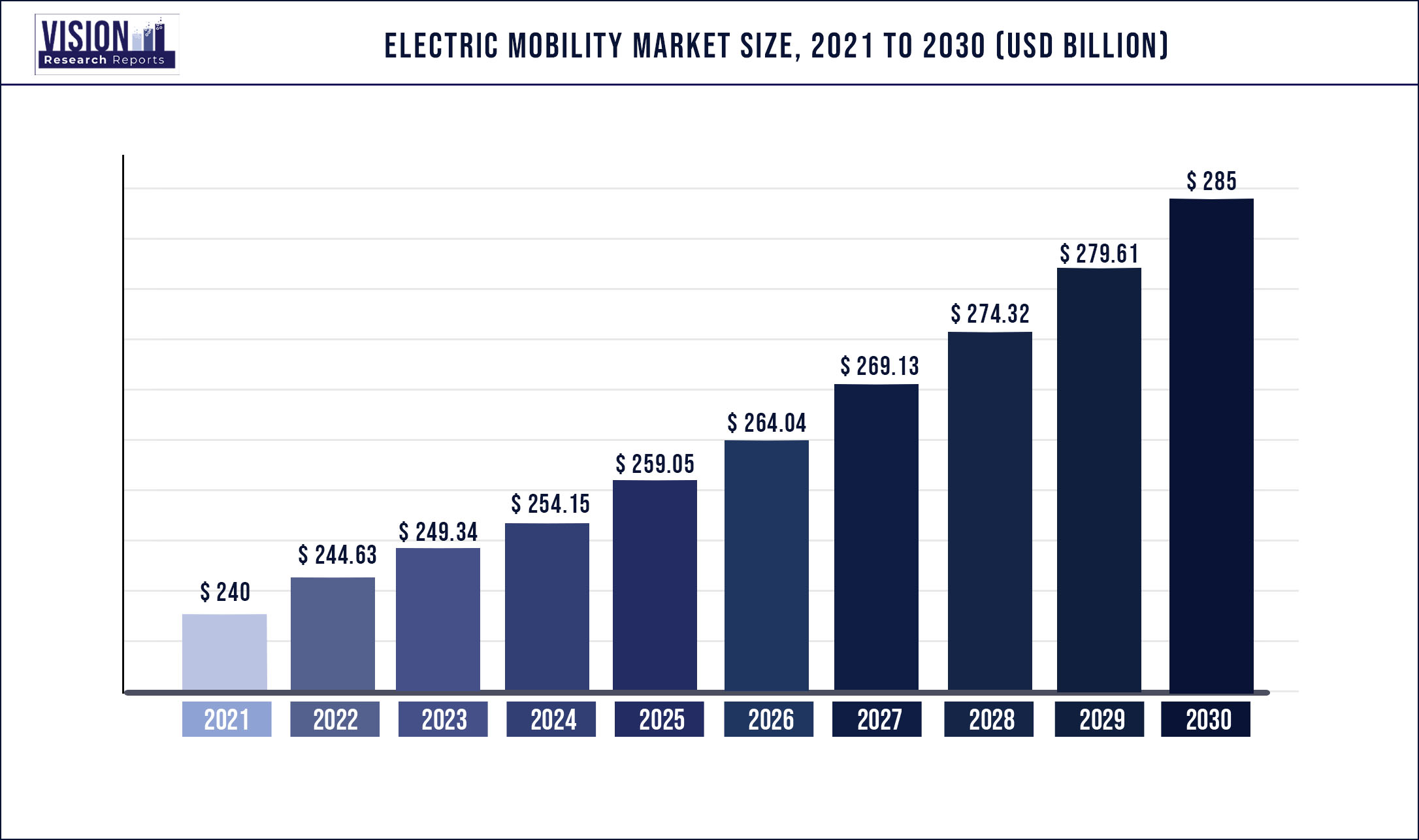

The global electric mobility market size was reached at USD 240 billion in 2021 and is expected to hit around USD 285 billion by 2030, poised to grow at a compound annual growth rate (CAGR) of 26% from 2022 to 2030. Rising automotive electrification and adoption of electric micro-mobility are expected to foster market growth.

Electric mobility is the adoption of e-bikes, cars, and motorbikes to reduce environmental impact. Rising automotive electrification is expected to boost the adoption of electric vehicles. This factor may boost such solution adoption. Furthermore, rising awareness regarding electric vehicles benefits is expected to boost the adoption of electric micro-mobility solutions worldwide. In addition, the growing consumer preferences toward electric vehicles from conventional vehicles and growing fuel prices may foster the industry's progress in the coming years.

The automotive industry is undergoing an economic, technological, and social transformation. This is chiefly driven by the increased awareness about the lower operational and maintenance costs of EVs, combined with their capability of reducing harmful emissions that contribute to global warming. These favorable trends are likely to work well for the market for EVs over the coming years, thus driving the market for electric mobility or E-mobility.

In addition to subsidies or tax benefits offered to buyers and vehicle manufacturers, governments of various countries are working toward making the adoption of EVs easier by investing in the development of EV charging infrastructure. The government of India, for instance, recently announced e-vehicle purchase tax benefits to increase the e-vehicle adoption in the country. Similar to many countries globally, the Indian government is also in the process of deploying regulations aimed at phasing out internal combustion engine vehicles and significantly reduce the production volume of such vehicles by 2030, hence improving the growth potential of the market for E-mobility.

Other countries such as South Korea, Portugal, Germany, and Spain have also set targets for the inclusion of EVs in their public and private vehicle fleets. By 2020, South Korea is aiming to have 200,000 EVs on the road, Portugal is aiming for 750,000 EVs, and Germany is aiming for 1 million EVs. Some countries such as Malaysia, Finland, and South Africa have set their respective e-vehicle targets for 2030. These factors are expected to aid the growth prospects of the market for electric mobility over the forecast period.

Automobile companies are actively working on launching E-car models. For instance, General Motors is aiming to introduce 100 different E-car models by 2020. Furthermore, the rising popularity of services such as car-sharing, ride-hailing, E-scooter sharing, E-bicycle, and E-motorcycle sharing is expected to work well for the market for electric mobility. However, the launch of these services varies significantly at both city and country-level depending on local transportation policies, existing charging infrastructure, and degree of urbanization.

Nevertheless, companies offering electric mobility sharing services are receiving significant investments from companies including prominent automotive OEMs such as Ford Motor Company. The companies are also focusing on capacity expansions as well as acquisitions to tap a larger share of the market for electric mobility. For instance, in September 2018, Govecs AG signed a letter of intent to supply 6,000 e-scooters to a U.K.-based company, which is operating on a shared mobility business model, by 2020. This deal has helped Govecs AG enter into the U.K. market. Similarly, in June 2019, Bird Rides, Inc. acquired Scoot Rides, Inc. to expand its vehicle fleet.

Robust Demand for Emission Free Vehicles to Boost Growth

Governments globally impose strict emission norms for the employment of electric vehicles and carbon footprint reduction. The introduction of several scrapping policies for fossil fuel-powered vehicles is expected to boost the demand. Further, technological developments in lithium-ion battery technology and mass production of lithium-ion batteries are expected to foster industry progress. Moreover, cheaper prices of lithium-ion batteries may fuel the industry's development. In addition, increasing initiatives for electric vehicle production may foster such solutions. However, the prevalence of the global semi-conductor shortage problem is expected to hinder the market’s progress.

Electric Mobility Market Trends

The growing automotive electrification and rise in the adoption of electric vehicles in countries such as China, India, and South Korea are causing a rapid increase in the number of electric vehicle sales. Additionally, the development of the electric car charging network and infrastructure is further boosting the market's growth. Furthermore, various regulatory bodies of several countries issues laws and policies that initiate the adoption of energy- efficient vehicle.

The shifting consumer preference from conventional vehicles to electric vehicles and rising price of fossil fuels coupled with the declining cost of lithium-ion batteries and increasing adoption of mobility-as-a-service (Maas) will further propel the market growth during the forecast period. Additionally, the automobile sector is undergoing an economic, social and technological transformation which is driven by an increased awareness of lower operational and maintenance cost of electric vehicles.

Moreover, several government initiatives towards adopting EVs, such as low tax, GST, and reduced subsidies, are further propelling market growth. For instance, in September 2021, the government of India introduced Production-Linked Incentives(PLI) schemes to manufacture advanced chemistry cells which will control the prices of batteries. Thereby decreasing the price of the electric vehicle.

High Electric Vehicle Adoption to Foster Market Development in Asia Pacific

Asia Pacific is expected to dominate the electric mobility market share due to the rising adoption of electric vehicles in China. The market in Asia Pacific stood at USD 116.35 billion in 2020 and is expected to gain a huge portion of the global market share. Further, the rising penetration of electric vehicles in India, South Korea, Japan, and others is expected to foster market development.

In Europe, rising incentives and increasing government policies are expected to foster electric mobility adoption. Further, the presence of a well-established automotive industry in Europe is expected to bolster the adoption of such solutions. These factors may fuel market progress.

In North America, strong electric vehicle sales and several leading vehicle manufacturers are expected to boost such mobility solutions. These factors may propel market growth.

Product Insights

In terms of product, the electric car segment accounted for over 71% of the revenue share of the market for electric mobility in 2021 and is estimated to retain its dominance over the forecast period. This can be attributed to the higher rate of adoption and high cost of battery EVs as compared to the cost of E-motorcycles, scooters, skateboards, wheelchairs, and bicycles. Moreover, the increasing demand for EVs spurred by policies that encourage fleet owners and municipalities to purchase an eco-friendly and low-maintenance vehicle.

The electric motorcycle segment is expected to register a considerable CAGR of 34.9% from 2022 to 2030. Government regulatory bodies are encouraging the adoption of electric two-wheelers by offering tax concession, which is expected to contribute to the promising growth prospects of the global market for electric mobility. Several companies have also started investing in the e-motorcycle industry, which is likely to further contribute toward creating a competitive business environment for e-motorcycles shortly. For instance, Bharat Forge has recently acquired a 45% stake in Tork Motors, an E-motorcycle manufacturing company. Similarly, TVS Motors Company Ltd. acquired a 25.76% stake in an E-motorcycle manufacturer Ultraviolette Automotive Pvt. Ltd. in August 2018.

Battery Insights

In terms of battery, the market for E-mobility is segmented into sealed lead acid, Nickel Metal Hydride (NiMH), and lithium-ion (Li-ion). The Li-ion segment dominated in 2021 and accounted for over 51% of the market. The segment is expected to register a promising CAGR of 24% over the forecast period. The cost of Li-ion battery packs for EVs has declined by over 70% in the past 7 years and is predicted to further reduce by around 50% till 2030 owing to production scale economies and technological developments. The increasingly economical nature of these batteries, coupled with their higher energy densities as compared to sealed lead acid and NiMH batteries, is expected to continue to drive their demand. Moreover, remarkable growth prospects exist in the Li-ion market as battery suppliers and manufacturers invest in R&D activities in a bid to offer safe, reliable, and cheap battery solutions with improved energy densities.

The nickel-metal hydride (NiMH) segment is expected to witness considerable growth as consumers demand high-performance and more environmentally conducive batteries. NiMH batteries continue to be the technology of choice for powering hybrid electric vehicles (HEVs) and are expected to continue to account for a notable share in the market for electric mobility over the forecast period. This is majorly due to some of the benefits offered by these batteries, such as lightweight, high charge density, and high charging-discharging efficiency. With increased investment in R&D activities, battery manufacturers are rolling out improved NiMH batteries in terms of life, efficiency, and costs, thus making them a more viable option for EVs.

Voltage Insights

The electric mobility market can be categorized by voltage into less than 24V, 24V, 36V, 48V, and greater than 48V. The 24V segment accounted for over 27% of the electric mobility revenue share in 2021. These batteries provide superior power output and possess high compatibility with EVs. Their demand is likely to steadily rise and the segment is likely to continue to account for a notable share in the market by the end of the forecast period as well.

The greater than 48V segment is expected to witness significant growth over the forecast period, registering a CAGR of 24.9%. The overall demand for EVs equipped with batteries greater than 48 voltage is anticipated to substantially rise shortly owing to constant research and development activities focusing on improving the distance coverage and speed of EVs. The segment is expected to account for the dominant share of the market by the end of the forecast period.

Regional Insights

The Asia-Pacific region holds the highest market share of 29% and CAGR 54% within the forecast owing to the adoption of electric vehicles, specifically electric scooters and electric bikes, in emerging economies such as India and China. Furthermore, the rising in the fuel price coupled with growing awareness of the rising pollution will further boost the market growth. Asian economies such as China and Japan are also among the top producers and sellers of electric vehicles. Furthermore, China is expected to lead the regional market throughout the forecast period, as the country accounts for the majority of EV demand.

The European electric mobility market is expected to grow at a CAGR of 22.5% percent over the forecast period owing to rapid advancements in the Pan-European battery charging network for BEVs are anticipated to accelerate the adoption of BEVs in European countries. For example, EU member states such as Denmark, France, Ireland, and the Netherlands have taken steps to prohibit the sale of new diesel and gasoline-powered vehicles by 2030. Such initiatives are projected to boost the region's electric mobility sector.

Key Players

Market Segmentation

By Product

By Product

By Battery

By Voltage

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others