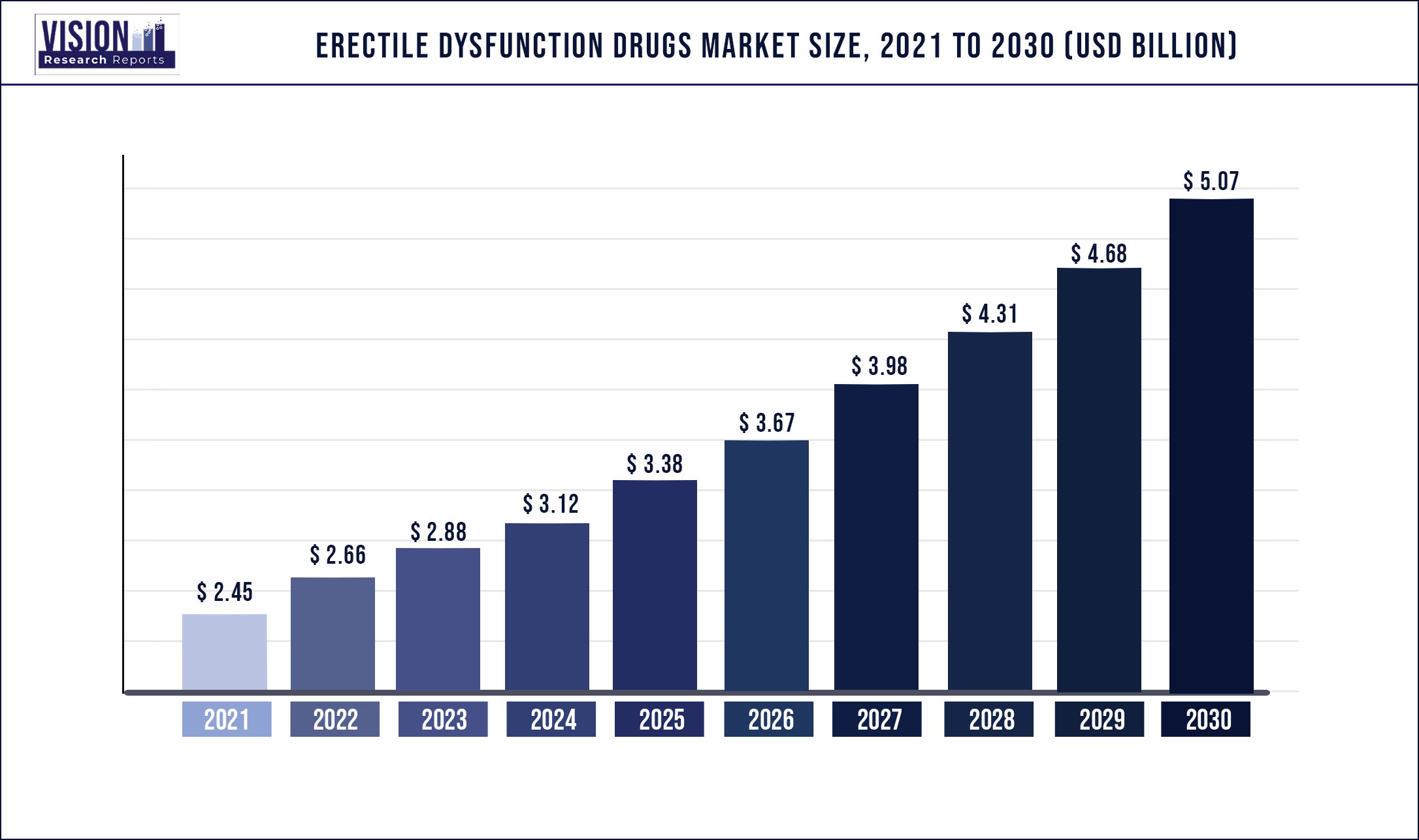

The global erectile dysfunction drugs market was valued at USD 2.45 billion in 2021 and it is predicted to surpass around USD 5.07 billion by 2030 with a CAGR of 8.42% from 2022 to 2030

Report Highlights

The increasing prevalence of erectile dysfunction is expected to contribute to market growth. According to the European Association of Urology, the overall prevalence of ED was found to be around 52% in the European male population aged 40-70 years in 2020. In addition, according to the Boston University School of Medicine, approximately 22.0% of 40 years aged male population and 49.0% by age of 70 years are affected by erectile dysfunction. Thus, the increasing geriatric population is anticipated to increase the prevalence of ED over the forecast period and is expected to create lucrative growth opportunities in the market.

Eli Lilly and Company is supporting ED patients by offering medicine at low cost through Lilly Patient Support Program (LPSP). This program provides financial assistance to eligible ED uninsured patients in Canada who may require registration for this program. Thus, the presence of such supportive programs for a branded version of Cialis may increase the affordability of the lower-income patient population and also aid in generating increased revenue. Moreover, companies have undertaken initiatives such as collaboration and partnership for the manufacturing and commercialization of products in the overseas market. For instance, in January 2022, Petros Pharmaceuticals Inc. partnered with a global Contract Manufacturing Organization (CDMO) for the commercial production of Avanafil tablets. This partnership was formed with an aim to replace the existing agreement with Vivus Inc. and continue product supply.

Furthermore, according to the National Library of Medicine (2021), a phase 3 clinical trial was conducted by Sichuan Haisco Pharmaceutical Co., Ltd. to evaluate the safety and efficacy of Stendra in patients with ED in mainland China. The results of the clinical trial showed improvement in Chinese ED patients after administration of two doses of Stendra 100 mg & 200 mg. Such proven clinical effectiveness may strengthen Strenda’s (Avanafil) position in the market. However, lack of awareness about erectile dysfunction, shame about treatment, false-positive beliefs, social stigma pertaining to the disease, and lack of discretion may restrain the market growth. As per the survey conducted by the European Association of Urology (EAU), only 18% of the Spanish population heard about ED treatment, whereas 68.0% of the population believes the treatment benefits.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 2.45 billion |

| Revenue Forecast by 2030 | USD 5.07 billion |

| Growth rate from 2022 to 2030 | CAGR of 8.42% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Product, Region |

| Companies Covered | Pfizer, Inc.; Eli Lilly and Company; Teva Pharmaceutical Industries Ltd; Sanofi; Sun Pharmaceutical Industries Ltd; Bayer AG; Petros Pharmaceuticals, Inc., VIVUS, Inc.; Auxilium Pharmaceuticals, Inc., Adamed |

Product Insights

The viagra segment held the highest revenue share of 57.92% in 2021. At present, many companies are undertaking various strategic initiatives such as research collaboration, partnerships, and agreements with an aim to expand their business footprint. For instance, in January 2020, Pfizer, Inc., and Digital Men’s Clinic Roman signed a supply agreement to provide a generic version of Viagra to roman members. This supply agreement is expected to boost the growth of the segment.

The others segment is also expected to witness lucrative market growth over the forecast period owing to the large application base and availability of ED medicines, such as Helleva (lodenafil carbonate), Mvix (mirodenafil), and others that are also used to treat adult patients with erectile dysfunction. Increasing approval of over-the-counter ED products offers easy access to ED patients. For instance, in February 2022, Adamed was the first-ever polish company that received marketing authorization approval for Tadalafil MAXON from prescription to over-the-counter (OTC) category. Hence, the introduction of such products in the market may boost the utilization of ED drugs.

Regional Insights

North America dominated the erectile dysfunction drugs market and accounted for a revenue share of 51.82% in 2021 due to the high burden of disease, strong healthcare infrastructure, and approval of new products for treatment. In March 2022, Lupin received the U.S. FDA approval for its ANDA for sildenafil (10 mg/mL oral suspension) to market a generic equivalent to Revatio of Viatris Specialty LLC. The accessibility of affordable generic products may increase patient compliance, consequently, increasing the consumer base and revenue for the market.

In Asia Pacific, the market for erectile dysfunction drugs is expected to witness fast growth during the forecast period. The growth of the region is attributable to the entry of new products into the region. For instance, in May 2020, iX Biopharma announced the supply of Wafesil and Silcap through telemedicine in Australia for the treatment of an adult patient with erectile dysfunction.

Key Players

Market Segmentation

Chapter 1.Introduction

1.1.Research Objective

1.2.Scope of the Study

1.3.Definition

Chapter 2.Research Methodology

2.1.Research Approach

2.2.Data Sources

2.3.Assumptions & Limitations

Chapter 3.Executive Summary

3.1.Market Snapshot

Chapter 4.Market Variables and Scope

4.1.Introduction

4.2.Market Classification and Scope

4.3.Industry Value Chain Analysis

4.3.1.Raw Material Procurement Analysis

4.3.2.Sales and Distribution Channel Analysis

4.3.3.Downstream Buyer Analysis

Chapter 5.COVID 19 Impact on Erectile Dysfunction Drugs Market

5.1.COVID-19 Landscape: Erectile Dysfunction Drugs Industry Impact

5.2.COVID 19 - Impact Assessment for the Industry

5.3.COVID 19 Impact: Global Major Government Policy

5.4.Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6.Market Dynamics Analysis and Trends

6.1.Market Dynamics

6.1.1.Market Drivers

6.1.2.Market Restraints

6.1.3.Market Opportunities

6.2.Porter’s Five Forces Analysis

6.2.1.Bargaining power of suppliers

6.2.2.Bargaining power of buyers

6.2.3.Threat of substitute

6.2.4.Threat of new entrants

6.2.5.Degree of competition

Chapter 7.Competitive Landscape

7.1.1.Company Market Share/Positioning Analysis

7.1.2.Key Strategies Adopted by Players

7.1.3.Vendor Landscape

7.1.3.1.List of Suppliers

7.1.3.2.List of Buyers

Chapter 8.Global Erectile Dysfunction Drugs Market, By Product

8.1.Erectile Dysfunction Drugs Market, by Product Type, 2020-2027

8.1.1.Viagra

8.1.1.1.Market Revenue and Forecast (2016-2027)

8.1.2.Cialis

8.1.2.1.Market Revenue and Forecast (2016-2027)

8.1.3.Zydena

8.1.3.1.Market Revenue and Forecast (2016-2027)

8.1.4.Levitra

8.1.4.1.Market Revenue and Forecast (2016-2027)

8.1.5.Stendra

8.1.5.1.Market Revenue and Forecast (2016-2027)

8.1.6.Others

8.1.6.1.Market Revenue and Forecast (2016-2027)

Chapter 9.Global Erectile Dysfunction Drugs Market, Regional Estimates and Trend Forecast

9.1.North America

9.1.1.Market Revenue and Forecast, by Product (2016-2027)

9.1.2.U.S.

9.1.3.Rest of North America

9.1.3.1.Market Revenue and Forecast, by Product (2016-2027)

9.2.Europe

9.2.1.Market Revenue and Forecast, by Product (2016-2027)

9.2.2.UK

9.2.2.1.Market Revenue and Forecast, by Product (2016-2027)

9.2.3.France

9.2.3.1.Market Revenue and Forecast, by Product (2016-2027)

9.2.4.Rest of Europe

9.2.4.1.Market Revenue and Forecast, by Product (2016-2027)

9.3.APAC

9.3.1.Market Revenue and Forecast, by Product (2016-2027)

9.3.2.India

9.3.2.1.Market Revenue and Forecast, by Product (2016-2027)

9.3.3.China

9.3.3.1.Market Revenue and Forecast, by Product (2016-2027)

9.3.4.Japan

9.3.4.1.Market Revenue and Forecast, by Product (2016-2027)

9.3.5.Rest of APAC

9.3.5.1.Market Revenue and Forecast, by Product (2016-2027)

9.4.MEA

9.4.1.Market Revenue and Forecast, by Product (2016-2027)

9.4.2.GCC

9.4.2.1.Market Revenue and Forecast, by Product (2016-2027)

9.4.3.North Africa

9.4.3.1.Market Revenue and Forecast, by Product (2016-2027)

9.4.4.South Africa

9.4.4.1.Market Revenue and Forecast, by Product (2016-2027)

9.4.5.Rest of MEA

9.4.5.1.Market Revenue and Forecast, by Product (2016-2027)

9.5.Latin America

9.5.1.Market Revenue and Forecast, by Product (2016-2027)

9.5.2.Brazil

9.5.2.1.Market Revenue and Forecast, by Product (2016-2027)

9.5.3.Rest of LATAM

9.5.3.1.Market Revenue and Forecast, by Product (2016-2027)

Chapter 10.Company Profiles

10.1.Pfizer Inc.

10.1.1.Company Overview

10.1.2.Product Offerings

10.1.3.Financial Performance

10.1.4.Recent Initiatives

10.2.Eli Lilly and Company

10.2.1.Company Overview

10.2.2.Product Offerings

10.2.3.Financial Performance

10.2.4.Recent Initiatives

10.3.Teva Pharmaceutical Industries Ltd

10.3.1.Company Overview

10.3.2.Product Offerings

10.3.3.Financial Performance

10.3.4.Recent Initiatives

10.4.Sanofi

10.4.1.Company Overview

10.4.2.Product Offerings

10.4.3.Financial Performance

10.4.4.Recent Initiatives

10.5.Sun Pharmaceutical Industries Ltd

10.5.1.Company Overview

10.5.2.Product Offerings

10.5.3.Financial Performance

10.5.4.Recent Initiatives

10.6.Bayer AG

10.6.1.Company Overview

10.6.2.Product Offerings

10.6.3.Financial Performance

10.6.4.Recent Initiatives

10.7.VIVUS, Inc.

10.7.1.Company Overview

10.7.2.Product Offerings

10.7.3.Financial Performance

10.7.4.Recent Initiatives

10.8.Auxilium Pharmaceuticals, Inc.

10.8.1.Company Overview

10.8.2.Product Offerings

10.8.3.Financial Performance

10.8.4.Recent Initiatives

10.9.Adamed

10.9.1.Company Overview

10.9.2.Product Offerings

10.9.3.Financial Performance

10.9.4.Recent Initiatives

Chapter 11.Research Methodology

11.1.Primary Research

11.2.Secondary Research

11.3.Assumptions

Chapter 12.Appendix

12.1.About Us

12.2.Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others