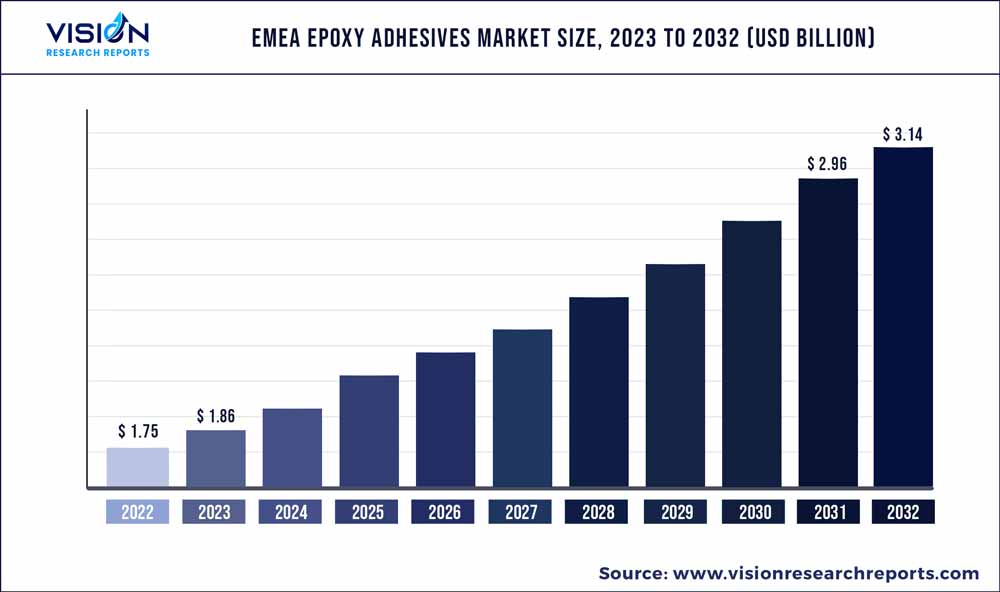

The global EMEA epoxy adhesives market size was estimated at around USD 1.75 billion in 2022 and it is projected to hit around USD 3.14 billion by 2032, growing at a CAGR of 6.02% from 2023 to 2032. The EMEA epoxy adhesives market in the United States was accounted for USD 473 million in 2022.

Key Pointers

Report Scope of the EMEA Epoxy Adhesives Market

| Report Coverage | Details |

| Revenue Share of Europe in 2022 | 94% |

| Revenue Forecast by 2032 | USD 3.14 billion |

| Growth Rate from 2023 to 2032 | CAGR of 6.02% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | 3M; Ashland; Bostik; Dow; H.B. Fuller Company; Henkel AG & Co. KGaA; Mapei S.p.A0.; Parker Hannifin Corp.; Permabond LLC; Sika AG |

The surging demand for these products from the construction industry is expected to positively impact the growth of the market in EMEA, as these adhesives are widely used for structural bonding and repairing, as well as maintenance. Market players in the market are investing heavily in brand building, research & development, innovation, and fostering strong relationships with customers to improve their market share and sustain competition. For instance, in July 2022, H.B. Fuller acquired Fourny NV, aimed at expanding its market presence and enhancing its ability to offer innovative and effective adhesive solutions to customers in the construction sector in Europe.

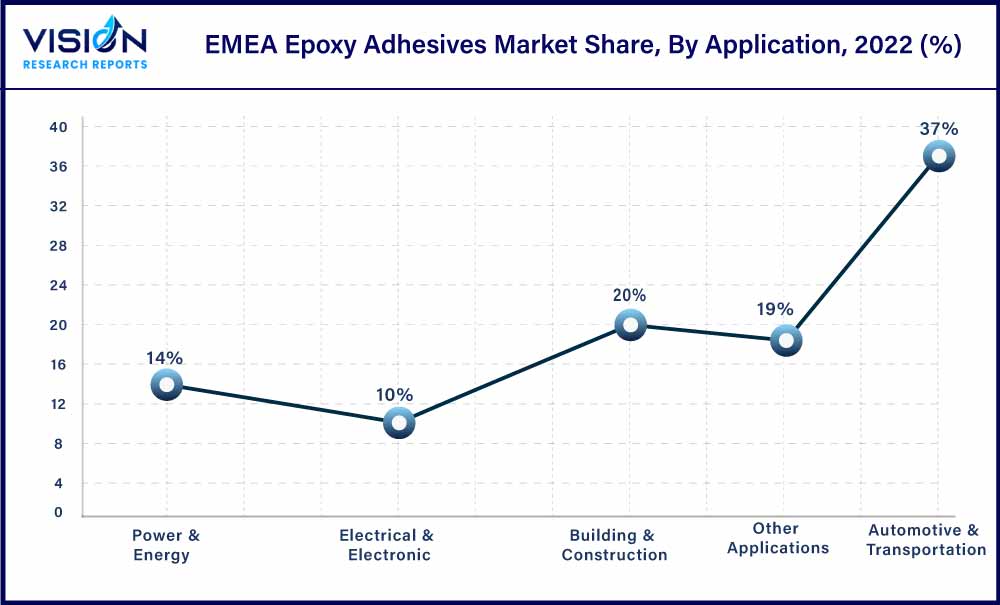

The penetration of epoxy adhesives is anticipated to be the highest in the power & energy segment on account of the increasing reliance on renewable energy sources to reduce greenhouse gas emissions across the EMEA. This trend is propelling the growth of the energy industry, which is anticipated to benefit the consumption of the product over the forecast period.

The epoxy adhesives market has seen significant growth in recent years owing to the product’s versatility, strength, and durability. They are widely used in various industries including construction, automotive, electronics, and aerospace, among others. The growth of these industries has led to the increased demand for the product, which, in turn, has led to the expansion of the market.

One of the key factors driving the market is the growth of the construction industry, which is a major end user of epoxy adhesives. They are widely used in the construction industry for structural bonding, repair, and maintenance applications, among others. In addition, the growth of the automotive industry has led to an increased demand for these products as they are used in a variety of applications such as bonding and sealing components.

Type Insights

Two Component type dominated the market with a revenue share of 43% in 2022. This is attributable to its widespread applications in various industries for its strong bonding capability, durability, and resistance to environmental factors such as temperature changes, corrosion, and weathering.

One-component epoxy adhesives are single-part products that cure when exposed to heat, light, or moisture without needing a second component to initiate the reaction. These products are commonly used in a wide range of industries, including construction, automotive, and electronics, due to their excellent bonding strength, durability, and resistance to chemicals and heat.

Other technologies used for formulating epoxy adhesives include waterborne and radiation cured. The demand for waterborne products has witnessed a rise due to strict regulations against solvent-based products resulting from their harmful volatile organic compounds (VOCs). By using suitable formulations, waterborne epoxy resins provide high performance and minimize risks associated with VOCs while increasing worker safety. Waterborne epoxy resins are used in adhesives for tie coats, primers, and laminates. Water-based wetting agents and other additives can be incorporated into waterborne epoxy resins to speed up the drying, enhance corrosion resistance, extend pot life, and increase adhesion.

Application Insights

Automotive & Transportation application dominated the market with a revenue share of 37% in 2022. This is attributable to the high strength, durability, and excellent bonding characteristics of these products that make them ideal for structural applications in automotive & transportation industry.

Epoxy adhesives are widely used in the building & construction industry due to their superior characteristics such as high strength, durability, and bonding properties. They are used to join building components or materials together. They are commonly used in industrial construction, civil engineering, and bridge building due to their ability to withstand high loads and extreme temperatures.

The power & energy segment is anticipated to witness the highest growth in the global epoxy adhesives market over the forecast period. Power & energy industry, especially renewable energy, is witnessing constant development in technologies, which require adhesives to protect and bond sensitive mechanical and electrical components such as charge controllers, solar panels, and wind turbine blades.

Regional Insights

Europe region dominated the EMEA epoxy adhesives market with a revenue share of 94% in 2022. This is attributable to the growing emphasis on reducing carbon dioxide emissions through the implementation of the Euro 6d emission standards in 2023 which is poised to create significant growth opportunities for lightweight materials in the European region. As a result, this is expected to drive the demand for EMEA epoxy adhesives in the automotive industry in the coming years.

With the increasing penetration of EVs in Germany, the demand for adhesives is increasing for making lightweight vehicles. Epoxy adhesives help in reducing and replacing heavy mechanical fasteners in EV battery design and production, which helps in achieving liberty in designing along with less assembly time. Germany, being the largest energy consumer of epoxy adhesives in Europe, is proactively fostering energy projects to address the surging demand.

Middle East & Africa is a significant contributor to the worldwide oil and gas production sector; however, there are impediments to attracting foreign direct investments due to a variety of constraints, including climatic deficiencies and geopolitical tensions. However, with manufacturers expanding and setting up new manufacturing plants in certain countries of the region and growing investments in construction industry, the demand for epoxy Adhesives is expected to propel in the region over the forecast period.

EMEA Epoxy Adhesives Market Segmentations:

By Type

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on EMEA Epoxy Adhesives Market

5.1. COVID-19 Landscape: EMEA Epoxy Adhesives Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global EMEA Epoxy Adhesives Market, By Type

8.1. EMEA Epoxy Adhesives Market, by Type, 2023-2032

8.1.1. One Component

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Two Component

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Others

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global EMEA Epoxy Adhesives Market, By Application

9.1. EMEA Epoxy Adhesives Market, by Application, 2023-2032

9.1.1. Automotive & Transportation

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Building & Construction

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Power & Energy

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Electrical & Electronic

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Other Applications

9.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global EMEA Epoxy Adhesives Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Type (2020-2032)

10.1.2. Market Revenue and Forecast, by Application (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Type (2020-2032)

10.1.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Type (2020-2032)

10.1.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Type (2020-2032)

10.2.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Type (2020-2032)

10.2.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Type (2020-2032)

10.2.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Type (2020-2032)

10.2.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Type (2020-2032)

10.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Type (2020-2032)

10.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Type (2020-2032)

10.3.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Type (2020-2032)

10.3.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Type (2020-2032)

10.3.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Type (2020-2032)

10.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Type (2020-2032)

10.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Type (2020-2032)

10.4.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Type (2020-2032)

10.4.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Type (2020-2032)

10.4.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Type (2020-2032)

10.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Type (2020-2032)

10.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Type (2020-2032)

10.5.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Type (2020-2032)

10.5.4.2. Market Revenue and Forecast, by Application (2020-2032)

Chapter 11. Company Profiles

11.1. 3M

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Ashland

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Bostik

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Dow

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. H.B. Fuller Company

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Henkel AG & Co. KGaA

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Mapei S.p.A0.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Parker Hannifin Corp.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Permabond LLC

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Sika AG

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others