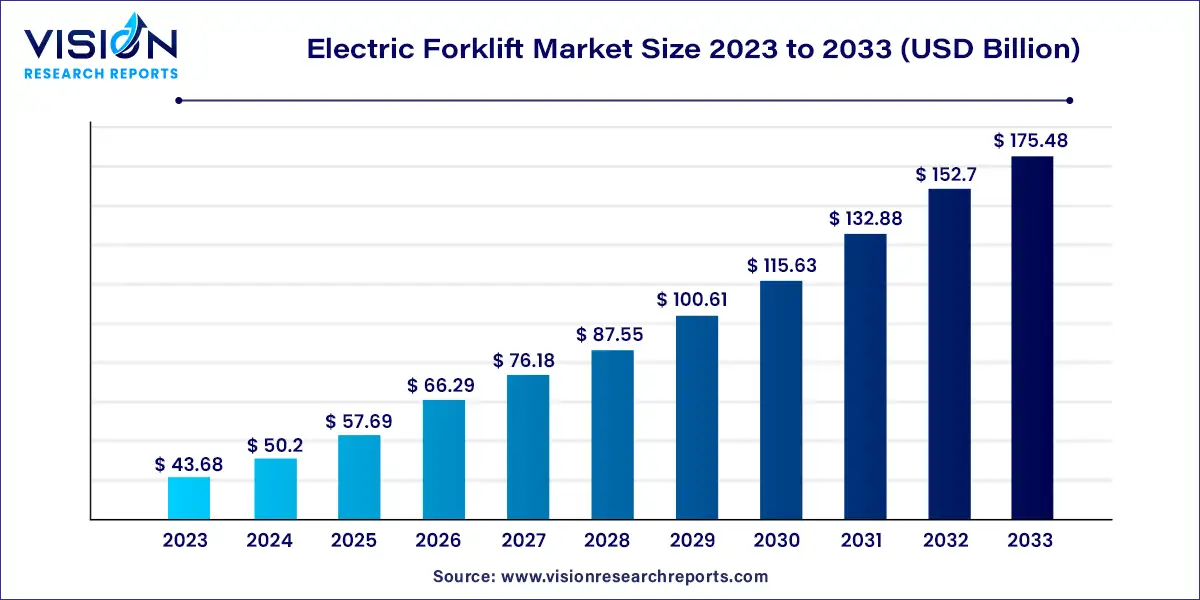

The global electric forklift market was valued at USD 43.68 billion in 2023 and it is predicted to surpass around USD 175.48 billion by 2033 with a CAGR of 14.92% from 2024 to 2033.

The electric forklift market is experiencing significant growth driven by various factors such as technological advancements, increasing emphasis on environmental sustainability, and rising demand for efficient material handling solutions across industries. This overview delves into key trends shaping the electric forklift market, highlighting growth drivers and outlining future prospects.

The growth of the electric forklift market is propelled by several key factors. Technological advancements, particularly in battery technology such as the widespread adoption of lithium-ion batteries, are enhancing the performance and efficiency of electric forklifts. Additionally, the increasing emphasis on environmental sustainability is driving companies to transition from traditional internal combustion engine models to electric-powered alternatives, in line with stringent emissions regulations and sustainability goals. Furthermore, the cost efficiency and operational benefits offered by electric forklifts, including lower fuel expenses and reduced maintenance requirements, contribute to their growing popularity among businesses seeking to optimize their material handling operations. Moreover, the expansion of e-commerce and warehouse automation is fueling demand for electric forklifts capable of navigating narrow aisles and integrating with automated systems, further driving market growth.

By product type, the segment is diversified into counterbalance, pallet trucks, reach trucks, pallet stacks, and others. As of 2023, the electric pallet trucks segment emerged as the dominant force in the market, commanding a market share exceeding 26%. This surge is primarily fueled by robust demand across end-use industries and the availability of a diverse product range offering varying load-handling capabilities. Electric pallet trucks are increasingly being integrated into logistics and warehouse operations to streamline item handling processes. Notably, their utilization of a magnetic motor translates to significantly reduced maintenance requirements compared to other pallet jack variants.

The reach truck segment is poised for notable growth throughout the forecast period. Reach trucks excel in maneuvering within narrow aisles, owing to their unique design with the truck wheels situated directly beneath the operator, allowing for a restricted turn radius. The burgeoning influence of e-commerce and retail sectors has spurred the expansion of warehouses across diverse locations, consequently driving demand for reach trucks. As a result, the reach truck segment is witnessing a significant uptick in demand.

The market is divided based on battery type into lithium-ion batteries and others, encompassing hydrogen fuel cell batteries and lead-acid batteries. In 2023, the others segment emerged as the dominant player, securing a market share exceeding 51%. Hydrogen fuel cell batteries are preferred over lead-acid and lithium-ion batteries due to their advantages, including lower emission rates and the absence of battery charging, swapping, or maintenance requirements. Furthermore, advancements in hydrogen fuel cell battery technology are bolstering growth in the electric forklift market.

The Li-ion segment is poised for significant growth in the forecast period, propelled by rising consumer spending on electronic products, which drives the demand for li-ion batteries. Government investments in energy and infrastructure development initiatives are expected to support the expansion of the lithium-ion battery market. The numerous advantages of lithium-ion batteries, such as cost-effectiveness and extended shelf life, are creating new opportunities for their application in electric forklifts.

Based on the end-use segment, the market further divides into subsegments such as chemicals, food & beverages, industrial, logistics, retail & e-commerce, and others. In 2023, the industrial segment claimed the largest share, surpassing 26%. Economic expansion and rising disposable income are key drivers behind the flourishing manufacturing activities across various industries, poised to fuel growth in the industrial segment. The integration of robotics and automation in the industrial sector has heightened the demand for forklifts, presenting opportunities to enhance operational efficiency.

The retail segment is projected to witness substantial growth throughout the forecast period. Electric forklifts play a pivotal role in enhancing retail sector efficiency. The adoption of IoT and wireless fleet management solutions is gaining momentum within the sector. Electronic forklifts equipped with sensors can detect and track impacts, trigger automated maintenance alerts, and enable operators to conduct safety checklists digitally.

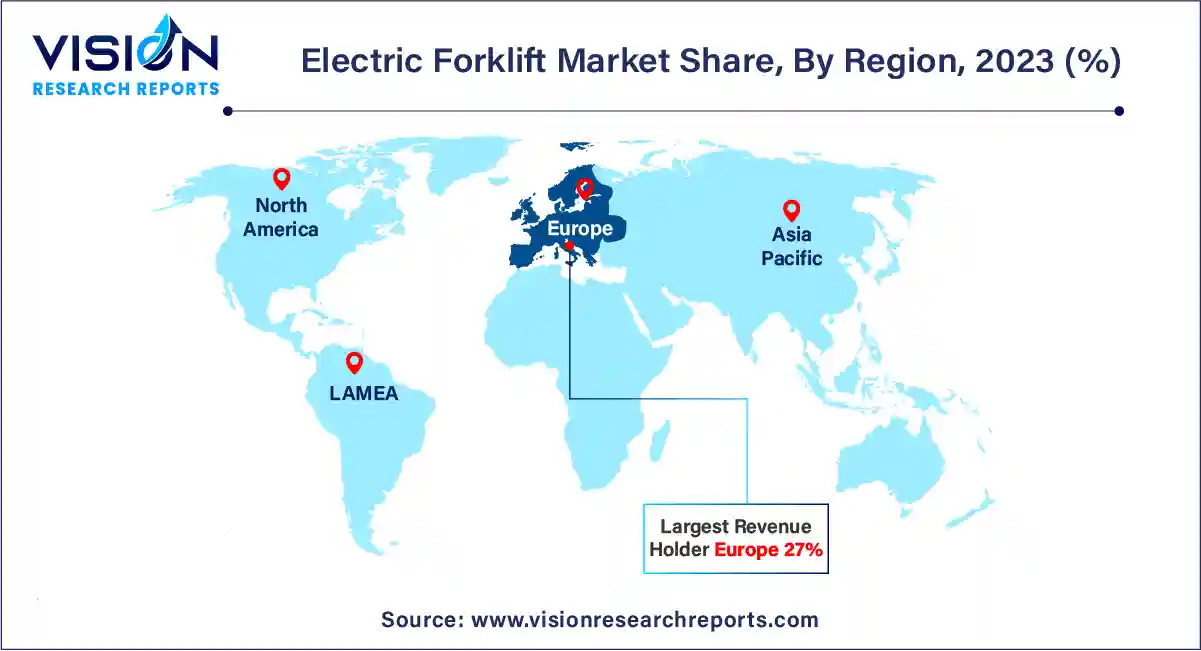

In terms of regional growth, Europe claimed the largest market share, surpassing 27% in 2023. The European region is experiencing a surge in forklift demand, driven by the flourishing automotive and electronics industries. Serving as a manufacturing hub for major automotive and consumer electronics OEMs, the region anticipates a heightened need for forklifts.

The Asia-Pacific market is poised for significant growth throughout the forecast period. Steady market expansion is anticipated as manufacturers increasingly adopt plant automation, thereby bolstering demand for forklifts. Additionally, forklifts play a crucial role in enhancing operational efficiency and workflow within production processes by facilitating supply chain distribution activities. Several regional players are employing the introduction of new products as a key strategy to attract new customers and enhance their customer base.

By Product

By Battery Type

By End use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Electric Forklift Market

5.1. COVID-19 Landscape: Electric Forklift Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Electric Forklift Market, By Product

8.1. Electric Forklift Market, by Product, 2024-2033

8.1.1 Counterbalanced

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Pallet Trucks

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Reach Trucks

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Pallet Stackers

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Electric Forklift Market, By Battery Type

9.1. Electric Forklift Market, by Battery Type, 2024-2033

9.1.1. Lithium-Ion

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Others

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Small & Medium Enterprises

Chapter 10. Global Electric Forklift Market, By End use

10.1. Electric Forklift Market, by End use, 2024-2033

10.1.1. Chemical

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Food & Beverage

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Industrial

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Logistics

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Retail & E-Commerce

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Others

10.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Electric Forklift Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.2. Market Revenue and Forecast, by Battery Type (2021-2033)

11.1.3. Market Revenue and Forecast, by End use (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Battery Type (2021-2033)

11.1.4.3. Market Revenue and Forecast, by End use (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Battery Type (2021-2033)

11.1.5.3. Market Revenue and Forecast, by End use (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.2. Market Revenue and Forecast, by Battery Type (2021-2033)

11.2.3. Market Revenue and Forecast, by End use (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Battery Type (2021-2033)

11.2.4.3. Market Revenue and Forecast, by End use (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Battery Type (2021-2033)

11.2.5.3. Market Revenue and Forecast, by End use (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Battery Type (2021-2033)

11.2.6.3. Market Revenue and Forecast, by End use (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Battery Type (2021-2033)

11.2.7.3. Market Revenue and Forecast, by End use (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.2. Market Revenue and Forecast, by Battery Type (2021-2033)

11.3.3. Market Revenue and Forecast, by End use (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Battery Type (2021-2033)

11.3.4.3. Market Revenue and Forecast, by End use (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Battery Type (2021-2033)

11.3.5.3. Market Revenue and Forecast, by End use (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Battery Type (2021-2033)

11.3.6.3. Market Revenue and Forecast, by End use (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Battery Type (2021-2033)

11.3.7.3. Market Revenue and Forecast, by End use (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.2. Market Revenue and Forecast, by Battery Type (2021-2033)

11.4.3. Market Revenue and Forecast, by End use (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Battery Type (2021-2033)

11.4.4.3. Market Revenue and Forecast, by End use (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Battery Type (2021-2033)

11.4.5.3. Market Revenue and Forecast, by End use (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Battery Type (2021-2033)

11.4.6.3. Market Revenue and Forecast, by End use (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Battery Type (2021-2033)

11.4.7.3. Market Revenue and Forecast, by End use (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.2. Market Revenue and Forecast, by Battery Type (2021-2033)

11.5.3. Market Revenue and Forecast, by End use (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Battery Type (2021-2033)

11.5.4.3. Market Revenue and Forecast, by End use (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Battery Type (2021-2033)

11.5.5.3. Market Revenue and Forecast, by End use (2021-2033)

Chapter 12. Company Profiles

12.1. Anhui Heli Co., Ltd.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Clark.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Crown Equipment Corporation.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Hangcha Group Co., Ltd.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Hyster-Yale Materials Handling, Inc

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Jungheinrich AG

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. KION Group AG

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Komatsu Ltd.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Doosan Industrial Vehicles Co. Ltd.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Crown Equipment Corp.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others