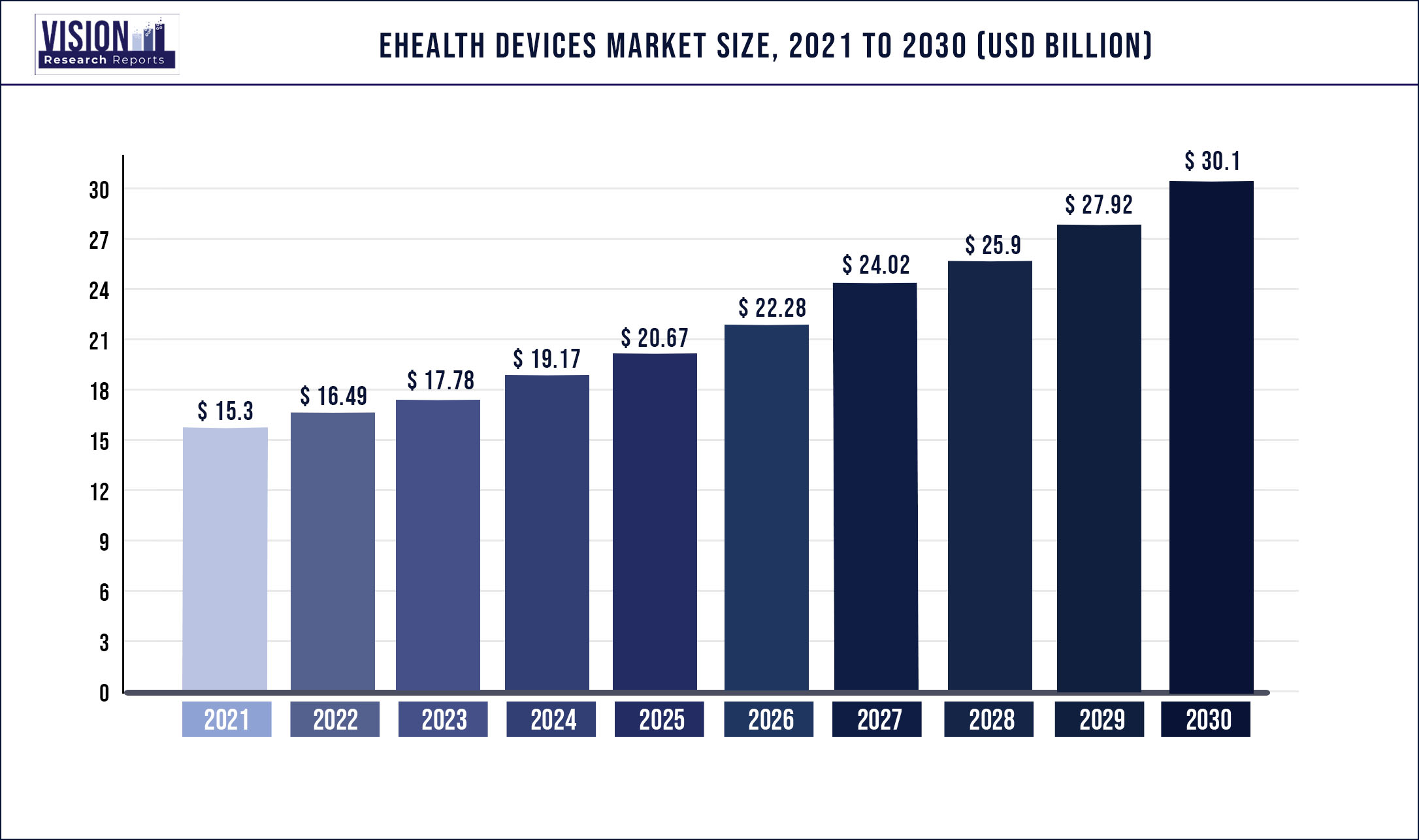

The global eHealth devices market size was estimated at around USD 15.3 billion in 2021 and it is projected to hit around USD 30.1 billion by 2030, growing at a CAGR of 7.81% from 2022 to 2030.

The market growth for eHealth is significantly driven by the increasing demand for blood pressure meters and care phone/social alarms from the rising geriatric population around the world. The rapidly increasing sedentary lifestyle and lack of physical activity have given rise to various lifestyle diseases such as obesity and diabetes. The rising prevalence of chronic lifestyle diseases is expected to propel market growth in the near future. Technological developments and product launches with more sophisticated functioning and accuracy are expected to boost market growth. However, the high cost of devices and privacy issues will act as restraints for the eHealth device market.

The rising investment and increased spending on research and development by key players and governments are also expected to facilitate market growth. Owing to the increasing investments, new products are being developed at a rapid pace. For instance, the Indian government has commenced various programs and initiatives in order to strengthen the medical and health devices sector, with emphasis on research and development, as well as 100% foreign direct investment in the market. In January 2022, the health-tech startup BlueSemi, based in India, announced the development of a needle-free glucose meter providing results in 1 minute.

The demand for eHealth devices surged during the COVID-19 pandemic. As a result of COVID-19, consumers started looking for safe ways for health tracking, and healthcare providers sought innovative ways to deliver safe healthcare access. This led to the increased adoption of eHealth devices and services during the pandemic, which has subsequently positively impacted the market growth.

In the global eHealth device market, the blood pressure meter segment is anticipated to witness the highest CAGR of 9.8% from 2022 to 2028. The worldwide cases of hypertension are increasing at an alarming rate due to various hereditary and environmental causes. A busy and hectic lifestyle, and increasing consumption of unhealthy fast-food, are the leading causes of the development of hypertension.

According to the World Health Organization, approximately 1.38 billion adults worldwide have hypertension, with 49% of adults being unaware of their condition. The sharply rising population aged 60 and above is also driving the demand for blood pressure meters, as the risk of hypertension increases with age.

North America dominated the global market for eHealth devices, accounting for around 39% of the revenue share in 2021. This region is further anticipated to witness the 2nd highest growth rate, registering a CAGR of 10.4% from 2022 to 2030. This can be credited to the increasing demand in the U.S. for eHealth devices such as glucose meters. According to the CDC’s National Diabetes Statistics Report, 2020, 34.2 million people, or 10.6% of the population in the U.S. had diabetes, while 34.5% of the adult population were prediabetic. This number is projected to rise to 39.7 million by 2030, thereby surging the demand for glucose meter devices.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 15.3 Billion |

| Revenue Forecast by 2030 | USD 30.1 billion |

| Growth rate from 2022 to 2030 | CAGR of 7.81% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Phase, study design, therapeutic areas, region |

| Companies Covered | Omron Corp.; Apple Inc.; Medtronic Plc.; DexCom, Inc.; Nokia Corp.; PHC Holdings Corporation; Abbott Laboratories; F. Hoffmann-La Roche AG; Doro AB. |

Type Insights

The eHealth devices market is dominated by the glucose meters segment, which accounted for around 34% of the revenue share in 2021. The smart glucose meter continuously detects the blood glucose level and collects information that is transmitted via electronic signals. The global prevalence of diabetes and growing awareness about diabetes care solutions is driving the demand for glucose meters. Moreover, the continuous tracking of glucose automatically provides an advantageous solution compared to the traditional one-time self-monitoring glucose devices.

In the eHealth device market, the blood pressure meter segment is anticipated to witness the highest CAGR of 12.8% from 2022 to 2030. With the hectic and stressful lifestyle globally, the cases of heart problems and blood pressure are increasing rapidly. The risk of high blood pressure and hypertension increases with age, generally above 45 years. The geriatric population in 2019 worldwide was 703 million. This number is increasing at a fast pace, according to UN data; the world population above 65 years in 2030 will reach 997 million. This leads to the increasing demand for blood pressure meter devices.

Regional Insights

The global eHealth devices market was dominated by North America, which contributed around 39% revenue share in 2021. The regional market dominance is credited to the high product awareness and strong presence of the key players such as DexCom, Inc., Abbott Laboratories, and Apple Inc. Moreover, the increased consumer spending and high per capita income and GDP also account for the higher market share in the global eHealth device market. Additionally, the higher government and private funding for R&D purposes in the U.S. also results in a higher frequency of product launches.

In the global market for eHealth devices, Asia Pacific is anticipated to advance at the highest CAGR of 11.9% from 2022 to 2030. The regional market is significantly driven by the economic output and growth, which is concentrated in major cities. The regional growth is attributed to the increasing consumer purchasing power, rising standard of living, and the rapidly improving healthcare sector. Rising government initiatives and foreign investments are also expected to advance market conditions and drive regional growth.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1.Raw Material Procurement Analysis

4.3.2.Sales and Distribution Channel Analysis

4.3.3.Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on EHealth Devices Market

5.1.COVID-19 Landscape: EHealth Devices Industry Impact

5.2.COVID 19 - Impact Assessment for the Industry

5.3.COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1.Market Drivers

6.1.2.Market Restraints

6.1.3.Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1.Bargaining power of suppliers

6.2.2.Bargaining power of buyers

6.2.3.Threat of substitute

6.2.4.Threat of new entrants

6.2.5.Degree of competition

Chapter 7. Competitive Landscape

7.1.1.Company Market Share/Positioning Analysis

7.1.2.Key Strategies Adopted by Players

7.1.3.Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global EHealth Devices Market, By Type

8.1. EHealth Devices Market, by Type Type, 2020-2027

8.1.1.Blood Pressure Meters

8.1.1.1. Market Revenue and Forecast (2016-2027)

8.1.2.Fever Meter

8.1.2.1. Market Revenue and Forecast (2016-2027)

8.1.3.Glucose Meters

8.1.3.1. Market Revenue and Forecast (2016-2027)

8.1.4.Care Phone/Social Alarms

8.1.4.1. Market Revenue and Forecast (2016-2027)

Chapter 9. Global EHealth Devices Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1.Market Revenue and Forecast, by Type (2016-2027)

9.1.2.U.S.

9.1.3.Rest of North America

9.1.3.1. Market Revenue and Forecast, by Type (2016-2027)

9.2. Europe

9.2.1.Market Revenue and Forecast, by Type (2016-2027)

9.2.2.UK

9.2.2.1. Market Revenue and Forecast, by Type (2016-2027)

9.2.3.France

9.2.3.1. Market Revenue and Forecast, by Type (2016-2027)

9.2.4.Rest of Europe

9.2.4.1. Market Revenue and Forecast, by Type (2016-2027)

9.3. APAC

9.3.1.Market Revenue and Forecast, by Type (2016-2027)

9.3.2.India

9.3.2.1. Market Revenue and Forecast, by Type (2016-2027)

9.3.3.China

9.3.3.1. Market Revenue and Forecast, by Type (2016-2027)

9.3.4.Japan

9.3.4.1. Market Revenue and Forecast, by Type (2016-2027)

9.3.5.Rest of APAC

9.3.5.1. Market Revenue and Forecast, by Type (2016-2027)

9.4. MEA

9.4.1.Market Revenue and Forecast, by Type (2016-2027)

9.4.2.GCC

9.4.2.1. Market Revenue and Forecast, by Type (2016-2027)

9.4.3.North Africa

9.4.3.1. Market Revenue and Forecast, by Type (2016-2027)

9.4.4.South Africa

9.4.4.1. Market Revenue and Forecast, by Type (2016-2027)

9.4.5.Rest of MEA

9.4.5.1. Market Revenue and Forecast, by Type (2016-2027)

9.5. Latin America

9.5.1.Market Revenue and Forecast, by Type (2016-2027)

9.5.2.Brazil

9.5.2.1. Market Revenue and Forecast, by Type (2016-2027)

9.5.3.Rest of LATAM

9.5.3.1. Market Revenue and Forecast, by Type (2016-2027)

Chapter 10. Company Profiles

10.1.Omron Corp.

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2.Apple Inc.

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3.Apple Inc.

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4.DexCom, Inc.

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5.Nokia Corp.

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

10.6.PHC Holdings Corporation

10.6.1. Company Overview

10.6.2. Product Offerings

10.6.3. Financial Performance

10.6.4. Recent Initiatives

10.7.Abbott Laboratories

10.7.1. Company Overview

10.7.2. Product Offerings

10.7.3. Financial Performance

10.7.4. Recent Initiatives

10.8.F. Hoffmann-La Roche AG

10.8.1. Company Overview

10.8.2. Product Offerings

10.8.3. Financial Performance

10.8.4. Recent Initiatives

10.9.Doro AB

10.9.1. Company Overview

10.9.2. Product Offerings

10.9.3. Financial Performance

10.9.4. Recent Initiatives

Chapter 11. Research Methodology

11.1.Primary Research

11.2.Secondary Research

11.3.Assumptions

Chapter 12. Appendix

12.1.About Us

12.2.Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others