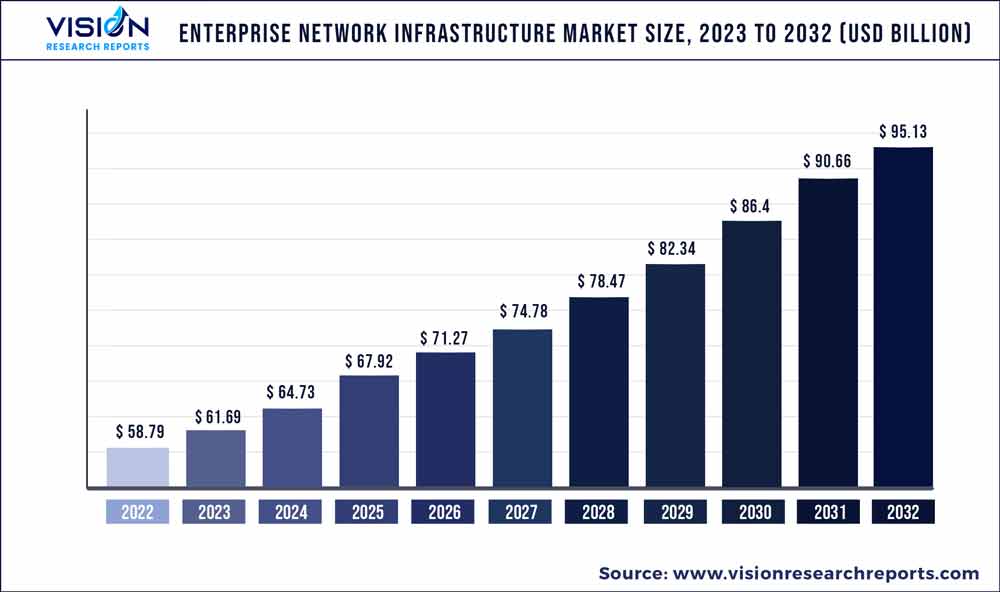

The global enterprise network infrastructure market was surpassed at USD 58.79 billion in 2022 and is expected to hit around USD 95.13 billion by 2032, growing at a CAGR of 4.93% from 2023 to 2032.

Key Pointers

Report Scope of the Enterprise Network Infrastructure Market

| Report Coverage | Details |

| Market Size in 2022 | USD 58.79 billion |

| Revenue Forecast by 2032 | USD 95.13 billion |

| Growth rate from 2023 to 2032 | CAGR of 4.93% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | ALE International; ALE USA INC; Aruba Networks; Inc.; Avaya Inc.; Broadcom; Cisco Systems, Inc.; Hewlett Packard Enterprise Development LP; Huawei Technologies Co., Ltd; Juniper Networks Inc; Nokia; ZTE Corporation |

The market is expected to grow due to the increasing need for bandwidth, technology shifts to wireless, and the rising adoption of smart devices. Enterprises are adopting digital technology to improve business operations. With increasing digitalization, the importance of network infrastructure is increasing, and thus the demand for network infrastructure is also growing. Moreover, the increasing virtualization of servers, hybrid cloud technologies, personal cloud, and growing demand for enterprise mobility are expected to favorably impact the market over the forecast period.

The rollout of 5G networks is expected to create opportunities for enterprise network infrastructure providers. The technology enables faster speeds and lower latency, enabling organizations to deploy more advanced applications and services. For instance, in January 2023, after consumer 5G rollouts, Indian telecom firms started deploying private 5G networks for enterprises in the country. The private 5G networks are entirely disconnected from public networks, which liberates enterprises from concerns like bandwidth problems that can impact processes. Many suppliers are expanding their product portfolios and global reach to bolster their market position and revenues. This type of undertaking is expected to increase the enterprise network infrastructure equipment adoption rate offering new growth opportunities for the market. For instance, in November 2022, Arrcus Inc., the hyper-scale networking Software Company, announced the continued expansion of its operations in India. The company also expanded its TAC support and customer engineering, enhancing its ability to provide 24 x 7 technical support.

Numerous well-established international corporations distinguish the market, and small and medium-sized vendors such as Cisco Systems, Inc., Hewlett Packard Enterprise Company, Huawei Technologies Co. Ltd., and Juniper Networks Inc. Equipment vendors focus on their R&D efforts on releasing the most recent technologies to boost access speed and expand enterprise network infrastructure space. Furthermore, many suppliers are increasing their global reach to strengthen their market position and revenues. This type of project is expected to increase the enterprise network infrastructure equipment adoption rate. Enterprise network infrastructure companies aggressively pursue organic and inorganic tactics to expand their global footprints.

North America is projected to hold a significant market share during the forecast period. The U.S. is positively contributing to the growth of the regional market. The presence of well-established device manufacturing vendors is one of the key factors supporting the market growth. This region is one of the promising regions to launch new technology in IT infrastructure and advanced research and development activities, which help innovate and manufacture high-speed Enterprise Network Infrastructure devices. Additionally, the ease of availability of IT resources and related technological talents contribute to and drive the market in the region.

Technology Insights

The routers & switches segment led the market in 2022, accounting for over 40.03% share of the global revenue. Routers transfer data packets along the network and are placed in conjunction with two or more networks. Thus, routers and switches are essential parts of the enterprise network, whereas switches connect devices on the network and employ packet switching to exchange data. The continuously increasing number of enterprise users and advanced broadband infrastructure are expected to drive this segment. Thus, demand for the router and switch segment is contributing to the market revenue. For instance, in July 2021, Edgecore Networks Corporation, which delivers wireless and wired networking solutions and products, launched an aggregation router solution for the following generation of service provider infrastructures. The AS7926-40XKFB 100G aggregation router allows users to upgrade their network infrastructure and address the challenges of 5G deployment and traffic growth from the network edge to the core.

The enterprise telephony segment is expected to showcase lucrative growth over the forecast period. Enterprise telephony is the transmission of voice, fax, and other information via an electronic medium with geographic business expansions across the globe by SMEs and large enterprises. Enterprise telephony ensures the smooth flow of communication and a socialized environment among employees from all industries. The adoption of enterprise telephony solutions is increasing to support the communication requirement of the enterprise. Thus, this segment contributes to the growth rate of the segment.

Industry Insights

The information technology & telecommunications segment dominated the market and accounted for more than 19.05% share of the global revenue in 2022. The startling increase in data traffic is projected to accelerate the expansion of IT and telecom infrastructure. Also, IT and telecom companies have been forced to build a robust IT and telecom infrastructure due to expanding smartphone penetration in rural regions and rising digital literacy, particularly in emerging and developing nations like China and India. An increasing number of mobile workers demand access to every networked and internet-based service using the most recent PC tablets, cellphones, and laptop PCs from anywhere.

The healthcare segment is anticipated to register the highest CAGR over the forecast period. Citizens are increasingly concerned about their health as public awareness of health issues grows. Healthcare institutions and businesses actively monitor and track their patients' health histories to provide patients with better health treatments and services. As a result, healthcare organizations and businesses are embracing digital platforms and utilizing enterprise networks for information sharing and collaboration. This will improve consumer support for their brand. Owing to this, businesses and health institutions are investing in enterprise network infrastructure. Cybercriminals increasingly target healthcare organizations due to the sensitive nature of the data they handle.

Enterprise Size Insights

The large enterprises segment led the market in 2022, accounting for over 71.1% share of the global revenue. Large enterprises include enterprises with revenues in billions and more than 1000 employees. Large enterprises increasingly invest in network security to protect themselves from cyber dangers. This requires installing intrusion detection and prevention systems, network segmentation, and multi-factor authentication. Major corporations are beginning to investigate the possibility of 5G networking, which provides faster speeds and lower latency than earlier generations of wireless technology. For instance, in November 2022, a digital infrastructure company, Equinix, Inc, expanded its international business exchange sites. The company has invested more than USD 1 billion in the digital infrastructure of the U.K.

The SMEs segment is predicted to foresee significant growth in the coming years. These enterprises have less than a billion in revenue and less than 1000 employees. The rising growth of this market is due to an increasing number of small and medium-sized businesses focusing on expansion, which encourages them to employ numerous innovative and novel solutions. These companies need more funding and more resources. On the other hand, governments support SMEs by offering tax benefits and other services.

Regional Insights

North America dominated the market and accounted for over 35.14% share of the global revenue in 2022, owing to the early and rapid adoption of advanced technologies across regional multinational companies. The emerging adoption of the work-from-home process is augmenting the growth of routers and switches, which is expected to expand and drive the growth of enterprise network infrastructure in North America. Demand for wireless access points also draws attention to business enterprises transforming their business infrastructure. For instance, in February 2022, the U.S. Department of Energy (DOE) announced USD 6 million in funding to advance 5G wireless networking for science applications for five research and development projects. The prominent evolution of enterprise network infrastructure has a wide range of technology and practices. The development involves integrating various software and hardware components, including routers, switches, firewalls, and other network devices. Moreover, the emerging use of cloud computing is augmenting market growth.

The Asia Pacific region is anticipated to witness significant growth in the enterprise network infrastructure owing to the presence of developing economies such as China, Japan India. The increased demand for high-bandwidth applications has prompted businesses to adopt advanced enterprise networking solutions to address current bandwidth shortage issues. Even in post-pandemic times, laptops, cellphones, and tablets have become more popular due to trends like BYOD (Bring Your Own Device), which is expected to drive the utilization of these devices in the region. Migration from rural to urban areas has increased megacities in Asia-Pacific. It is also driving the need for the government and public sector to digitalize and expand the solutions that address urban challenges and improve the quality of life for citizens.

Enterprise Network Infrastructure Market Segmentations:

By Technology

By Industry

By Enterprise Size

By Regional

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others