Component (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.7.3. Market Revenue and Forecast, by Industry Vertical (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Component (2017-2030)

11.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.3. Market Revenue and Forecast, by Industry Vertical (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Component (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.4.3. Market Revenue and Forecast, by Industry Vertical (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Component (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.5.3. Market Revenue and Forecast, by Industry Vertical (2017-2030)

Chapter 12. Company Profiles

12.1. ABB

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Amazon Web Services (AWS), Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Aricent, Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Atos

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Cisco Systems, Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. General Electric Company

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Hewlett Packard Enterprise Development

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Honeywell International Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Huawei Technologies Co., Ltd.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. IBM Corporation

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

12.11. Intel Corporation

12. 11.1. Company Overview

12. 11.2. Product Offerings

12. 11.3. Financial Performance

12. 11.4. Recent Initiatives

12.12. Microsoft Corporation

12.12.1. Company Overview

12. 12.2. Product Offerings

12. 12.3. Financial Performance

12. 12.4. Recent Initiatives

12.13. Rockwell Automation, Inc

12.13.1. Company Overview

12. 13.2. Product Offerings

12. 13.3. Financial Performance

12. 13.4. Recent Initiatives

12.14. SAP SE

12.14.1. Company Overview

12. 14.2. Product Offerings

12. 14.3. Financial Performance

12. 14.4. Recent Initiatives

12.15. Siemens AG

12.15.1. Company Overview

12. 15.2. Product Offerings

12. 15.3. Financial Performance

12. 15.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others