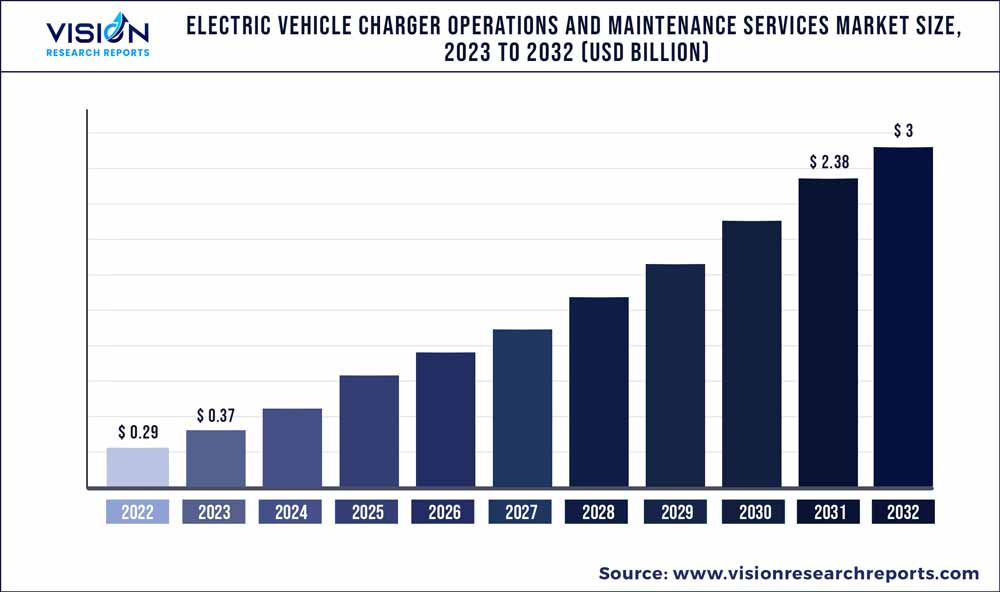

The global electric vehicle charger operations and maintenance services market was estimated at USD 0.29 billion in 2022 and it is expected to surpass around USD 3 billion by 2032, poised to grow at a CAGR of 26.34% from 2023 to 2032. The electric vehicle charger operations and maintenance services market in the United States was accounted for USD 72.9 million in 2022.

Key Pointers

Report Scope of the Electric Vehicle Charger Operations And Maintenance Services Market

| Report Coverage | Details |

| Revenue Share of Asia Pacific in 2022 | 40% |

| Revenue Forecast by 2032 | USD 3 billion |

| Growth Rate from 2023 to 2032 | CAGR of 26.34% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | ChargerPoint, Inc.; ABB; bp pulse; EVA Global; SEAM Group; Chargerhelp!; BTC Power; eFaraday; Pearce Renewables; Vital EV Solutions |

The rapid adoption of Electric Vehicles (EVs) worldwide is expected to drive the market growth. As the number of EVson the roads continues to increase, the demand for charging infrastructure and maintenance services also rises. This trend is fueled by government incentives and initiatives to promote electric mobility and reduce Greenhouse Gas (GHG) emissions. Moreover, advancements in charging technology are driving the market forward.

Innovations, such as fast charging, wireless charging, and smart charging solutions, are enhancing the convenience and efficiency of charging EVs. These technological advancements are attracting consumers and encouraging the expansion of charging networks, leading to an increased demand for operations and maintenance services. Furthermore, the market is driven by the need for reliable and efficient charging infrastructure. EV owners rely on charging stations for their daily commuting and long-distance travel, and they expect a seamless charging experience. Therefore, the maintenance and upkeep of charging stations are crucial to ensure their proper functioning and availability.

Service providers play a vital role in ensuring that charging infrastructure is well-maintained, minimizing downtime, and maximizing customer satisfaction. In addition, the focus on sustainability and environmental consciousness is propelling the growth market. Governments, organizations, and individuals are increasingly embracing clean energy solutions, including EVs, as part of their efforts to reduce carbon footprints. As a result, there is a growing emphasis on maintaining and expanding charging infrastructure to support the widespread adoption of EVs and promote sustainable transportation.

The increasing complexity of charging infrastructure is also driving the demand for specialized operations and maintenance services. EV charging networks are becoming more intricate, incorporating multiple charging standards, payment systems, and data management platforms. Service providers with expertise in managing and maintaining such complex networks are essential to ensure seamless operations and optimize the charging experience for EV users. In addition, these specialized operations and maintenance services contribute to the overall growth and sustainability of the EV industry by promoting reliability, efficiency, and customer satisfaction.

However, the market is restrained by the lack of standardized charging infrastructure. The industry currently lacks uniformity in terms of charging standards, connectors, and protocols, which can create challenges for service providers and users alike. This lack of standardization poses barriers to interoperability and hinders the seamless operation and maintenance of charging stations. To overcome this challenge, industry stakeholders, including governments, manufacturers, and service providers, need to work collaboratively to establish protocols and common standards for charging infrastructure. Developing standardized solutions will enhance compatibility, reduce costs, and enable efficient operations and maintenance services across different charging networks.

Charger Type Insights

The level 2 segment dominated the market in 2022 and accounted for a revenue share of more than 53%. Level 2 chargers offer a balance between charging speed and affordability, making them a popular choice for both residential and commercial applications. They provide a significant improvement over standard Level 1 chargers in terms of charging time, allowing for faster and more convenient charging of electric vehicles. Moreover, Level 2 chargers are versatile and compatible with a wide range of EVs, making them suitable for widespread adoption.

The level 3 segment is anticipated to register significant growth over the forecast period. Level 3 chargers, also known as DC fast chargers, offer significantly faster charging times compared to Level 2 chargers. They can provide a substantial amount of power to EVs, enabling them to charge at a much higher rate. This feature particularly appeals to EV owners who require quick and convenient charging options, such as those on long road trips or in busy urban areas.

Installation Insights

The private installation segment dominated the market in 2022 and accounted for a revenue share of more than 70%. Private installations cater to the charging needs of individual EV owners, residential complexes, commercial establishments, and private parking facilities. These private installations offer the convenience and accessibility of charging at home or within private premises, eliminating the need for owners to rely solely on public charging infrastructure. Moreover, private installations provide more control and flexibility over charging operations, allowing users to customize their charging experience according to their specific requirements.

The public segment is anticipated to register significant growth over the forecast period. The increasing adoption of EVs has led to a growing demand for public charging infrastructure to cater to the charging needs of EV owners who do not have access to private installations. Public installations provide a convenient and accessible charging solution for owners away from home or in public areas, such as shopping malls, parking lots, and roadside stations. Moreover, the expansion of public charging networks by government authorities, utility companies, and other stakeholders plays a crucial role in driving the growth of the public segment.

Application Insights

The commercial segment dominated the market in 2022 and accounted for a revenue share of over 91%. Businesses and organizations are increasingly adopting EVs for their fleet operations as part of their sustainability initiatives and to reduce carbon emissions. This has led to a surge in demand for charging infrastructure in commercial settings, such as office complexes, parking lots, and logistics centers. Furthermore, commercial establishments often require more charging stations to accommodate the charging needs of their EV fleet or their employees' vehicles. As a result, installing and maintaining EV chargers in commercial settings have become crucial to ensure uninterrupted charging services and efficient fleet management.

The residential segment is anticipated to register significant growth. The increasing adoption of EVs among homeowners drives the demand for residential charging infrastructure. As more individuals choose to own electric vehicles, they require convenient and accessible home charging solutions. This has led to a surge in the installation of residential charging stations, allowing EV owners to conveniently charge their vehicles overnight or during periods of low electricity demand. Moreover, government incentives and policies promoting the installation of residential charging infrastructure have further accelerated the growth of this segment.

End-use Insights

The commercial segment dominated the market in 2022 and accounted for a global revenue share of more than 20%. Commercial entities often have a larger number of vehicles than individual consumers, making it essential for them to have efficient and reliable charging solutions to meet their operational needs. Moreover, the commercial segment benefits from economies of scale, as multiple EVs can be charged simultaneously, making it a cost-effective solution for businesses. This scalability and efficiency contribute to the dominance of the commercial segment in the market.

The retail segment is anticipated to register significant growth over the forecast period. The retail industry is increasingly recognizing the importance of providing convenient charging solutions for customers who own EVs. Retail establishments, such as shopping malls, supermarkets, and convenience stores strategically install charging stations in their parking lots to attract and retain customers. These charging facilities offer convenience to EV owners and serve as an additional service that enhances the overall customer experience.

Regional Insights

Asia Pacific dominated the market in 2022 and accounted for a share of more than 40% of the overall revenue. The Asia Pacific region is experiencing rapid growth in EV adoption, driven by supportive government policies, incentives, and a strong commitment to reducing carbon emissions. Countries like China, Japan, and South Korea have invested significantly in EV charging infrastructure, creating a robust ecosystem for EV owners. This widespread adoption has created a high demand for charger operations and maintenance services in the region. The North America regional market is anticipated to emerge at a significant CAGR from 2023 to 2032.

North America has seen a substantial increase in the adoption of EVs, driven by government initiatives, environmental regulations, and consumer demand for sustainable transportation options. This surge in EV ownership has created a need for robust charging infrastructure and reliable maintenance services, fueling regional market growth. In addition, North America’s supportive regulatory framework and incentives have encouraged the development of charging infrastructure, making it more accessible for EV owners. This favorable environment has attracted investments and spurred the expansion of charger operations & maintenance services in the region.

Electric Vehicle Charger Operations And Maintenance Services Market Segmentations:

By Charger Type

By Installation

By Application

By End-use

By Regional

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others