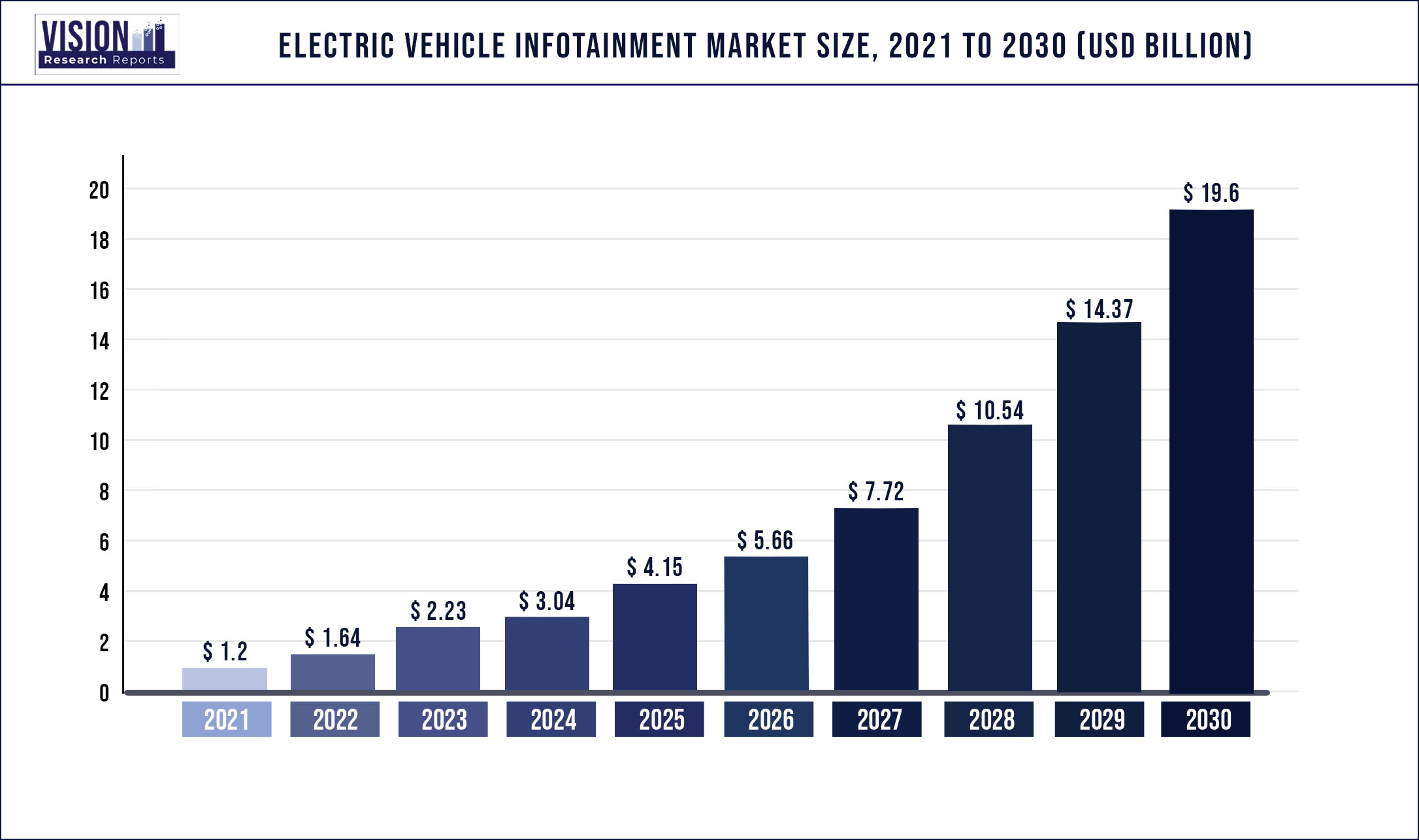

The global electric vehicle infotainment market size was estimated at around USD 1.2 billion in 2021 and it is projected to hit around USD 19.6 billion by 2030, growing at a CAGR of 36.39% from 2022 to 2030.

EV infotainment systems offer components such as video/audio entertainment, navigation, call control, climate control, apps, and connectivity features, bringing digital life on the road. The market is witnessing high growth owing to new connectivity features based on smartphones, Bluetooth, and wired & wireless technologies at low cost. The increasing connectivity capability in the infotainment system is enabling end-users to access basic features such as navigation and calling easily. The rising uptake of EVs in mid to high-end segment cars is also driving the market growth.

The integration of cloud technology in the infotainment system is also creating avenues for market growth. The integration of cloud technology in cars can update traffic data and maps, helping prevent road accidents. Electric cars exchange data to provide real-time traffic information and weather condition for safe and easy navigation through real-time maps. The use of cloud technology enables secure, alert, and comfortable driving. Additionally, manufacturers are paying attention to designing details of the infotainment system to match the aesthetics of the vehicles. Thus, driving the growth of the electric vehicle infotainment market. Technological advancements in heads-up, rear-seat entertainment, and dashboard infotainment systems are gaining traction among manufacturers and end-users.

Electric vehicles are becoming more interactive in terms of information exchange and entertainment systems. For this purpose, many manufacturers are installing high-definition screens of various sizes. For, Tesla’s Model 3 and Model Y has a 15-inch infotainment screen. The specification of these screens enables the driver to view and operate the infotainment system with efficiency and effectiveness without much strain on the driver’s eyes. With the growing emphasis on passenger safety, automotive manufacturers are also integrating Advanced Driver Assistance Systems (ADAS) and Digital Monitoring Systems (DMS) are being connected with the infotainment system in EVs. These technological advancements are creating new growth opportunities for infotainment manufacturers.

The wireless connection segment holds the highest market share in 2021. As the use of smartphones grows, so does the need for network access. The use of smartphones to connect to the internet has enabled wireless communication and cellular connection for infotainment because of the high-speed connection and ease of use, electric vehicle infotainment systems are gaining popularity. The Wireless connectivity's global expansion enables EV infotainment to give a smooth driving experience while moving the market forward growth.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 1.2 billion |

| Revenue Forecast by 2030 | USD 19.6 billion |

| Growth rate from 2022 to 2030 | CAGR of 36.39% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | System type, connectivity type, end-use, region |

| Companies Covered | Alpine Electronics, Inc., Continental AG, DENSO Corporation, Harman International Industries Inc., Panasonic Corporation, Pioneer Corporation, Airbiquity Inc., AISIN SEIKI Co., Ltd., Clarion Corporation of America, JVC KENWOOD, Garmin Ltd., Audi AG, General Motors Corp., Ford Motor Company |

System Type Insights

Based on system type, the EV infotainment market is segmented into multimedia systems, heads-up systems, navigation systems, driver safety, communication system, and rear system entertainment system. The multimedia infotainment system is projected to show significant growth during the forecast period, with the highest market share of 55.69 %in 2021. The multimedia infotainment system enables the driver to access features such as navigation system, calling, and music. Multimedia infotainment is also popular as it includes basic to some high-end functions and is compatible with low to high-end segment cars.

The heads-up display system is expected to register the highest CAGR of 46.6% in the forecast period. The heads-up display presents the information at the driver’s line of sight on the windshield. Using projection systems and mirrors to display navigation, road speed, warning message, and call information. The heads-up display enables the driver to operate the machine with reduced fatigue enhancing the driver’s alertness with respect to the outside environment. These are the major growth drivers for the adoption of heads-up displays.

Connectivity Insights

EV vehicle infotainment system can be categorized into Bluetooth, cellular, wireless, and wired connectivity based on connectivity type. The wireless connectivity segment has the highest market share of 41.07% in 2021 and the highest CAGR of 39.5% from 2022 to 2030. As the penetration of smartphones increases, network connectivity is also becoming stronger to cater to the growing connectivity functionalities of smartphones. The internet connection through smartphones has enabled wireless and cellular infotainment connectivity. Wireless and cellular connectivity in EV infotainment systems is gaining traction due to high-speed connection and high data transfer speed. The internet connection-based wireless technology facilitates cloud data transfer in an advanced infotainment system. The expanding reach of wireless connectivity worldwide enables EV infotainment systems to provide a seamless driving experience while propelling market growth.

Bluetooth connectivity is the most common option available in infotainment systems due to its low cost. However, the data transfer on Bluetooth is comparatively slow than cellular, wireless, and wired connectivity.

End-Use Insight

The electric vehicle infotainment market is bifurcated into two end-use types - battery electric vehicle and hybrid electric vehicle. The battery electric vehicle will dominate the end-use market with a share of 66.63% of the overall market in 2021. The rising carbon emission and increasing calls for alternative fuel options led to the adoption of battery electric vehicles. The government initiatives such as subsidies are also leading to the adoption of electric vehicles. The integration of technologies such as cloud, AI, and IoT, along with increased screen size, in battery electric vehicles is leading to the adoption of digital infotainment systems. Moreover, the rising popularity of rear-seat entertainment systems in a battery electric vehicle is also driving the market growth.

The HEV segment is expected to expand at a CAGR of over 39.3 % within the forecast period. The utility of infotainment system in commercial vehicles is generally for navigation, tracking and communication. However, advanced infotainment system in commercial vehicles will enable the drivers to navigate the routes effectivity with the help of real-time traffic intel and maps. These factors will help expand the market share of commercial vehicle types for EV infotainment system.

Regional Insight

Based on the regional segment, the European region has the highest market share of 46.44% in 2021. The EV infotainment market growth in the European region is attributed to the presence of major automotive manufacturers, availability of manpower, and technological innovations. The rising demand for EVs in the region, along with stringent emission norms mandated by the authorities, is also a major factor in the market growth.

The rest of the market regions in the world are expected to expand at a CAGR of 53.9% within the forecast period. In the Asia Pacific and North America, the increased disposable income, availability of EV infrastructure, higher ownership of cars, and integration of infotainment with ADAS system and cloud are driving the market demand. The Latin America market segment is also expanding owing to the increasing demand for electric vehicle infotainment. The availability of 4G and 5G networks in the region, decreased data tariff rate, and increasing popularity of EV vehicles is driving the market.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Electric Vehicle Infotainment Market

5.1. COVID-19 Landscape: Electric Vehicle Infotainment Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Electric Vehicle Infotainment Market, By System Type

8.1. Electric Vehicle Infotainment Market, by System Type, 2022-2030

8.1.1 Multimedia

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Heads-up Display

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Navigation Unit

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Communication Unit

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. Rear Seat Entertainment

8.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Electric Vehicle Infotainment Market, By Connectivity Type

9.1. Electric Vehicle Infotainment Market, by Connectivity Type, 2022-2030

9.1.1. Bluetooth

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Cellular

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Wireless

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Wired Connectivity

9.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Electric Vehicle Infotainment Market, By End-User

10.1. Electric Vehicle Infotainment Market, by End-User, 2022-2030

10.1.1. BEV

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. HEV

10.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Electric Vehicle Infotainment Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by System Type (2017-2030)

11.1.2. Market Revenue and Forecast, by Connectivity Type (2017-2030)

11.1.3. Market Revenue and Forecast, by End-User (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by System Type (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Connectivity Type (2017-2030)

11.1.4.3. Market Revenue and Forecast, by End-User (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by System Type (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Connectivity Type (2017-2030)

11.1.5.3. Market Revenue and Forecast, by End-User (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by System Type (2017-2030)

11.2.2. Market Revenue and Forecast, by Connectivity Type (2017-2030)

11.2.3. Market Revenue and Forecast, by End-User (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by System Type (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Connectivity Type (2017-2030)

11.2.4.3. Market Revenue and Forecast, by End-User (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by System Type (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Connectivity Type (2017-2030)

11.2.5.3. Market Revenue and Forecast, by End-User (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by System Type (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Connectivity Type (2017-2030)

11.2.6.3. Market Revenue and Forecast, by End-User (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by System Type (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Connectivity Type (2017-2030)

11.2.7.3. Market Revenue and Forecast, by End-User (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by System Type (2017-2030)

11.3.2. Market Revenue and Forecast, by Connectivity Type (2017-2030)

11.3.3. Market Revenue and Forecast, by End-User (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by System Type (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Connectivity Type (2017-2030)

11.3.4.3. Market Revenue and Forecast, by End-User (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by System Type (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Connectivity Type (2017-2030)

11.3.5.3. Market Revenue and Forecast, by End-User (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by System Type (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Connectivity Type (2017-2030)

11.3.6.3. Market Revenue and Forecast, by End-User (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by System Type (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Connectivity Type (2017-2030)

11.3.7.3. Market Revenue and Forecast, by End-User (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by System Type (2017-2030)

11.4.2. Market Revenue and Forecast, by Connectivity Type (2017-2030)

11.4.3. Market Revenue and Forecast, by End-User (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by System Type (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Connectivity Type (2017-2030)

11.4.4.3. Market Revenue and Forecast, by End-User (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by System Type (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Connectivity Type (2017-2030)

11.4.5.3. Market Revenue and Forecast, by End-User (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by System Type (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Connectivity Type (2017-2030)

11.4.6.3. Market Revenue and Forecast, by End-User (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by System Type (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Connectivity Type (2017-2030)

11.4.7.3. Market Revenue and Forecast, by End-User (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by System Type (2017-2030)

11.5.2. Market Revenue and Forecast, by Connectivity Type (2017-2030)

11.5.3. Market Revenue and Forecast, by End-User (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by System Type (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Connectivity Type (2017-2030)

11.5.4.3. Market Revenue and Forecast, by End-User (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by System Type (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Connectivity Type (2017-2030)

11.5.5.3. Market Revenue and Forecast, by End-User (2017-2030)

Chapter 12. Company Profiles

12.1. Alpine Electronics

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Continental AG

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. DENSO Corporation

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Harman International Industries Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Panasonic Corporation

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others