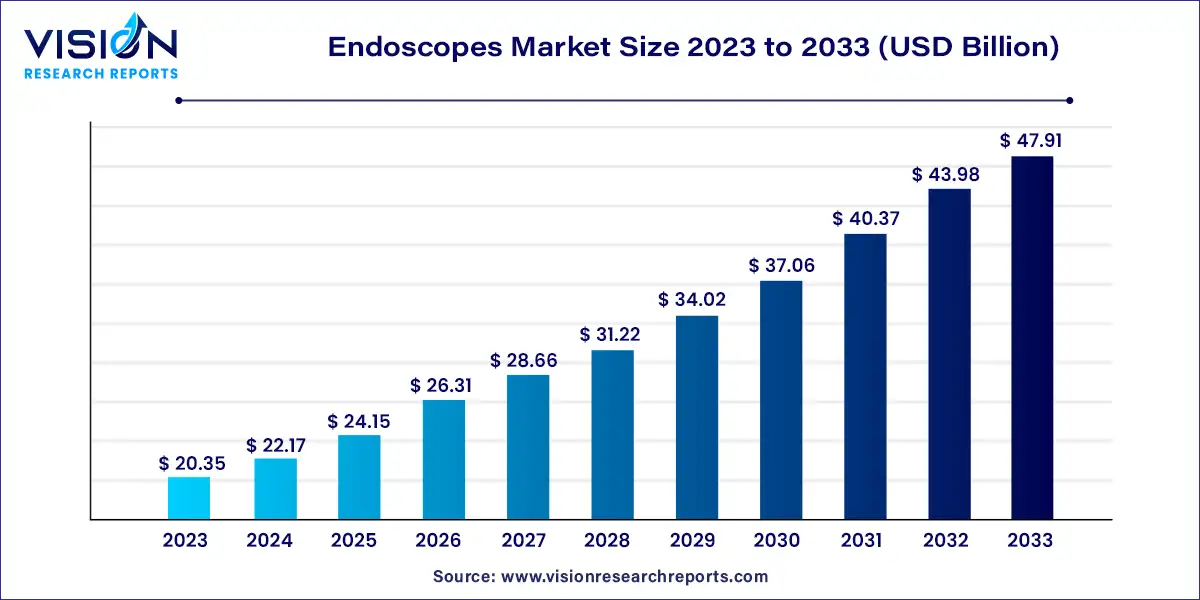

The global endoscopes market size was estimated at around USD 20.35 billion in 2023 and it is projected to hit around USD 47.91 billion by 2033, growing at a CAGR of 8.94% from 2024 to 2033.

The endoscopes market has experienced significant growth driven by an advancements in technology, increasing prevalence of gastrointestinal diseases, and rising demand for minimally invasive procedures. Endoscopes are medical devices used for visual examination of internal organs and structures of the body.

The growth of the endoscopes market is propelled by an increasing prevalence of gastrointestinal disorders, such as colorectal cancer and inflammatory bowel disease, drives the demand for endoscopic procedures for diagnosis and treatment. Secondly, advancements in endoscopic imaging technologies, such as high-definition and 3D imaging systems, enhance diagnostic accuracy and improve patient outcomes, fostering market growth. Thirdly, the rising preference for minimally invasive procedures due to reduced patient discomfort, shorter recovery times, and lower healthcare costs fuels the adoption of endoscopic techniques across various medical specialties. Lastly, the expanding applications of endoscopic interventions for therapeutic purposes, such as polyp removal and tumor resection, further contribute to market expansion.

The product segment of the endoscopes market comprises rigid endoscopes, flexible endoscopes, disposable endoscopes, robot-assisted endoscopes, and capsule endoscopes. Flexible endoscopes held the largest market share, accounting for over 47% of revenue in 2023. This dominance is driven by the increasing demand for minimally invasive surgical procedures like laparoscopy and cystoscopy. However, the COVID-19 pandemic impacted the demand for rigid endoscopes due to the postponement of elective surgeries to prioritize COVID-19-infected patients. With the resumption of many elective surgeries in the post-pandemic period, primarily due to the rising burden of chronic diseases globally, there is an expected shift that will drive market growth for rigid endoscopes.

The disposable endoscopes segment is anticipated to witness the fastest CAGR growth during the forecast period. This growth is fueled by the increasing demand for single-use endoscopes to mitigate the risk of device-related infections. Factors such as patient preference for minimally invasive procedures, supportive regulatory frameworks, and favorable reimbursement policies in developed countries also contribute to the segment's growth. Additionally, investments, funds, and grants from governments and organizations to enhance healthcare infrastructure and advance research in the endoscopy field further benefit this segment

The end-use segment of the endoscopes market includes hospitals and outpatient facilities. In 2023, outpatient facilities dominated the market in terms of revenue share, and this segment is expected to experience the fastest growth over the forecast period. The increasing adoption of endoscopes in outpatient facilities, such as diagnostic clinics and ambulatory surgery centers (ASCs), for the early diagnosis and detection of chronic diseases is driving the growth of this segment.

Outpatient facilities play a crucial role in the endoscopes market by offering convenient and efficient diagnostic and therapeutic procedures. The growing popularity of endoscopes in outpatient settings can be attributed to their numerous advantages. One significant advantage of endoscopes in outpatient facilities is their cost-effectiveness. These single-use devices eliminate the need for reprocessing, saving valuable time and resources required for cleaning, sterilizing, and maintaining reusable endoscopes. This streamlined approach improves workflow efficiency, reduces turnaround time, and enhances patient throughput.

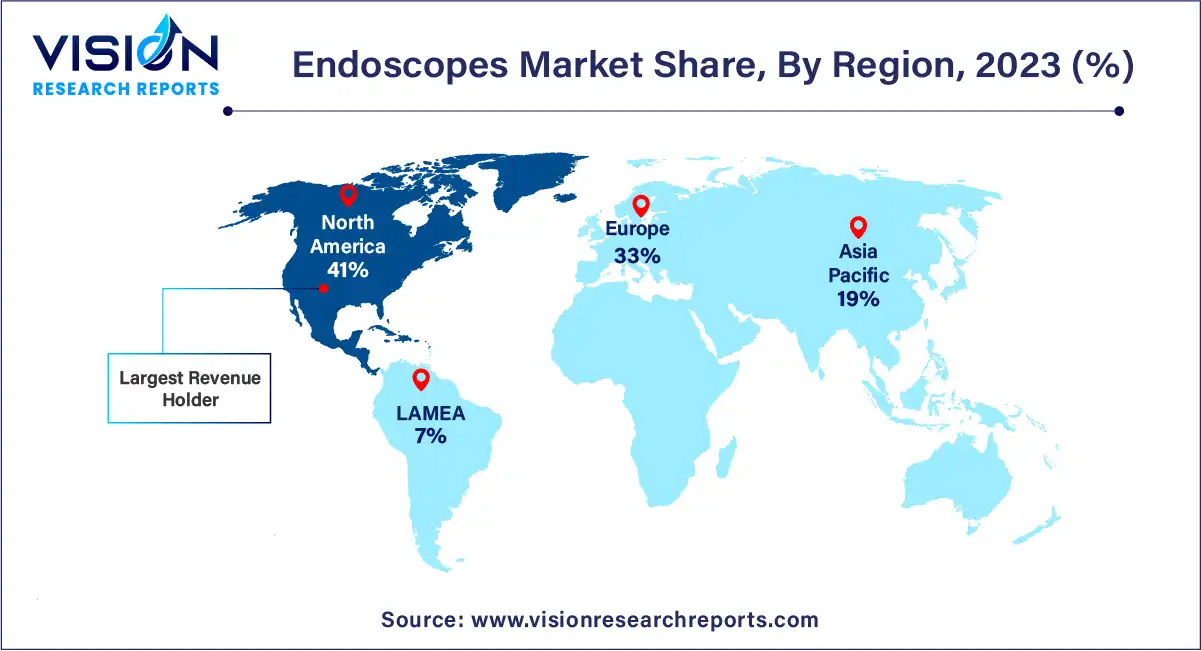

In 2023, North America emerged as the leader in the endoscopes market, capturing the highest share of global revenue at 41%. The region is poised to maintain its dominant position throughout the forecast period, driven by the increasing adoption of elective endoscopic procedures, enhanced healthcare expenditure, and a substantial geriatric population. Additionally, the prevalence of cancer and functional gastrointestinal disorders in the U.S. is expected to further bolster market growth. For example, the American Cancer Society estimates approximately 1.9 million new cancer cases in the U.S. for 2021.

Conversely, the Middle East and Africa region are projected to experience the most rapid growth over the forecast period. This surge is attributed to a growing population suffering from functional gastrointestinal disorders and other chronic lifestyle ailments. Advancements in healthcare infrastructure, increased healthcare spending, and rising awareness of available diagnostic and therapeutic solutions are key drivers of regional market growth. Furthermore, factors such as a growing geriatric population, rapid economic development, and increased government healthcare investments are expected to attract foreign investments to the region. The presence of key industry players in the Middle East and Africa further accelerates the adoption of endoscopes, supporting the region's market growth.

By Product

By End-use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others