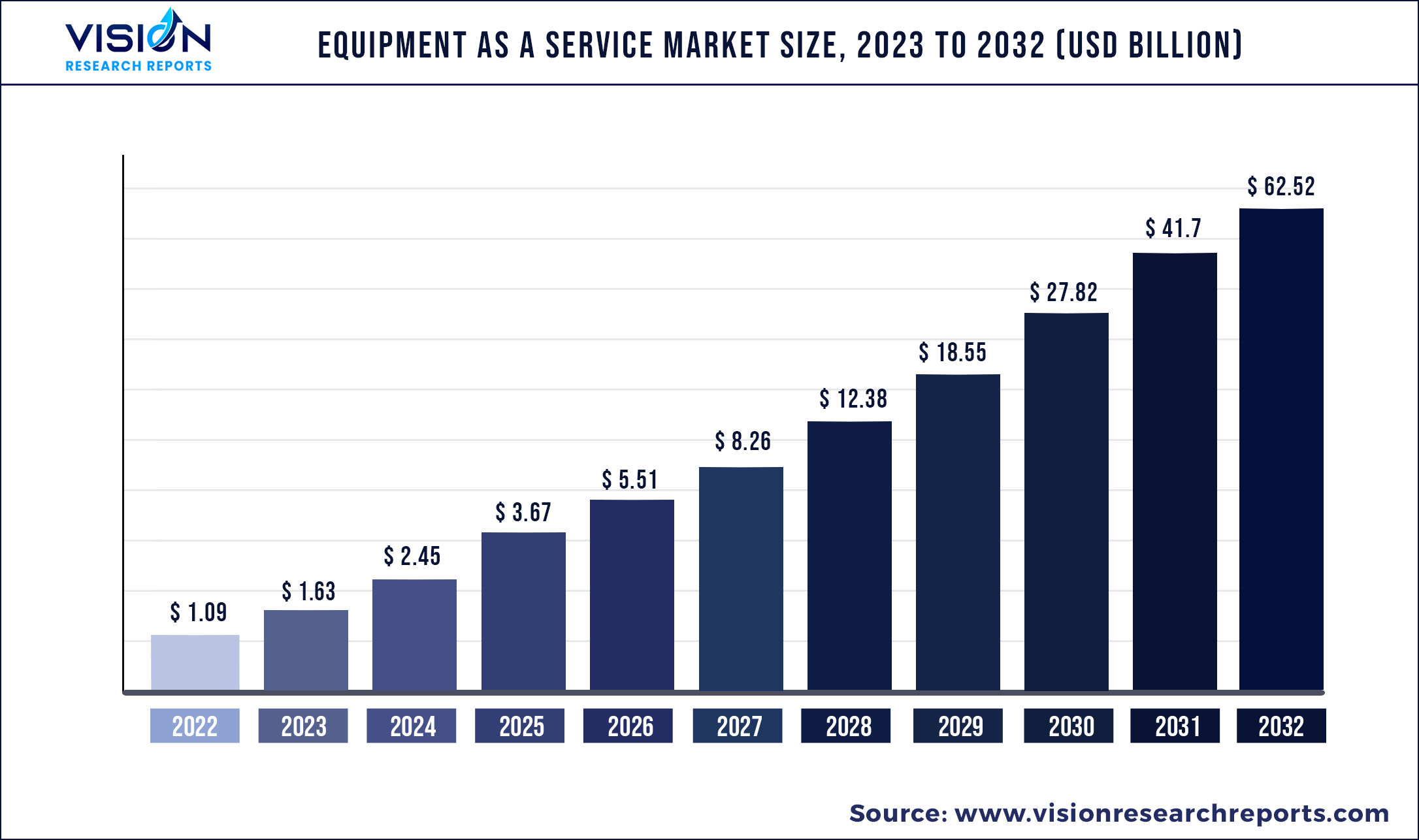

The global equipment as a service market was estimated at USD 1.09 billion in 2022 and it is expected to surpass around USD 62.52 billion by 2032, poised to grow at a CAGR of 49.92% from 2023 to 2032.

Key Pointers

Report Scope of the Equipment As A Service Market

| Report Coverage | Details |

| Market Size in 2022 | USD 1.09 billion |

| Revenue Forecast by 2032 | USD 62.52 billion |

| Growth rate from 2023 to 2032 | CAGR of 49.92% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | TRUMPF; Atlas Copco; KAESER KOMPRESSOREN; Heidelberger Druckmaschinen AG; SMS group GmbH; Arnold Machine; Uteco; AB Volvo; Exone; Siemens; Heller Maschinenfabrik GmbH; DMG MORI; Hilti; SK LASER; Tamturbo turbo compressors; Metso Outotec |

The relatively new concept of "Equipment as a Service" is comparable to the already well-known "Software as a Service" or “Machine as a Service” business model. In this strategy, the vendor rents out equipment while also monitoring, maintaining, or repairing it as needed to keep it in better operating order and increase client uptime. During the projection period, it is predicted that increasing consumer adoption of cutting-edge technologies, together with increased equipment uptime and efficiency provided by equipment as a service (EaaS), will fuel the market expansion.

The main objective of Industry 4.0 is to maximize machine uptime, which is done by adopting EaaS models. EaaS increases equipment uptime and efficiency, lowering costs and labor for planned and unexpected maintenance and providing consumers with cutting-edge technologies and pricing structures while also fostering the market growth. For instance, Advantech's Machine APM/M2I-31A is an end-to-cloud intelligent equipment management solution for industrial infrastructure equipment. Air compressors, injection molding machines, electric motors, pumps, vulcanizing equipment, and steam turbines are modified using this approach. Moreover, it enables edge device connectivity, data collecting, and equipment monitoring.

In several industries in the U.S., it has been a common procedure to switch from one-time sales of capital goods (CapEx) to recurring income streams created on equipment usage or output (OpEx). One outstanding example is the widely recognized Rolls-Royce design that has completely changed the way the business sells aircraft turbines. This model is referred to as "power-by-the-hour" since customers are only charged for the actual hours that the aircraft turbine is actually in use. Due to the numerous advantages offered by OpEx, the aforementioned factors will increase demand for EaaS in the U.S.

For instance, EaaS allows Volvo CE to maintain ownership of the equipment, streamlining the entire fleet acquisition and administration process. One of the major benefits of EaaS is that it is considered as an operating cost (OpEx). Additionally, they will benefit from Volvo CE's vast customer service operation taking full responsibility for equipment maintenance and availability. This enables customers to concentrate on their primary use while leaving other tasks to the manufacturers.

IIoT, 5G, Cloud, Big Data, and AI technological advancements have given rise to a number of digital service solutions that are either implementing EaaS models or enabling them from the start. Various IIoT solutions that allow equipment to automatically exchange asset performance data and provide transparency on asset usage are great examples of EaaS. For instance, Siemens provides the sensors and controllers required to link machines to the edge utilizing digital transformation technology through its equipment-as-a-service approach for the edge's hardware and software.

In addition, product innovation has also contributed to the rise of EaaS models. The focus of new equipment is on the entire production process used by the customer. For instance, laser manufacturers can improve the customer's overall process by giving them the opportunity to draw or categorize produced products. Hence, optimizing the entire flow is more important than concentrating on specific process phases.

Equipment As A Service Market Segmentations:

By Equipment

By End-use

By Financing Models

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Equipment Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Equipment As A Service Market

5.1. COVID-19 Landscape: Equipment As A Service Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Equipment As A Service Market, By Equipment

8.1. Equipment As A Service Market, by Equipment, 2023-2032

8.1.1 Air Compressor

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Pump

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Power Tools

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Ground Power Units

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Laser Cutting Machines

8.1.5.1. Market Revenue and Forecast (2020-2032)

8.1.6. Printing Machines

8.1.6.1. Market Revenue and Forecast (2020-2032)

8.1.7. CNC Machines

8.1.7.1. Market Revenue and Forecast (2020-2032)

8.1.8. Material Handling System

8.1.8.1. Market Revenue and Forecast (2020-2032)

8.1.9. Packaging Machine

8.1.9.1. Market Revenue and Forecast (2020-2032)

8.1.10. Excavators

8.1.10.1. Market Revenue and Forecast (2020-2032)

8.1.11. Cranes

8.1.11.1. Market Revenue and Forecast (2020-2032)

8.1.12. Others

8.1.12.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Equipment As A Service Market, By End-use

9.1. Equipment As A Service Market, by End-use, 2023-2032

9.1.1. Construction

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Material Handling

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Mining

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Manufacturing

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Packaging

9.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Equipment As A Service Market, By Financing Models

10.1. Equipment As A Service Market, by Financing Models, 2023-2032

10.1.1. Subscription-based

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Outcome-based

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Equipment As A Service Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Equipment (2020-2032)

11.1.2. Market Revenue and Forecast, by End-use (2020-2032)

11.1.3. Market Revenue and Forecast, by Financing Models (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Equipment (2020-2032)

11.1.4.2. Market Revenue and Forecast, by End-use (2020-2032)

11.1.4.3. Market Revenue and Forecast, by Financing Models (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Equipment (2020-2032)

11.1.5.2. Market Revenue and Forecast, by End-use (2020-2032)

11.1.5.3. Market Revenue and Forecast, by Financing Models (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Equipment (2020-2032)

11.2.2. Market Revenue and Forecast, by End-use (2020-2032)

11.2.3. Market Revenue and Forecast, by Financing Models (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Equipment (2020-2032)

11.2.4.2. Market Revenue and Forecast, by End-use (2020-2032)

11.2.4.3. Market Revenue and Forecast, by Financing Models (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Equipment (2020-2032)

11.2.5.2. Market Revenue and Forecast, by End-use (2020-2032)

11.2.5.3. Market Revenue and Forecast, by Financing Models (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Equipment (2020-2032)

11.2.6.2. Market Revenue and Forecast, by End-use (2020-2032)

11.2.6.3. Market Revenue and Forecast, by Financing Models (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Equipment (2020-2032)

11.2.7.2. Market Revenue and Forecast, by End-use (2020-2032)

11.2.7.3. Market Revenue and Forecast, by Financing Models (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Equipment (2020-2032)

11.3.2. Market Revenue and Forecast, by End-use (2020-2032)

11.3.3. Market Revenue and Forecast, by Financing Models (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Equipment (2020-2032)

11.3.4.2. Market Revenue and Forecast, by End-use (2020-2032)

11.3.4.3. Market Revenue and Forecast, by Financing Models (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Equipment (2020-2032)

11.3.5.2. Market Revenue and Forecast, by End-use (2020-2032)

11.3.5.3. Market Revenue and Forecast, by Financing Models (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Equipment (2020-2032)

11.3.6.2. Market Revenue and Forecast, by End-use (2020-2032)

11.3.6.3. Market Revenue and Forecast, by Financing Models (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Equipment (2020-2032)

11.3.7.2. Market Revenue and Forecast, by End-use (2020-2032)

11.3.7.3. Market Revenue and Forecast, by Financing Models (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Equipment (2020-2032)

11.4.2. Market Revenue and Forecast, by End-use (2020-2032)

11.4.3. Market Revenue and Forecast, by Financing Models (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Equipment (2020-2032)

11.4.4.2. Market Revenue and Forecast, by End-use (2020-2032)

11.4.4.3. Market Revenue and Forecast, by Financing Models (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Equipment (2020-2032)

11.4.5.2. Market Revenue and Forecast, by End-use (2020-2032)

11.4.5.3. Market Revenue and Forecast, by Financing Models (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Equipment (2020-2032)

11.4.6.2. Market Revenue and Forecast, by End-use (2020-2032)

11.4.6.3. Market Revenue and Forecast, by Financing Models (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Equipment (2020-2032)

11.4.7.2. Market Revenue and Forecast, by End-use (2020-2032)

11.4.7.3. Market Revenue and Forecast, by Financing Models (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Equipment (2020-2032)

11.5.2. Market Revenue and Forecast, by End-use (2020-2032)

11.5.3. Market Revenue and Forecast, by Financing Models (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Equipment (2020-2032)

11.5.4.2. Market Revenue and Forecast, by End-use (2020-2032)

11.5.4.3. Market Revenue and Forecast, by Financing Models (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Equipment (2020-2032)

11.5.5.2. Market Revenue and Forecast, by End-use (2020-2032)

11.5.5.3. Market Revenue and Forecast, by Financing Models (2020-2032)

Chapter 12. Company Profiles

12.1. TRUMPF

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Atlas Copco

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. KAESER KOMPRESSOREN

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Heidelberger Druckmaschinen AG

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. SMS group GmbH

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Arnold Machine

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Uteco

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. AB Volvo

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Exone

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Siemens

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others