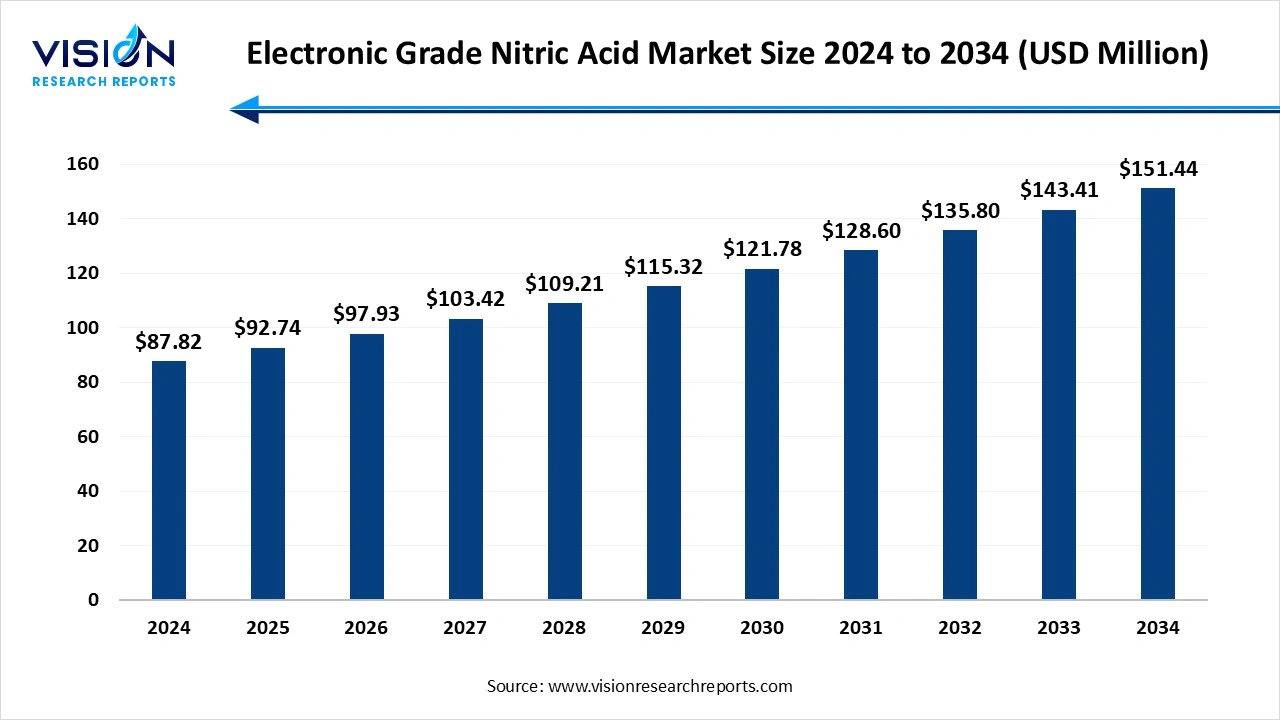

The global electronic grade nitric acid market size was estimated at USD 87.82 million in 2024, which is expected to grow with a CAGR of 5.60% and reach USD 151.44 million by 2034.

Key Pointers

Key PointersThe electronic grade nitric acid market is experiencing steady growth, driven by the rising demand for high-purity chemicals in the semiconductor and electronics industries. This specialized form of nitric acid, characterized by ultra-low levels of metal ions and contaminants, is essential for cleaning and etching processes in the manufacturing of integrated circuits and printed circuit boards. Technological advancements, the rapid expansion of consumer electronics, and increasing investments in semiconductor fabrication facilities across Asia-Pacific, North America, and Europe are key factors propelling market expansion. Moreover, stringent quality standards in electronic manufacturing are intensifying the need for ultra-pure chemicals, further strengthening the market outlook.

The growth of the electronic gade nitric acid market is primarily fueled by the increasing demand for advanced semiconductor devices and electronic components. As global reliance on high-performance computing, 5G technology, and consumer electronics intensifies, manufacturers are scaling up production, thereby requiring greater volumes of ultra-high-purity chemicals for wafer cleaning and etching. Nitric acid, with its powerful oxidizing properties and compatibility with precision manufacturing processes, is indispensable in ensuring the performance and reliability of microelectronic devices.

Another key growth factor is the rapid expansion of semiconductor fabrication facilities (fabs), particularly in Asia-Pacific countries such as China, South Korea, and Taiwan, which are investing heavily in domestic chip production capabilities. Supportive government initiatives and increased R&D spending by key players to enhance chemical purity and supply chain efficiency are also contributing to market acceleration.

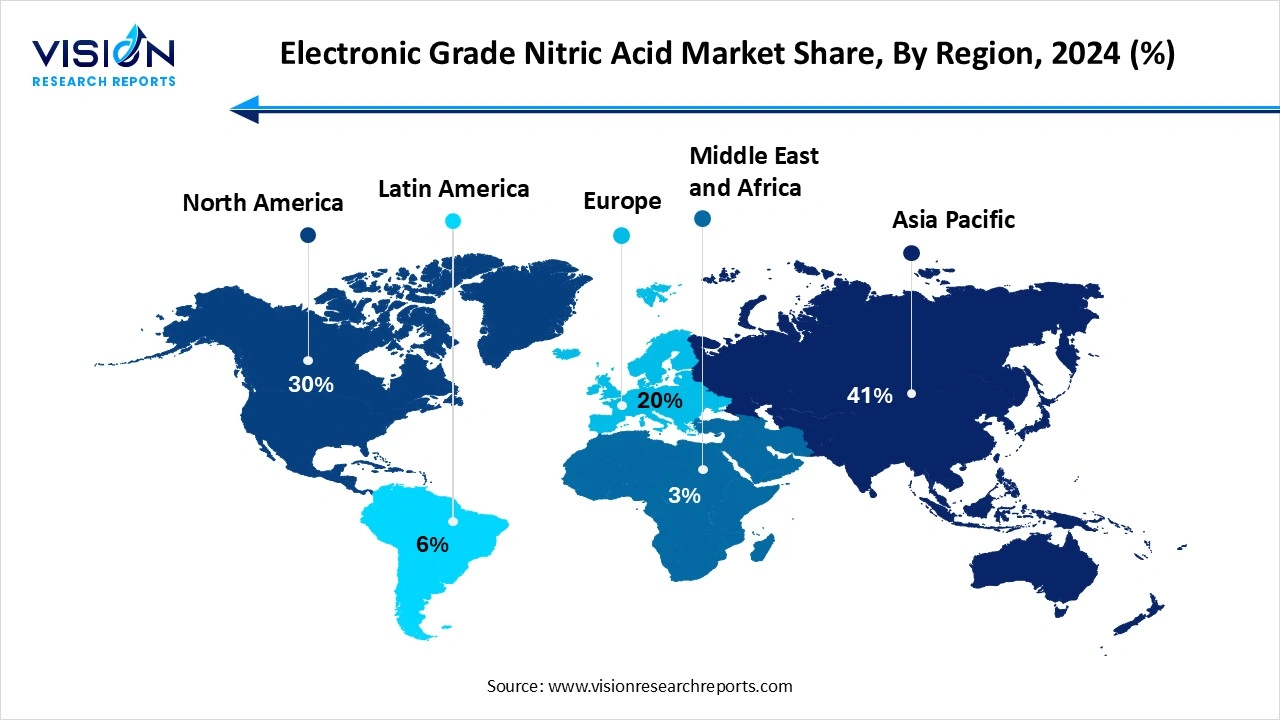

The Asia Pacific region led the global electronic grade nitric acid market, capturing the largest revenue share of 41% in 2024. This growth is fueled by the rapid expansion of the electronics and solar energy sectors, especially in countries such as China, Japan, South Korea, and Taiwan. These nations play a key role in semiconductor manufacturing and solar panel production, which drives substantial demand for high-purity chemicals.

Europe’s electronic grade nitric acid market is projected to expand at a compound annual growth rate (CAGR) of 5.5% between 2025 and 2034. This growth is driven by the region’s strong focus on environmental sustainability and innovation, essential for the advanced etching and cleaning processes in semiconductor manufacturing. Additionally, Europe’s strategic efforts to strengthen its technological infrastructure and lower carbon emissions through the adoption of clean energy technologies are further fueling the demand for electronic grade nitric acid.

Europe’s electronic grade nitric acid market is projected to expand at a compound annual growth rate (CAGR) of 5.5% between 2025 and 2034. This growth is driven by the region’s strong focus on environmental sustainability and innovation, essential for the advanced etching and cleaning processes in semiconductor manufacturing. Additionally, Europe’s strategic efforts to strengthen its technological infrastructure and lower carbon emissions through the adoption of clean energy technologies are further fueling the demand for electronic grade nitric acid.

The EL grade segment dominated the market, capturing the largest revenue share of 51% in 2024. EL grade nitric acid is characterized by a relatively lower concentration of metallic impurities compared to standard industrial grades, making it suitable for general-purpose cleaning and etching applications in electronics fabrication. It is widely used in the initial stages of semiconductor production where extremely high purity levels are not yet critical but still significantly influence the performance and yield of final products.

The VL grade is projected to grow at a compound annual growth rate (CAGR) of 6% throughout the forecast period. This grade is essential for advanced semiconductor processes, particularly in the production of highly integrated circuits and next-generation microchips, where even minute impurities can compromise device performance or lead to defects. As chip designs become increasingly complex and miniaturized, the demand for VL grade nitric acid is growing rapidly. Its application is crucial in the final cleaning and etching steps, where the highest possible chemical purity is mandatory to ensure the integrity and reliability of electronic components. The growth of this segment reflects the broader trend in the industry toward tighter process controls and improved manufacturing precision.

The semiconductor segment led the global electronic-grade nitric acid market in 2024, capturing the largest revenue share of 57%. As integrated circuits become smaller and more complex, the need for ultra-high-purity chemicals intensifies, positioning electronic grade nitric acid as an indispensable material in ensuring the precision and reliability of semiconductor devices. Its usage spans various stages of chip fabrication, particularly in front-end processes where stringent purity standards are essential to avoid contamination and yield loss. The rapid advancement of technologies such as 5G, artificial intelligence, and automotive electronics continues to drive semiconductor demand, thereby boosting the consumption of electronic grade nitric acid.

The solar energy application segment is projected to expand at a compound annual growth rate (CAGR) of 6% during the forecast period. As the production of photovoltaic (PV) cells becomes more sophisticated, manufacturers increasingly rely on high-purity chemicals to maintain efficiency and reduce defects in solar panels. Electronic grade nitric acid is used in the surface treatment and cleaning of silicon wafers used in solar cells, helping to optimize light absorption and improve overall cell performance. The global push for renewable energy and sustainability has led to significant investments in solar infrastructure, particularly in regions like Asia-Pacific and Europe, further expanding the market for electronic grade nitric acid. As solar technology evolves and efficiency targets become more aggressive, the role of ultra-pure chemicals in the production process will continue to gain importance.

By Product Type

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Electronic Grade Nitric Acid Market

5.1. COVID-19 Landscape: Electronic Grade Nitric Acid Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Electronic Grade Nitric Acid Market, By Product Type

8.1. Electronic Grade Nitric Acid Market, by Product Type

8.1.1. EL Grade

8.1.1.1. Market Revenue and Forecast

8.1.2. VL Grade

8.1.2.1. Market Revenue and Forecast

8.1.3. UL Grade

8.1.3.1. Market Revenue and Forecast

8.1.4. SL Grade

8.1.4.1. Market Revenue and Forecast

Chapter 9. Electronic Grade Nitric Acid Market, By Application

9.1. Electronic Grade Nitric Acid Market, by Application

9.1.1. Semiconductor

9.1.1.1. Market Revenue and Forecast

9.1.2. Solar Energy

9.1.2.1. Market Revenue and Forecast

9.1.3. LCD Panel

9.1.3.1. Market Revenue and Forecast

9.1.4. Others

9.1.4.1. Market Revenue and Forecast

Chapter 10. Electronic Grade Nitric Acid Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Product Type

10.1.2. Market Revenue and Forecast, by Application

Chapter 11. Company Profiles

11.1. BASF SE

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Dow Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Mitsui Chemicals, Inc.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Merck KGaA

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Sumitomo Chemical Co., Ltd.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Jiangsu Fengshan Group Co., Ltd.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Shanghai SECCO Petrochemical Co., Ltd.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Gujarat Narmada Valley Fertilizers & Chemicals Ltd. (GNFC)

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Nippon Shokubai Co., Ltd.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. INEOS Group Limited

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others