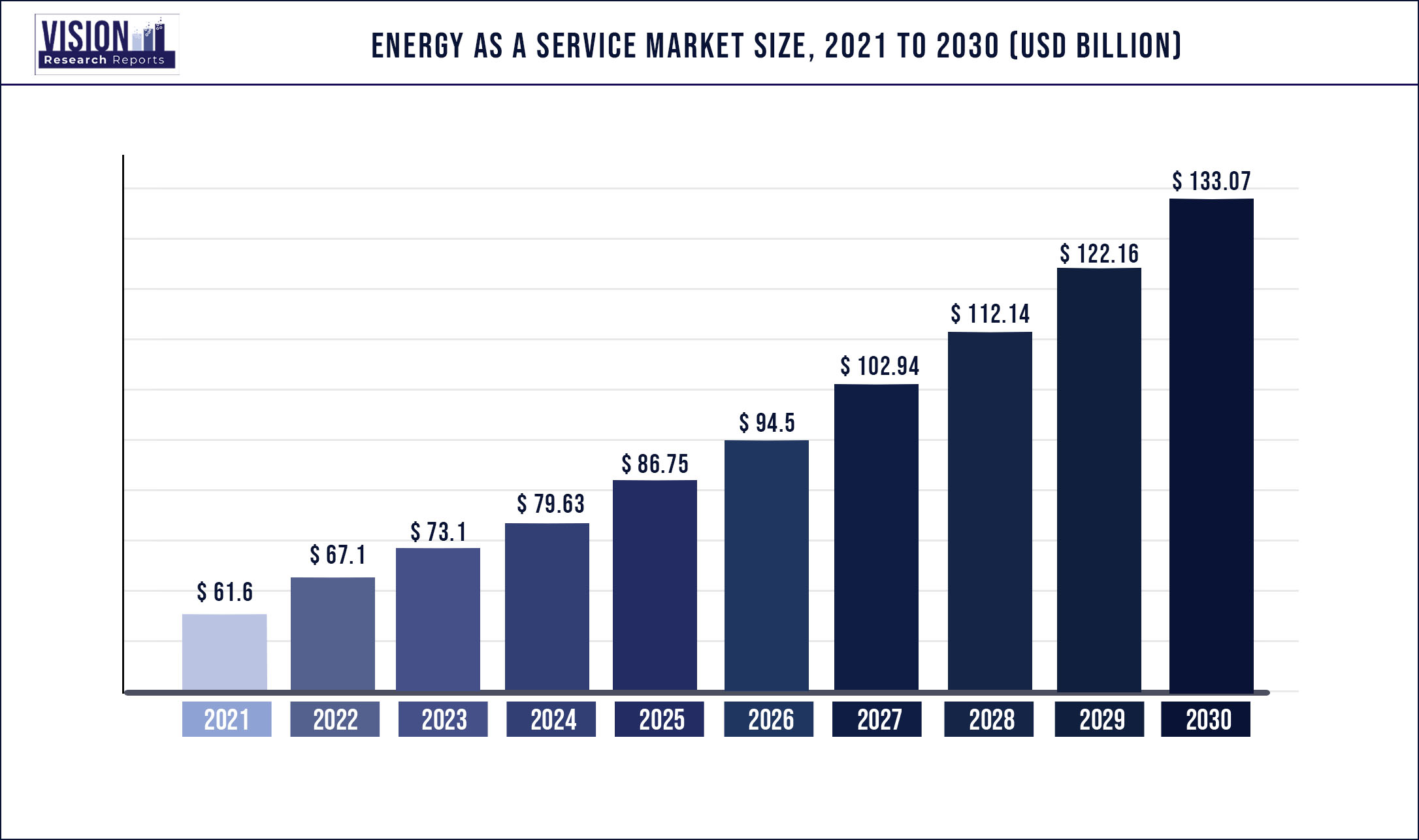

The global energy as a service market was surpassed at USD 61.6 billion in 2021 and is expected to hit around USD 133.07 billion by 2030, growing at a CAGR of 8.93% from 2022 to 2030.

Upsurge in energy supply along with rising awareness regarding the adoption of green energy sources has transformed the energy and power industry.

Rising volatility of crude oil prices is likely to positively influence the growth of the market for Energy as a Service (EaaS). Relaxation in the privatization and Foreign Direct Investment (FDI) norms is another significant factor enabling the market growth. Governments across the world are increasingly financing various energy projects, which in turn is projected to fuel the demand for energy and power plants in the forthcoming years.

Collective use of smart metering and smart grids are likely to aid for the superior management of energy and power services. Improved infrastructural amenities are also estimated to fuel the market expansion in the forthcoming years. Increasing expenditure on oil and gas is an additional factor likely to motivate the market growth over the forecast period.

Increasing investments in energy efficient projects sponsored by governing bodies will also encourage the market expansion. The diffusion of renewable energy sources is on the rise and will, fuel up the demand for energy. Rise in the adoption of Distributed Energy Resources (DER), various transformation in the transportation sector by electrification such as electric vehicles and sustainably improved emphasis on energy.

Asia Pacific is projected to witness a CAGR of over 17.2% from 2022 to 2027. The presence of a large enterprises customer base in the region is projected to bode well for the regional growth. Even if the energy as a service is a novel concept in Asia Pacific, energy is projected to be a notable element for the purpose of electricity generation with the exhaustion of fossil fuels.

The key market players include Schneider Electric; Engie; Siemens; Honeywell International Inc.; Veolia; Enel X S.r.l.; and EDF. Schneider Electric is a major player in automation and energy management. The company is inclined toward providing microgrids as services to commercial and governmental institutions. The company has signed several agreements in order to enhance the EaaS business model which is disturbing the space and thus aiding the consumers to accept the microgrids.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 61.6 billion |

| Revenue Forecast by 2030 | USD 133.07 billion |

| Growth rate from 2022 to 2030 | CAGR of 8.93% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Service, end user, region |

| Companies Covered |

Schneider Electric; Siemens; Engie; Honeywell International Inc.; Veolia; EDF; Johnson Controls; Bernhard; General Electric; Entegrity; Enel SpA; Ørsted A/S; NORESCO, LLC; Centrica plc; Wendel |

End-user Insights

On the basis of end user, the energy as a service market is segmented into commercial and industrial users. The commercial segment is projected to register the fastest growth during the forecast period. The segment includes establishments, such as educational institutions, healthcare institutes, information centers, airports, and others. In the commercial sector, the buildings are solely responsible for more than 30% of overall consumption. As per the American Council for Energy-Efficient Economy (ACEEE), these institutions/establishments account for over 18% of the energy used by various sectors in the United States. Furthermore, half of the energy used by the commercial sector goes toward lighting and heating.

The growth in the segment can be attributed to various factors including an increase in occupancy, floor area, and admittance to services coupled with a surge in activities, including changes in climate and population. Different types of commercial buildings have exceptional energy needs and the EaaS market helps the commercial owner’s technical expertise and limited capital to instrument efficiency programs. Among several types of commercial buildings, service, and mercantile buildings consume most of the energy and are thus anticipated to contribute to the market growth.

The industrial segment is anticipated to hold the largest market share during the forecast period with energy service operations being mandated in the commercial segment. This is mainly because of significant structural impacts such as economic growth.

Service Insights

Based on service, the market for energy as a service is bifurcated into supply, demand, and optimization services. Supply service accounted for the largest market share in 2022 whereas, the demand services segment, on the other hand, is anticipated to register the fastest CAGR over the forecast period. Rising government efforts to encourage renewable energy coupled with the need for cost containment and energy conservation are anticipated to bode well for the growth of the segment in the forthcoming years.

The demand service segment held the leading market share in 2022 and is anticipated to continue leading the market during the forecast period. With the growing prices, the consumers are looking to procure robust energy supply in the absence of grid. This factor is anticipated to fuel the growth of the segment in near future.

The demand response management solution is expected to be vital in Energy as a service, which schedules the operation of appliances to save energy costs by considering the characteristics of electric equipment as well as customer convenience. Moreover, the solution advances the reliability of electrical grids and decreases the electricity cost of customers by shifting part of the demand from peak to off-peak demand periods. This has resulted in the increased adoption of demand services in industrial facilities.

The energy optimization services segment, on the other hand, is anticipated to register a healthy growth rate over the forecast period. Rising government efforts to encourage renewable energy coupled with the need for cost containment and energy conservation are anticipated to bode well for the growth of the segment in the forthcoming years.

Regional Insights

Europe is projected to remain as the largest regional segment for energy as a service, at a market share of 41.85% in 2030, owing to the presence of intelligent building and building automation vendors in the utility and space. Key players in the region are inclined towards reducing costs for delivering services and enhancing the customer experience as per their needs.

Europe, led by Germany, Italy, and UK emerged as the largest regional market in 2022 of the global energy as a service market share. Various manufacturing enterprises have witnessed a rising trend of technology adoption in their operating facilities. IT-enabled high performance and intelligent manufacturing process is one of the key trends driving manufacturing industry in the region. In addition, revisions in European Commission legislative norms to incorporate energy efficiency in various industrial, commercial and residential sectors is expected to drive technological advancements in manufacturing and power & energy sectors over the next few years.

North America is projected to emerge as the second-largest regional segment. Key players are inclined toward reducing costs for delivering services and enhancing the customer experience.

The United States has a majority share of the North American energy market as a service, and this trend is expected to continue until 2030. North America is expected to be the largest regional segment due to the presence of smart building and building automation vendors. Key players tend to reduce the cost of providing services and improve the customer experience. Industry growth is expected to trigger a green building model, and also, support from their respective governments will lead to consumption-based energy measurements.

Asia Pacific is expected to witness the highest market growth due to the rise in large enterprises. For instance, in 2019, India had more than 300 proposed smart cities projects worth $2 billion. Although energy as a service is still in a nascent stage in the region, the exhaustion of fossil fuels for electricity generation is anticipated to create growth opportunities for the market in the forthcoming years. Moreover, the adoption of green building models and rising government support are some of the factors projected to fuel regional growth.

China will hold the largest market share in the Asia Pacific region in 2022 and will register a significant CAGR during the forecast period. The Chinese government has been actively investing in energy efficient power generation. They also opened a channel for foreign investment in the country. This is expected to boost the energy market as a service in the region.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Energy As A Service Market

5.1. COVID-19 Landscape: Energy As A Service Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Energy As A Service Market, By Service

8.1. Energy As A Service Market, by Service, 2022-2030

8.1.1. Supply

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Demand

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Energy Optimization

8.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Energy As A Service Market, By End-user

9.1. Energy As A Service Market, by End-user, 2022-2030

9.1.1. Industrial

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Commercial

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Energy As A Service Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Service (2017-2030)

10.1.2. Market Revenue and Forecast, by End-user (2017-2030)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Service (2017-2030)

10.1.3.2. Market Revenue and Forecast, by End-user (2017-2030)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Service (2017-2030)

10.1.4.2. Market Revenue and Forecast, by End-user (2017-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Service (2017-2030)

10.2.2. Market Revenue and Forecast, by End-user (2017-2030)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Service (2017-2030)

10.2.3.2. Market Revenue and Forecast, by End-user (2017-2030)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Service (2017-2030)

10.2.4.2. Market Revenue and Forecast, by End-user (2017-2030)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Service (2017-2030)

10.2.5.2. Market Revenue and Forecast, by End-user (2017-2030)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Service (2017-2030)

10.2.6.2. Market Revenue and Forecast, by End-user (2017-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Service (2017-2030)

10.3.2. Market Revenue and Forecast, by End-user (2017-2030)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Service (2017-2030)

10.3.3.2. Market Revenue and Forecast, by End-user (2017-2030)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Service (2017-2030)

10.3.4.2. Market Revenue and Forecast, by End-user (2017-2030)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Service (2017-2030)

10.3.5.2. Market Revenue and Forecast, by End-user (2017-2030)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Service (2017-2030)

10.3.6.2. Market Revenue and Forecast, by End-user (2017-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Service (2017-2030)

10.4.2. Market Revenue and Forecast, by End-user (2017-2030)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Service (2017-2030)

10.4.3.2. Market Revenue and Forecast, by End-user (2017-2030)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Service (2017-2030)

10.4.4.2. Market Revenue and Forecast, by End-user (2017-2030)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Service (2017-2030)

10.4.5.2. Market Revenue and Forecast, by End-user (2017-2030)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Service (2017-2030)

10.4.6.2. Market Revenue and Forecast, by End-user (2017-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Service (2017-2030)

10.5.2. Market Revenue and Forecast, by End-user (2017-2030)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Service (2017-2030)

10.5.3.2. Market Revenue and Forecast, by End-user (2017-2030)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Service (2017-2030)

10.5.4.2. Market Revenue and Forecast, by End-user (2017-2030)

Chapter 11. Company Profiles

11.1. Schneider Electric

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Siemens

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Engie

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Honeywell International Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Veolia

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. EDF

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Johnson Controls

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Bernhard

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. General Electric

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Entegrity

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others