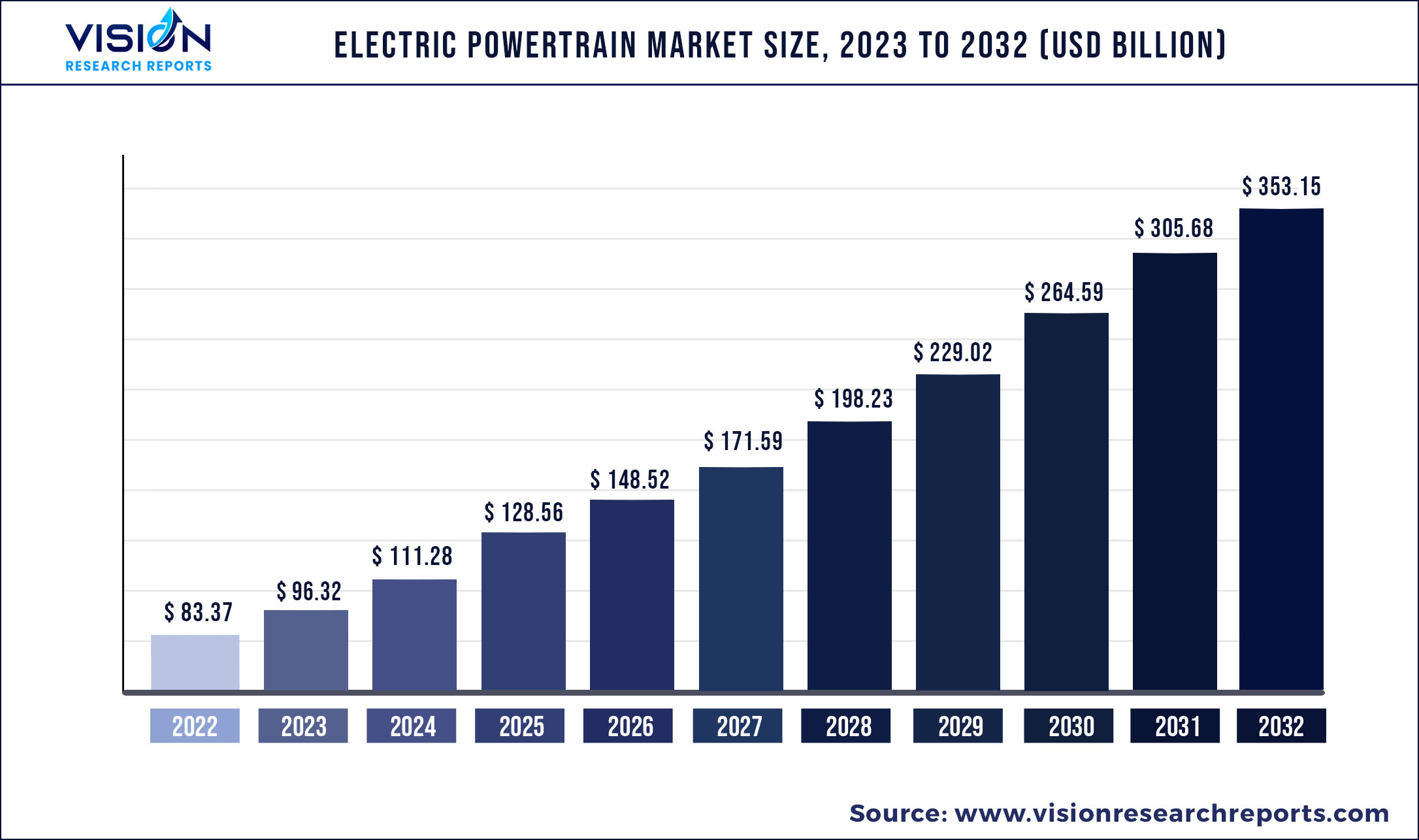

The global electric powertrain market was surpassed at USD 83.37 billion in 2022 and is expected to hit around USD 353.15 billion by 2032, growing at a CAGR of 15.35% from 2023 to 2032.

Key Pointers

Report Scope of the Electric Powertrain Market

| Report Coverage | Details |

| Market Size in 2022 | USD 83.37 billion |

| Revenue Forecast by 2032 | USD 353.15 billion |

| Growth rate from 2023 to 2032 | CAGR of 15.35% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | BorgWarner Inc.; Continental AG; Cummins Inc.; Hitachi Ltd; Magna International Inc.; Marelli Holdings Co., Ltd. |

The COVID-19 pandemic has affected the overall automotive industry, leading to a subsequent decline in the growth of the electric powertrain industry due to low automotive sales and new requirements. However, stringent emission norms by government agencies, such as emission standards for Greenhouse Gas (GHG) emissions by the U.S. Environmental Protection Agency (EPA), BS-VI norms in India, and China VI, are driving the market growth. The post-COVID-19 recovery in the sales of pure and hybrid electric vehicles is a prominent driving factor for the growth of the electric powertrain industry. Moreover, the mass adoption of electric cars and attractive incentives by governments for the domestic production of electric vehicles is also anticipated to boost the demand for electric powertrains globally.

Electric vehicles are the future of the automotive market as traditional fuel vehicles are expected to phase out over the coming years. These vehicles are gaining traction as they provide improved environmental benefits and lower total cost of ownership compared to their internal combustion engine vehicle counterpart. Numerous countries have come up with stringent policies to encourage the adoption of alternative fuel vehicles, including electric vehicles.

In the past decade, the automotive industry comprised of the same internal combustion engine powertrain. However, the industry now is a broad powertrain mix as it has been shifting toward more efficient and environmentally friendly transportation. The automotive powertrain portfolio is diversified and includes many pure electric and hybrid powertrains. Additionally, the overall powertrain landscape is becoming more dynamic and complex with the emergence of electric powertrains.

The growing adoption of electric powertrains can be determined by four factors: infrastructure, regulations, consumer preference, and technology. The penetration of PHEVs and BEVs would strongly determine the future adoption of electric powertrains globally. Regulations for monitoring CO2 emissions are becoming more demanding in the U.S. and Europe.

Europe has set its emission limit to 95 g/km by 2020 and an additional reduction of 37.5% by 2030, resulting in a limit of 59 g/km. Meanwhile, North America has set the emission limit to 99 g/km following Corporate Average Fuel Economy (CAFE) standards for passenger-vehicle till 2025. To efficiently meet emission targets and avoid penalties, OEMs would have to increase the sales of electrified vehicles over the coming years.

Innovations in battery technologies have made electric vehicles more competitive than conventional ICE vehicles by providing an increased range on a single charge. Batteries are an integral part of the electric powertrain system. They constitute a significant portion of the total cost of electric cars, and their cost has reduced significantly due to technological advancements, production process optimization, and economies of scale. With the price expected to decline over the forecast period, EVs are expected to reach a Total Cost Ownership (TCO) parity, paving the way for the mass-market penetration of electric vehicles.

Electric Powertrain Market Segmentations:

| By Electric Vehicle | By BEV Electric Powertrain Component | By HEV/PHEV Electric Powertrain Component |

|

BEV HEV/PHEV |

Motor/Generator Battery Power Electronics Controller Converter Transmission On-Board Charger |

Motor/Generator Battery Power Electronics Controller Converter Transmission On-Board Charger |

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Electric Vehicle Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Electric Powertrain Market

5.1. COVID-19 Landscape: Electric Powertrain Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Electric Powertrain Market, By Electric Vehicle

8.1. Electric Powertrain Market, by Electric Vehicle, 2023-2032

8.1.1 BEV

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. HEV/PHEV

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Electric Powertrain Market, By BEV Electric Powertrain Component

9.1. Electric Powertrain Market, by BEV Electric Powertrain Component, 2023-2032

9.1.1. Motor/Generator

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Battery

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Power Electronics Controller

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Converter

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Transmission

9.1.5.1. Market Revenue and Forecast (2020-2032)

9.1.6. On-Board Charger

9.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Electric Powertrain Market, By HEV/PHEV Electric Powertrain Component

10.1. Electric Powertrain Market, by HEV/PHEV Electric Powertrain Component, 2023-2032

10.1.1. Motor/Generator

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Battery

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Power Electronics Controller

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Converter

10.1.4.1. Market Revenue and Forecast (2020-2032)

10.1.5. Transmission

10.1.5.1. Market Revenue and Forecast (2020-2032)

10.1.6. On-Board Charger

10.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Electric Powertrain Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Electric Vehicle (2020-2032)

11.1.2. Market Revenue and Forecast, by BEV Electric Powertrain Component (2020-2032)

11.1.3. Market Revenue and Forecast, by HEV/PHEV Electric Powertrain Component (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Electric Vehicle (2020-2032)

11.1.4.2. Market Revenue and Forecast, by BEV Electric Powertrain Component (2020-2032)

11.1.4.3. Market Revenue and Forecast, by HEV/PHEV Electric Powertrain Component (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Electric Vehicle (2020-2032)

11.1.5.2. Market Revenue and Forecast, by BEV Electric Powertrain Component (2020-2032)

11.1.5.3. Market Revenue and Forecast, by HEV/PHEV Electric Powertrain Component (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Electric Vehicle (2020-2032)

11.2.2. Market Revenue and Forecast, by BEV Electric Powertrain Component (2020-2032)

11.2.3. Market Revenue and Forecast, by HEV/PHEV Electric Powertrain Component (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Electric Vehicle (2020-2032)

11.2.4.2. Market Revenue and Forecast, by BEV Electric Powertrain Component (2020-2032)

11.2.4.3. Market Revenue and Forecast, by HEV/PHEV Electric Powertrain Component (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Electric Vehicle (2020-2032)

11.2.5.2. Market Revenue and Forecast, by BEV Electric Powertrain Component (2020-2032)

11.2.5.3. Market Revenue and Forecast, by HEV/PHEV Electric Powertrain Component (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Electric Vehicle (2020-2032)

11.2.6.2. Market Revenue and Forecast, by BEV Electric Powertrain Component (2020-2032)

11.2.6.3. Market Revenue and Forecast, by HEV/PHEV Electric Powertrain Component (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Electric Vehicle (2020-2032)

11.2.7.2. Market Revenue and Forecast, by BEV Electric Powertrain Component (2020-2032)

11.2.7.3. Market Revenue and Forecast, by HEV/PHEV Electric Powertrain Component (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Electric Vehicle (2020-2032)

11.3.2. Market Revenue and Forecast, by BEV Electric Powertrain Component (2020-2032)

11.3.3. Market Revenue and Forecast, by HEV/PHEV Electric Powertrain Component (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Electric Vehicle (2020-2032)

11.3.4.2. Market Revenue and Forecast, by BEV Electric Powertrain Component (2020-2032)

11.3.4.3. Market Revenue and Forecast, by HEV/PHEV Electric Powertrain Component (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Electric Vehicle (2020-2032)

11.3.5.2. Market Revenue and Forecast, by BEV Electric Powertrain Component (2020-2032)

11.3.5.3. Market Revenue and Forecast, by HEV/PHEV Electric Powertrain Component (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Electric Vehicle (2020-2032)

11.3.6.2. Market Revenue and Forecast, by BEV Electric Powertrain Component (2020-2032)

11.3.6.3. Market Revenue and Forecast, by HEV/PHEV Electric Powertrain Component (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Electric Vehicle (2020-2032)

11.3.7.2. Market Revenue and Forecast, by BEV Electric Powertrain Component (2020-2032)

11.3.7.3. Market Revenue and Forecast, by HEV/PHEV Electric Powertrain Component (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Electric Vehicle (2020-2032)

11.4.2. Market Revenue and Forecast, by BEV Electric Powertrain Component (2020-2032)

11.4.3. Market Revenue and Forecast, by HEV/PHEV Electric Powertrain Component (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Electric Vehicle (2020-2032)

11.4.4.2. Market Revenue and Forecast, by BEV Electric Powertrain Component (2020-2032)

11.4.4.3. Market Revenue and Forecast, by HEV/PHEV Electric Powertrain Component (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Electric Vehicle (2020-2032)

11.4.5.2. Market Revenue and Forecast, by BEV Electric Powertrain Component (2020-2032)

11.4.5.3. Market Revenue and Forecast, by HEV/PHEV Electric Powertrain Component (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Electric Vehicle (2020-2032)

11.4.6.2. Market Revenue and Forecast, by BEV Electric Powertrain Component (2020-2032)

11.4.6.3. Market Revenue and Forecast, by HEV/PHEV Electric Powertrain Component (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Electric Vehicle (2020-2032)

11.4.7.2. Market Revenue and Forecast, by BEV Electric Powertrain Component (2020-2032)

11.4.7.3. Market Revenue and Forecast, by HEV/PHEV Electric Powertrain Component (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Electric Vehicle (2020-2032)

11.5.2. Market Revenue and Forecast, by BEV Electric Powertrain Component (2020-2032)

11.5.3. Market Revenue and Forecast, by HEV/PHEV Electric Powertrain Component (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Electric Vehicle (2020-2032)

11.5.4.2. Market Revenue and Forecast, by BEV Electric Powertrain Component (2020-2032)

11.5.4.3. Market Revenue and Forecast, by HEV/PHEV Electric Powertrain Component (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Electric Vehicle (2020-2032)

11.5.5.2. Market Revenue and Forecast, by BEV Electric Powertrain Component (2020-2032)

11.5.5.3. Market Revenue and Forecast, by HEV/PHEV Electric Powertrain Component (2020-2032)

Chapter 12. Company Profiles

12.1. BorgWarner Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Continental AG

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Cummins Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Hitachi Ltd

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Magna International Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Marelli Holdings Co., Ltd.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others