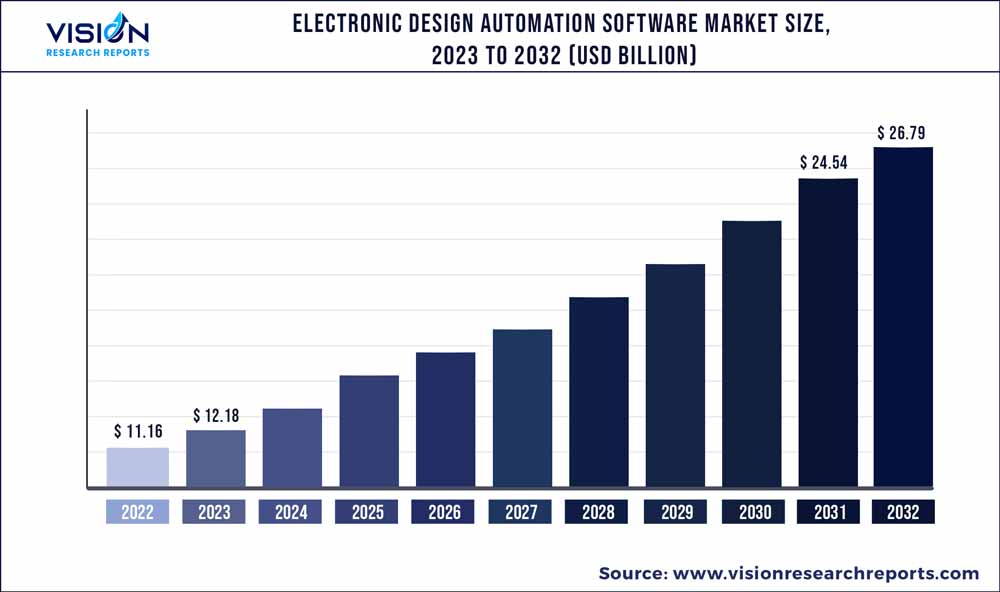

The global electronic design automation software market was valued at USD 11.16 billion in 2022 and it is predicted to surpass around USD 26.79 billion by 2032 with a CAGR of 9.15% from 2023 to 2032. The electronic design automation software market in the United States was accounted for USD 3.9 billion in 2022.

Key Pointers

Report Scope of the Electronic Design Automation Software Market

| Report Coverage | Details |

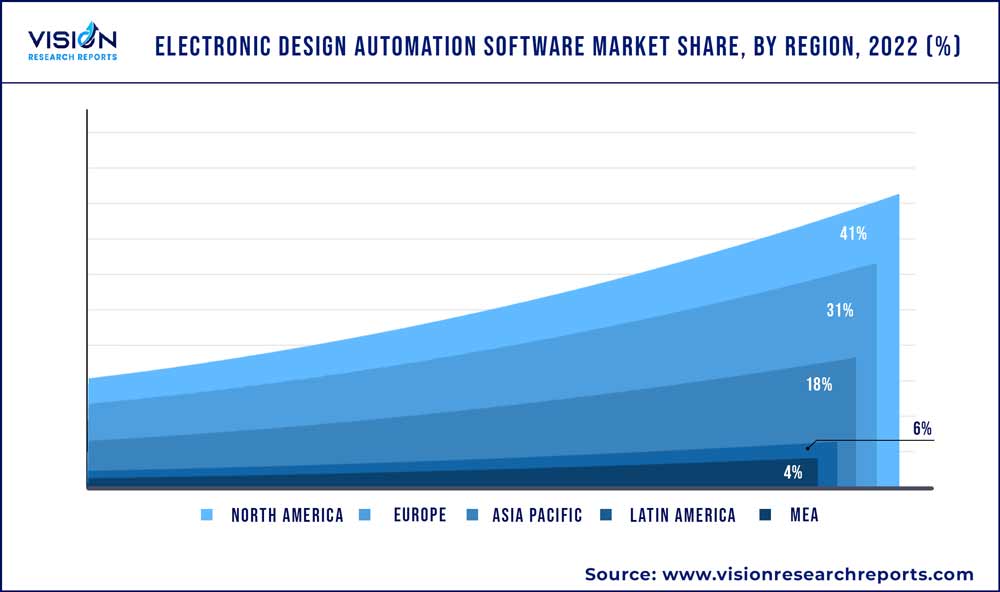

| Revenue Share of North America in 2022 | 41% |

| CAGR of Asia Pacific from 2023 to 2032 | 9.63% |

| Revenue Forecast by 2032 | USD 26.79 billion |

| Growth Rate from 2023 to 2032 | CAGR of 9.15% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Advanced Micro Devices, Inc; Aldec, Inc.; Altium LLC; ANSYS, Inc.; Cadence Design Systems, Inc.; eInfochips; EMA Design Automation, Inc.; Keysight Technologies; Mentor, a Siemens Business; Microsemi; Synopsys, Inc.; Silvaco, Inc.; The MathWorks, Inc.; Vennsa Technologies; Zuken |

Electronic Design Automation (EDA) includes hardware, software, and services to assist in the planning, implementation, validation, and manufacturing of semiconductor chips or devices. The market growth is directly proportional to the demand for the semiconductor & electronics sector. Any new design undertaking by semiconductor manufacturers is expected to create opportunities for EDA vendors over the forecast period.

Growing demand for advanced electronic components particularly in the consumer electronics market has witnessed a massive uptick over the last few years. This ongoing demand for smart consumer electronic devices is expected to encourage IC providers to focus on circuit designs with the help of advanced EDA software. As such the industry has witnessed growing collaboration among electronic OEMs and IC manufacturers. This is expected to create avenues for EDA software market growth over the forecast period.

However, the EDA market has some factors that negatively impact market growth. The lack of skilled labor and moderate adoption of electronic automation is expected to restrain the growth of the market. Furthermore, undetermined technological advancements and economic conditions are predicted to impede market growth. Additionally, the increasing complexity of Very Large-Scale Integration (VLSI) such as microcontroller and microprocessor and Non-Recurring Engineering (NRE) costs which are affiliated with this design are anticipated to restrain the growth of the market over the forecast period.

Machine Learning (ML) and Artificial Intelligence (AI) are making inroads into almost every sector out there including healthcare, electronics, automotive, and aerospace & defense. To improve product offerings across the aforementioned industries, companies are integrating AI and ML into their products. These increasing implementations of the given technologies call for advanced electronic components and chips, thereby creating avenues for EDA providers. The integration of AI while developing software allows testers to deviate from manual testing with automated procession testing. Moreover, the electronic design automation software industry was impacted marginally due to COVID-19 as the hardware supply was hampered due to logistic activities coming to a halt. EDA helps reduce cost as well as time concerning electric circuit designs. The software also helps eliminate manual errors subsequently favoring the market growth. Tech integration into the existing solutions such as machine learning to reduce design costs is also creating avenues for future growth. However, in recent times the pandemic has impacted the EDA business considerably. This was primarily due to the pandemic-instigated lockdown at the start of 2020 that resulted in the halt of manufacturing activities. This shuttering of factories delayed semiconductor design and production activities subsequently impacting the electronic design software market growth over the short term. Post-pandemic an increased emphasis on the automation of manufacturing processes is anticipated to create avenues for EDA software market vendors.

The aerospace and defense industry has been witnessing increased usage of electronic design automation software, which has significantly contributed to the growth of the EDA software market. Some significant benefits of using EDA software in the aerospace industry include streamlining the design process, improved reliability and accuracy, improved collaboration and communication, reduced cost, and accelerated technological innovation. Moreover, the number of companies offering EDA software solutions catering to the aerospace industry has also been on the high side; some include Cadence Design Systems, Inc., and Synopsys, Inc., among others.

Application Insights

The healthcare segment of the market is projected to witness significant growth over the forecast period. The growth of this segment can be attributed to the benefits of EDA software in healthcare which include faster design and development, reduced cost, improved patient outcomes, enabled regulatory compliance of medical devices, and simulation and testing of medical equipment, among others. The improvement made by EDA software has helped in the development of the healthcare industry, which has resulted in the growth of the healthcare segment of the market over the period 2023-2032.

The aerospace and defense segment of the EDA software market by application is projected to grow more than 7% during the period 2023-2032. The growth of this segment can be attributed to the highly secretive way things are carried out in defense departments across the world, which EDA software offers. Moreover, the companies in the EDA software market have partnered with various government agencies to develop better IC designs, boosting the adoption of EDA software solutions among defense agencies. For instance, in September 2021, Siemens partnered with the United States Department of Defense’s Research and development agency (DARPA) to develop silicon photonic ICs, advanced analog, digital and mixed-signal ICs, among others.

End-use Insights

The demand for EDA software in the designing of microprocessors & controllers garnered the highest revenue share in 2022. The microprocessors & controllers segments accounted to lead a market share of over 61% in 2022. The high market share is attributed to a healthy demand for home appliances, lighting systems, and medical devices, among others. Continuous improvements in consumer electronics due to applications of new features to the products almost every quarter keeps the semiconductor industry on its toes. Therefore, microcontroller design upgrades form the core of the product development process, creating favorable avenues for EDA providers in this segment.

In addition to microprocessors & controllers, electronic design automation also finds applications in memory management units, among others. A memory Management Unit (MMU) is essentially a hardware component that plays a vital role in device memory management. Therefore, increased demand for processing speed requirements is creating a favorable scenario for segment growth. The MMU segment is estimated to grow at a CAGR exceeding 8.03% from 2023 to 2032.

Regional Insights

North American electronic design automation software market led the growth, with regional revenue surpassing 41% of the total market in 2022. Early technology adoption including 5G, machine learning and artificial intelligence, among others has been a major force contributing to the regional demand. Additionally, the increasing usage of several industries such as consumer electronics, and automotive, among others helps in the regional market growth. Further, the region boasts of a robust wireless infrastructure along with government support, which is expected to favor growth over the forecast period.

Asia Pacific although not the largest market yet for EDA software, is expected to witness robust growth over the next few years. The regional CAGR is expected to surpass 9.63% from 2023 to 2032. This strong growth is attributed to a rise in the number of electronic manufacturing companies. Additionally, increased demand for consumer devices along with the expansion of facilities to meet this demand will further boost regional growth over the forecast period.

Electronic Design Automation Software Market Segmentations:

By Application

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Electronic Design Automation Software Market

5.1. COVID-19 Landscape: Electronic Design Automation Software Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Electronic Design Automation Software Market, By Application

8.1. Electronic Design Automation Software Market, by Application, 2023-2032

8.1.1. Aerospace and Defense

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Automotive

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Healthcare

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Industrial

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Electronic Design Automation Software Market, By End-use

9.1. Electronic Design Automation Software Market, by End-use, 2023-2032

9.1.1. Microprocessors & Controllers

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Memory Management Unit (MMU)

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Others

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Electronic Design Automation Software Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Application (2020-2032)

10.1.2. Market Revenue and Forecast, by End-use (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Application (2020-2032)

10.1.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Application (2020-2032)

10.1.4.2. Market Revenue and Forecast, by End-use (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Application (2020-2032)

10.2.2. Market Revenue and Forecast, by End-use (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Application (2020-2032)

10.2.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Application (2020-2032)

10.2.4.2. Market Revenue and Forecast, by End-use (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Application (2020-2032)

10.2.5.2. Market Revenue and Forecast, by End-use (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Application (2020-2032)

10.2.6.2. Market Revenue and Forecast, by End-use (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Application (2020-2032)

10.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Application (2020-2032)

10.3.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Application (2020-2032)

10.3.4.2. Market Revenue and Forecast, by End-use (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Application (2020-2032)

10.3.5.2. Market Revenue and Forecast, by End-use (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Application (2020-2032)

10.3.6.2. Market Revenue and Forecast, by End-use (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Application (2020-2032)

10.4.2. Market Revenue and Forecast, by End-use (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Application (2020-2032)

10.4.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Application (2020-2032)

10.4.4.2. Market Revenue and Forecast, by End-use (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Application (2020-2032)

10.4.5.2. Market Revenue and Forecast, by End-use (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Application (2020-2032)

10.4.6.2. Market Revenue and Forecast, by End-use (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Application (2020-2032)

10.5.2. Market Revenue and Forecast, by End-use (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Application (2020-2032)

10.5.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Application (2020-2032)

10.5.4.2. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 11. Company Profiles

11.1. Advanced Micro Devices, Inc

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Aldec, Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Altium LLC

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. abbot

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. ANSYS, Inc.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Cadence Design Systems, Inc.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. eInfochips

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. EMA Design Automation, Inc

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Keysight Technologies

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Mentor, a Siemens Business

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others