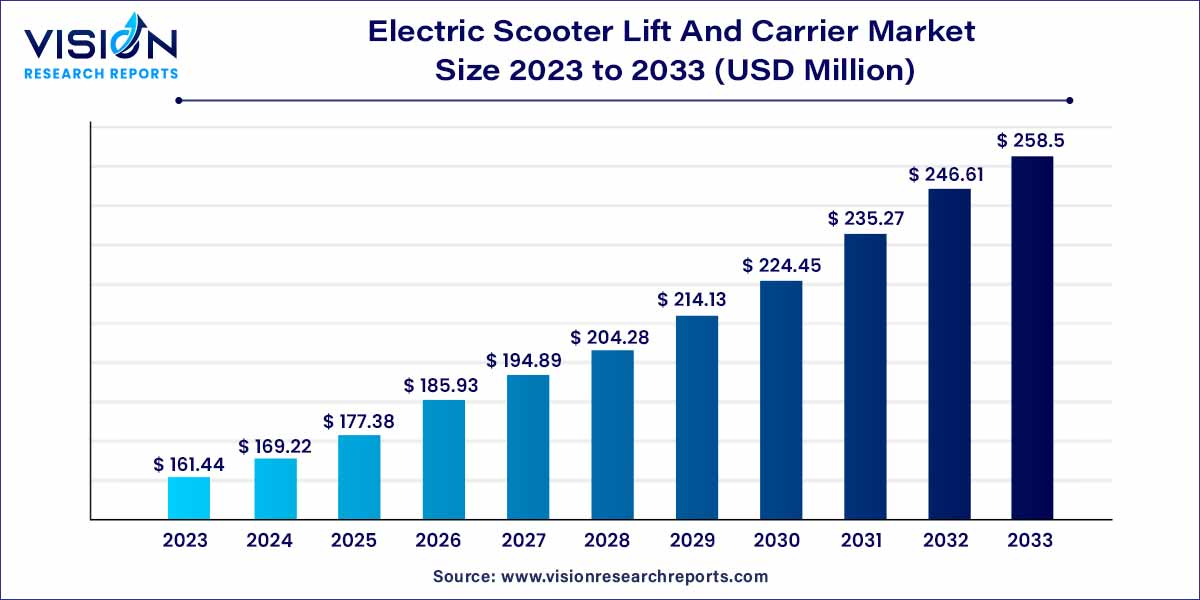

The global electric scooter lift and carrier market size was estimated at around USD 161.44 million in 2023 and it is projected to hit around USD 258.5 million by 2033, growing at a CAGR of 4.82% from 2024 to 2033. A vehicle mobility lift is a piece of equipment that makes it easier for people with physical disabilities to travel long distances with their wheelchairs or scooters. In addition, lifts are fastened to the car's body.

The electric scooter lift and carrier market have witnessed significant traction in recent years, propelled by the increasing adoption of electric scooters as a sustainable and efficient mode of urban transportation. This overview aims to provide a comprehensive snapshot of the market's landscape, encompassing key drivers, challenges, and opportunities shaping its trajectory.

The burgeoning growth of the electric scooter lift and carrier market can be attributed to several key factors. Firstly, the escalating popularity of electric scooters as a sustainable and convenient mode of urban transportation has propelled the demand for complementary accessories, including efficient lift and carrier systems. Urbanization trends further contribute to this growth, with the increasing need for compact and maneuverable solutions in densely populated areas. Government initiatives promoting sustainable transportation solutions and providing incentives for electric scooter adoption create a favorable environment for market expansion. Additionally, the continuous evolution of technology in lift and carrier systems presents opportunities for innovation, fostering enhanced functionality and user-friendly designs. As the global market for electric scooters continues to mature, manufacturers are poised to capitalize on these growth factors, driving the sustained expansion of the Electric Scooter Lift and Carrier market.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 4.82% |

| Market Revenue by 2033 | USD 258.5 million |

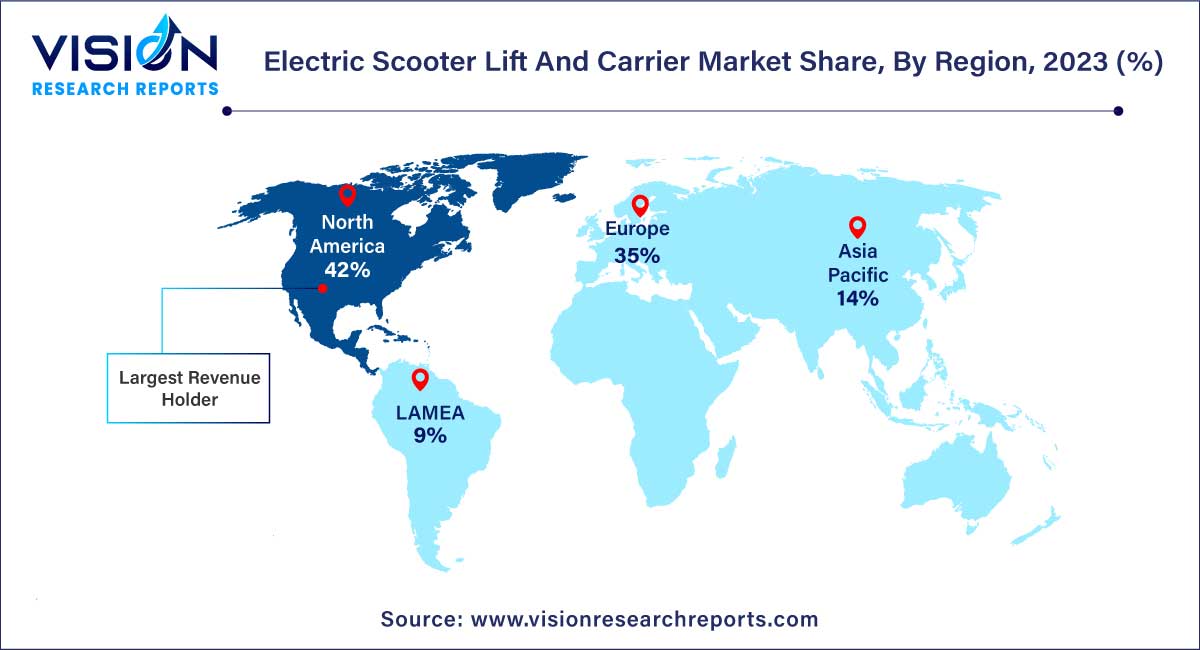

| Revenue Share of North America in 2023 | 42% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Increasing Adoption of Electric Scooters:

The primary driver for the electric scooter lift and carrier market is the widespread adoption of electric scooters as a preferred means of urban transportation. The heightened awareness of environmental sustainability and the need for convenient commuting options contribute significantly to the growing demand for electric scooters, consequently propelling the market for compatible lift and carrier solutions.

Urbanization and Compact Mobility Needs:

The ongoing global trend towards urbanization has intensified the demand for compact and easily maneuverable transportation solutions. Electric scooter lift and carrier systems address this need by enhancing the portability and accessibility of electric scooters, especially in densely populated urban environments where space is a premium.

Compatibility Challenges:

A notable restraint in the electric scooter lift and carrier market is the inherent difficulty in ensuring seamless compatibility between diverse electric scooter models and lift/carrier systems. The varied designs, sizes, and specifications of electric scooters pose a challenge for manufacturers to develop universally compatible solutions, hindering the ease of integration and adoption.

Regulatory Compliance Complexity:

The adherence to diverse and evolving regulations related to the transportation of electric scooters presents a significant challenge. Navigating through the intricate web of compliance requirements across different regions demands meticulous attention, potentially impeding the market's growth as manufacturers grapple with varying standards and specifications.

Global Market Expansion:

The global surge in electric scooter adoption creates significant opportunities for market expansion, particularly in regions where the trend is in its early stages. Manufacturers can capitalize on this by strategically entering new markets, tailoring their products to regional preferences and regulations. This geographical diversification not only fosters increased sales but also strengthens brand presence on a global scale.

Collaboration and Partnerships:

Opportunities abound for collaboration and partnerships within the electric scooter ecosystem. By forging alliances with electric scooter manufacturers or urban mobility service providers, lift and carrier system manufacturers can create integrated solutions that cater to a broader customer base. Synergistic partnerships can lead to the development of comprehensive and efficient mobility solutions, unlocking new business opportunities.

The exterior segment accounted for the largest revenue share of 65% in 2023 and is expected to expand at the fastest CAGR over the forecast period. This growth is attributed to the benefits offered by the equipment, such as saving boot space. For smaller cars and sedans, electric scooter lifts and carriers have to be hitch-mounted on the rear of the vehicle. However, such exterior systems are suspended directly for carrying small-sized scooters or rested on a platform installed externally for carrying larger scooters.

The interior segment is projected to witness significant growth over the forecast period owing to the safety provided by these tools against the risks involved in transporting the scooter externally, as a failure in the lift component can considerably damage the mobility scooter or wheelchair. These types of systems are usually preferred for large-sized cars, such as SUVs and cars having more boot space.

North America dominated the market with the largest revenue share of 42% in 2023 and is expected to expand at the fastest CAGR over the forecast period. The prominent players in the electric scooter lift and carrier market based in North America are working on developing advanced products to maintain their dominance across the world.

In October 2021, Harmar Mobility was honored for Highlander II, in HME Business’s 2021 New Product Award competition. Highlander II is a new generation vertical platform lift(VPL) equipment with updated designs and advanced technology. The new technologies incorporated in the Highlander II have increased ease of operation, enhanced reliability, and reduced the number of potential visits.

Additionally, there are stringent regulatory guidelines pertaining to the production, transportation, and handling of electric scooters, which are governed by the Department of Transportation (DoT) and local bodies in the U.S. Thus, to comply with the rules and regulations of handling and transportation of electric scooters there is an increase in the demand of the electric scooter lift and carriers in the region.

Europe is expected to witness significant growth in the market during the forecast period. The increasing demand for electric scooters in the region is fueling the adoption of lifting equipment in the market. The high demand for electric scooters is due to government policies to combat air combustion and the growing trend of rental-sharing services in the region.

The key manufacturers of the electric scooter market based in Europe are providing an extensive range of rental electric scooters at minimal prices. The rental electric scooter has eliminated the total cost of the ownership and maintenance cost which makes it the most viable option for transport, thus they are widely preferred over other electric alternatives in the market. Increasing demand for electric vehicles has cascading effects on the sales of electric scooters and lift & carriers in the market.

Elektra, a Chennai-based company, created a wheelchair lift in August 2020 to enable accessibility for bus travel. The "Elektra" step lift is a product designed specifically for municipal buses. It can be mounted at the bus's side entry, occupying the area formerly occupied by the access steps.

Harmar purchased Pride Mobility Products Corp.'s lifts and ramps division in January 2019. Pride Mobility further focused its efforts on producing consumer-focused mobility goods in its lift chair, power chair, and scooter product lines.

By Type

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Electric Scooter Lift And Carrier Market

5.1. COVID-19 Landscape: Electric Scooter Lift And Carrier Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Electric Scooter Lift And Carrier Market, By Type

8.1.Electric Scooter Lift And Carrier Market, by Type Type, 2024-2033

8.1.1. Interior

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Platform lift

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Crane style lift

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Exterior

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Outside and hitch mount lifts

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Wheeled lifts

8.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Electric Scooter Lift And Carrier Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by Type (2021-2033)

9.1.2. U.S.

9.1.2.1. Market Revenue and Forecast, by Type (2021-2033)

9.1.3. Rest of North America

9.1.3.1. Market Revenue and Forecast, by Type (2021-2033)

9.2. Europe

9.2.1. Market Revenue and Forecast, by Type (2021-2033)

9.2.2. UK

9.2.2.1. Market Revenue and Forecast, by Type (2021-2033)

9.2.3. Germany

9.2.3.1. Market Revenue and Forecast, by Type (2021-2033)

9.2.4. France

9.2.4.1. Market Revenue and Forecast, by Type (2021-2033)

9.2.5. Rest of Europe

9.2.5.1. Market Revenue and Forecast, by Type (2021-2033)

9.3. APAC

9.3.1. Market Revenue and Forecast, by Type (2021-2033)

9.3.2. India

9.3.2.1. Market Revenue and Forecast, by Type (2021-2033)

9.3.3. China

9.3.3.1. Market Revenue and Forecast, by Type (2021-2033)

9.3.4. Japan

9.3.4.1. Market Revenue and Forecast, by Type (2021-2033)

9.3.5. Rest of APAC

9.3.5.1. Market Revenue and Forecast, by Type (2021-2033)

9.4. MEA

9.4.1. Market Revenue and Forecast, by Type (2021-2033)

9.4.2. GCC

9.4.2.1. Market Revenue and Forecast, by Type (2021-2033)

9.4.3. North Africa

9.4.3.1. Market Revenue and Forecast, by Type (2021-2033)

9.4.4. South Africa

9.4.4.1. Market Revenue and Forecast, by Type (2021-2033)

9.4.5. Rest of MEA

9.4.5.1. Market Revenue and Forecast, by Type (2021-2033)

9.5. Latin America

9.5.1. Market Revenue and Forecast, by Type (2021-2033)

9.5.2. Brazil

9.5.2.1. Market Revenue and Forecast, by Type (2021-2033)

9.5.3. Rest of LATAM

9.5.3.1. Market Revenue and Forecast, by Type (2021-2033)

Chapter 10. Company Profiles

10.1. Bruno Independent Living Aids, Inc.

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2. Harmar

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3. Pride Mobility Products Corp.

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4. EZ Carrier USA.

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5. Magneta Trailers Inc

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

Chapter 11. Research Methodology

11.1. Primary Research

11.2. Secondary Research

11.3. Assumptions

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others