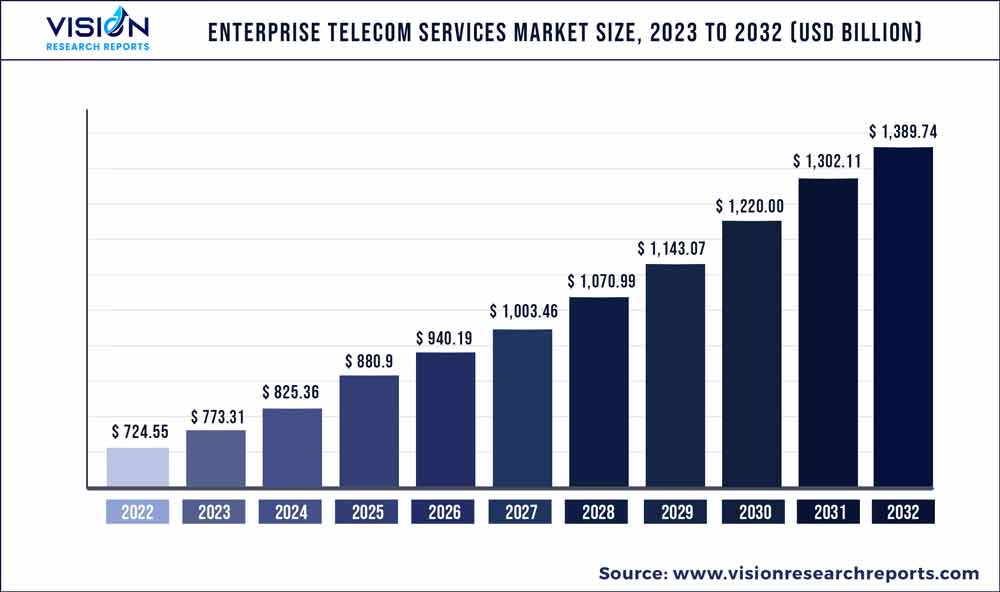

The global enterprise telecom services market was valued at USD 724.55 billion in 2022 and it is predicted to surpass around USD 1,389.74 billion by 2032 with a CAGR of 6.73% from 2023 to 2032.

Key Pointers

Report Scope of the Enterprise Telecom Services Market

| Report Coverage | Details |

| Market Size in 2022 | USD 724.55 billion |

| Revenue Forecast by 2032 | USD 1,389.74 billion |

| Growth rate from 2023 to 2032 | CAGR of 6.73% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Nokia Corporation; TELEFONAKTIEBOLAGET LM ERICSSON; ZTE Corporation; AT&T INC.; Huawei Technologies Co., Ltd.; Verizon Communications Inc.; Thales Group; Vodafone Group Plc.; China Mobile Limited; Microsoft Corporation. |

Rising usage of unified communications tools that integrate voice, video, messaging, and collaboration features is a major factor contributing to the segment growth. These tools are essential for businesses seeking to improve communication and productivity while enabling remote work. 5G networks are also transforming the enterprise telecom services market, providing faster data speeds and lower latency, which is essential for supporting emerging technologies such as IoT and AI. Moreover, as businesses continue to rely on digital services, cybersecurity remains a top priority, and the demand for secure enterprise telecom services is on the rise.

Private 5G networks are projected to play a big part in the 5G IoT market's growth. As compared to public networks, these networks give specialized high-speed access with improved dependability, security, and control to enterprises. Private 5G networks will be especially important for businesses like manufacturing, logistics, and healthcare, where high-bandwidth, low-latency connection is required for real-time applications and services. Moreover, private 5G networks can enable automation and robots, making processes more efficient and cost-effective.

The increasing spread of 5G networks being built by telecommunications firms worldwide is a crucial driver driving market development. Businesses and consumers will progressively embrace 5G-enabled IoT devices as 5G networks become more generally available, resulting in further investment in this industry. Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) with 5G IoT devices is projected to drive investment since these technologies can allow predictive analytics and automated decision-making, further increasing IoT system capabilities.

The outbreak of the COVID-19 pandemic had a positive impact on the market. The outbreak of the COVID-19 pandemic highlighted the vulnerabilities and weaknesses of conventional business models and prompted businesses to pursue digital transformation initiatives.Moreover, the pandemic has accelerated the shift to remote work, leading to an increased demand for telecom services such as broadband, voice, and video conferencing services. It has also driven an increase in the adoption of cloud-based services as enterprises look for ways to support remote work and virtual collaboration

Service Insights

The fixed internet services segment dominated the market in 2022 and accounted for more than 43.01% share of the global revenue. The segment is anticipated to expand at the fastest CAGR throughout the forecast period. Enterprises are seeking faster and more dependable internet connections as they rely increasingly on the internet for business, education, and pleasure. As a result, businesses are turning to fixed internet access services, which give higher internet speeds and are more stable. Furthermore, the growing popularity of online services, constant technological advancements, and increased government measures to encourage fixed broadband services all contribute to the growth of the fixed internet access services market.

The mobile data segment is projected to witness remarkable growth over the forecast period. As organizations become more digital, they must provide clear, open channels of communication to enhance worker and consumer contact. Mobile data services improve the customer experience by connecting workers and consumers directly. Adopting current phone and data services may not only ensure that customers' incoming calls are moved to the appropriate department, but also that calls are not interrupted. Improved connection and simple data transmission enabled by mobile voice and mobile data services are likely to promote the growth of the others category throughout the forecast period.

Transmission Insights

The wireless segment dominated the market in 2022 and accounted for more than 76.04% share of the global revenue. Wireless Local Area Network (WLAN) systems have been quickly adopted throughout the years, allowing cellular devices to connect to the internet in private homes, public spaces, business buildings, airport cafeterias, and other locations. Moreover, the adoption of artificial intelligence, cloud computing, and the internet of things is predicted to contribute greatly to the worldwide expansion of wireless communication channels. Moreover, wireless densification to improve work processes and automate routine test activities is likely to drive market expansion throughout the projection period.

The wireline segment is anticipated to grow substantially over the forecast period. Wireline telecom services link services to the business premises via cables or data lines. The wireline segment's rise may be due to the several benefits provided by wireline connectivity, such as dependability, flexibility, infrastructure, and coverage. When wireless infrastructure is unavailable or inconvenient, wireline transmission is a viable option for businesses. Large or very open regions, such as factories or industrial facilities, require a big volume of data, which wireless connectivity does not handle. In such cases, regular wireline connectivity offers dependable coverage.

Enterprise Size Insights

The small and medium enterprises segment dominated the market in 2022 and accounted for more than 89.06% share of the global revenue. The rising number of small and medium businesses is generating a potential market for enterprise telecom service providers. Small firms are looking for enough IT help to keep up with changing business demands, and an increasingly remote workforce requires an acceptable connection. Small & medium businesses are using telecom services to boost cross-team communication, increase employee productivity, and reach more clients, among other things. Such factors bode well for the growth of the segment over the coming years.

The large enterprises segment is projected to expand at the moderate CAGR over the forecast period. Large enterprises are in constant need to update their offerings and improve their work environment to sustain the growing competition in almost every field. To gain a competitive edge, large enterprises are undergoing digital transformation wherein AI, ML, cloud computing, and automation are playing a crucial role. This is creating significant opportunities for the adoption of telecom services. Additionally, large enterprises across industries such as healthcare, automotive, and manufacturing are seeking improved speed and efficiency through connectivity. At this juncture, telecom service providers are targeting large enterprises to yield more profits. Many telecom providers have also started offering telecom-as-a-service with an aim to partner with enterprises for their telecom needs. Such trends are expected to drive segment growth over the forecast period

End-use Insights

The IT & Telecom segment dominated the market in 2022 and accounted for more than 21.06% share of the global revenue. The broad deployment of 5G networks is a significant growing trend in the IT & Telecom services industry. 5G technology promises faster speeds, lower latency, and more network capacity, allowing new IoT, AR/VR, and autonomous car use cases. The implementation of next-generation high-speed networks is increasing demand for telecom services in IT and telecom applications. Companies are establishing 5G small cell networks, as well as private LTE and 5G networks, in order to acquire faster data bandwidth and prevent network latency. Increased bandwidth connectivity would enable businesses to meet the needs of their clients with minimal downtime, thereby improving the overall customer experience.

The BFSI segment is expected to grow significantly over the forecast period. In recent years, the BFSI industry has undergone a paradigm shift. Online banking, open banking, chatbots, and virtual assistants powered by cutting-edge technologies such as blockchain and big data are just a few of the latest technological trends that will shape the BFSI industry in the coming years. By delivering reliable telecommunications and internet access, enterprise telecom services are likely to play a key role in driving these changes. Yet, maintaining proper data security and privacy protection is one of the primary issues that the BFSI business has faced. Banks and financial institutions must take special precautions to secure their clients' private data and personal information against cyberattacks. As a result, business telecom service providers are developing novel solutions to assist incumbents.

Regional Insights

The Asia Pacific region dominated the market in 2022 and accounted for more than 32.03% share of the global revenue. 5G networks are being rolled out across the Asia Pacific region, and this is expected to drive demand for enterprise telecom services. 5G networks will provide faster data speeds and lower latency, which will enable businesses to develop new applications and services. The Asia Pacific region is also seeing significant growth in the IoT market as more and more devices become connected to the internet, there is a growing demand for enterprise telecom services that can support these devices.

The North America region is expected to grow significantly over the forecast period. Increasing. Rising adoption of cloud-based communications solutions, which allows businesses to access telecom services through the cloud, improving scalability, and reducing costs is a significant factor contributing to the regional growth. The growing popularity of 5G networks is also transforming the industry, providing faster data speeds and low latency for enterprises. With the rise of IoT, there is a growing need for enterprise telecom services that can support connected devices, thereby contributing to the growth of the market.

Enterprise Telecom Services Market Segmentations:

By Service

By Transmission

By Enterprise Size

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Enterprise Telecom Services Market

5.1. COVID-19 Landscape: Enterprise Telecom Services Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Enterprise Telecom Services Market, By Service

8.1. Enterprise Telecom Services Market, by Service, 2023-2032

8.1.1. Fixed Voice Services

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Fixed Internet Access Services

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Pay TV Services

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Machine-to-Machine (Mobile IoT) Services

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Enterprise Telecom Services Market, By Transmission

9.1. Enterprise Telecom Services Market, by Transmission, 2023-2032

9.1.1. Wireline

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Wireless

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Enterprise Telecom Services Market, By Enterprise Size

10.1. Enterprise Telecom Services Market, by Enterprise Size, 2023-2032

10.1.1. Small & Medium Enterprises

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Large Enterprises

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Enterprise Telecom Services Market, By End-use

11.1. Enterprise Telecom Services Market, by End-use, 2023-2032

11.1.1. IT & Telecom

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Manufacturing

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. Healthcare

11.1.3.1. Market Revenue and Forecast (2020-2032)

11.1.4. Retail

11.1.4.1. Market Revenue and Forecast (2020-2032)

11.1.5. Media & Entertainment

11.1.5.1. Market Revenue and Forecast (2020-2032)

11.1.6. Government & Defense

11.1.6.1. Market Revenue and Forecast (2020-2032)

11.1.7. Education

11.1.7.1. Market Revenue and Forecast (2020-2032)

11.1.8. BFSI

11.1.8.1. Market Revenue and Forecast (2020-2032)

11.1.9. Energy and utilities

11.1.9.1. Market Revenue and Forecast (2020-2032)

11.1.10. Transportation & Logistics

11.1.10.1. Market Revenue and Forecast (2020-2032)

11.1.11. Travel & Hospitality

11.1.11.1. Market Revenue and Forecast (2020-2032)

11.1.12. O&G and Mining

11.1.12.1. Market Revenue and Forecast (2020-2032)

11.1.13. Others

11.1.13.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global Enterprise Telecom Services Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Service (2020-2032)

12.1.2. Market Revenue and Forecast, by Transmission (2020-2032)

12.1.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.1.4. Market Revenue and Forecast, by End-use (2020-2032)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Service (2020-2032)

12.1.5.2. Market Revenue and Forecast, by Transmission (2020-2032)

12.1.5.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.1.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Service (2020-2032)

12.1.6.2. Market Revenue and Forecast, by Transmission (2020-2032)

12.1.6.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.1.6.4. Market Revenue and Forecast, by End-use (2020-2032)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Service (2020-2032)

12.2.2. Market Revenue and Forecast, by Transmission (2020-2032)

12.2.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.2.4. Market Revenue and Forecast, by End-use (2020-2032)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Service (2020-2032)

12.2.5.2. Market Revenue and Forecast, by Transmission (2020-2032)

12.2.5.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.2.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Service (2020-2032)

12.2.6.2. Market Revenue and Forecast, by Transmission (2020-2032)

12.2.6.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.2.6.4. Market Revenue and Forecast, by End-use (2020-2032)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Service (2020-2032)

12.2.7.2. Market Revenue and Forecast, by Transmission (2020-2032)

12.2.7.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.2.7.4. Market Revenue and Forecast, by End-use (2020-2032)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Service (2020-2032)

12.2.8.2. Market Revenue and Forecast, by Transmission (2020-2032)

12.2.8.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.2.8.4. Market Revenue and Forecast, by End-use (2020-2032)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Service (2020-2032)

12.3.2. Market Revenue and Forecast, by Transmission (2020-2032)

12.3.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.3.4. Market Revenue and Forecast, by End-use (2020-2032)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Service (2020-2032)

12.3.5.2. Market Revenue and Forecast, by Transmission (2020-2032)

12.3.5.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.3.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Service (2020-2032)

12.3.6.2. Market Revenue and Forecast, by Transmission (2020-2032)

12.3.6.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.3.6.4. Market Revenue and Forecast, by End-use (2020-2032)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Service (2020-2032)

12.3.7.2. Market Revenue and Forecast, by Transmission (2020-2032)

12.3.7.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.3.7.4. Market Revenue and Forecast, by End-use (2020-2032)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Service (2020-2032)

12.3.8.2. Market Revenue and Forecast, by Transmission (2020-2032)

12.3.8.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.3.8.4. Market Revenue and Forecast, by End-use (2020-2032)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Service (2020-2032)

12.4.2. Market Revenue and Forecast, by Transmission (2020-2032)

12.4.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.4.4. Market Revenue and Forecast, by End-use (2020-2032)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Service (2020-2032)

12.4.5.2. Market Revenue and Forecast, by Transmission (2020-2032)

12.4.5.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.4.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Service (2020-2032)

12.4.6.2. Market Revenue and Forecast, by Transmission (2020-2032)

12.4.6.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.4.6.4. Market Revenue and Forecast, by End-use (2020-2032)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Service (2020-2032)

12.4.7.2. Market Revenue and Forecast, by Transmission (2020-2032)

12.4.7.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.4.7.4. Market Revenue and Forecast, by End-use (2020-2032)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Service (2020-2032)

12.4.8.2. Market Revenue and Forecast, by Transmission (2020-2032)

12.4.8.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.4.8.4. Market Revenue and Forecast, by End-use (2020-2032)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Service (2020-2032)

12.5.2. Market Revenue and Forecast, by Transmission (2020-2032)

12.5.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Service (2020-2032)

12.5.5.2. Market Revenue and Forecast, by Transmission (2020-2032)

12.5.5.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.5.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Service (2020-2032)

12.5.6.2. Market Revenue and Forecast, by Transmission (2020-2032)

12.5.6.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.5.6.4. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 13. Company Profiles

13.1. Nokia Corporation

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. TELEFONAKTIEBOLAGET LM ERICSSON

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. ZTE Corporation

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. AT&T INC.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Huawei Technologies Co., Ltd.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Verizon Communications Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Thales Group

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Vodafone Group Plc.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. China Mobile Limited

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Microsoft Corporation.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others