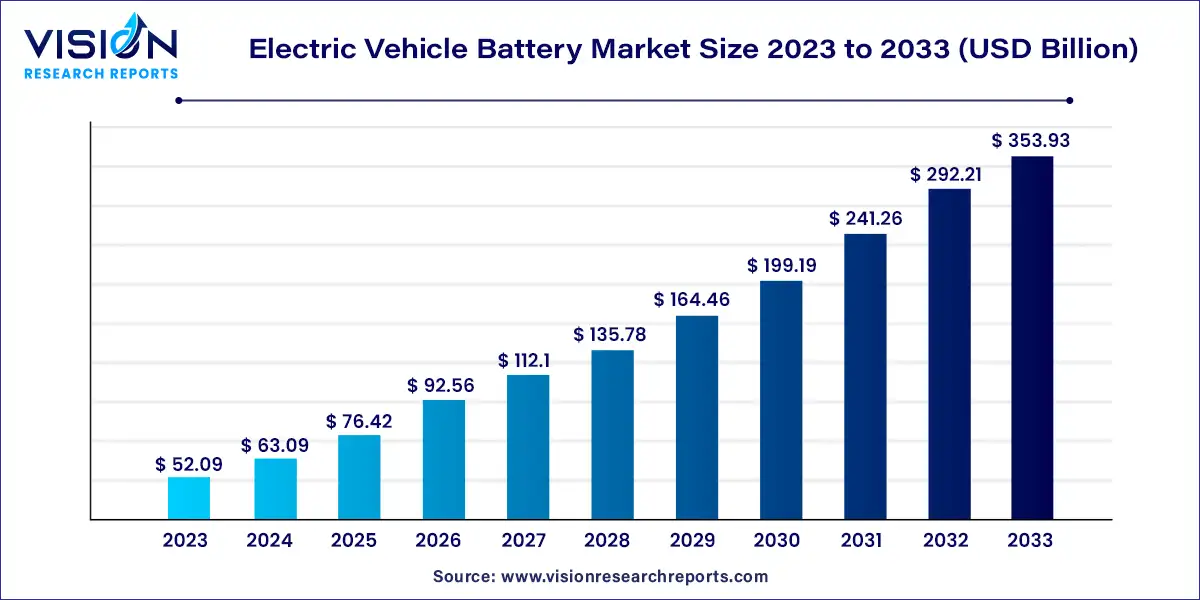

The global electric vehicle battery market was surpassed at USD 52.09 billion in 2023 and is expected to hit around USD 353.93 billion by 2033, growing at a CAGR of 21.12% from 2024 to 2033.

The electric vehicle (EV) battery market is experiencing significant growth and transformation in recent years. With increasing concerns about environmental sustainability and the push towards reducing carbon emissions, electric vehicles have emerged as a promising solution in the automotive industry.

The growth of the electric vehicle (EV) battery market is propelled by several key factors. Firstly, stringent emissions regulations worldwide are driving the transition towards cleaner transportation solutions, spurring increased demand for EVs and their associated batteries. Secondly, continuous advancements in battery technology, including improvements in energy density and charging capabilities, are enhancing the performance and range of electric vehicles, making them more appealing to consumers. Thirdly, the expansion of charging infrastructure is alleviating range anxiety and bolstering consumer confidence in EVs, thereby supporting market growth. Additionally, ongoing efforts to reduce the cost of EV batteries through economies of scale and manufacturing efficiencies are making electric vehicles more affordable and accessible to a broader audience. Lastly, growing environmental consciousness among consumers is fueling demand for cleaner transportation alternatives, further driving the uptake of electric vehicles and their batteries. Together, these factors are contributing to the rapid growth and evolution of the electric vehicle battery market, positioning it as a key driver of the automotive industry's electrification efforts.

The lithium-ion battery segment dominated the market, accounting for over 67% of the global revenue in 2023. This segment is projected to experience the highest compound annual growth rate (CAGR) during the forecast period. The widespread adoption of lithium-ion batteries in electric vehicles is attributed to their numerous benefits. Compared to lead-acid batteries, they are up to 60% lighter and boast higher energy density, enabling the use of smaller and more space-efficient battery packs. Lithium-ion batteries also excel in efficiency, with the ability to achieve a full charge in just one to three hours, making them the preferred choice for electric vehicle manufacturers. Consequently, there has been a rapid surge in the adoption of lithium-ion batteries in electric vehicles.

The "others" segment, encompassing solid-state batteries, nickel-metal hydride, and sodium-ion batteries, is expected to witness significant growth during the forecast period. The heightened focus of various automobile manufacturers on developing electric vehicles with solid-state battery technology is anticipated to drive growth in this segment. For instance, in February 2023, Nissan Motor Corp., an automobile manufacturer, announced plans to introduce its first electric car equipped with a solid-state battery in 2028. The company is progressing in solid-state battery development, aiming to commence pilot production by 2025. Initial technology engineering is projected to be finalized by 2026, with the first mass-produced electric vehicle utilizing this technology slated for availability by 2028.

The battery electric vehicle (BEV) segment emerged as the market leader, commanding over 72% of the global revenue in 2023. This segment is poised to maintain its dominance, with the highest projected compound annual growth rate (CAGR) during the forecast period. BEVs are distinguished by their reliance solely on rechargeable battery packs, devoid of any gasoline engine. The surging preference for removable and rechargeable EV batteries stems from supportive government policies targeting net-zero emissions and escalating consumer interest in BEVs. These batteries offer multiple reuses, curbing waste and extending their lifespan, pivotal in achieving a zero-carbon footprint.

On the other hand, the plug-in hybrid electric vehicle (PHEV) segment is anticipated to register significant growth over the forecast period. PHEVs integrate batteries with an alternative fuel source, such as diesel or gasoline, to power internal combustion engines or other propulsion systems alongside an electric motor. While passenger cars represent a considerable portion of PHEVs, they are also available across diverse commercial and utility categories, spanning buses, vans, motorbikes, trucks, trains, and military vehicles. The current PHEV market features numerous light-duty models, with medium-duty variants gradually infiltrating the global market landscape.

In 2023, the passenger cars segment commanded a share of over 41% in the market. The segment's growth is driven by the rising sales of electric passenger cars, including sedans, hatchbacks, SUVs, and other variants like XUVs, station wagons, and minivans. According to the International Energy Agency (IEA), the electric passenger car market is experiencing remarkable growth, with sales surpassing 10 million in 2023. The momentum is expected to continue, with robust sales projected through 2023. Notably, the first quarter of the current year witnessed sales exceeding 2.3 million electric cars, marking a growth of approximately 25% compared to the same period in 2023.

Meanwhile, the two-wheelers segment is forecasted to exhibit the highest compound annual growth rate (CAGR) over the forecast period. This segment stands as one of the most electrified market segments, particularly in developing economies and emerging markets where two-wheelers outnumber cars. For instance, India, with its substantial two-wheeler market, ranks among the leading countries advocating for electric two-wheelers, bolstered by support from both national and local governments.

On the other hand, the commercial light-duty vehicle segment is expected to register the second-highest CAGR during the forecast period. The electrification of commercial light-duty vehicle stock is on the rise, with global sales of electric light commercial vehicles (LCVs) witnessing a surge of over 90% in 2023, exceeding 310,000 vehicles.

In 2023, the Asia Pacific region asserted its dominance in the market, capturing over a 52% share of the global revenue. This region is poised to maintain its leadership position, with the highest projected compound annual growth rate (CAGR) during the forecast period. Countries in the Asia Pacific, notably China, India, and South Korea, have witnessed a surge in product demand in tandem with the increasing preference for electric vehicles. China, in particular, boasts a concentrated battery market due to its low maintenance and labor costs, which significantly contribute to regional market growth. Additionally, the presence of key product manufacturers such as Contemporary Amperex Technology Co., Ltd. (CATL), LG Energy Solution, BYD Company Ltd., Panasonic Corp., and Samsung SDI Co., Ltd., further bolsters market expansion in the region.

Meanwhile, Europe and North America have experienced a rapid rise in EV battery demand, propelled by increasing electric car sales. Several prominent electric vehicle manufacturers, including Ford Motor Company, Bayerische Motoren Werke AG, and Tesla Motor Inc., are headquartered in the U.S. and Germany. Consequently, these countries have taken the lead in both the production and sale of electric vehicle batteries. Moreover, the heightened focus on electric car development has intensified competition among market players to deliver enhanced and cost-effective solutions. This intense market competition augurs well for continued market growth.

By Battery Type

By Propulsion Type

By Vehicle Type

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others