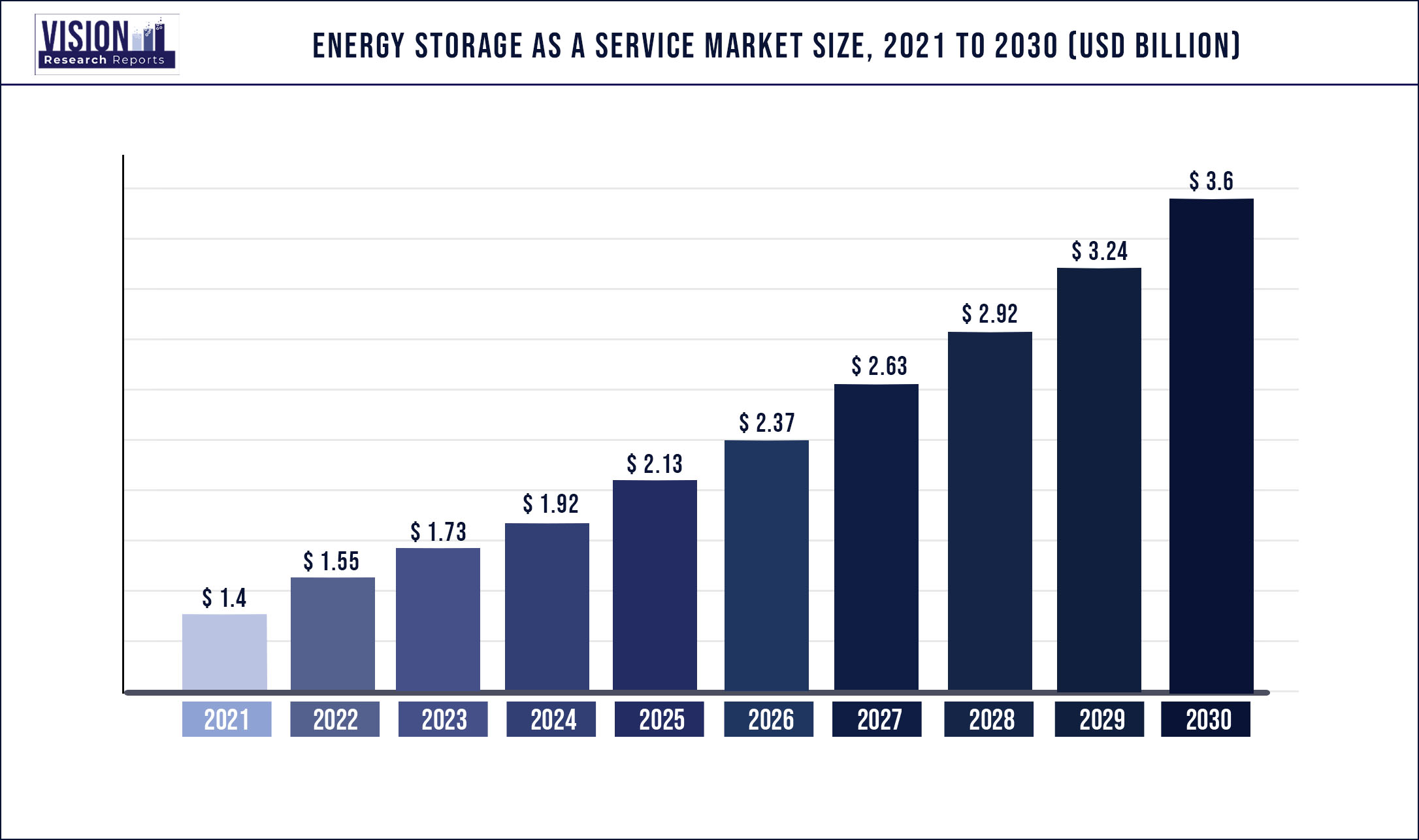

The global energy storage as a service market size was estimated at around USD 1.4 billion in 2021 and it is projected to hit around USD 3.6 billion by 2030, growing at a CAGR of 11.06% from 2022 to 2030

Report Highlights

The global market is predominantly driven by the rising energy consumption and increasing demand for power management in the industrial and residential sectors. Moreover, the convenience and cost-effectiveness offered by the energy storage services are attracting consumers across the globe.

Growing industrialization in emerging countries such as India, Brazil, and China is creating significant energy demand, which, in turn, is expected to drive the market. ESaaS model offers various services, including ancillary services and energy management services, which help in the regular supply of electricity, prevent blackouts, and reduce electricity bills.

In 2021, the market witnessed a decline in growth owing to the outbreak of the Coronavirus pandemic. Lockdown across nations and travel restrictions affected the market. Various industries and commercial complexes were closed, which resulted in a decline in service demand in 2021.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 1.4 billion |

| Revenue Forecast by 2030 | USD 3.6 billion |

| Growth rate from 2022 to 2030 | CAGR of 11.06% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Service, end-user, region |

| Companies Covered | Siemens Energy; Veolia; Honeywell International Inc.; NRStor Inc.; ENGIE Storage Services NA LLC; Customized Energy Solutions Ltd.; YSG Solar; Suntuity; Hydrostor Inc. |

Service Insights

The customer energy management services segment led the market and accounted for over 30.4% share of the global revenue in 2021. Customer energy management services include power reliability, power quality, retail electric energy time-shift, demand charge management, and increased self-consumption of solar PV. Energy storage as a service model has a huge demand for customer energy and power management. It is used as backup power for power reliability when the customer uses solar energy and other renewable energy sources.

The ancillary services segment is likely to expand at the fastest CAGR of 11.9% over the forecast period and is expected to gain high momentum during the upcoming years owing to the increasing adoption of battery storage systems in the ancillary service market. Utilities are decreasing dependency on conventional fossil fuel generation and focusing on renewable and battery storage systems for ancillary services. Ancillary services include frequency regulation, spinning/non-spinning supplemental reserves, voltage support, and black start.

End-user Insights

The industrial, residential, and commercial segment led the market and accounted for over 70.4% share of the global revenue in 2021. Energy storage as a service model is majorly adopted by industrial, residential, and commercial sectors. The industrial sector utilizes these services for reliable power and stable energy supply. Big housing societies and remote residential areas utilize it for regular power supply and lowering the cost of energy consumption.

The utility segment is likely to expand at the fastest CAGR of 11.7% over the forecast period. The increasing focus of energy and power facilities on sustainability is one of the major driving factors for energy storage as a service model. Decreasing dependency on the conventional fossil fuel generators for services such as black start, voltage support, and energy arbitrage by the utilities and increasing focus on renewable power generation and battery storage for such services are expected to drive the market.

Regional Insights

North America dominated the market and accounted for over 30.6% share of the global revenue in 2021 on account of several factors including high energy consumption due to the presence of various industries such as automotive, aerospace, chemical, and healthcare. The demand for services such as peak load, energy arbitrage, black start, and demand charge management is high among the industrial, commercial, and residential sectors. Thus, industrialists rather than purchasing the energy storage systems opt for energy storage services for regular energy supply and to avoid blackouts.

Asia Pacific is expected to expand at the highest CAGR of 12.78% over the forecast period. This is due to the presence of various untapped markets, increasing industrialization, and rising energy consumption. The utilities and industries in countries such as India, South Korea, Japan, and China are expected to increase focus on this business model and increase utilization of these services in their system in the future.

The Middle East and Africa is expected to be the second-fastest-growing market over the forecast period. This is due to the presence of emerging markets and remote areas such as Africa where approximately 600 million people do not have reliable power. There is an opportunity for the market players to deploy resilient and distributed microgrids with renewables and energy storage.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Energy Storage As A Service Market

5.1. COVID-19 Landscape: Energy Storage As A Service Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Energy Storage As A Service Market, By Service

8.1. Energy Storage As A Service Market, by Service, 2022-2030

8.1.1. Bulk Energy Services

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Ancillary Services

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Transmission Infrastructure Services

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Distribution Infrastructure Services

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. Customer Energy Management Services

8.1.5.1. Market Revenue and Forecast (2017-2030)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Energy Storage As A Service Market, By Service

9.1. Energy Storage As A Service Market, by Service, 2022-2030

9.1.1. Utility

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Industrial, Residential & Commercial

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Energy Storage As A Service Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Service (2017-2030)

10.1.2. Market Revenue and Forecast, by Service (2017-2030)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Service (2017-2030)

10.1.3.2. Market Revenue and Forecast, by Service (2017-2030)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Service (2017-2030)

10.1.4.2. Market Revenue and Forecast, by Service (2017-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Service (2017-2030)

10.2.2. Market Revenue and Forecast, by Service (2017-2030)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Service (2017-2030)

10.2.3.2. Market Revenue and Forecast, by Service (2017-2030)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Service (2017-2030)

10.2.4.2. Market Revenue and Forecast, by Service (2017-2030)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Service (2017-2030)

10.2.5.2. Market Revenue and Forecast, by Service (2017-2030)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Service (2017-2030)

10.2.6.2. Market Revenue and Forecast, by Service (2017-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Service (2017-2030)

10.3.2. Market Revenue and Forecast, by Service (2017-2030)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Service (2017-2030)

10.3.3.2. Market Revenue and Forecast, by Service (2017-2030)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Service (2017-2030)

10.3.4.2. Market Revenue and Forecast, by Service (2017-2030)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Service (2017-2030)

10.3.5.2. Market Revenue and Forecast, by Service (2017-2030)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Service (2017-2030)

10.3.6.2. Market Revenue and Forecast, by Service (2017-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Service (2017-2030)

10.4.2. Market Revenue and Forecast, by Service (2017-2030)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Service (2017-2030)

10.4.3.2. Market Revenue and Forecast, by Service (2017-2030)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Service (2017-2030)

10.4.4.2. Market Revenue and Forecast, by Service (2017-2030)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Service (2017-2030)

10.4.5.2. Market Revenue and Forecast, by Service (2017-2030)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Service (2017-2030)

10.4.6.2. Market Revenue and Forecast, by Service (2017-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Service (2017-2030)

10.5.2. Market Revenue and Forecast, by Service (2017-2030)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Service (2017-2030)

10.5.3.2. Market Revenue and Forecast, by Service (2017-2030)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Service (2017-2030)

10.5.4.2. Market Revenue and Forecast, by Service (2017-2030)

Chapter 11. Company Profiles

11.1. Siemens Energy

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Veolia

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Honeywell International Inc.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. NRStor Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. ENGIE Storage Services NA LLC

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Customized Energy Solutions Ltd.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. YSG Solar

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Hydrostor Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others