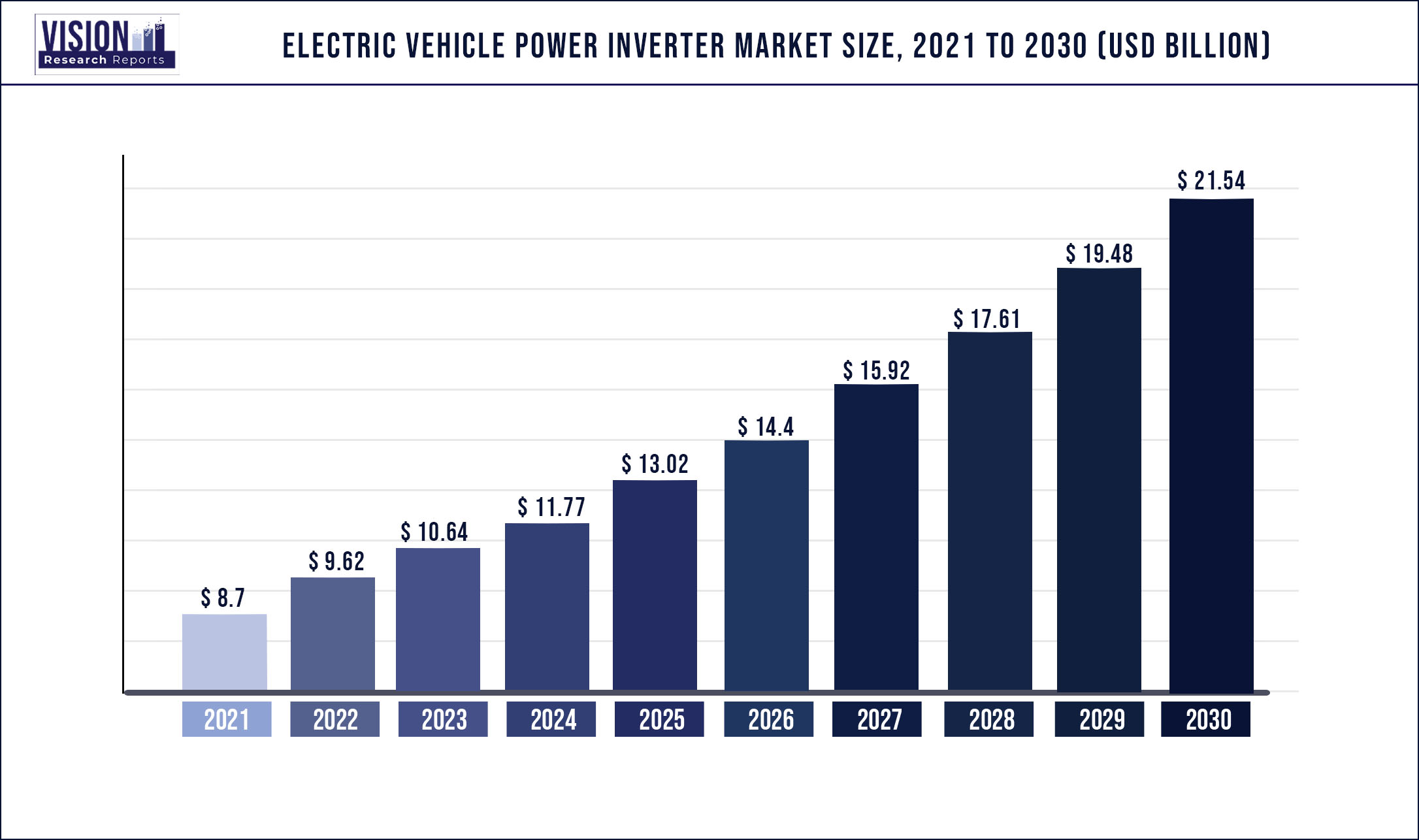

The global electric vehicle power inverter market was surpassed at USD 8.7 billion in 2021 and is expected to hit around USD 21.54 billion by 2030, growing at a CAGR of 10.6% from 2022 to 2030.

Electric Vehicle Power Inverter is defined as electrical device which converts DC (direct current) source to alternating current (AC) and it is used in electric vehicle motor. There are various types of inverters that are used in electric vehicles including traction inverter, and soft switching inverter. These inverters help to generate very high current during the time of switching the engine as generated voltage & input voltage. Factors like the huge amount of domestic automakers & the consolidation of prominent battery makers are expected to contribute the electric vehicle power inverter market growth.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 8.7 billion |

| Revenue Forecast by 2030 | USD 21.54 billion |

| Growth rate from 2022 to 2030 | CAGR of 10.6% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Propulsion, Inverter Type, Integration Level, Vehicle Type, Distribution, Region |

| Companies Covered |

Aptiv, Continental AG, DENSO Corporation, Hitachi Automotive Systems Ltd., Infineon Technologies AG, Meidensha Corporation, Mitsubishi Electric Corporation, Robert Bosch GmbH, Toyota Industries Corporation, Valeo Group |

Key Market Trends

Growing Sales of Electric Vehicles

Electric vehicles have become an integral part of the automotive industry, and they represent a pathway toward achieving energy efficiency, along with reduced emission of pollutants and other greenhouse gases. The increasing environmental concerns, coupled with favorable government initiatives, are some of the major factors driving the market growth.

Global EV sales was marked at 8.98 million units during 2021, which was significantly higher compared to sales figure in 2020. The volume includes all segments including passenger vehicles, light commercial vehicles and light trucks and all propulsion types.

The movement to accelerate the adoption of light-duty passenger electric cars (EVs) and phase out traditional vehicles with internal combustion engines is gaining traction around the world. The increase in average fuel prices reflects the fact that Europe has a higher share of new electric car registrations than other parts of world. Hence, mass adoption of electric vehicles, owing to rising fuel prices, is expected to proliferate business globally. EV is furthermore driven by the increasing sales of BEVs and PHEVs globally has also remained a major cause for bolstering the electric vehicles demand. Manufacturers around the globe has consistently driven the demand for EV. For instance:

Moreover, the high cost associated with batteries has necessitated the improvement of inverters and other power electronics, along with improving the performance of vehicles. For instance,

Though change has not resulted in a slump in IC engine vehicle sales, it created a promising market for electric vehicles in the present and future. The above trend has propelled some of the automakers to increase their expenditure on R&D in electric vehicles and associated components, like power inverters, while others have started focusing on launching new products to capture the market share, eventually pushing the demand in the market.

Market Dynamics

Drivers

Increased Sales of Electric Vehicles

The automobile industry has embraced electric vehicles as a necessary component, offering a method to improve energy efficiency and reduce emissions of pollutants and other greenhouse gases. The rising environmental concerns and supportive government initiatives are vital elements fueling market expansion. The market is further driven by the increasing sales of BEVs and PHEVs and reduced cost of inverter components due to advancements in materials and improved packaging arrangement. Moreover, the high price associated with batteries has necessitated the improvement of inverters and other power electronics, along with improving the performance of vehicles.

Governments worldwide have also initiated various schemes and policies that encourage buyers to choose electric vehicles over conventional ones. California ZEV program, which aims at having 1.53 million electric vehicles on the road by 2025, is one such initiative that promotes the purchase of electric vehicles. Countries like India, China, the United Kingdom, South Korea, France, Germany, Norway, and the Netherlands, are other countries that have various incentives for people willing to buy electric vehicles. Rapid global sales expansion and the ongoing technological developments in power inverters of electric vehicles are expected to fuel the market's growth over the forecast period.

Improved Investments in Electric Vehicles

The electric vehicle market is growing, likely accelerating further over the forecast period. This is because most vehicle manufacturers and the associated industries see electric vehicles as an investment opportunity. This growth is driving the electric vehicle and EV charging station market. China is the most promising market for electric buses globally, likely driving the e-bus demand over the forecast period. The overall bus purchases in the country are expected to remain stable, with more than 400,312 new purchases expected by 2025. Sales of electric buses are anticipated to rise due to ongoing government initiatives to foster e-mobility. By 2040, the global adoption of e-buses is expected to account for 40% of all new bus purchases.

Thailand is the 11th largest automotive producer in the world and the leading producer of vehicles in the ASEAN (Association of Southeast Asian Nations) area. In March 2020, the Thailand Board of Investment announced that Thailand received significant foreign direct investments supporting the country's growing electric vehicle production system. The Electric Vehicle Association of Thailand reports a sharp increase in the number of businesses involved in Thailand's electric vehicle market since 2015. Increasing focus on electric vehicles bring more opportunities for spare part manufacturers, and the ongoing technological developments in power inverters of electric vehicles are expected to fuel the growth of the market studied over the forecast period.

Restraint

Lack of Sufficient Infrastructure for Electric Vehicles

For electric car adoption, a robust infrastructure for charging EVs is required. Despite their advantages from an environmental and financial standpoint, electric vehicles have not yet become mainstream. A lack of charging outlets constrains the electric vehicle business. For instance, a survey by Grant Thornton-Bharat and the Federation of Indian Chambers of Commerce & Industry (FICCI) predicted that by June 2021, India would need 4 lakh public charging stations to support the estimated 2 million electric vehicles that would be driving in Indian roads by that year. India only has 1,028 public electric vehicle charging points as of December 2021.

In addition, a report from the International Energy Agency (IEA) in 2021 stated that the number of electric vehicles worldwide reached 10 million in 2020, up 43% from 2019 and acquiring a 1% market share. In 2020, battery electric vehicles (BEVS) accounted for two-thirds of the stock and new electric car registrations. As a result, electric vehicle growth is slowed, making it difficult for the market for electric vehicle power inverters to thrive. Consequently, this has a negative effect on the production and acceptance of electric vehicles, which in turn restrains the expansion of the market for EV power inverters. Therefore, such an imbalance between the need for charging and the distribution of infrastructure discourages the manufacture of electric vehicles and further impediments the market's expansion.

Opportunities

Increased Government and Consumer Spending

Governments across the globe are incentivizing electric car purchases with tax deductions. In 2020, globally, the governments spent USD 14 billion on direct investment and incentives and tax deductions for electric cars, an increase of 25%. Significant government spending took place in Europe. Spending decreased in China to lower incentive schemes rolled out earlier to boost sales. Electric cars witnessed a slight price decline due to price caps introduced for subsidies. This resulted in a 3% decrease in the price of BEVs and an 8% fall in the price of PHEV cars in Europe and China. In December 2021, India announced a tax exemption of INR 1,50,000 to increase the sales of electric vehicles.

Improving business sentiments, post-COVID recovery, and increasing awareness about green vehicles have increased consumer spending on electric vehicles. The uptick in EV sales offers excellent opportunities for EV parts manufacturers, including power inverter manufacturers. In 2020, there was overall spending of USD 120 billion on electric cars, which was a 50% increase from 2019. Sales increased despite the hike of 6% in the average price of electric vehicles. Such spending provides lucrative market growth opportunities.

Market Insights

Propulsion Insights

Based on Propulsion, the market is segmented into Hybrid Electric Vehicle, Plug-in Hybrid Electric Vehicle, Battery Electric Vehicle, and Fuel Cell Electric Vehicle. Out of which, Hybrid Electric Vehicle segment is expected to dominate the global market over the forecast period and this is attributed to the growing sales of HEVs around the world. For instance, the U.S. witnessed increased hybrid vehicle sales with 454,721-units sold as compared to 380,813-units sold in 2019.

Plug-in Hybrid Electric Vehicle segment is also expected to witness significant growth in the near future owing to the rise in demand for enhanced vehicle performance, better driving experience and improved economy.

Inverter Type Insights

Based on Inverter Type, the Electric Vehicle Power Inverter Market is classified into Traction Inverter and Soft Switching Inverter. In 2021, the traction inverter segment witnessed the largest revenue share of the electric vehicle power inverter market. The traction inverter’s function is to change the DC current from the battery of an electric car into AC current so that it may be utilized to power the electric motor that powers the car’s propulsion system.

Integration Level Insights

Based on Integration Level, the Electric Vehicle Power Inverter Market is segmented into Integrated Inverter System, Separate Inverter System, and Mechatronic Integration System. In 2021, the integrated inverter system segment held the highest revenue in the electric vehicle power inverter market. Its structure largely consists of integrating an output current shaping function and recently developed maximum point tracking technique into a converter formed from a buck-boost and then inverting the shaped current across a grid frequency bridge to the grid.

Vehicle Type Insights

Based on Vehicle Type, the market is segmented into Passenger Cars and Commercial Vehicles. Out of which Passenger Cars segment is anticipated to dominate the global market during the forecast period and this is attributed to rise in demand for fuel, hybrid and electric passenger cars around the world. For instance, in 2020, the registration of BEVs accounted for 54% of all electric car registration in European countries, which exceeded plug-in hybrid car vehicles.

Distribution Insights

Based on Distribution, the Electric Vehicle Power Inverter Market is bifurcated into OEM and Aftermarket. In 2021, the OEM segment acquired the largest revenue share of the electric vehicle power inverter market. The primary advantage of OEM items is their cost. OEM products drastically lower the cost of production due to economies of scale. Additionally, the business buying these items can use them to create systems without having to run their own factories and this factor is propelling the growth of this segment of the market.

Regional Insights

Based on Region, the Electric Vehicle Power Inverter Market is segregated into North America, Europe, Asia-Pacific, and LAMEA. In 2021, Asia-Pacific accounted for the largest revenue share of the electric vehicle power inverter market. The electric vehicle power inverter market is expanding quickly in China and India owing to the rapid expansion of the automotive industry in the region as well as government subsidies and incentives for electric vehicles.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Siemens AG, Continental AG, Robert Bosch GmbH, Denso Corporation, Valeo SA, Mitsubishi Electric Corporation, Aptiv PLC, Toyota Industries Corporation, Nissan Motor Corporation and Marelli.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Electric Vehicle Power Inverter Market

5.1. COVID-19 Landscape: Electric Vehicle Power Inverter Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Electric Vehicle Power Inverter Market, By Propulsion

8.1. Electric Vehicle Power Inverter Market, by Propulsion, 2022-2030

8.1.1. Hybrid Electric Vehicles

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Plug-in Hybrid Electric Vehicle

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Battery Electric Vehicle

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Fuel Cell Electric Vehicle

8.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Electric Vehicle Power Inverter Market, By Inverter Type

9.1. Electric Vehicle Power Inverter Market, by Inverter Type, 2022-2030

9.1.1. Traction Inverter

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Soft Switching Inverter

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Electric Vehicle Power Inverter Market, By Integration Level

10.1. Electric Vehicle Power Inverter Market, by Integration Level, 2022-2030

10.1.1. Integrated Inverter System

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Mechatronic Integration System

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Separate Inverter System

10.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Electric Vehicle Power Inverter Market, By Vehicle Type

11.1. Electric Vehicle Power Inverter Market, by Vehicle Type, 2022-2030

11.1.1. Passenger Cars

11.1.1.1. Market Revenue and Forecast (2017-2030)

11.1.2. Commercial Vehicles

11.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 12. Global Electric Vehicle Power Inverter Market, By Distribution

12.1. Electric Vehicle Power Inverter Market, by Distribution, 2022-2030

12.1.1. Aftermarket

12.1.1.1. Market Revenue and Forecast (2017-2030)

12.1.2. OEM

12.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 13. Global Electric Vehicle Power Inverter Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Propulsion (2017-2030)

13.1.2. Market Revenue and Forecast, by Inverter Type (2017-2030)

13.1.3. Market Revenue and Forecast, by Integration Level (2017-2030)

13.1.4. Market Revenue and Forecast, by Vehicle Type (2017-2030)

13.1.5. Market Revenue and Forecast, by Distribution (2017-2030)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Propulsion (2017-2030)

13.1.6.2. Market Revenue and Forecast, by Inverter Type (2017-2030)

13.1.6.3. Market Revenue and Forecast, by Integration Level (2017-2030)

13.1.6.4. Market Revenue and Forecast, by Vehicle Type (2017-2030)

13.1.7. Market Revenue and Forecast, by Distribution (2017-2030)

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Propulsion (2017-2030)

13.1.8.2. Market Revenue and Forecast, by Inverter Type (2017-2030)

13.1.8.3. Market Revenue and Forecast, by Integration Level (2017-2030)

13.1.8.4. Market Revenue and Forecast, by Vehicle Type (2017-2030)

13.1.8.5. Market Revenue and Forecast, by Distribution (2017-2030)

13.2. Europe

13.2.1. Market Revenue and Forecast, by Propulsion (2017-2030)

13.2.2. Market Revenue and Forecast, by Inverter Type (2017-2030)

13.2.3. Market Revenue and Forecast, by Integration Level (2017-2030)

13.2.4. Market Revenue and Forecast, by Vehicle Type (2017-2030)

13.2.5. Market Revenue and Forecast, by Distribution (2017-2030)

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Propulsion (2017-2030)

13.2.6.2. Market Revenue and Forecast, by Inverter Type (2017-2030)

13.2.6.3. Market Revenue and Forecast, by Integration Level (2017-2030)

13.2.7. Market Revenue and Forecast, by Vehicle Type (2017-2030)

13.2.8. Market Revenue and Forecast, by Distribution (2017-2030)

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Propulsion (2017-2030)

13.2.9.2. Market Revenue and Forecast, by Inverter Type (2017-2030)

13.2.9.3. Market Revenue and Forecast, by Integration Level (2017-2030)

13.2.10. Market Revenue and Forecast, by Vehicle Type (2017-2030)

13.2.11. Market Revenue and Forecast, by Distribution (2017-2030)

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Propulsion (2017-2030)

13.2.12.2. Market Revenue and Forecast, by Inverter Type (2017-2030)

13.2.12.3. Market Revenue and Forecast, by Integration Level (2017-2030)

13.2.12.4. Market Revenue and Forecast, by Vehicle Type (2017-2030)

13.2.13. Market Revenue and Forecast, by Distribution (2017-2030)

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Propulsion (2017-2030)

13.2.14.2. Market Revenue and Forecast, by Inverter Type (2017-2030)

13.2.14.3. Market Revenue and Forecast, by Integration Level (2017-2030)

13.2.14.4. Market Revenue and Forecast, by Vehicle Type (2017-2030)

13.2.15. Market Revenue and Forecast, by Distribution (2017-2030)

13.3. APAC

13.3.1. Market Revenue and Forecast, by Propulsion (2017-2030)

13.3.2. Market Revenue and Forecast, by Inverter Type (2017-2030)

13.3.3. Market Revenue and Forecast, by Integration Level (2017-2030)

13.3.4. Market Revenue and Forecast, by Vehicle Type (2017-2030)

13.3.5. Market Revenue and Forecast, by Distribution (2017-2030)

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Propulsion (2017-2030)

13.3.6.2. Market Revenue and Forecast, by Inverter Type (2017-2030)

13.3.6.3. Market Revenue and Forecast, by Integration Level (2017-2030)

13.3.6.4. Market Revenue and Forecast, by Vehicle Type (2017-2030)

13.3.7. Market Revenue and Forecast, by Distribution (2017-2030)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Propulsion (2017-2030)

13.3.8.2. Market Revenue and Forecast, by Inverter Type (2017-2030)

13.3.8.3. Market Revenue and Forecast, by Integration Level (2017-2030)

13.3.8.4. Market Revenue and Forecast, by Vehicle Type (2017-2030)

13.3.9. Market Revenue and Forecast, by Distribution (2017-2030)

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Propulsion (2017-2030)

13.3.10.2. Market Revenue and Forecast, by Inverter Type (2017-2030)

13.3.10.3. Market Revenue and Forecast, by Integration Level (2017-2030)

13.3.10.4. Market Revenue and Forecast, by Vehicle Type (2017-2030)

13.3.10.5. Market Revenue and Forecast, by Distribution (2017-2030)

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Propulsion (2017-2030)

13.3.11.2. Market Revenue and Forecast, by Inverter Type (2017-2030)

13.3.11.3. Market Revenue and Forecast, by Integration Level (2017-2030)

13.3.11.4. Market Revenue and Forecast, by Vehicle Type (2017-2030)

13.3.11.5. Market Revenue and Forecast, by Distribution (2017-2030)

13.4. MEA

13.4.1. Market Revenue and Forecast, by Propulsion (2017-2030)

13.4.2. Market Revenue and Forecast, by Inverter Type (2017-2030)

13.4.3. Market Revenue and Forecast, by Integration Level (2017-2030)

13.4.4. Market Revenue and Forecast, by Vehicle Type (2017-2030)

13.4.5. Market Revenue and Forecast, by Distribution (2017-2030)

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Propulsion (2017-2030)

13.4.6.2. Market Revenue and Forecast, by Inverter Type (2017-2030)

13.4.6.3. Market Revenue and Forecast, by Integration Level (2017-2030)

13.4.6.4. Market Revenue and Forecast, by Vehicle Type (2017-2030)

13.4.7. Market Revenue and Forecast, by Distribution (2017-2030)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Propulsion (2017-2030)

13.4.8.2. Market Revenue and Forecast, by Inverter Type (2017-2030)

13.4.8.3. Market Revenue and Forecast, by Integration Level (2017-2030)

13.4.8.4. Market Revenue and Forecast, by Vehicle Type (2017-2030)

13.4.9. Market Revenue and Forecast, by Distribution (2017-2030)

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Propulsion (2017-2030)

13.4.10.2. Market Revenue and Forecast, by Inverter Type (2017-2030)

13.4.10.3. Market Revenue and Forecast, by Integration Level (2017-2030)

13.4.10.4. Market Revenue and Forecast, by Vehicle Type (2017-2030)

13.4.10.5. Market Revenue and Forecast, by Distribution (2017-2030)

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Propulsion (2017-2030)

13.4.11.2. Market Revenue and Forecast, by Inverter Type (2017-2030)

13.4.11.3. Market Revenue and Forecast, by Integration Level (2017-2030)

13.4.11.4. Market Revenue and Forecast, by Vehicle Type (2017-2030)

13.4.11.5. Market Revenue and Forecast, by Distribution (2017-2030)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Propulsion (2017-2030)

13.5.2. Market Revenue and Forecast, by Inverter Type (2017-2030)

13.5.3. Market Revenue and Forecast, by Integration Level (2017-2030)

13.5.4. Market Revenue and Forecast, by Vehicle Type (2017-2030)

13.5.5. Market Revenue and Forecast, by Distribution (2017-2030)

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Propulsion (2017-2030)

13.5.6.2. Market Revenue and Forecast, by Inverter Type (2017-2030)

13.5.6.3. Market Revenue and Forecast, by Integration Level (2017-2030)

13.5.6.4. Market Revenue and Forecast, by Vehicle Type (2017-2030)

13.5.7. Market Revenue and Forecast, by Distribution (2017-2030)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Propulsion (2017-2030)

13.5.8.2. Market Revenue and Forecast, by Inverter Type (2017-2030)

13.5.8.3. Market Revenue and Forecast, by Integration Level (2017-2030)

13.5.8.4. Market Revenue and Forecast, by Vehicle Type (2017-2030)

13.5.8.5. Market Revenue and Forecast, by Distribution (2017-2030)

Chapter 14. Company Profiles

14.1. Aptiv

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. Continental AG

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. DENSO Corporation

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Hitachi Automotive Systems Ltd

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Infineon Technologies AG

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Meidensha Corporation

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Mitsubishi Electric Corporation

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. Robert Bosch GmbH

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Toyota Industries Corporation

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Valeo Group

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others