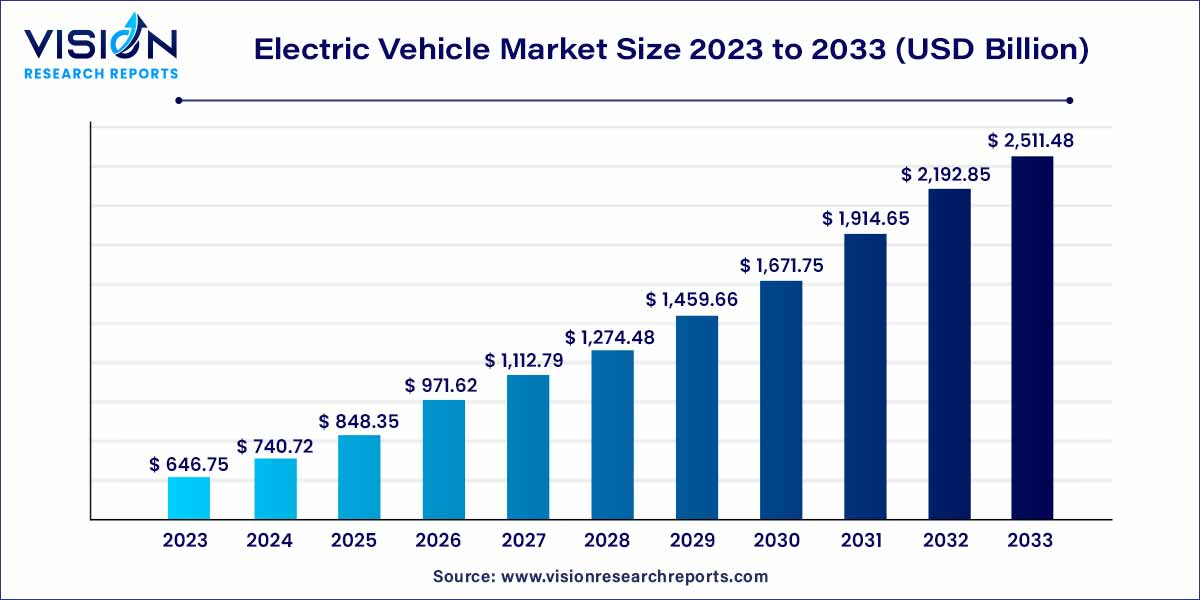

The global electric vehicle market size was estimated at around USD 646.75 billion in 2023 and it is projected to hit around USD 2,511.48 billion by 2033, growing at a CAGR of 14.53% from 2024 to 2033. Government policies implemented worldwide to encourage the production of electric vehicles are driving the market.

The electric vehicle (EV) market has witnessed unprecedented growth and transformation in recent years, propelled by a confluence of technological advancements, shifting consumer preferences, and a global commitment to sustainability. This overview provides a comprehensive snapshot of the current state of the electric vehicle market, encompassing key trends, market dynamics, and notable players shaping the industry.

The growth of the electric vehicle (EV) market is underpinned by a convergence of influential factors steering its upward trajectory. Technological breakthroughs, particularly in battery technology, have substantially extended the range of EVs while concurrently reducing manufacturing costs. Government initiatives and policy support, including tax credits and subsidies, play a pivotal role in incentivizing both manufacturers and consumers to embrace electric mobility. The development of a robust charging infrastructure, spanning urban centers to major transportation corridors, addresses a critical consumer concern and fosters the widespread adoption of EVs. Increasing consumer awareness of environmental sustainability and a shift in preferences towards cleaner transportation options contribute significantly to the market's expansion. Furthermore, commitments from major automakers to invest substantially in electric vehicle research and development underscore a transformative industry-wide dedication to a sustainable automotive future. These interconnected growth factors collectively propel the electric vehicle market forward, marking a paradigm shift in the global automotive landscape.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 14.53% |

| Market Revenue by 2033 | USD 2,511.48 billion |

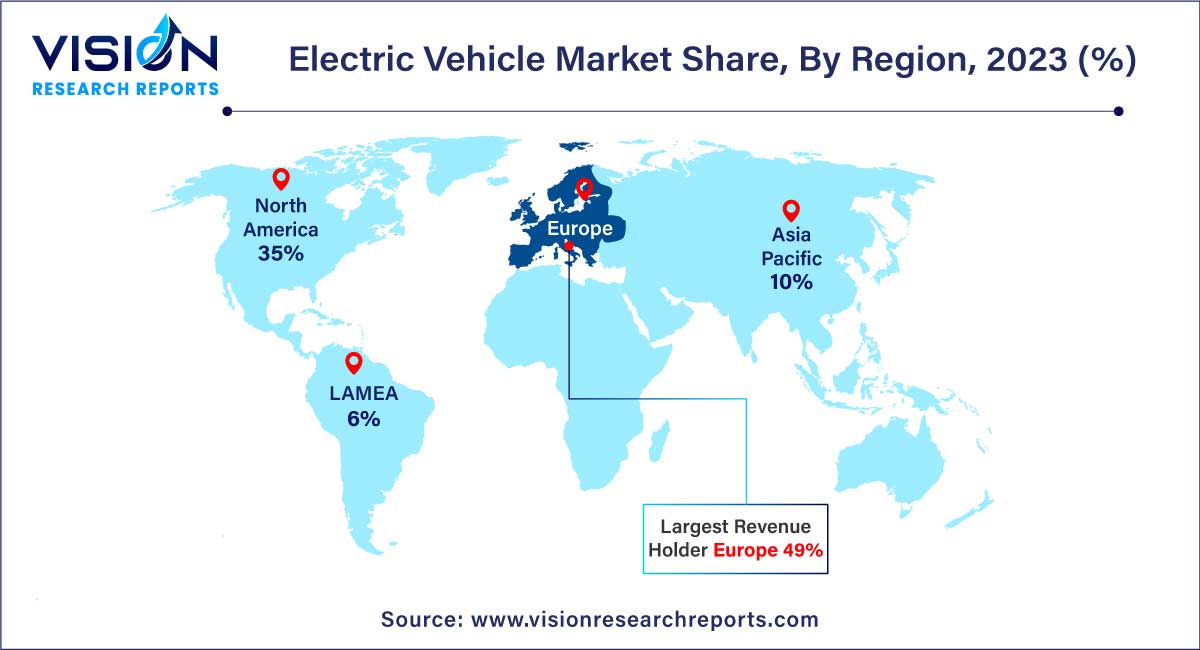

| Revenue Share of Europe in 2023 | 49% |

| CAGR of Latin America from 2024 to 2033 | 17.65% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The product segment in the global electric vehicle market is bifurcated into battery electric vehicle (BEV), fuel cell electric vehicle (FCEV), and plug-in hybrid electric vehicle (PHEV). The BEV segment accounted for the largest revenue share of 72% in 2023 and is further expected to advance at a steady CAGR during the projection period. The dominant market share can be attributed to the increasing environmental awareness and benefits of BEV among consumers globally.

The fuel cell electric vehicle (FCEV) segment is projected to register the highest CAGR of 22.23% during the forecast period. The FCEV segment is experiencing rapid growth in the electric vehicle (EV) market due to factors such as longer driving range, zero tailpipe emissions, improved hydrogen infrastructure, diverse applications, and ongoing research and development efforts. These factors contribute to the increasing popularity of FCEVs as a viable alternative to zero-emission transportation.

In terms of revenue, the passenger cars segment dominated with a market share of 87% in 2023. This is attributed to growing environmental concerns, advancements in EV technology, government incentives, and the availability of a range of models from different automakers. Rising awareness about environmental issues and improvements in battery capacity and charging infrastructure have made EVs more practical for everyday use. Governments globally are implementing measures to promote EV adoption, such as financial incentives and stricter emission standards. Moreover, competitive pricing for these vehicles has also boosted consumer interest and demand.

The commercial vehicle segment is poised to advance at a CAGR of 16.25% during forecast period. This is owing to the increasing demand for sustainable transportation solutions, advancements in EV technology, supportive government policies and incentives, and cost competitiveness. Businesses opt for commercial EVs to reduce emissions, use improved battery capacity & charging infrastructure, benefit from financial incentives, and comply with stricter emission regulations. Additionally, the decreasing costs of EV components contribute to the overall demand growth for commercial electric vehicles in the market.

Europe dominated the market with the largest revenue share of 49% in 2023, owing to factors such as increasing environmental concerns in the region, regulatory incentives, rapid infrastructure development, technological advancements, and changing consumer preferences. The presence of well-established and renowned electric vehicle manufacturers is also fueling the regional market expansion.

North America held a substantial market revenue share in 2023. This is attributed to the increasing demand for electric vehicles in regional economies such as the U.S. Furthermore, new initiatives are being taken up by automotive manufacturers, policymakers, non-profit organizations, and charging network companies, an example being the launch of a new non-profit organization named "Veloz." This organization aims to attract investments, innovations, marketing, and drive growth of electric vehicles in North America.

In February 2023, the U.S. government announced a substantial investment in various aspects of the electric vehicle industry. It includes allocating USD 10 billion for clean transportation initiatives, USD 7.5 billion for EV charging infrastructure, and over USD 7 billion for EV-critical minerals, battery components, and materials. These major funding programs would work alongside the Inflation Reduction Act, which has provided crucial support for advanced batteries and offers expanded tax credits for EV purchases and charging infrastructure installations.

Asia Pacific is projected to emerge as one of the most lucrative regions during the forecast timeframe. This is aided by the growing demand for electric cars in China, Japan, and India. In August 2022, the Economic and Social Commission for Asia and the Pacific (ESCAP) introduced the Asia-Pacific Initiative on Electric Mobility, intending to expedite the shift towards electric mobility in public transportation. The initiative aims to reduce the transport sector's greenhouse gas emissions and offer support for implementing the Paris Agreement.

Latin America is expected to expand at the fastest CAGR of 17.65% during the forecast period in the market. While the EV market in the region is still in its early stages compared to other regions, factors such as the steadily increasing adoption of these vehicles in corporate fleets, along with government incentives, ongoing investments, and policy support, are contributing to the regional market growth.

The 2025 Ram 1500 REV, a cutting-edge, all-electric light-duty pickup truck from Ram Truck, was unveiled by Stellantis NV in April 2023. It announces Ram's foray into the electric car market and demonstrates its dedication to offering clients cutting-edge and environmentally friendly solutions. The first of the company's future electrified alternatives that use cutting-edge technology is the 2025 Ram 1500 REV.

Stellantis NV declared in March 2023 that it would switch to producing battery-electric light commercial cars at its Mangualde Production Center in Portugal by early 2025. Production of a number of models, including light commercial and passenger versions of the Citroën ë-Berlingo, Fiat e-Doblò, Opel Combo-e, Peugeot e-Partner, and Fiat e-Doblò, is expected to occur during this phase. The Mangualde plant would be the first in Portugal to manufacture entirely battery-electric vehicles on a big scale for both local and foreign markets.

By Product

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Electric Vehicle Market

5.1. COVID-19 Landscape: Electric Vehicle Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Electric Vehicle Market, By Product

8.1. Electric Vehicle Market, by Product, 2024-2033

8.1.1. BEV

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. PHEV

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. FCEV

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Electric Vehicle Market, By Application

9.1. Electric Vehicle Market, by Application, 2024-2033

9.1.1. Passenger Cars

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Commercial Vehicles

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Electric Vehicle Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. BYD Company Ltd.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Mercedes-Benz Group AG

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Ford Motor Company

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. General Motors

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Renault Group

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Mitsubishi Motors Corporation

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Nissan Motor Co., Ltd.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Tesla

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Toyota Motor Corporation

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Volkswagen Group

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others