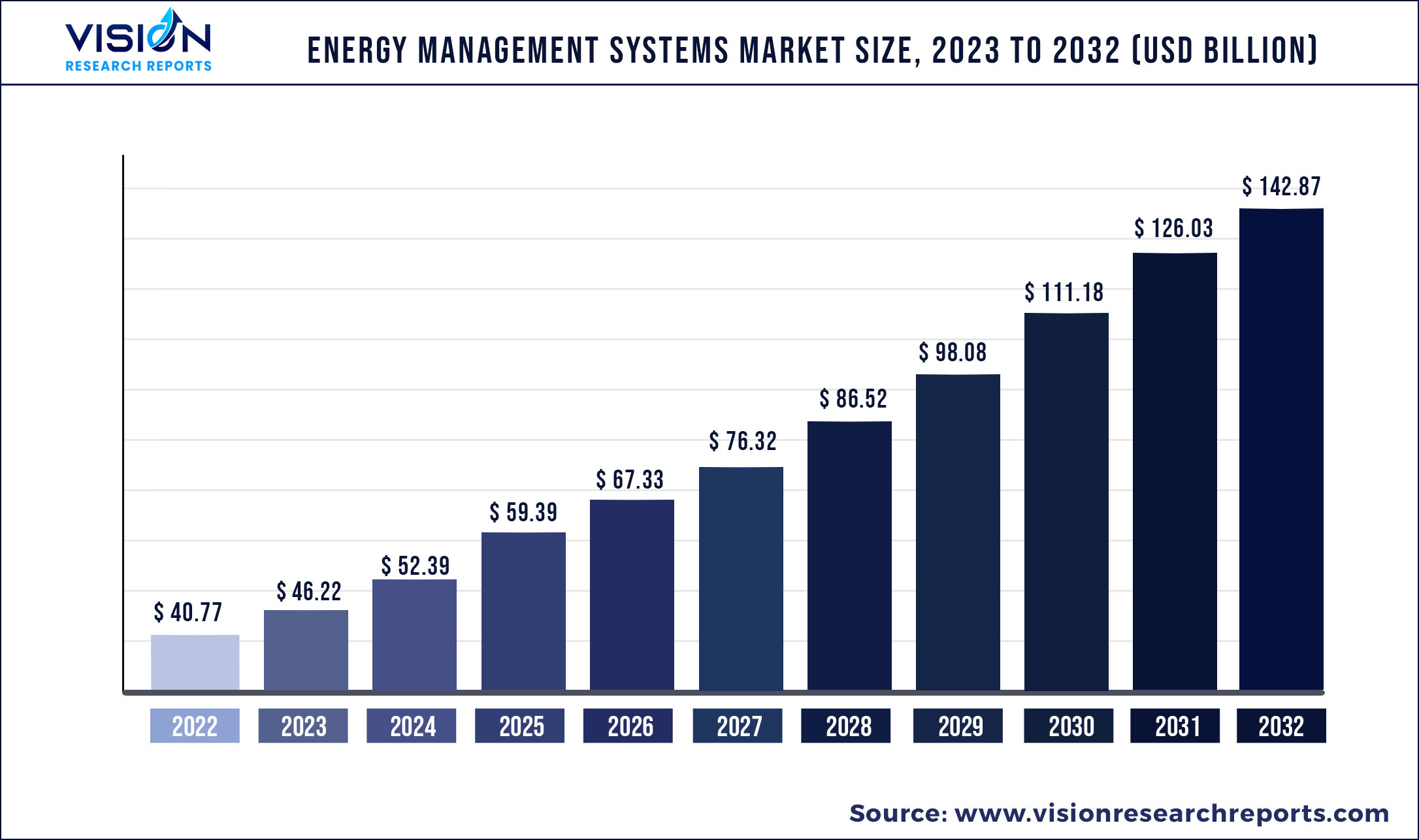

The global energy management systems market was estimated at USD 40.77 billion in 2022 and it is expected to surpass around USD 142.87 billion by 2032, poised to grow at a CAGR of 13.36% from 2023 to 2032.

Key Pointers

| Report Coverage | Details |

| Market Size in 2022 | USD 40.77 billion |

| Revenue Forecast by 2032 | USD 142.87 billion |

| Growth rate from 2023 to 2032 | CAGR of 13.36% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Schneider Electric SE; Honeywell International Inc.; Siemens AG; Johnson Controls, Inc.; C3.ai; Inc.; GridPoint; General Electric; ABB; International Business Machines Corporation; Cisco Systems, Inc. |

An uptick in the management of energy use across commercial, industrial, and public sector organizations has fueled the demand for energy management systems (EMS). Implementing advanced energy-efficient technologies and reducing energy waste will gain ground to contain greenhouse gas emissions, minimize the potential exposure to fluctuating energy prices and bolster productivity. In February 2020, the World Resources Institute cited data suggesting that energy consumption was the biggest source of human-caused greenhouse gas emissions. Amidst the prevailing trend, industry players could seek IoT-based solutions to optimize energy consumption and control the energy flow.

The competitive landscape alludes to strategic planning, such as technological advancements, collaborations, product offerings, mergers & acquisitions, and geographical expansion to gain momentum globally. For instance, in July 2022, Eaton collaborated with the EU-backed Flow Consortium (24 external partners and six leading universities across Europe) to develop and demonstrate an integrated electric vehicle charging infrastructure. The USD 10.4 million project, under the aegis of EU’s Horizon Europe Research and Innovation program, could span till March 2026.

The robust pace of digitization in the energy landscape, along with the paradigm shift witnessed in electrification, has fostered the demand for energy management system software. EMS plays an invaluable role in helping companies identify opportunities to enhance and adopt energy-saving technologies. EMS is likely to receive impetus to provide stability in energy provision, flexibility in power generation and boost energy efficiency. Furthermore, the environmentally friendly energy consumer framework will emphasize quality and occupancy sensors to regulate energy consumption. Technologies to minimize energy consumption may lead to the decarbonization trend to avoid using fossil fuels.

State-of-the-art technologies, such as edge AI have gained considerable traction across advanced and emerging economies, mainly due to the onslaught of the COVID-19 pandemic. The prevalence of hybrid work culture and rotating class schedules furthered the trend for smart building management. Additionally, edge AI has underscored building management system (BMS) to bolster safety, minimize energy consumption, better utilize building assets and offer increased occupant comfort. The outbreak prompted building managers to prioritize AI-leveraged BMS and optimize and automate energy usage. The post-COVID outlook suggests an emphasis on EMS could pave the way for low-carbon economic growth.

Energy Management Systems Market Segmentations:

| By System Type | By Component | By Deployment | By Vertical |

|

Industrial energy management systems (IEMS) Building energy management systems (BEMS) Home energy management systems (HEMS) |

Hardware Software Services |

On-Premises Cloud |

Residential Energy & Power Telecom & IT Manufacturing Retail Healthcare Others |

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Energy Management Systems Market

5.1. COVID-19 Landscape: Energy Management Systems Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Energy Management Systems Market, By System Type

8.1. Energy Management Systems Market, by System Type, 2023-2032

8.1.1. Industrial energy management systems (IEMS)

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Building energy management systems (BEMS)

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Home energy management systems (HEMS)

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Energy Management Systems Market, By Component

9.1. Energy Management Systems Market, by Component, 2023-2032

9.1.1. Hardware

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Software

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Services

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Energy Management Systems Market, By Deployment

10.1. Energy Management Systems Market, by Deployment, 2023-2032

10.1.1. On-Premises

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Cloud

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Energy Management Systems Market, By Vertical

11.1. Energy Management Systems Market, by Vertical, 2023-2032

11.1.1. Residential

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Energy & Power

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. Telecom & IT

11.1.3.1. Market Revenue and Forecast (2020-2032)

11.1.4. Manufacturing

11.1.4.1. Market Revenue and Forecast (2020-2032)

11.1.5. Retail

11.1.5.1. Market Revenue and Forecast (2020-2032)

11.1.6. Healthcare

11.1.6.1. Market Revenue and Forecast (2020-2032)

11.1.7. Others

11.1.7.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global Energy Management Systems Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by System Type (2020-2032)

12.1.2. Market Revenue and Forecast, by Component (2020-2032)

12.1.3. Market Revenue and Forecast, by Deployment (2020-2032)

12.1.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by System Type (2020-2032)

12.1.5.2. Market Revenue and Forecast, by Component (2020-2032)

12.1.5.3. Market Revenue and Forecast, by Deployment (2020-2032)

12.1.5.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by System Type (2020-2032)

12.1.6.2. Market Revenue and Forecast, by Component (2020-2032)

12.1.6.3. Market Revenue and Forecast, by Deployment (2020-2032)

12.1.6.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.2. Europe

12.2.1. Market Revenue and Forecast, by System Type (2020-2032)

12.2.2. Market Revenue and Forecast, by Component (2020-2032)

12.2.3. Market Revenue and Forecast, by Deployment (2020-2032)

12.2.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by System Type (2020-2032)

12.2.5.2. Market Revenue and Forecast, by Component (2020-2032)

12.2.5.3. Market Revenue and Forecast, by Deployment (2020-2032)

12.2.5.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by System Type (2020-2032)

12.2.6.2. Market Revenue and Forecast, by Component (2020-2032)

12.2.6.3. Market Revenue and Forecast, by Deployment (2020-2032)

12.2.6.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by System Type (2020-2032)

12.2.7.2. Market Revenue and Forecast, by Component (2020-2032)

12.2.7.3. Market Revenue and Forecast, by Deployment (2020-2032)

12.2.7.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by System Type (2020-2032)

12.2.8.2. Market Revenue and Forecast, by Component (2020-2032)

12.2.8.3. Market Revenue and Forecast, by Deployment (2020-2032)

12.2.8.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.3. APAC

12.3.1. Market Revenue and Forecast, by System Type (2020-2032)

12.3.2. Market Revenue and Forecast, by Component (2020-2032)

12.3.3. Market Revenue and Forecast, by Deployment (2020-2032)

12.3.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by System Type (2020-2032)

12.3.5.2. Market Revenue and Forecast, by Component (2020-2032)

12.3.5.3. Market Revenue and Forecast, by Deployment (2020-2032)

12.3.5.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by System Type (2020-2032)

12.3.6.2. Market Revenue and Forecast, by Component (2020-2032)

12.3.6.3. Market Revenue and Forecast, by Deployment (2020-2032)

12.3.6.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by System Type (2020-2032)

12.3.7.2. Market Revenue and Forecast, by Component (2020-2032)

12.3.7.3. Market Revenue and Forecast, by Deployment (2020-2032)

12.3.7.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by System Type (2020-2032)

12.3.8.2. Market Revenue and Forecast, by Component (2020-2032)

12.3.8.3. Market Revenue and Forecast, by Deployment (2020-2032)

12.3.8.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.4. MEA

12.4.1. Market Revenue and Forecast, by System Type (2020-2032)

12.4.2. Market Revenue and Forecast, by Component (2020-2032)

12.4.3. Market Revenue and Forecast, by Deployment (2020-2032)

12.4.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by System Type (2020-2032)

12.4.5.2. Market Revenue and Forecast, by Component (2020-2032)

12.4.5.3. Market Revenue and Forecast, by Deployment (2020-2032)

12.4.5.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by System Type (2020-2032)

12.4.6.2. Market Revenue and Forecast, by Component (2020-2032)

12.4.6.3. Market Revenue and Forecast, by Deployment (2020-2032)

12.4.6.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by System Type (2020-2032)

12.4.7.2. Market Revenue and Forecast, by Component (2020-2032)

12.4.7.3. Market Revenue and Forecast, by Deployment (2020-2032)

12.4.7.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by System Type (2020-2032)

12.4.8.2. Market Revenue and Forecast, by Component (2020-2032)

12.4.8.3. Market Revenue and Forecast, by Deployment (2020-2032)

12.4.8.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by System Type (2020-2032)

12.5.2. Market Revenue and Forecast, by Component (2020-2032)

12.5.3. Market Revenue and Forecast, by Deployment (2020-2032)

12.5.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by System Type (2020-2032)

12.5.5.2. Market Revenue and Forecast, by Component (2020-2032)

12.5.5.3. Market Revenue and Forecast, by Deployment (2020-2032)

12.5.5.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by System Type (2020-2032)

12.5.6.2. Market Revenue and Forecast, by Component (2020-2032)

12.5.6.3. Market Revenue and Forecast, by Deployment (2020-2032)

12.5.6.4. Market Revenue and Forecast, by Vertical (2020-2032)

Chapter 13. Company Profiles

13.1. Schneider Electric SE

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Honeywell International Inc.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Siemens AG

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Johnson Controls, Inc.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. C3.ai; Inc.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. GridPoint

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. General Electric

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. ABB

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. International Business Machines Corporation

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Cisco Systems, Inc.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others